Fourth Party Logistics Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Fourth Party Logistics Market is segmented By Type (Solution Integrator Model, Synergy Plus Operating Model, Industry Innovator Model), By End User (M....

Fourth Party Logistics Market Size

Market Size in USD Bn

CAGR7.81%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.81% |

| Market Concentration | High |

| Major Players | XPO Logistics, DHL Supply Chain, C.H. Robinson, GEODIS, DB Schenker and Among Others. |

please let us know !

Fourth Party Logistics Market Analysis

The fourth party logistics market is estimated to be valued at USD 67.6 Bn in 2024 and is expected to reach USD 114.4 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.81% from 2024 to 2031. Companies in the fourth party logistics market are increasingly outsourcing their logistics operations to specialized fourth party logistics providers to better focus on their core business and improve supply chain efficiencies.

Fourth Party Logistics Market Trends

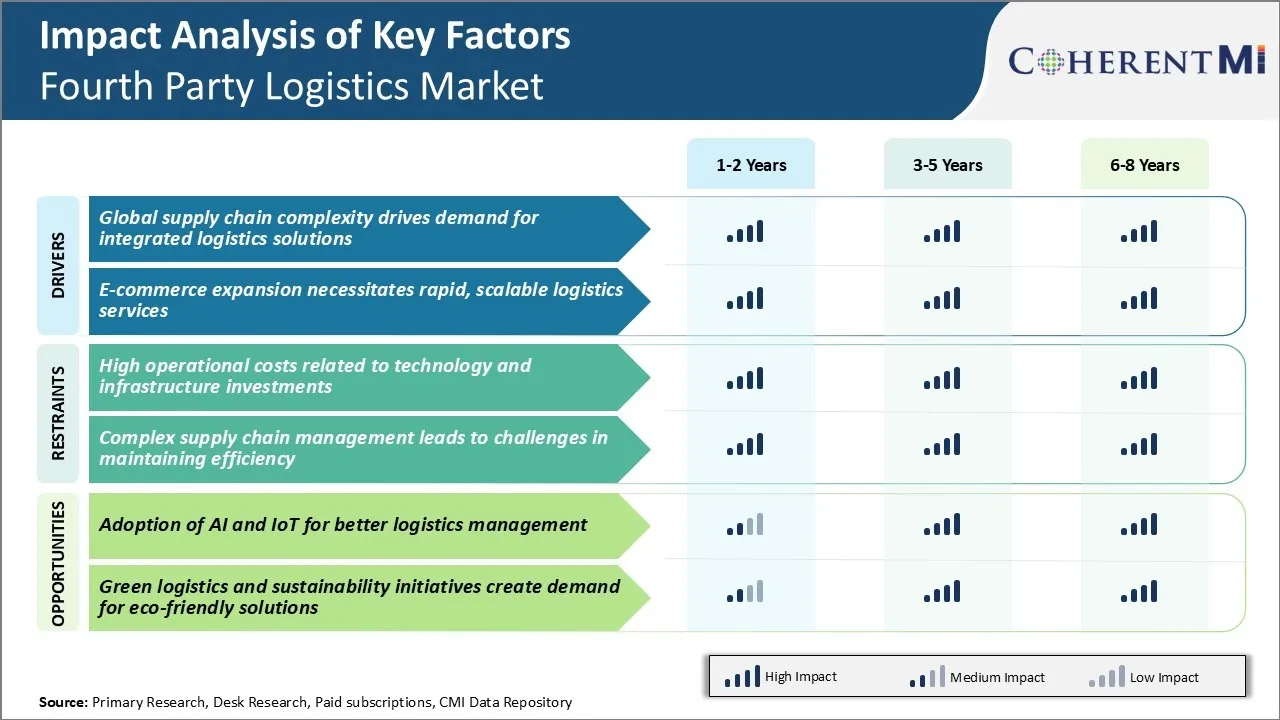

Market Driver - Global Supply Chain Complexity Drives Demand for Integrated Logistics Solutions

As international trade expands and companies source components globally, supply chain networks grow increasingly complex. Manufacturers must carefully coordinate inventories, production schedules, and shipping across numerous domestic and international facilities and third-party providers. Any delay or disruption at a single point can impact the entire supply chain.

Seeking to gain control over sprawling supply networks, many brands now demand integrated logistics partners that can lend omnichannel visibility and orchestrate movements across all nodes. Rather than rely on separate vendors for shipping, warehousing, customs clearance and other services, companies favor fourth party logistics providers that consolidate operations under a single platform.

The scope of services fourth party logistics firms provide has grown considerably as well. Shift towards holistic supply chain management solutions stems from the difficulties companies face in synchronizing far-flung, multi-step operations themselves.

By outsourcing control to an expert fourth party, they gain the integrated intelligence and control desperately needed to navigate today's intricate global supply networks. This demand looks set to rise further as trade barriers fall and companies extend their international footprints into new and emerging markets.

Market Driver - E-Commerce Expansion Necessitates Rapid, Scalable Logistics Services

The breakneck growth of online retail has transformed expectations for delivery speeds and service levels. Retailers recognize that slow delivery is the top reason shoppers will abandon an online cart.

At the same time, the handling of returns, product exchanges and other reverse logistics functions needed to ensure positive customer experiences has become hugely complex for companies managing nationwide e-commerce operations.

Keeping pace with these demands strains the traditional logistics models of even the largest retailers and brands. In-house fleets and warehouses struggle to scale up or down quickly enough to match volatile e-commerce order surges and lulls. Meanwhile, the dynamic requirements of omnichannel purchasing and ultra-fast delivery windows make one-off outsourcing agreements inflexible and inefficient.

This is where fourth party logistics providers gain an edge. With their extensive national networks of fulfillment centers, flexible capacity and proprietary technology systems, they offer the speed and agility that digital-first shopping demands. As purchasing habits continue migrating online, such proven capabilities for handling peaks and fulfilling modern consumer expectations will be vital for all retailers and brands seeking to compete through logistics.

Market Challenge - High Operational Costs Related to Technology and Infrastructure Investments

One of the major challenges faced by the fourth party logistics market is the high operational costs related to technology and infrastructure investments. As fourth party logistics providers play the role of a coordinator and integrator of various logistics services on behalf of their clients, they need to make huge investments in establishing the necessary technological infrastructure and capabilities. They also need to regularly upgrade and modernize these technologies to cope with the evolving client and market requirements.

In addition, fourth party logistics also bear the infrastructure costs related to managing a network of warehouses, transportation assets and other physical logistics facilities. Coordinating shipments across multiple transport modes and managing inventory movement across different locations spread over large geographies also drive-up operational expenditures.

The rising costs of fuel and transportation further add to the overall expense of logistics operations. Managing such increasing operational costs while staying competitive by offering value-added services to clients is a major challenge for providers in the fourth party logistics market.

Market Opportunity - Adoption of AI And IoT for Better Logistics Management

One of the major opportunities for the fourth party logistics market is the rising adoption of artificial intelligence and internet of things technologies for better logistics management. Advances in Artificial Intelligence (AI) and machine learning capabilities are enabling fourth party logistics providers to optimize resource allocation, demand forecasting and transportation planning. Applications of AI such as predictive analytics can help reduce warehouse costs and inventory levels while improving fill rates.

Adopting AI assistants and chatbots powered by natural language processing supports more effective communications and coordination between various logistics stakeholders. Emerging technologies such as autonomous vehicles and drones also open up new possibilities for warehouse automation and last-mile deliveries.

Leveraging these technologies allows fourth party logistics to offer innovative, cost-effective and customized solutions to their clients. It helps strengthen competitive differentiation and drive new business opportunities. The rising focus on technology-driven logistics is a major tailwind for the fourth party logistics market.

Key winning strategies adopted by key players of Fourth Party Logistics Market

Focus on asset-light model: Many 4PL providers have adopted an asset-light business model where they do not own trucks, warehouses or other logistics assets. This allows them to be more flexible and reduce capital costs. For example, DHL expanded its 4PL offerings in 2018 by launching a full-fledged "Supply Chain on Demand" platform focusing on asset-light services. This helped DHL win new clients without heavy investment.

Use of technology for visibility and optimization: Leading 4PLs have invested heavily in developing advanced technologies like analytics, AI, IoT and cloud-based platforms. This gives them end-to-end visibility of clients' supply chains and ability to continuously optimize operations. For example, CEVA Logistics launched a digital platform called 'CEVA Link' in 2019 which provides clients visibility into their network performance through analytics and tracking.

Focus on customized solutions: Rather than offering standardized services, successful 4PLs develop customized, client-specific solutions. For instance, when DHL partnered with Starbucks in 2015 to handle their complex global distribution, DHL developed an end-to-end customized solution optimized for Starbucks' retail network.

Segmental Analysis of Fourth Party Logistics Market

Insights, By Type: Solution Integrator Model Drives Growth in Type Segment

The solution integrator model segment 61% share to the fourth party logistics market by type in 2024. This segment is driven primarily by the extensive solutions and strategic partnerships it offers customers.

As a solution integrator, this segment acts as a one-stop-shop, managing all aspects of the clients' supply chain including warehousing, transportation, and other value-added services. Solution integrators design customized logistics networks that precisely meet each client's unique business needs. They integrate diverse technologies, data analytics capabilities, and strategic vendor alliances to deliver fully optimized supply chain solutions.

Solution integrator model in fourth party logistics increases efficiency and visibility across the supply chain while reducing costs for customers. Solution integrators leverage relationships with 3PLs, carriers, technology firms, and more to pull together best-in-class capabilities.

The one-stop-shop approach and strategic partnerships of solution integrators address many of the challenges driving customers to outsource to fourth party logistics providers. As supply chains grow more global and complex, the value of comprehensive solution integration will continue propelling this segment's growth in fourth party logistics market.

Insights, By End User: Manufacturing Drives Largest Share of End User Segment

Within the end user segment of the fourth party logistics market, manufacturing segment is expected to account for 34.7% market share in 2024. Global manufacturers have highly complex international supply chains and face increasing pressures to optimize costs and improve efficiencies.

Outsourcing logistics to a specialized fourth party provider allows manufacturing companies to focus on their core competencies of product design and manufacturing while reducing logistics costs. Fourth party partnerships help manufacturers streamline supply chain management, realizing greater transparency and control.

Manufacturing companies also benefit from the economies of scale and standardized processes achieved through fourth party partnerships. With production and distribution networks spanning the globe, the cost savings realized through optimized fourth party logistics are particularly attractive to multinational manufacturers.

Minimizing logistics costs is a major priority for manufacturers given the impact on profit margins. Outsourcing to specialized fourth party logistics providers focused on data-driven supply chain optimization addresses this priority - driving manufacturing segment's leadership within end user segment of the fourth party logistics market.

Additional Insights of Fourth Party Logistics Market

- The North American fourth party logistics market is driven by advanced technologies, including AI and IoT, ensuring supply chain accuracy and efficiency.

- The fourth party logistics market in Asia Pacific is growing rapidly due to industrial expansion in China, India, and Southeast Asia, necessitating advanced logistics solutions.

- North America accounted for 40.6% of the fourth party logistics market in 2023, largely due to its advanced technology infrastructure and adoption of innovative solutions.

- The U.S. fourth party logistics market is expected to grow from USD 19.09 billion in 2023 to USD 41.39 billion by 2034.

Competitive overview of Fourth Party Logistics Market

The major players operating in the fourth party logistics market include XPO Logistics, DHL Supply Chain, C.H. Robinson, GEODIS, DB Schenker, CEVA Logistics AG, United Parcel Service, Inc., GEFCO Group, Logistics Plus Inc., DAMCO, and Allyn International Services, Inc.

Fourth Party Logistics Market Leaders

- XPO Logistics

- DHL Supply Chain

- C.H. Robinson

- GEODIS

- DB Schenker

Fourth Party Logistics Market - Competitive Rivalry, 2024

Fourth Party Logistics Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Fourth Party Logistics Market

- In June 2024, Gulf Warehousing Company (GWC) launched the Al Wukair Logistics Park Directory, coinciding with the United Nations Micro, Small, and Medium-Sized Enterprises (MSMEs) Day on June 27. This initiative aims to enhance the fourth party logistics capabilities in the region. It also aims at supporting local businesses and driving growth, particularly for MSMEs in the fourth party logistics market. This is mainly because they play a crucial role in Qatar's economic diversification and industrial sector.

- In April 2024, CL Synergy Limited launched a subsidiary named Logistics365 (Pvt) Ltd. Logistics365 is designed to deliver seamless logistics solutions to various types of cargo, specializing in international trading under the 'Entrepot' scheme, and is committed to providing stable and uninterrupted services year-round.

- In November 2023, GWC (Gulf Warehousing Company) signed a cooperation agreement with Qatar Development Bank (QDB) aimed at supporting micro, small, and medium-sized enterprises (MSMEs). The agreement was formalized during the GWC Forum 2023, and it focuses on providing preferential logistics solutions to boost the efficiency and operational capabilities of MSMEs in Qatar.

Fourth Party Logistics Market Segmentation

- By Type

- Solution Integrator Model

- Synergy Plus Operating Model

- Industry Innovator Model

- By End User

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the fourth party logistics market?

The fourth party logistics market is estimated to be valued at USD 67.6 Bn in 2024 and is expected to reach USD 114.4 Bn by 2031.

What are the key factors hampering the growth of the fourth party logistics market?

High operational costs related to technology, high infrastructure investments, and complex supply chain management are the major factors hampering the growth of the fourth party logistics market.

What are the major factors driving the fourth party logistics market growth?

Global supply chain complexity, which drives demand for integrated logistics solutions, and e-commerce expansion, which necessitates rapid, scalable logistics services, are the major factors driving the fourth party logistics market.

Which is the leading type in the fourth party logistics market?

The leading type segment is solution integrator model.

Which are the major players operating in the fourth party logistics market?

CEVA Logistics AG, United Parcel Service, Inc., GEFCO Group, Logistics Plus Inc., DAMCO, Allyn International Services, Inc. are the major players.

What will be the CAGR of the fourth party logistics market?

The CAGR of the fourth party logistics market is projected to be 7.81% from 2024-2031.