第四次物流市場 サイズ - 分析

市場規模(米ドル) Bn

CAGR7.81%

| 調査期間 | 2024 - 2031 |

| 推定の基準年 | 2023 |

| CAGR | 7.81% |

| 市場集中度 | High |

| 主要プレーヤー | XPO物流, DHLの サプライチェーン, C.H. ロビンソン, ゲオディス, DBシェンカー その他 |

お知らせください!

第四次物流市場 トレンド

マーケットドライバー - Eコマースの拡張は、迅速でスケーラブルな物流サービスが必要

オンライン小売の画期的な成長は、配送速度とサービスレベルのための期待を変化させました。 小売店は遅い配達が最上位の理由の買い物客がオンラインカートを放棄することを認識します。

同時に、返品、商品交換などのリバース・ロジスティクスの取り扱いは、前向きな顧客体験が全国の電子商取引業務を管理している企業にとって非常に複雑になりました。

これらの要求のペースを維持することは、最大の小売店やブランドの伝統的な物流モデルを負担します。 社内のフリートと倉庫は、揮発性電子商取引注文サージとルールと一致するのに十分なスケールアップまたはダウンに苦労しています。 一方、オムニチャネルの購入と超高速配信ウィンドウの動的要件は、ワンオフアウトソーシング契約を柔軟かつ非効率的なものにします。

これは、 4 つのパーティ ロジスティクス プロバイダーがエッジを獲得する場所です。. 充実した設備の全国ネットワーク、フレキシブルな容量と独自の技術システムにより、デジタルファーストのショッピングニーズに対応するスピードと俊敏性を提供します。 購買習慣はオンラインの移行を継続するにつれて、ピークを処理し、現代の消費者の期待を達成するためのそのような実証済みの能力は、物流を通じて競争しようとしているすべての小売店やブランドにとって不可欠です。

市場機会 - より良い物流管理のためのAIとIoTの採用

第4回締約国向け物流市場における主要な機会の一つは、より良い物流管理のためのモノの人工知能とインターネットの普及が高まっています。 人工知能(AI)と機械学習能力の進歩により、4つのパーティー・ロジスティクス・プロバイダがリソース割り当て、需要予測、輸送計画を最適化することができます。 予測分析などのAIの適用は、倉庫コストと在庫レベルを削減し、充填率を改善するのに役立ちます。

自然言語処理によるAIアシスタントやチャットボットを採用することで、さまざまな物流関係者間のより効果的なコミュニケーションと調整をサポートします。 オートノマイズ車やドローンなどのエマージ技術も、倉庫の自動化や最終輸送に新たな可能性を広げています。

これらの技術を活用することで、4つのパーティ・ロジスティクスが革新的で費用対効果の高いソリューションを顧客に提供できます。 それは競争の差別を強化し、新しいビジネスチャンスを運転するのに役立ちます。 テクノロジー主導の物流に重点を置いたのは、第4回締約国物流市場における主要な潮風です。

主要プレーヤーが採用した主な勝利戦略 第四次物流市場

アセットライトモデルの焦点: 多く 4PLプロバイダは、トラック、倉庫、その他の物流資産を所有していない資産の事業モデルを採用しています。 これにより、より柔軟になり、資本コストを削減することができます。 たとえば、DHLは、アセットライトサービスに焦点を当てた本格的な「サプライチェーンオンデマンド」プラットフォームを発売することにより、2018年に4PL製品を展開しました。 これは、重い投資なしでDHLが新しい顧客に勝つのを助けました。

視認性と最適化のための技術の使用: リード4PLは、分析、AI、IoT、クラウドベースのプラットフォームなどの高度な技術の開発に大きく投資しました。 これにより、クライアントのサプライチェーンのエンドツーエンドの可視性や、継続的に業務を最適化することができます。 たとえば、CEVA Logisticsは、2019年に「CEVA Link」と呼ばれるデジタルプラットフォームを開始しました。これにより、クライアントは分析と追跡を通じてネットワークのパフォーマンスを可視化できます。

カスタマイズされたソリューションに焦点を当てる: 標準化されたサービスを提供するよりもむしろ、成功した4PLは、カスタマイズされた、クライアント固有のソリューションを開発します。 たとえば、DHLは2015年にスターバックスと提携し、複雑なグローバルディストリビューションを処理するため、Starbucksの小売ネットワーク用に最適化されたエンドツーエンドのカスタマイズされたソリューションを開発しました。

セグメント分析 第四次物流市場

エンドユーザーによるインサイト: エンドユーザーセグメントの最大のシェア

第4回物流市場におけるエンドユーザーセグメント内で、2024年の34.7%の市場シェアを想定しています。 グローバルメーカーは、コストを最適化し、効率性を向上させるために、高度に複雑な国際サプライチェーンと圧力の増加に直面しています。

物流を専門とする4社プロバイダーにアウトソーシングすることで、物流コストを削減しながら、製品設計・製造のコアコンピテンシーに集中できます。 第四者のパートナーシップは、メーカーがサプライチェーン管理を合理化し、透明性を高め、管理するのに役立ちます。

製造企業は、第4回パートナーシップにより達成されたスケールおよび標準化されたプロセスの経済性からも恩恵を受けています。 世界中を網羅する生産・流通ネットワークにより、最適化された4つのパーティ・ロジスティクスによるコスト削減は、多国籍企業にとって特に魅力的です。

物流コストの最小化は、利益率に影響を与えるメーカーにとって大きな優先順位です。 データ主導のサプライチェーン最適化に重点を置いた4社に注力した4社目の物流プロバイダが、この重点を置いています - 製造業のセグメントのリーダーシップを4社に展開する。

追加の洞察 第四次物流市場

- 北米第4部の物流市場は、AIやIoTなどの先端技術によって駆動され、サプライチェーンの精度と効率性を確保しています。

- 中国、インド、東南アジアの産業拡大により、アジアパシフィックの4社目の物流市場が急速に成長し、先進的な物流ソリューションを必要としています。

- 北米は、2023年に4つ目のパーティー・ロジスティクス・マーケットの40.6%を占め、先進的な技術インフラと革新的なソリューションの採用により、大幅でした。

- 米国の4社目の物流市場は、2023年のUSD 19.09億から2034年までのUSD 41.39億に成長すると予想されます。

競合の概要 第四次物流市場

第4回物流市場で活躍する主要な選手は、XPO物流、DHLサプライチェーン、C.H.ロビンソン、GEODIS、DBシェンカー、CEVAロジスティクスAG、ユナイテッドパーセルサービス、GEFCOグループ、物流プラス株式会社、DAMCO、アリンインターナショナルサービス株式会社などです。

第四次物流市場 リーダー

- XPO物流

- DHLの サプライチェーン

- C.H. ロビンソン

- ゲオディス

- DBシェンカー

第四次物流市場 - 競合関係

第四次物流市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 第四次物流市場

- 2024年6月、Gulf Warehousing Company(GWC)は、6月27日の国連マイクロ、小型、中規模の企業(MSME)の日と一致し、Al Wukair Logistics Park Directoryを立ち上げました。 この取り組みは、地域における4つのパーティの物流能力を高めることを目指しています。 また、地域事業の支援や成長の推進、特に第4回物流市場におけるMSMEの推進を目指しています。 主にカタールの経済の多様化と産業分野において重要な役割を果たしているためです。

- 2024年4月、CL Synergy Limitedは、ロジスティックス365(Pvt) Ltd.の子会社を立ち上げました。ロジスティックス365は、「Entrepot」スキームに基づく国際取引に特化した、さまざまな種類の貨物にシームレスな物流ソリューションを提供するように設計されています。

- 2023年11月、GWC(Gulf Warehousing Company)は、マイクロ、小型、中規模企業(MSME)の支援を目的としたカタール開発銀行(QDB)との協力協定を締結しました。 GWCフォーラム2023では合意が正式化され、QatarのMSMEの効率性と運用能力を高めるための優先物流ソリューションを提供することに重点を置いています。

第四次物流市場 セグメンテーション

- タイプ別

- ソリューションインテグレータ モデル

- Synergy Plusの動作モデル

- 産業イノベーター モデル

- エンドユーザ

- 製造業

- リテール

- ヘルスケア

- 自動車産業

- その他

購入オプションを検討しますか?このレポートの個々のセクション?

Gautam Mahajan は、市場調査とコンサルティングで 5 年以上の経験を持つリサーチ コンサルタントです。市場エンジニアリング、市場動向、競合状況、技術開発の分析に優れています。一次調査と二次調査の両方、およびさまざまな分野にわたる戦略コンサルティングを専門としています。

よくある質問 :

第4回パーティの物流市場はどれくらいの大きさですか?

4人目の物流市場は、USD 67.6で評価されると推定される 2024年のBnは、2031年までにUSD 114.4 Bnに達すると予想されます。

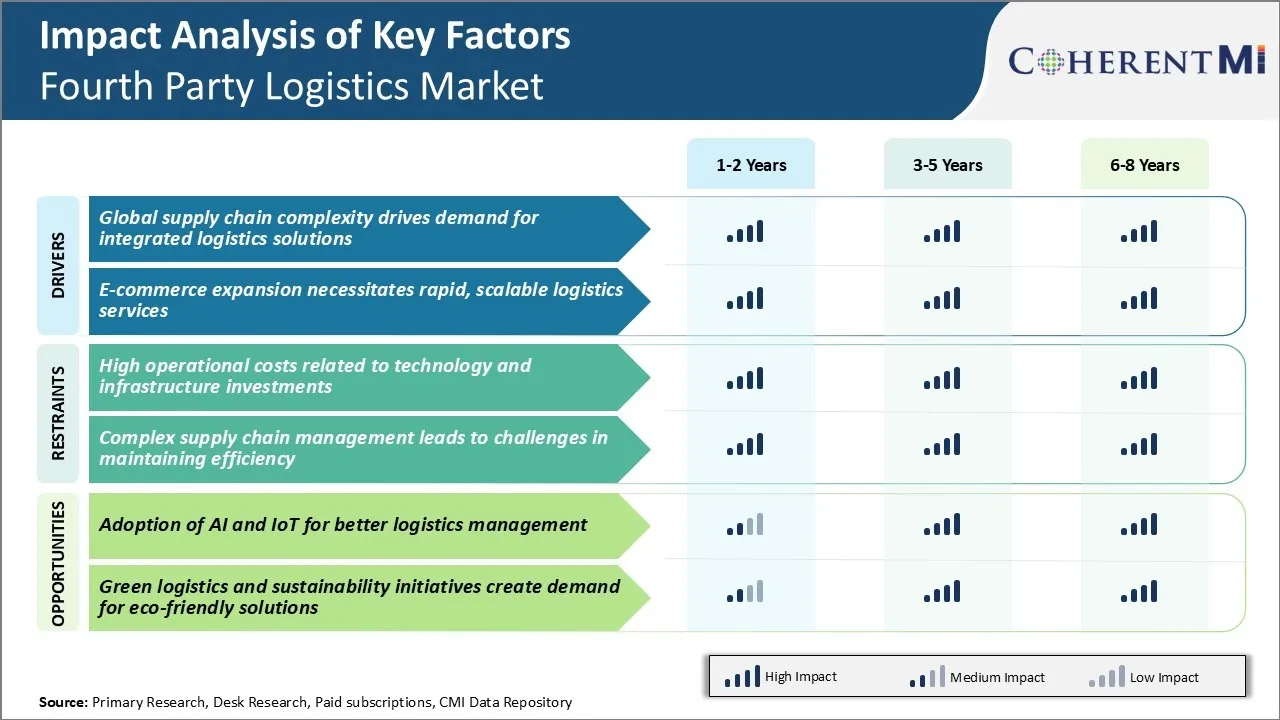

第4回物流市場の成長を妨げる重要な要因は何ですか?

テクノロジー、高インフラ投資、および複雑なサプライチェーン管理に関する高い運用コストは、第4次物流市場の成長を妨げる主要な要因です。

第4回物流市場成長を推進する主要な要因は何ですか?

グローバルサプライチェーンの複雑性は、統合物流ソリューションの需要を促進し、急激でスケーラブルな物流サービスを必要とする電子商取引の拡大は、第4回物流市場を牽引する主要な要因です。

4人目の物流市場でのリーディングタイプは?

主要なタイプ区分は解決の積分器モデルです。

4人目の物流市場で活躍している主要な選手は?

CEVA Logistics AG, United Parcel Service, Inc., GEFCO Group, Logistics Plus Inc., DAMCO, Allyn International Services, Inc.は、主要なプレーヤーです。

第4回パーティ・ロジスティクス・マーケットのCAGRとは?

2024年から2031年にかけて、第4回パーティ・ロジスティクス・マーケットのCAGRが7.81%となる見込みです。