Global Remote Sensing Services Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2023 - 2030)

Global Remote Sensing Services Market is Segmented By Service (Data Acquisition/Processing, Consulting Services, Managed Services, Value-added Service....

Global Remote Sensing Services Market Size

Market Size in USD Bn

CAGR11.8%

| Study Period | 2023 - 2030 |

| Base Year of Estimation | 2022 |

| CAGR | 11.8% |

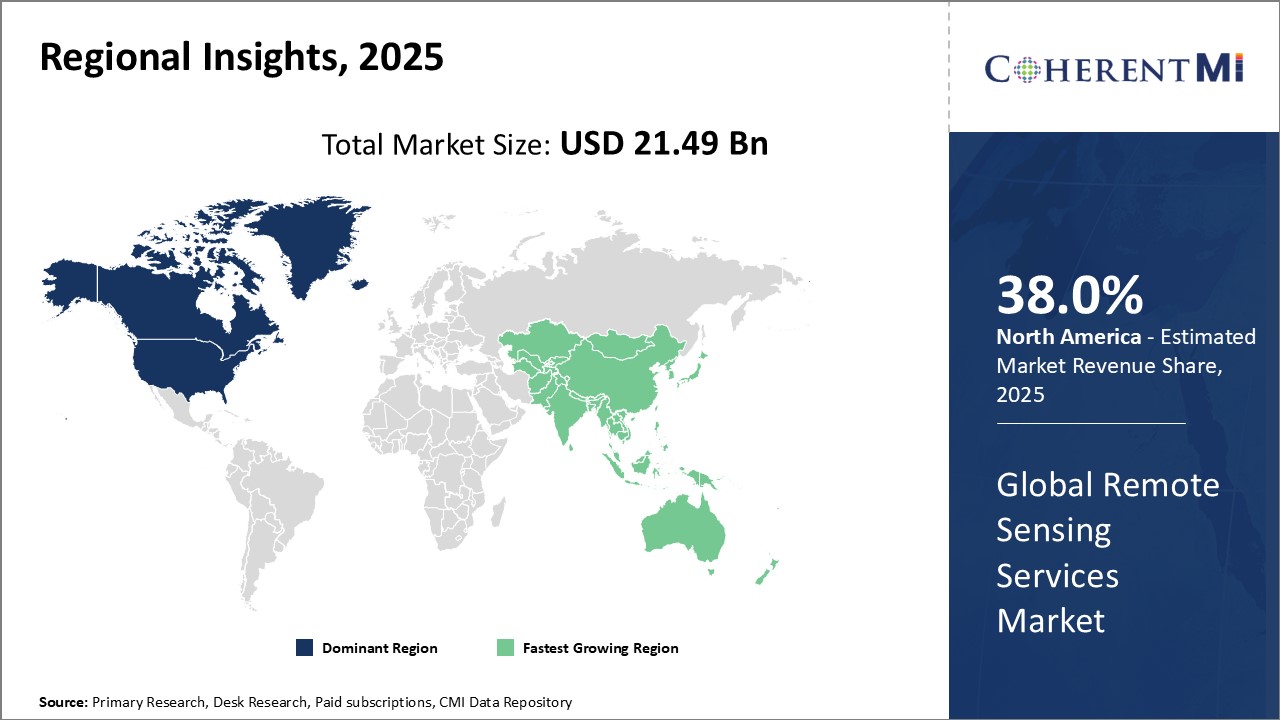

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | High |

| Major Players | Airbus, Planet Labs, Maxar Technologies, ICEYE, BlackSky and Among Others. |

please let us know !

Global Remote Sensing Services Market Analysis

Global remote sensing services market size is estimated to be valued at US$ 17.13 Bn in 2023 and is expected to reach US$ 37.82 Bn by 2030, exhibit a compound annual growth rate (CAGR) of 11.8% from 2023 to 2030. Remote sensing services involve acquiring and analyzing data about an object or phenomenon through devices that are not in physical contact with the object. This includes technologies like aerial photography, satellites, radars, lidar, and others. Remote sensing provides several advantages such as wide coverage, real time data, and cost effectiveness as compared to ground surveys. The market growth is driven by rising need for improved monitoring and surveillance across industries, increasing adoption of location-based services, growing applications in military intelligence, and defense sectors.

Global remote sensing services market is segmented by service, end use industry, technology, application, and region. By service, the market is segmented into data acquisition/data processing, consulting services, managed services and value-added services. Data acquisition/data processing accounted for the largest share, due to the increasing need for geospatial data and maps across various industries.

Global Remote Sensing Services Market Drivers:

- Increasing need for improved monitoring and surveillance: The need for improved monitoring and surveillance across various industries such as agriculture, defense, infrastructure, and energy is driving the growth of the global remote sensing services market. Remote sensing technologies allow round-the-clock, real-time monitoring of assets, infrastructure, borders, troop movements, and others. Industries are adopting remote sensing services for applications ranging from pipeline monitoring, illegal mining detection, border patrolling, crop health monitoring and more. For instance, satellite imagery is being used to monitor oil pipeline networks spanning thousands of kilometers to identify leaks, encroachments or damages. Such wide scale monitoring needs are creating significant demand for remote sensing services.

- Rising adoption of location-based intelligent systems: Adoption of location-based intelligent systems across transportation, logistics, defense and other sectors is contributing to the remote sensing services market growth. Technologies like global navigation satellite system (GNSS), geographic information system (GIS), internet of things (IoT) and navigation systems rely on location-based data and geospatial inputs which remote sensing provides. For example, self-driving cars use lidar, camera, and satellite inputs for navigation. Drone food delivery relies on global positioning system and satellite maps. Such growing use cases of location-aware intelligent systems are driving the need for remote sensing services for mapping, geospatial data applications.

- Increasing applications in the military and defense sector: Remote sensing technology is being increasingly adopted in the military and defense sector for applications such as border monitoring, battle damage assessment, terrain mapping, navigation, troop movement monitoring, and more. Defense forces are using high-resolution satellite imagery, unmanned aerial vehicle (UAV) and radar data for intelligence, surveillance, and reconnaissance. For instance, synthetic aperture radar data is used for detecting disturbed soil and camouflaged objects. Rising adoption in the defense sector is contributing to the growth of the global remote sensing services market.

- Advancements in sensor technologies and imaging capabilities: Continuous advancements in sensor technologies like Synthetic Aperture RADAR, Light Detection and Ranging (LiDAR), thermal, and multispectral imaging are leading to higher resolution and 3D imaging capabilities. New micro and nanosat constellations can provide real-time earth observation data. Drones can provide centimeter-level mapping. Such improvements are leading to more accurate and rich data available through remote sensing. This is driving uptake across mapping, agriculture, mining and other sectors which depend on highly precise and detailed data.

Global Remote Sensing Services Market Opportunities:

- Integration of artificial intelligence (AI) and big data analytics: The integration of AI and big data analytics in remote sensing for automated feature extraction, image analysis, and insights generation provides significant growth opportunities. AI can help process huge volumes of geospatial data efficiently. Machine learning algorithms can help automatically classify terrain, detect objects, map changes, and others from satellite imagery. The companies are forming partnerships to integrate AI in their analytics workflows. For instance, geospatial analytics firm Orbital Insight, California-based geospatial analytics company acquired AI startup RS Metrics, a satellite analytics company. Such integration unlocks the full potential of geospatial big data.

- Increasing government initiatives and investments: Governments are undertaking initiatives like smart city projects, digital India, infrastructure modernization, and others which are driving public investments in geospatial technologies and remote sensing services. Government tenders related to urban planning, transportation mapping, and land records digitization provide opportunities for private remote sensing firms. Moreover, space agencies like National Aeronautics and Space Administration (NASA), an independent agency of the U.S. federal government responsible for the civil space program, aeronautics research, and space research, European Space Agency (ESA), a 22-member intergovernmental body devoted to space exploration and Indian Space Research Organisation (ISRO), national space agency of India. are expanding their earth observation and satellite missions. Such rising public investments and focus on remote sensing technology development is creating growth avenues.

- Emergence of micro and nanosatellites: Emergence of micro and nanosatellites has the potential to disrupt the remote sensing services market, by lowering launch costs and facilitating deployment of satellite constellations for real-time earth observation. Companies like Planet Labs, Spire Global, Capella Space are launching Cubesat and microsatellite networks for high revisit imaging. Such lower cost access to space is enabling new use cases dependent on timely data. As microsatellite adoption rises, it can expand the adoption of remote sensing across newer industries and applications.

- Growing penetration in developing countries: Developing countries like India, China, and Brazil offer strong growth opportunities for remote sensing service providers, due to rapidly growing economies, focus on modernization, and improved internet connectivity. These countries have major infrastructure, agriculture, and urbanization needs where geospatial intelligence provides valuable insights. Emerging economies are also investing more in their space programs. Rising awareness and adoption of remote sensing data can potentially uplift millions in developing countries.

Global Remote Sensing Services Market Restraints:

- Limitations in spatial and spectral resolution: While remote sensing technology has improved significantly, there still remain some limitations in terms of the spatial and spectral resolution possible from satellite and aerial platforms. This poses challenges for applications that require highly detailed and precise data. For instance, identifying tree species, measuring crop canopy geometry relies on high resolution hyperspectral or Light Detection and Ranging (LIDAR) data which can be costly. Such limitations restrain adoption for use in cases with fine data requirements.

- Complexities in data integration and analytics: Realizing the full potential of remote sensing requires integration of data from multiple platforms like satellites, drones, and ground sensors along with advanced analytics and algorithms. However, significant technical challenges exist in systematic collation, processing, fusion and analysis of heterogeneous remote sensing datasets. Lack of common data models, taxonomies makes integration complex. Analytics capabilities also need to keep improving. Such challenges hinder widespread adoption.

- High costs of services and data acquisitions: The high costs of remote sensing services and data acquisition remain a barrier, especially for smaller firms and developing countries. Satellite launches, operations, and data processing require significant investments and specialized infrastructure. High resolution data can be very expensive, thus limiting uptake to only well-funded organizations. There is also a shortage of technical expertise required to analyze and interpret remote sensing data. Such costs and expertise requirements restrain market growth.

Analyst’s View:

The global remote sensing services market has tremendous growth opportunities in the coming years. The increasing use of geospatial data across various industries such as defense, agriculture, energy & power is a major driver for market growth. Additionally, the rise in urbanization and infrastructure development projects worldwide will augment the demand for remote sensing solutions. However, the lack of skilled workforce and high costs associated with satellite imagery and data processing are some challenges impeding the market expansion. Data privacy and security concerns also act as a restraint while collecting and sharing geospatial data.

That said, the increasing integration of AI, IoT, and blockchain technologies with remote sensing platforms is expected to unlock new revenue streams. Adoption of remote sensing as a service or SaaS model would help lower the entry barriers for small organizations. Moreover, the development of small satellite constellations for Earth observation by private space companies would make space-based imaging more accessible and affordable.

The Asia Pacific region, with emerging economies like China and India investing heavily in infrastructure and urban development, is projected to dominate the global market in the long run. North America will likely continue holding the second position owing to strong defense budgets and the presence of leading tech companies offering commercial remote sensing. Overall, the demand for precision agriculture, environmental monitoring, and defense modernization worldwide will drive sustained growth in the remote sensing services industry.

Global Remote Sensing Services Market Trends

- Increasing demand for unmanned aerial vehicle (UAV) /drones for remote sensing: The demand for UAVs and drones integrated with remote sensors for mapping, surveying, and earth observation applications has seen significant growth. Drones provide on-demand and flexible data capture, with quick turnaround times. High resolution drone imagery and lidar data enables creation of accurate base maps, 3D site models, digital terrain models, and others. Logistics firms are using drones for last mile delivery navigation. Such rising adoption of drones for remote sensing is a key trend.

- Growing interest in small satellites: There is a growing interest in small satellites like cubesats and microsatellites to provide earth imaging capabilities at lower costs as compared to large legacy observation satellites. Companies like Satellogic, a company specializing in Earth-observation satellites, ICEYE, a Finnish microsatellite manufacturer, Capella Space, an American space company are deploying constellations of small SAR and optical satellites for near real-time earth observation. Their low costs enable faster refresh rates and deployments, supporting new capabilities. More competitors are likely to enter this small satellite remote sensing segment.

- Cloud computing and data analytics: The remote sensing field is increasingly adopting cloud computing, geospatial analytics, machine learning to process huge volumes of satellite data into actionable insights. Cloud delivers the storage and computational power to apply analytics at scale. Analytics helps classify terrain, detect map features, assess disasters, monitor climate change and others by processing multiple data sources. Cloud and analytics are disrupting traditional manual image analysis processes.

- Partnerships and platforms for data integration: There is a rise in strategic partnerships between geospatial data providers, satellite operators, analytics firms and end use industries to integrate data sources into platforms and solutions tailored to industry-specific use cases. For instance, miners are partnering with remote sensing firms to integrate geospatial and ground sensor data to identify new deposits. Such partnerships help integrate real-time and archival data from diverse sources into customizable decision support platforms.

Figure 1. Global Remote Sensing Services Market Share (%), By Region, 2023

Competitive overview of Global Remote Sensing Services Market

Airbus, Planet Labs, Maxar Technologies, ICEYE, BlackSky, Satellogic, UrtheCast Corp., Deimos Imaging, and GeoOptics

Global Remote Sensing Services Market Leaders

- Airbus

- Planet Labs

- Maxar Technologies

- ICEYE

- BlackSky

Global Remote Sensing Services Market - Competitive Rivalry, 2023

Global Remote Sensing Services Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Global Remote Sensing Services Market

New product launches

- In April 2022, Planet Labs, an American public Earth imaging company launched its high-resolution SkySat satellites capable of 50 cm per pixel resolution. This launch expands Planet Labs’ constellation and imaging capabilities.

- In January 2021, BlackSky, a space-based intelligence company launched its latest high resolution Gen-3 satellites to enhance monitoring capabilities for government and commercial customers

- In June 2020, Maxar Technologies unveiled its new WorldView Legion satellite constellation to provide high revisit rates and mid-resolution imagery

Acquisition and partnerships

- In April 2022, Satellogic announced acquisition of Arceo.ai to integrate AI analytics capabilities into its earth observation platform

- In November 2021, Planet Labs acquired VanderSat to expand into radio occultation data services using satellite technology

- In March 2021, BlackSky entered into a strategic partnership agreement with Palantir Technologies to integrate geospatial data into Palantir's analytics platform

Global Remote Sensing Services Market Segmentation

- By Service

- Data Acquisition/Data Processing

- Consulting Services

- Managed Services

- Value-added Services

- Others (Application Development, Ground Segment, Image Processing)

- By End Use Industry

- Defense & Security

- Agriculture

- Energy & Natural Resources Management

- Engineering & Infrastructure

- Environmental Monitoring

- Marine

- Others (Media & Entertainment, Insurance, Tourism)

- By Technology

- GIS/GNSS

- Lidar

- Drones/UAV

- Aerial Photography

- Satellite Imagery

- Others (IoT, Cloud Computing)

- By Application

- Geoengineering & Construction

- Disaster Management

- Energy Management

- Surveillance & Security

- Urban Planning & Development

- Agriculture Monitoring & Management

- Others (Mining, Marine, Insurance)

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering growth of the global remote sensing services market?

Limitations in spatial and spectral resolution, complexities in data integration and analytics, and high costs of services and data acquisition are the key factors hampering growth of the global remote sensing services market.

What are the major factors driving the global remote sensing services market growth?

Increasing need for improved monitoring and surveillance, rising adoption of location-based intelligent systems, increasing applications in the military and defense sector, advancements in sensor technologies and imaging capabilities are the major factors driving the global remote sensing services market growth.

Which is the leading service segment in the global remote sensing services market?

The leading service segment in the global remote sensing services market is data acquisition and data processing services.

Which are the major players operating in the global remote sensing services market?

The major players operating in the global remote sensing services market are Airbus, Planet Labs, Maxar Technologies, ICEYE, BlackSky, Satellogic, UrtheCast Corp., Deimos Imaging, and GeoOptics.

What will be the CAGR of global remote sensing services market?

The CAGR of the global remote sensing services market is 11.8%.