Medical Suction Devices Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Medical Suction Devices Market is segmented By Product Type (AC-Powered Suction Devices, Battery-Pow...

Medical Suction Devices Market Size - Analysis

The Global Medical Suction Devices Market is estimated to be valued at USD 1.41 Billion in 2024 and is expected to reach USD 2.03 Billion by 2031, growing at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2031.

The medical suction devices market is expected to witness positive growth over the forecast period. Key factors such as rising incidences of various chronic diseases & increased number of surgical procedures performed globally will drive the demand for medical suction devices. Additionally, ongoing technological advancements leading to product developments catering to the needs of various end users including homecare settings & emergency medical services will further aid the market expansion. Adoption of portable & wireless devices for suction and rising medical tourism in emerging nations also present significant growth opportunities for market players operating in this sector. However, high costs associated may negatively impact the market growth to some extent during the forecast years.

Market Size in USD Bn

CAGR5.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.2% |

| Market Concentration | High |

| Major Players | Olympus, Laerdal Medical, Medela AG, Precision Medical, Inc., ATMOS MedizinTechni GmbH & Co. KG and Among Others |

please let us know !

Medical Suction Devices Market Trends

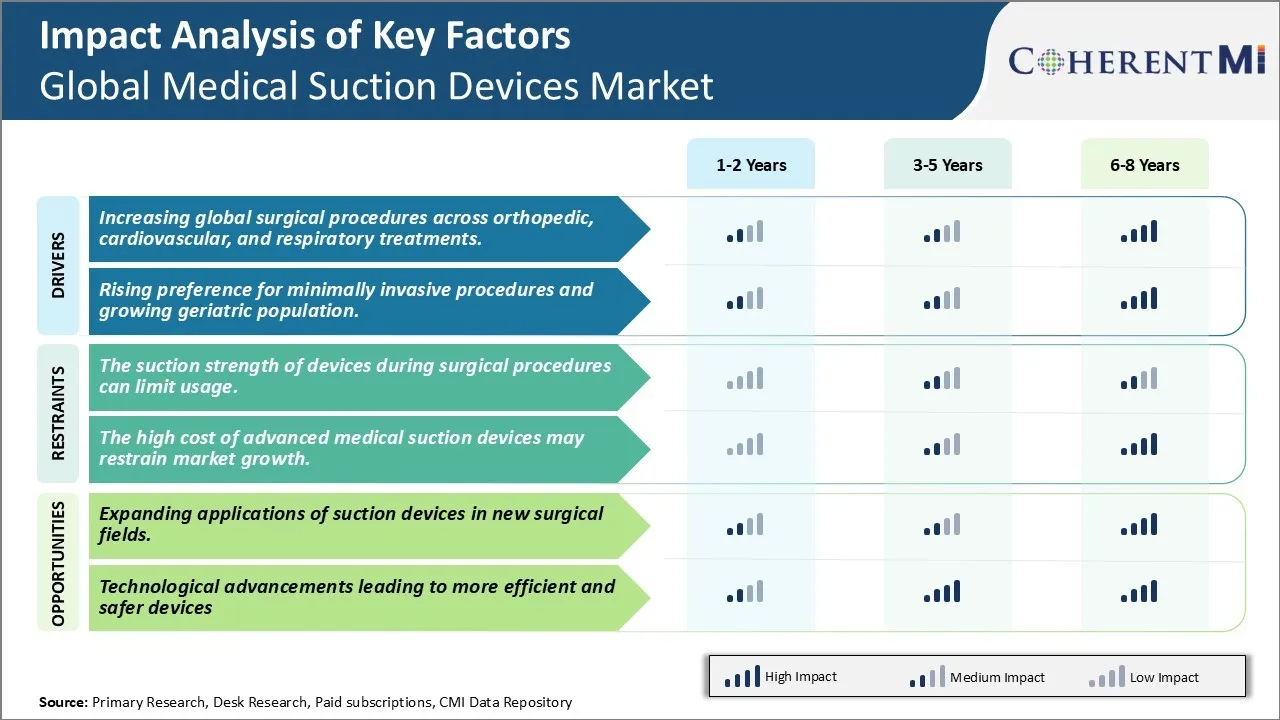

Market Driver - Increasing global surgical procedures across orthopedic, cardiovascular, and respiratory treatments.

As per the statistics, the number of surgeries performed globally has witnessed a significant rise over the past few years. This increasing surgical trend can be attributed to various factors such as growing incidence of chronic diseases, rise in ageing population, advancement in surgical technologies and methods, and increasing healthcare expenditure levels in developing economies.

Orthopedic surgeries have shown a strong rise owing to factors such as growing obesity problem leading to orthopedic disorders, increasing road accidents and injuries, continuous advancement in joint replacement surgeries including knee and hip replacement. It has been estimated that over 4 million knee and hip replacement surgeries are performed globally each year. With better implants, improved surgical techniques and rising affordability, the volumes are expected to grow substantially in the coming years. Suction devices play a vital role in minimizing blood loss and maintaining a clear surgical field during orthopedic procedures.

Similarly, cardiovascular surgical procedures have also grown considerably driven by the rising prevalence of cardiovascular diseases (CVDs) as well as growing adoption of minimally invasive cardiac surgeries. CVDs have become one of the leading causes of morbidity and mortality worldwide. As per recent reports, over 17 million people die annually from CVDs accounting for nearly one third of total global deaths. This has further driven the need for various interventional cardiac procedures thereby fueling demand for suction devices in the cardiovascular segment.

Even respiratory surgeries have witnessed significant growth rates over time. Chronic respiratory conditions including COPD, asthma and lung cancer have increased manifold in recent years. This can be attributed to rapidly growing pollution levels, rising smoking prevalence until recent past and aging population. Continuously increasing respiratory diseases and growing accessible and affordable care is positively impacting the respiratory surgery volumes globally. Various critical respiratory procedures such as lung cancer surgeries, tracheostomy require suction devices to remove excessive fluids providing clear surgical access and minimizing risks.

Rising preference for minimally invasive procedures and growing geriatric population

With advanced technology and accumulating clinical evidences, minimally invasive procedures have become the standard of care for various surgeries over the past few years. These advanced procedures are preferred by surgeons as well as patients owing to benefits such as reduced trauma, fewer complications, shorter recovery time, minimal pain and scarring. Procedures such as laparoscopic gallbladder removal, laparoscopic hernia repair, arthroscopic knee surgery, and robotic cardiac surgery are increasingly performed using minimally invasive techniques. In addition, preference for day-care or short-stay surgeries has also been increasing worldwide due to their convenience and affordability. Suction devices play an important role in minimizing bleeding and maintaining clear field of vision during such minimally invasive procedures.

At the same time, increasing global life expectancy has resulted in significant growth of aging population worldwide. As per United Nations report, the population aged 60 years and above is projected to double from 12% to 22% between 2015 and 2050 globally. Aged population is more prone to acquire chronic illnesses and injuries. With age, body’s physiological functions start declining increasing the necessity of medical interventions. Also, the aged might already be on long-term medications requiring surgeries or biopsies from time to time. Recent advancements have enabled even complex surgeries to be performed safely on geriatric patients. However, extra precautions and specific instrument requirements have to be followed. Hence, growing seniors’ population base undergoing various surgical procedures is anticipated to boost demand for safe and effective suction devices globally in the coming years.

Market Challenge - The suction strength of devices during surgical procedures can limit usage.

The suction strength of devices during surgical procedures can limit usage. One of the key challenge faced by the global medical suction devices market is inconsistent suction strength provided by the devices during surgical procedures. The suction strength needs to be controlled and adjusted precisely based on the requirement during different stages of a surgery. However, many existing devices have limitation in providing variable yet consistent suctioning power according to the need. This becomes more difficult during complex surgeries which require high level of precision. Any unevenness in suction strength can disrupt the workflow for surgeons and affect the outcome of the procedures. Device manufacturers need to focus on innovations to design programmable suction pumps and systems which can deliver adjustable yet constant suctioning as per the real-time requirements during surgical workflows. This will help address current limitations and allow broader application of suction devices across different types of surgeries.

Market Opportunities for the Global Medical Suction Devices Market

Expanding applications of suction devices in new surgical fields. The global medical suction devices market is poised to witness significant growth opportunities due to the expanding applications of these devices in new surgical verticals. Traditionally, suction pumps and equipment were predominantly used in general surgery, gynaecology and dental surgeries for clearing fluids and secretions from the surgical site. However, with ongoing advancements, these devices are now increasingly finding applications in other complex surgical specialties. For instance, mechanical suction probes with highly customizable tips help surgeons clearly view narrow operating fields in delicate surgeries like laparoscopy and arthroscopy. Similarly, portable battery-powered suction units have enabled new minimally invasive procedures. Device manufacturers can capitalize on these emerging opportunities by launching specialized product ranges tailored for unique needs of different surgical specialties. This will help expand market outreach as well as aid standardization of suction-based workflows across multiple therapeutic areas.

Key winning strategies adopted by key players of Medical Suction Devices Market

Product Innovation: Introducing innovative products designed to suit evolving patient needs has proven to be an effective strategy. For example, in 2015, Allied Healthcare launched the ACHIEVE range of portable suction units with features like battery life indicators and easy-to-use controls. This helped them gain market share. Similarly, Medela LLC launched its InnovaSate suction devices in 2017 featuring Whisper technology for ultra-quiet use. Novel features enhanced quality of care and boosted brands’ reputation.

Strategic Acquisitions: Acquiring established brands has helped companies expand their portfolio and presence across regions. For instance, in 2019, Olympus Corporation acquired Medela, a leading player offering breast pumps and other homecare solutions. This solidified Olympus' presence in breastfeeding and breastmilk pumping market. Similarly, in 2021, Invacare acquired Arjo, the second largest medical device company. This strengthened Invacare's product portfolio and distribution globally.

Focus on Emerging Markets: With developing economies expected to drive future growth, targeting emerging Asia Pacific and Latin American countries proved profitable. For example, ATMOS MedizinTechnik focused investments in China, India and Brazil since 2010. By 2017, these regions contributed over 35% of its revenues. Similarly, Medicop's establishment of subsidiaries in Russia and other CIS countries helped grow regional sales by 18% annually between 2012-2017.

These examples demonstrate how product innovation, strategic acquisitions and focus on high growth regions helped companies achieve competitive advantage and gain substantial market share in the global medical suction devices industry. Timely implementation of right strategies supported their leadership positions.

Segmental Analysis of Medical Suction Devices Market

Insights, By Product Type - Efficiency and Reliability Drive Demand for AC-Powered Suction Devices

In terms of By Product Type, AC-Powered Suction Devices contributes the highest share of the market with 41.2% in 2024 owing to their consistent performance and cost-effectiveness. Powered directly from wall outlets, AC-powered devices do not require battery replacements, making them a low-maintenance option ideal for high-volume settings. Their powerful, continuous suction allows for swift removal of fluids without interruption, crucial in emergency situations or complex procedures. As healthcare facilities strive for prompt treatment and turnover times, AC-powered suction devices meet the need for reliable suction available on demand. Their durability also makes them a worthwhile long-term investment. With no batteries that degrade over time, their suction output remains strong throughout the device lifespan, reducing total cost of ownership compared to alternatives.

Insights, By Application, - Respiratory Applications Benefit from Maximum Suction Functionality

In terms of By Application, Respiratory contributes the highest share of the market with 35% in 2024owing to extensive use of suction in pulmonary care. Removing fluids, secretions, vomit or blood from airways is essential for respiration, resuscitation and oxygen therapy. The often-significant volumes and viscosity of materials extracted require high levels of suction that are best provided by medical suction devices. Their portability also allows continuous suction at the point-of-care throughout respiratory treatment and monitoring. Various respiratory suction attachments precisely target different airways, enabling thorough and gentle clearing. As respiratory conditions continue affecting large patient populations, the need for specialized yet flexible suction tools drive steady demand in this application segment.

Insights, By End User, - Access to Critical Care Boosts Hospital Adoption of Suction Devices

In terms of By End User, Hospitals contribute the highest share of the market with 45% in 2024 owing to concentration of complex respiratory, surgery and ICU cases. Demand is driven by need for rapid response in emergencies and acuity of inpatient cases. Access to advanced surgical, diagnostic and monitoring equipment within hospital infrastructure also requires corresponding medical suction devices for various applications and specialties. Preference for branded, high-quality equipment supports by facilities helps ensure patient safety and compliance with institutional standards. Given large patient volumes and necessity of suction for numerous acute and critical care needs, hospitals represent a substantial and consistent consumer base for medical suction device manufacturers.

Additional Insights of Medical Suction Devices Market

- The Medical Suction Devices Market is poised for steady growth, driven by increasing surgical procedures and the rise in minimally invasive surgeries. North America dominates the market, with a significant share attributed to the advanced healthcare infrastructure and the rising geriatric population in the region. Technological advancements, such as the integration of more efficient suction mechanisms and better materials, are likely to create new opportunities for market expansion. However, challenges like the high cost of advanced devices and limitations in suction power during critical procedures may restrain the market.

Competitive overview of Medical Suction Devices Market

The major players operating in the Global Medical Suction Devices Market include Laerdal Medical, Precision Medical, Inc., Medela AG, Olympus Corporation, Amsino International Inc., Allied Healthcare Products, Atmos Medizintechnik, Drive DeVilbiss Healthcare, MG Electric (Colchester) Ltd., Asahi Kasei Corporation (Zoll Medical Corporation), Integra Biosciences AG, Labconco Corporation, Flexicare (Group) Limited, Stryker Corporation and Smiths Medical.

Medical Suction Devices Market Leaders

- Olympus

- Laerdal Medical

- Medela AG

- Precision Medical, Inc.

- ATMOS MedizinTechni GmbH & Co. KG

Medical Suction Devices Market - Competitive Rivalry

Medical Suction Devices Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Medical Suction Devices Market

- On April 2024 Flexicare (Group) Limited, a leading global provider of innovative medical devices, acquired Allied Healthcare Products. This acquisition aims to enhance Flexicare's product portfolio by incorporating new areas such as emergency products, medical gas systems, suction regulators and aspirators, transport ventilators, CO2 absorbents, and home healthcare products. The expansion will leverage well-established brands like Gomco, Lif-O-Gen, Chemetron, Timeter, Vacutron, Schuco, B&F Medical, Carbolime, and LithoLyme.

- In March 2023, Amsino International Inc. secured a suction and fluid management product agreement with Premier Inc. This agreement offers Premier members access to pre-negotiated special pricing and terms for suction and fluid management products.

- In April 2023 Defibtech LLC launched the automated CPR device ARM XR, which includes a suction cup piston design for improved chest wall expansion during CPR, enhancing patient outcomes in cardiac emergencies.

- In August 2021Boston Scientific Corporation received FDA clearance for the EXALT™ Model B Single-Use Bronchoscope, designed for ICU and OR procedures, offering superior suction and precise imaging.

- In May 2021 Olympus received FDA clearance for its Airway Mobilescopes, which provide suction and continuous air supply during upper and lower airway management procedures.

Medical Suction Devices Market Segmentation

- By Product Type

- AC-Powered Suction Devices

- Battery-Powered Suction Devices

- Manual Suction Devices

- By Application

- Respiratory

- Surgical

- Gastric

- Wound Drainage

- Others (Dental, Veterinary, etc.)

- By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Home Care Settings

- Emergency Medical Services (EMS)

- By Portability

- Portable Suction Devices

- Stationary Suction Devices

Would you like to explore the option of buyingindividual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

What are the key factors hampering the growth of the Global Medical Suction Devices Market?

The the suction strength of devices during surgical procedures can limit usage. and the high cost of advanced medical suction devices may restrain market growth. are the major factor hampering the growth of the Global Medical Suction Devices Market.

What are the major factors driving the Global Medical Suction Devices Market growth?

The increasing global surgical procedures across orthopedic, cardiovascular, and respiratory treatments. and rising preference for minimally invasive procedures and growing geriatric population. are the major factor driving the Global Medical Suction Devices Market.

Which is the leading Product Type in the Global Medical Suction Devices Market?

The leading Product Type segment is AC-Powered Suction Devices.

Which are the major players operating in the Global Medical Suction Devices Market?

Laerdal Medical, Precision Medical, Inc., Medela AG, Olympus Corporation, Amsino International Inc., Allied Healthcare Products, Atmos Medizintechnik, Drive DeVilbiss Healthcare, MG Electric (Colchester) Ltd., Asahi Kasei Corporation (Zoll Medical Corporation), Integra Biosciences AG, Labconco Corporation, Flexicare (Group) Limited, Stryker Corporation, Smiths Medical are the major players.

What will be the CAGR of the Global Medical Suction Devices Market?

The CAGR of the Global Medical Suction Devices Market is projected to be 5.2% from 2024-2031.