Peritoneal Dialysis Equipment Market Size - Analysis

Market Size in USD Bn

CAGR6.2%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.2% |

| Market Concentration | High |

| Major Players | Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Terumo Corporation, Medtronic plc, Utah Medical Products, Inc. and Among Others |

please let us know !

Peritoneal Dialysis Equipment Market Trends

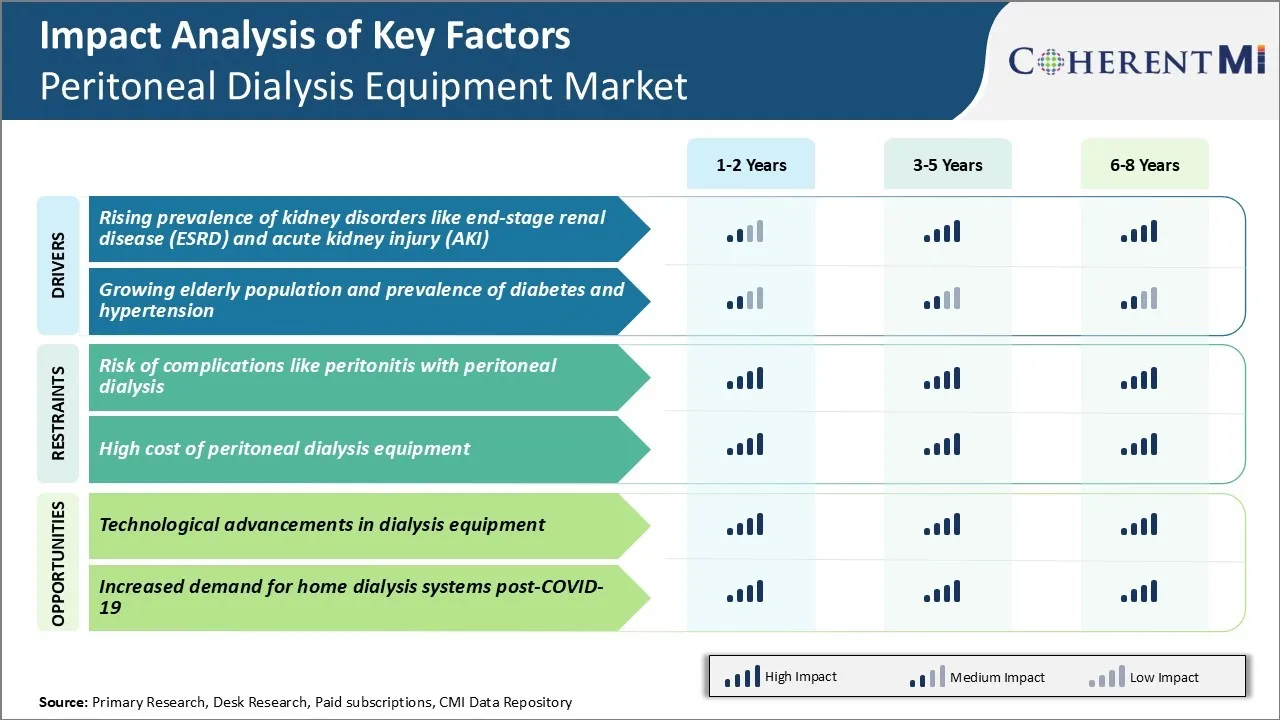

Increasing prevalence of chronic kidney diseases especially ESRD and AKI has emerged as one of the key drivers of the peritoneal dialysis equipment market.

As per WHO, over 13 million cases of AKI are reported annually across the world. Even though majority of AKI cases improve with conservative treatment, the rising burden on healthcare systems due to longer hospital stays is undisputed.

With growing prevalence of risk factors globally, the incidence of both chronic and acute kidney diseases is expected to rise significantly creating sustained demand in the peritoneal dialysis equipment market in coming years.

Market Driver - Growing Elderly Population and Prevalence of Diabetes and Hypertension

Notably, over 80% of kidney failures occur in people aged over 60 as elderly people have higher kidney dysfunction risks. Global prevalence of diabetes and pre-diabetes has risen dramatically over the past few decades and now affecting over half billion people. Hypertension is even more widespread with an estimated 1.13 billion hypertensive population globally as per WHO estimates.

Overall, confluence of demographic and disease trends has not only expanded the pool of dialysis patients but also the pool suitable for automated peritoneal dialysis to self-manage their healthcare requirements.

One of the key challenges faced by the peritoneal dialysis equipment market is the risk of various complications that can arise from using peritoneal dialysis as a treatment method. Peritonitis, which refers to the infection or inflammation of the peritoneum, is a severe complication that can occur in up to 30% of peritoneal dialysis patients over time.

The risk of peritonitis and other infections means patients have to be very careful about aseptic techniques during dialysis exchanges. Minor contamination can potentially lead to inflammation. This risk factor and the treatment challenges associated with peritonitis cases can negatively impact the demand for peritoneal dialysis systems and affect growth for the peritoneal dialysis equipment market.

Market Opportunity - Technological Advancements in Dialysis Equipment for Market Opportunities

Another focus area is the integration of advanced connectivity features in dialysis cyclers and systems. The addition of wireless data transfer capabilities and remote monitoring functions allow patients to receive treatment while staying at home. This shift to ‘home hemodialysis’ is more convenient and improves patient comfort.

Key winning strategies adopted by key players of Peritoneal Dialysis Equipment Market

One of the most successful strategies adopted was focus on innovation and new product launches. For instance, Baxter launched newer versions of its cycler machines and peritoneal dialysis solutions in 2015 and 2017 that were smaller, more portable and integrated touchscreen controls. This made home therapy more convenient for patients. These launches helped Baxter strengthen its leadership position in the market.

Players also focused intensively on partnerships and collaborations. For example, in 2010 DaVita partnered with Novartis to private label its diabetes drug and bundle it with PD treatments. This made therapy more accessible and affordable for patients. More recently in 2019, Baxter partnered with Resmed to integrate personalized respiratory therapies into home systems. This helped address comorbid conditions and improve patient outcomes.

Segmental Analysis of Peritoneal Dialysis Equipment Market

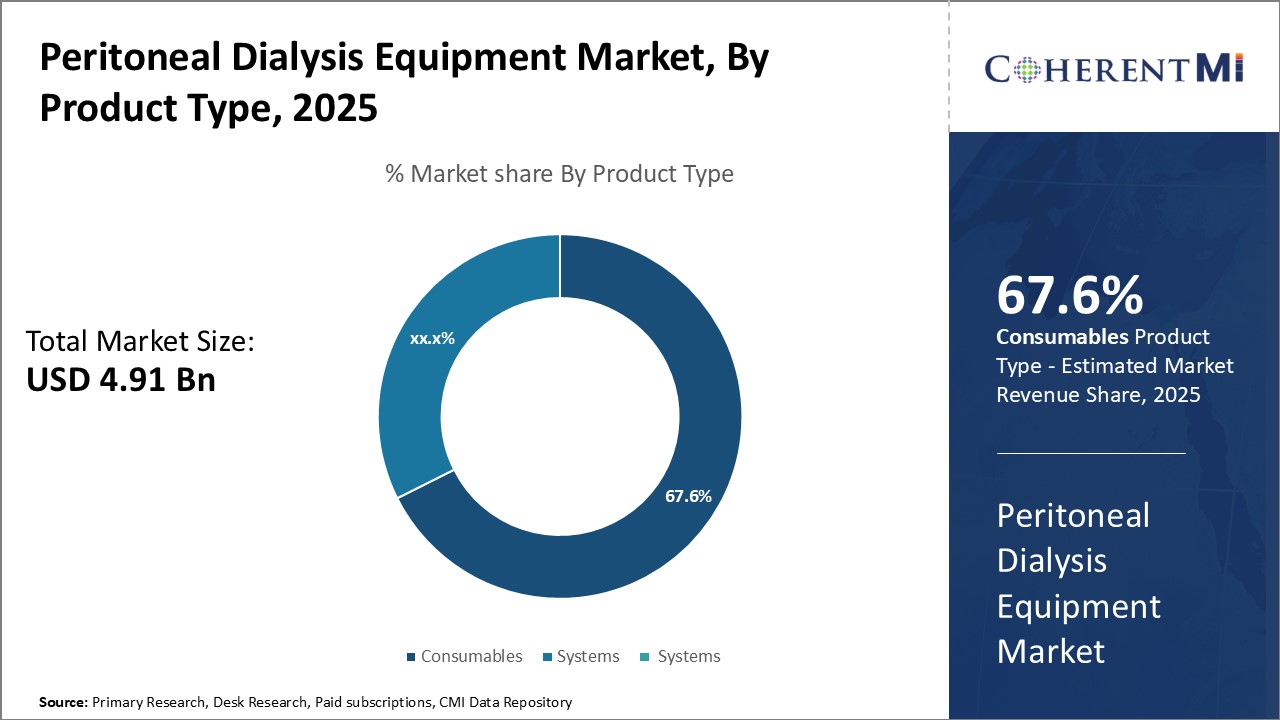

Insights, By Product Type: Convenience and Cost-Effectiveness Drive Consumables Demand

It also eliminates costs associated with equipment sterilization, maintenance, and repairs. As a result, consumables see high recurring demand from patients performing peritoneal dialysis at home or in centers.

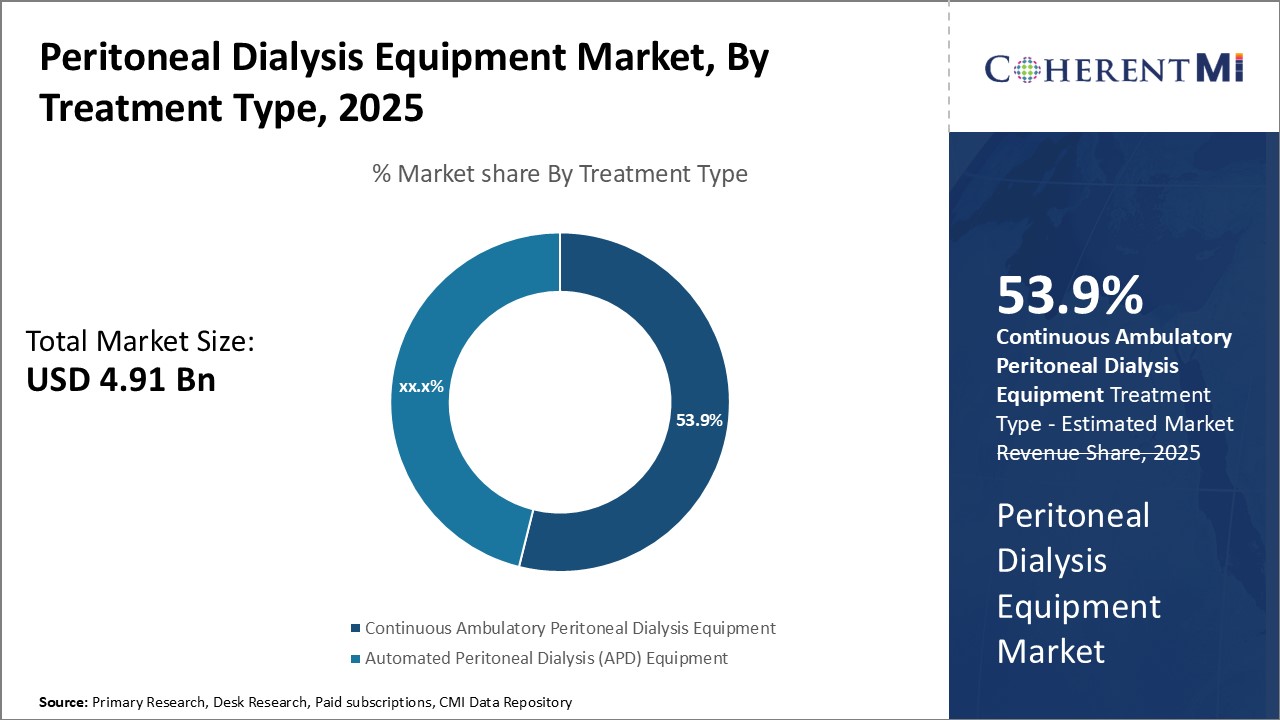

Insights, By Treatment Type: Flexibility Drives CAPD Equipment Popularity

Insights, By Treatment Type: Flexibility Drives CAPD Equipment PopularityIn terms of treatment type, continuous ambulatory peritoneal dialysis (CAPD) equipment segment is estimated to hold 53.9% share of the market in 2025, owing to the flexibility it provides patients. CAPD is a simple, manual process that does not require specialized equipment or training to operate.

Its convenience has resulted in strong adoption rates, particularly among elderly patients living independently or in assisted living facilities. As such, CAPD equipment maintains a clear lead over automated modalities that present constraints on mobility and freedom.

Insights, By End User: Independence Drives Home Care Demand

This independence helps maintain a sense of normalcy and improved quality of life compared to being restricted by center timing. With majority of peritoneal dialysis now shifting to simpler, user-friendly modalities like CAPD, most patients can independently manage therapy at home with basic training. This has made home-based care the compelling mode of treatment. Support from reimbursement programs and home health agencies further aid its accessibility.

Additional Insights of Peritoneal Dialysis Equipment Market

- The rising cases of ESRD and hypertension in the U.S. are boosting the demand for dialysis products. According to the CDC (2019), 47% of the U.S. population (116 million) suffer from hypertension, leading to kidney complications.

- Regional Insights: North America held the largest market share due to advanced healthcare infrastructure and high ESRD prevalence.

- The shift towards telemedicine has allowed for remote monitoring of peritoneal dialysis patients, enhancing patient care and adherence.

- Increased investments in R&D by key players are leading to more efficient and safer dialysis equipment.

Competitive overview of Peritoneal Dialysis Equipment Market

The major players operating in the peritoneal dialysis equipment market include Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Terumo Corporation, Medtronic plc, Utah Medical Products, Inc., Polymedicure, Cook, Cardiomed, Angiplast, Merit Medical Systems, Amecath, Newsol Technologies Inc., Renax Biomedical Tech. Co., Ltd., Jilin Province Maida Medical Equipment Co., Ltd., Kelun Group, Huaren Pharmaceutical Co., Ltd., Mitra Industries Pvt. Ltd., EQUIPOS DE BIOMEDICINA DE MÉXICO S.A DE C.V, Advin Health Care, and AWAK Technologies.

Peritoneal Dialysis Equipment Market Leaders

- Baxter International Inc.

- Fresenius Medical Care AG & Co. KGaA

- Terumo Corporation

- Medtronic plc

- Utah Medical Products, Inc.

Peritoneal Dialysis Equipment Market - Competitive Rivalry

Peritoneal Dialysis Equipment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Peritoneal Dialysis Equipment Market

- In September 2021, Fresenius Medical Care entered into a strategic distribution partnership with JMS Co. Ltd. in Japan. This agreement focuses on distributing Fresenius Medical Care's innovative home dialysis therapies, including automatic peritoneal dialysis systems, which have already received approvals from the U.S. FDA and European CE Mark. The partnership aims to address the growing demand for home dialysis in Japan, particularly driven by the country's aging population. This collaboration provides patients with a wider range of dialysis options that are more suited to their lifestyle and healthcare needs.

- In March 2021, Baxter International launched a new generation of peritoneal dialysis solutions aimed at improving patient outcomes. Baxter introduced systems like the HomeChoice Claria with the Sharesource remote patient management platform. This system enhances patient care by allowing clinicians to monitor PD treatments remotely and make adjustments without requiring patients to visit the clinic. This innovation is designed to improve patient outcomes, particularly in home-based dialysis settings, by offering real-time monitoring and data analysis.

- In October 2020, Fresenius Medical Care North America received FDA approval for their DELFLEX® peritoneal dialysis solutions, which use Biofine®, an innovative and more environmentally friendly bag material. This approval marked an important milestone in the company's efforts to enhance home dialysis products.

- In July 2020, Fresenius Medical Care announced the expansion of its home dialysis portfolio, particularly emphasizing the growth of peritoneal dialysis (PD) treatments. This expansion included increasing the availability of peritoneal dialysis solutions, highlighting their commitment to advancing home therapy options for patients with end-stage renal disease (ESRD). This was part of their broader strategy to enhance home-based care, which became even more significant during the COVID-19 pandemic as more patients opted for home dialysis to reduce clinic visits.

Peritoneal Dialysis Equipment Market Segmentation

- By Product Type

- Consumables

- Peritoneal Dialysis Solution

- Peritoneal Dialysis Transfer Sets

- Peritoneal Dialysis Catheters

- Others

- Systems

- Consumables

- By Treatment Type

- Continuous Ambulatory Peritoneal Dialysis (CAPD) Equipment

- Dialysis Solution

- Administration Sets

- Catheters

- Automated Peritoneal Dialysis (APD) Equipment

- Cyclers

- Tubing Sets

- Drainage Bags

- Continuous Ambulatory Peritoneal Dialysis (CAPD) Equipment

- By End User

- Home Care Settings

- Hospitals

- Dialysis Centers

Would you like to explore the option of buying individual sections of this report?

Komal Dighe is a Management Consultant with over 8 years of experience in market research and consulting. She excels in managing and delivering high-quality insights and solutions in Health-tech Consulting reports. Her expertise encompasses conducting both primary and secondary research, effectively addressing client requirements, and excelling in market estimation and forecast. Her comprehensive approach ensures that clients receive thorough and accurate analyses, enabling them to make informed decisions and capitalize on market opportunities.

Frequently Asked Questions :

How big is the peritoneal dialysis equipment market?

The peritoneal dialysis equipment market is estimated to be valued at USD 4.91 Bn in 2025 and is expected to reach USD 7.48 Bn by 2032.

What are the key factors hampering the growth of the peritoneal dialysis equipment market?

Risk of complications like peritonitis with peritoneal dialysis and high cost of peritoneal dialysis equipment are the major factors hampering the growth of the peritoneal dialysis equipment market.

What are the major factors driving the peritoneal dialysis equipment market growth?

Rising prevalence of kidney disorders like end-stage renal disease (ESRD) and acute kidney injury (AKI), growing elderly population, and prevalence of diabetes and hypertension are the major factors driving the peritoneal dialysis equipment market.

Which is the leading product type in the peritoneal dialysis equipment market?

The leading product type segment is consumables.

Which are the major players operating in the peritoneal dialysis equipment market?

Baxter International Inc., Fresenius Medical Care AG & Co. KGaA, Terumo Corporation, Medtronic plc, Utah Medical Products, Inc., Polymedicure, Cook, Cardiomed, Angiplast, Merit Medical Systems, Amecath, Newsol Technologies Inc., Renax Biomedical Tech. Co., Ltd., Jilin Province Maida Medical Equipment Co., Ltd., Kelun Group, Huaren Pharmaceutical Co., Ltd., Mitra Industries Pvt. Ltd., EQUIPOS DE BIOMEDICINA DE MÉXICO S.A DE C.V, Advin Health Care, and AWAK Technologies are the major players.

What will be the CAGR of the peritoneal dialysis equipment market?

The CAGR of the peritoneal dialysis equipment market is projected to be 6.2% from 2025-2032.