Penile Implants Market Size - Analysis

Market Size in USD Mn

CAGR2.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 2.4% |

| Market Concentration | Medium |

| Major Players | Boston Scientific Corporation, Coloplast Corp, PROMEDON GmbH, SILIMED, ZSI Zephyr Surgical Implants and Among Others |

please let us know !

Penile Implants Market Trends

The rising prevalence of erectile dysfunction among men has been a key factor driving growth in the penile implants market.

As men are becoming increasingly aware of treatment options available for erectile dysfunction, there is less stigma associated with the condition now. More men are willing to acknowledge they have a problem and are actively seeking help.

Overall, as erectile dysfunction is impacting greater numbers of men and they are willing to address it proactively, it has amplified demand for options like penile implants significantly.

Market Driver - Technological Innovations Facilitating Development of Advanced Implants

A key breakthrough was the introduction of inflatable or hydraulic penile implants in the 1980s using hydraulics and a fluid system. These devices could be easily concealed inside the body when not inflated and provided a more natural appearance and feel. Most recent models now have advanced features to improve safety, versatility and performance. Some incorporate antibiotic coatings for enhanced biocompatibility and reduce risk of infection.

Market Challenge - High Cost of Penile Implant Procedures

For many men suffering from erectile dysfunction, the high price tag associated with penile implants presents a significant barrier to treatment. The cost burden often leads patients to opt for less invasive yet potentially less effective treatment options like oral medications or pumps first before considering a surgical solution.

One opportunity area in the penile implants market is the development of new device designs with improvements in infection reduction and reliability. Infections have historically been a challenge with penile prosthetics due to the insertion of foreign materials near the genital region.

Continued innovation to develop more natural feeling and fully inflatable prostheses may further increase patient satisfaction and uptake rates. Manufacturers investing in research to design penile implants with better outcomes have an opportunity to drive penile implants market forward through best-in-class technology.

Segmental Analysis of Penile Implants Market

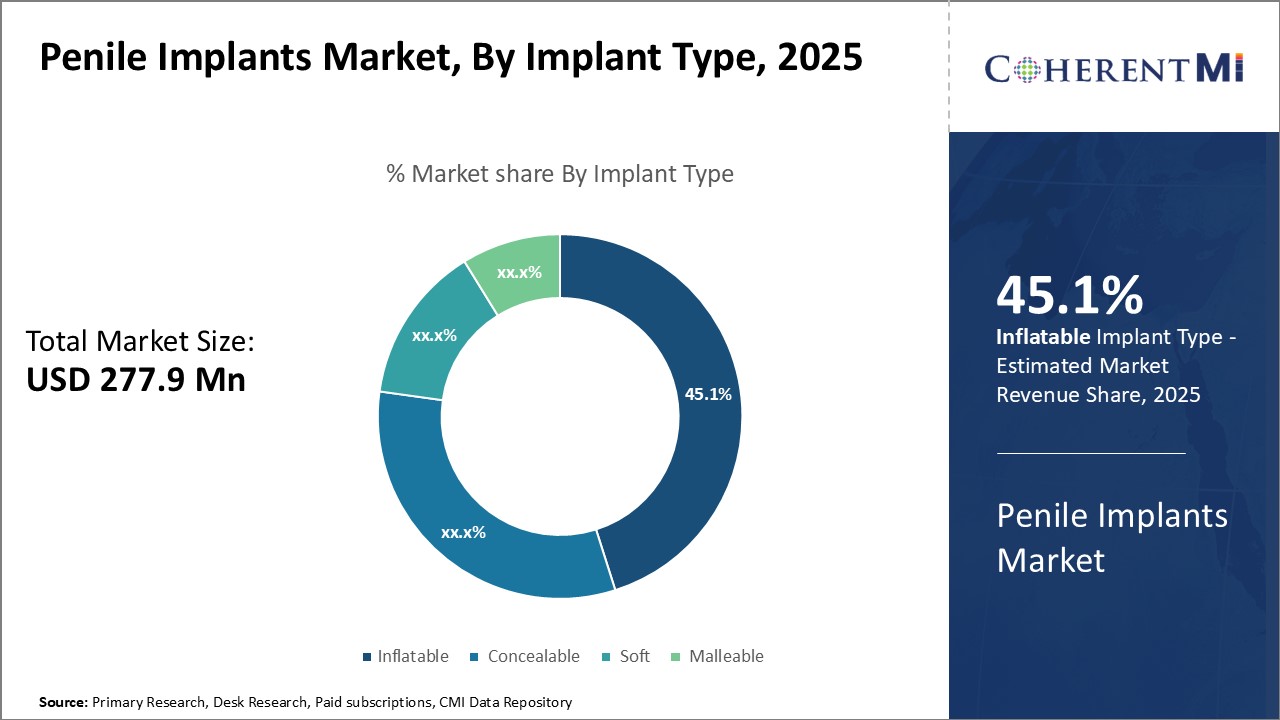

Insights, By Implant Type: Inflatable Implants Remain in Demand Owing to their Effectiveness and Natural Feel

Inflatable implants consist of three pieces - two cylinders that are surgically inserted into the penis and a small reservoir and pump assembly implanted in the scrotum. Fluid is pumped into the cylinders from the reservoir to achieve and maintain an erection. Deflation occurs by pushing a button on the pump to remove fluid from the cylinders.

Physicians prefer inflatable implants as they are minimally invasive to insert and easy to use. They produce rigidity comparable to a natural erection. Adjustability and the look and feel of a natural erection have boosted patient satisfaction rates with this implant type above other options. Consumers are also receptive to inflatables due to their discretion and enhanced sexual experiences.

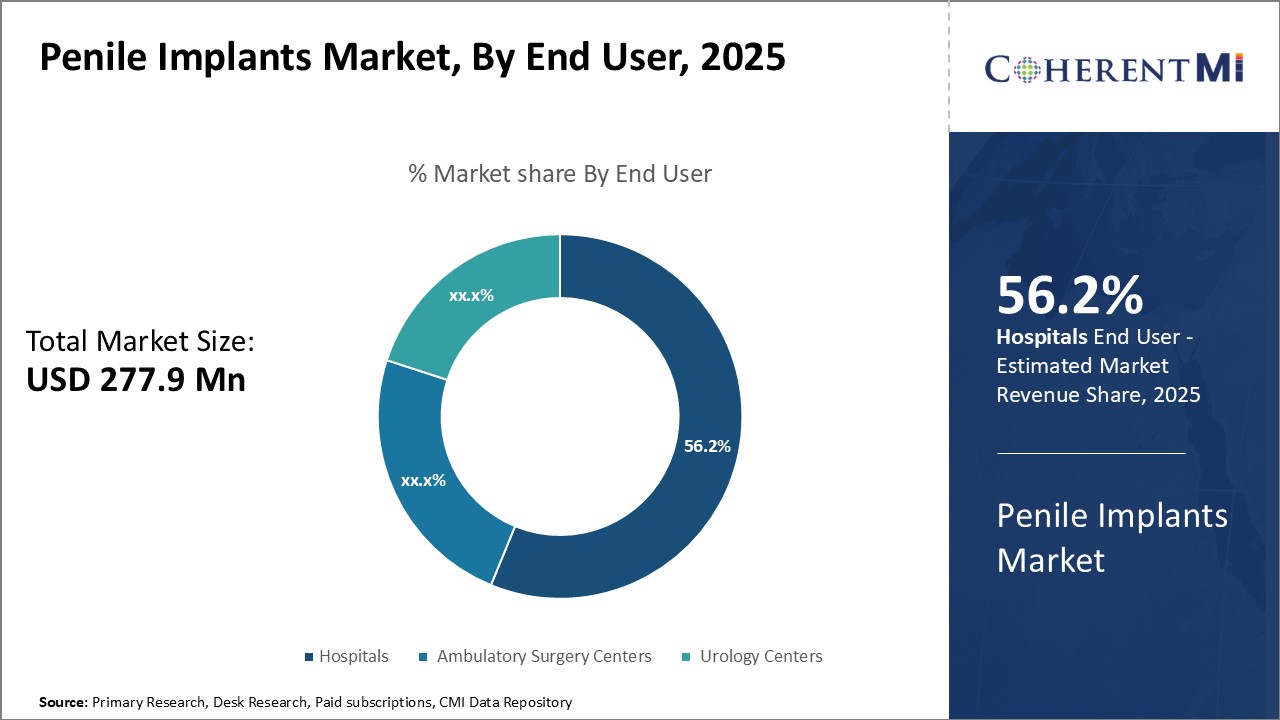

Insights, By End User: Hospitals Offer Insurance Coverage and Specialist Expertise

Insights, By End User: Hospitals Offer Insurance Coverage and Specialist Expertise

In addition, hospitals have urologists and other specialists trained to perform penile implant surgeries safely and effectively. The procedures require delicate surgical skills and experience with male pelvic anatomy and available implant technologies. Urologists practicing in hospitals are often board-certified and keep up with the latest techniques through hospital-based residency programs and continuing education courses.

Additional Insights of Penile Implants Market

- Global Prevalence of Erectile Dysfunction: Erectile dysfunction affects a significant portion of the male population worldwide, with prevalence increasing with age. This growing patient pool underscores the potential in penile implants market for penile implants.

- Preference for Inflatable Implants: Inflatable implants are generally preferred over malleable ones due to their ability to provide a more natural erection, influencing penile implants market trends towards inflatable options.

- Adoption of Minimally Invasive Surgical Techniques: Surgeons are increasingly utilizing minimally invasive procedures for implant placement, resulting in reduced recovery times and lower risk of complications, thereby attracting more patients.

- Collaborations for Patient Education: Manufacturers and healthcare providers are partnering to increase awareness about erectile dysfunction and available treatments, helping to destigmatize the condition and promote penile implants market growth.

Competitive overview of Penile Implants Market

The major players operating in the penile implants market include Boston Scientific Corporation, Coloplast Corp, PROMEDON GmbH, SILIMED, ZSI Zephyr Surgical Implants, Rigicon Inc, Advin Health Care, and G.SURGIWEAR LTD.

Penile Implants Market Leaders

- Boston Scientific Corporation

- Coloplast Corp

- PROMEDON GmbH

- SILIMED

- ZSI Zephyr Surgical Implants

Penile Implants Market - Competitive Rivalry

Penile Implants Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Penile Implants Market

- In July 2023, Boston Scientific Corporation expanded its urology and pelvic health portfolio by acquiring Axonics, a company specializing in innovative implant technologies. Axonics focuses on sacral neuromodulation (SNM) therapy, a minimally invasive treatment for urinary and bowel dysfunction. The acquisition, valued at $3.7 billion, strengthens Boston Scientific's position in the urology market, giving them access to Axonics' advanced technologies for overactive bladder and fecal incontinence treatment.

- In March 2023, Coloplast Corp launched the Titan® Touch, a new inflatable penile implant designed to improve durability and provide a more natural feel. The device features an innovative "one-touch release" pump that simplifies deflation, allowing for easier use and a quicker return to a flaccid state. The implant also incorporates Bioflex® material for enhanced cylinder strength, providing increased girth and rigidity. This product aims to enhance patient outcomes by offering improved ease of use, durability, and a more lifelike experience, addressing common patient concerns like loss of penile size during treatment.

- In December 2019, Rigicon Inc received FDA clearance for its Rigi10™ Malleable Penile Prosthesis for treating erectile dysfunction. This innovation allows males to regain sufficient stiffness for sexual activity. This prosthesis is designed to help men with erectile dysfunction achieve adequate penile rigidity for sexual intercourse. The device's flexible rod technology allows for easier implantation and a better fit, enhancing both comfort and functionality.

- In July 2019, Boston Scientific launched the Tactra Malleable Penile Prosthesis in the United States. This device uses dual-layer silicone and a Nitinol core, designed to optimize both comfort and rigidity for patients suffering from erectile dysfunction. It represents Boston Scientific's first major innovation in penile implants in over a decade and aims to provide patients with a durable, natural-feeling option for the restoration of sexual function. The device is particularly suited for those who cannot use other erectile dysfunction treatments or inflatable prostheses due to medical conditions. The Tactra prosthesis is manually adjustable, allowing patients to lift it for intercourse and push it down for concealment when not in use.

Penile Implants Market Segmentation

- By Implant Type

- Inflatable

- Two-piece Inflatable Implants

- Three-piece Inflatable Implants

- Concealable

- Soft

- Malleable

- Inflatable

- By End User

- Hospitals

- Ambulatory Surgery Centers

- Urology Centers

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Frequently Asked Questions :

How big is the penile implants market?

The penile implants market is estimated to be valued at USD277.9 Mn in 2025 and is expected to reach USD 328.1 Mn by 2032.

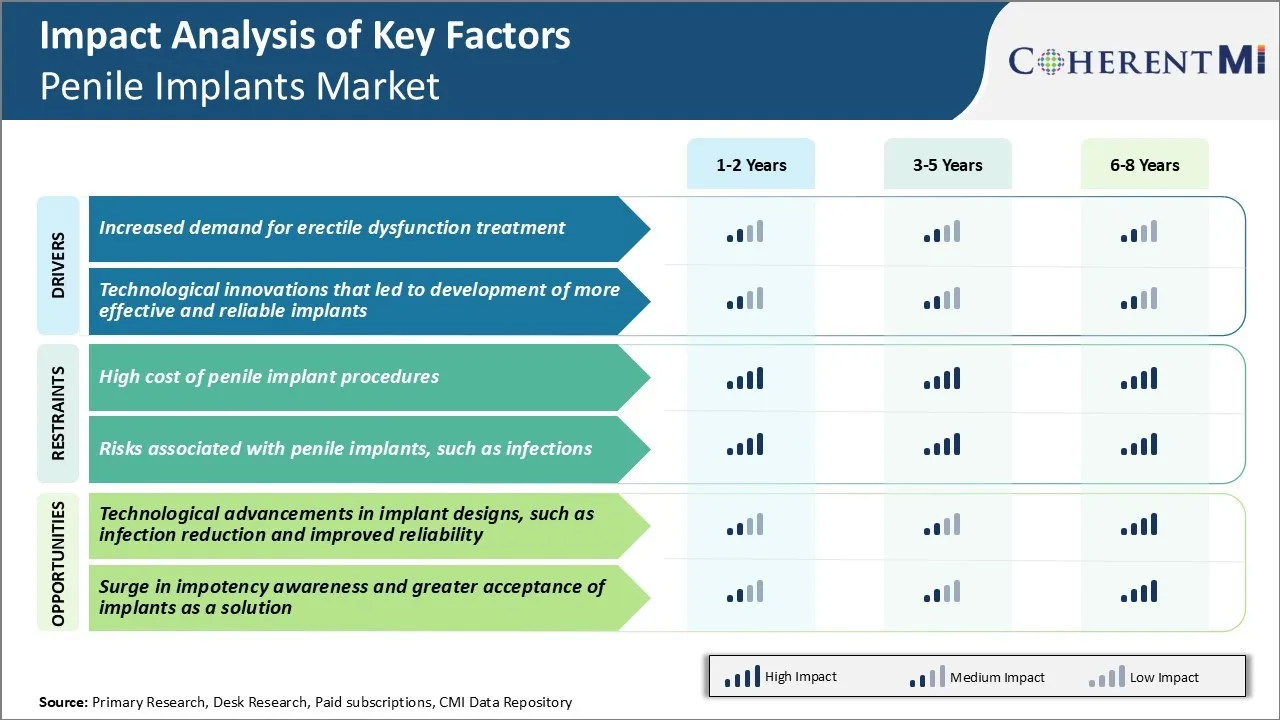

What are the key factors hampering the growth of the penile implants market?

High cost of penile implant procedures and risks associated with penile implants, such as infections are the major factors hampering the growth of the penile implants market.

What are the major factors driving the penile implants market growth?

Increased demand for erectile dysfunction treatment and technological innovations that led to development of more effective and reliable implants are the major factors driving the penile implants market.

Which is the leading implant type in the penile implants market?

The leading implant type segment is inflatable.

Which are the major players operating in the penile implants market?

Boston Scientific Corporation, Coloplast Corp, PROMEDON GmbH, SILIMED, ZSI Zephyr Surgical Implants, Rigicon Inc, Advin Health Care, and G.SURGIWEAR LTD are the major players.

What will be the CAGR of the penile implants market?

The CAGR of the penile implants market is projected to be 2.4% from 2025-2032.