Metallized PET Packaging Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Metallized PET Packaging Market is segmented By Type (Silver Metallized PET Films, Aluminum Metallized PET Films, Others), By Application (Packaging, ....

Metallized PET Packaging Market Size

Market Size in USD Bn

CAGR5.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.2% |

| Market Concentration | High |

| Major Players | Hangzhau Hengxin (Jinxin) Filming Packaging, Gaylord Packers, Cosmo Films, Polyplex Corporation, Ester Industries Limited and Among Others. |

please let us know !

Metallized PET Packaging Market Analysis

The Global Metallized PET Packaging Market is estimated to be valued at USD 6.6 Bn in 2024 and is expected to reach USD 10.9 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2031. Metallized PET packaging finds extensive usage in food & beverage industry for packaging of snacks, chips, biscuits, and confectionery as it improves barrier properties and enhances shelf life of products. Growth of global snacks industry along with rising demand for printed & flexible packaging from consumers will drive consumption of metallized polyester films in packaging over coming years. The market is anticipated to witness healthy due to the increasing use of metallized PET films in packaging various food products such as chips, biscuits, instant noodles, and functional foods. Metallized PET packaging helps extend product shelf life without refrigeration which makes it an ideal solution for storage as well as transportation of snacks and ready to eat meals.

Metallized PET Packaging Market Trends

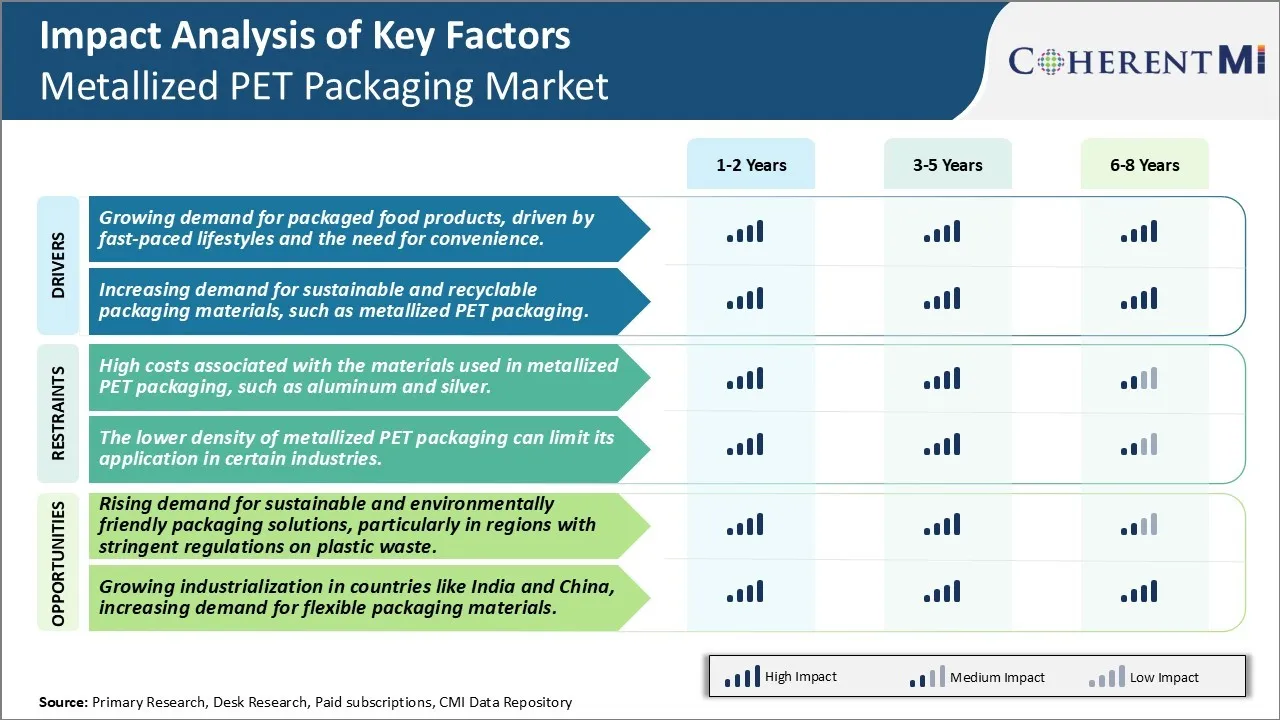

Market Driver - Growing Demand for Packaged Food Products, Driven by Fast-Paced Lifestyles and the Need for Convenience

The fast-paced urban lifestyles that many people around the world are leading leaves little time for elaborate home cooking or eating out. People are relying more and more on packaged and ready-to-eat foods that can be prepared and consumed quickly. This is driving sales of prepared and packaged products across food categories like snacks, dairy, bakery and more. Metallized PET packaging has become the material of choice for many of these products as it allows manufacturers to extend shelf life of products while also providing barrier against moisture, gas and light. Its lightweight and shatter resistance properties ensure products packaged in metallized PET can withstand transportation and handling without damage.

Consumers are shifting towards packaged foods is convenience. People want options that can be easily prepared within minutes whether as part of a meal or on-the-go. Metallized PET packaging allows companies to offer convenient snacks, desserts and beverages that can be grabbed and consumed effortlessly. The uniform nature of metallized PET lends itself to efficient production and filling lines where products can be processed at high speeds. Furthermore, tamper evident features and ease of use ensure consumers have peace of mind regarding product safety and handling. Taken together, the convenience driven lifestyles that are becoming mainstream certainly underpin the growing demand for various packaged foods and beverages which is boosting usage of metallized PET packaging.

Market Driver - Increasing Demand for Sustainable and Recyclable Packaging Materials

With growing environmental awareness, consumers are increasingly focusing on packaging sustainability and searching for eco-friendly options. They want brands to take responsibility for minimizing waste and adopt greener solutions. Metallized PET packaging addresses this demand well as it delivers high barrier protection using less material compared to some alternatives. In addition, metallized PET films are fully recyclable and many communities now accept them in their regular recycling streams. Recycling rates for PET are improving consistently which diverts this material from landfills. Packaging manufacturers recognize the commercial opportunity in developing sustainable options made from recycled content in line with circular economy principles.

Another important sustainability benefit of metallized PET is its light weighting properties. Thinner films provide the same level of protection using fewer raw material resources. This reduces the environmental footprint across sourcing, production and transportation stages of the value chain. By choosing metallized PET over non-recyclable materials, brands are able to build eco-friendly credentials and appeal to socially conscious consumers. Furthermore, as recycling infrastructure expands globally, the availability of recycled PET will continue growing, creating a self-reinforcing cycle. Leading regulators are also introducing policies nudging business towards sustainable practices. The rising wave of sustainability demands from stakeholders is translating directly into augmented demand for petallized PET packaging solutions.

Market Challenge - High Costs Associated with The Materials used in Metallized PET Packaging, Such as Aluminum and Silver

One of the major challenges faced by the metallized PET packaging market is the high costs associated with the materials used, namely aluminum and silver. Aluminum and silver are quite expensive metals and incorporating them into PET films or laminates to produce metallized PET packaging adds significantly to production costs. The prices of aluminum and silver are also prone to fluctuations depending on global commodity market prices. As these materials account for a large portion of the total raw material costs for metallized PET packaging manufacturers, even small changes in aluminum or silver prices can negatively impact their margins. Additionally, metallized PET packaging involves more complex manufacturing processes compared to conventional PET packaging to apply thin metal coatings, which further increases production costs. The higher costs often limit the applications of metallized PET packaging and make it less affordable for cost-sensitive or mass market product segments. This acts as a constraint for metallized PET packaging to achieve wider market adoption.

Market Opportunity - Rising Demand for Sustainable and Environmentally Friendly Packaging Solutions

One major opportunity for growth in the metallized PET packaging market is the rising demand for sustainable and environmentally friendly packaging solutions, particularly in regions with stringent regulations on plastic waste. Metallized PET packaging offers advantages over conventional plastic packaging in terms of recyclability and sustainability. The thin aluminum or silver coatings allow metallized PET packaging to be easily separated into metal and polymer components at recycling centers. This makes them suitable for both metal and plastic recycling streams. Moreover, the barrier properties of metallized PET enable downgauging of plastic material while maintaining product freshness. Less plastic usage equates to lower environmental footprint. Many brand owners and retailers are actively pursuing sustainable packaging goals to appeal to eco-conscious consumers and comply with waste management policies. This growing emphasis on sustainability and recyclability bodes well for the increasing adoption of metallized PET packaging across various industries in the coming years.

Key winning strategies adopted by key players of Metallized PET Packaging Market

Key Winning strategies adopted by key players:

Strategic partnerships and collaborations: One of the most successful strategies adopted by leading players has been entering into strategic partnerships and collaborations. For example, in 2020, Graham Packaging partnered with Amcor to produce metallized PET films for food and personal care packaging applications. This partnership allowed both companies to leverage their combined expertise and infrastructure to rapidly scale production of more sustainable packaging solutions.

R&D investments in new barrier technologies: Major players like Amcor, Sonoco, and Cosmo Films have heavily invested in R&D to develop innovative barrier technologies that can be applied to metallized PET films.

Focus on sustainability and recyclability: As sustainability becomes a priority, companies like Ampac and Sealed Air have emphasized recyclable and compostable metallized film solutions. For example, in 2021 Ampac launched its REVUpet recycling technology which retains the barrier properties of used PET packaging post recycling. Similarly, in 2022 Sealed Air announced plans to make all its packaging fully reusable, recyclable or compostable by 2025.

Segmental Analysis of Metallized PET Packaging Market

Insights, By Type, Silver Metallized PET Films Are Expected to Dominate in the Forecast Period

By Type, Silver Metallized PET Films are expected to contribute the market share 48.1% in 2024 due to its enhanced reflective properties. Silver metallized PET films dominate the metallized PET packaging market share due to their superior reflective characteristics. The lustrous silver coating on these films allows for maximum reflection of light, making packaged products appear brighter and visually appealing. This helps products stand out on shelves and draws more consumer attention.

The high reflectivity of silver metallized PET films makes them ideal for packaging various food items that require protection from light exposure. The silver layer helps shield light-sensitive contents from degradation. It is thus frequently used for packing snacks, chips, dried foods and cereals. Silver metallized PET films significantly prolong the shelf-life of light-sensitive products.

Their high barrier properties against moisture, oxygen and grease further boosts the longevity of packaged items. The excellent barrier attributes of silver metallized PET films are especially beneficial for packaging items with high fat or oil content. This prevents spoilage and rancidity for a longer duration. Besides food, silver metallized PET films are extensively used for lightweight decorative packaging of consumer electronics, accessories and gift items.

The shiny surface renders an upmarket look and feel, adding to the visual appeal. This drives greater sales and brand perception for companies. Given the unmatched reflective shine and barrier strengths offered, silver metallized PET films remain the top choice for various packaging applications. The enhanced shelf-life and protection of product quality attributable to silver metallization is expected to further increase its market dominance over other metallized films.

Insights, By Packaging, Packaging Dominates the Metallized PET Packaging Market owing to Widespread Usage in Food & Consumer Goods Industries

The packaging segment generates maximum revenue in the metallized PET packaging market due to enormous consumption of metallized films for wrapping numerous packaged goods. The projected market share in 2024 is 50.5%. Metallized PET films are pervasively used across food, healthcare, electronics and various consumer sectors for primary, secondary and tertiary packaging needs.

In the food industry, metallized PET films see extensive application for packaging snacks, chips, baked foods, confectionery items, dried fruits and ready-to-eat meals. Their high barrier attributes help maintain freshness and extend shelf-life of foods. For packaging pharmaceuticals, healthcare and personal care products, metallized PET films provide an effective moisture and oxygen barrier. In the electronics segment, these films are employed for packaging small appliances, gadgets and accessories. Their shiny appearance coupled with protection against external elements enhances the aesthetic appeal and longevity of electronic products. Metallized PET films also gain usage in the packaging of cosmetics, consumer lifestyle products, apparel and garments.

Additional Insights of Metallized PET Packaging Market

The global metallized PET packaging market is poised for steady growth, driven by increased demand for sustainable and efficient packaging solutions across various industries, including food and beverages, pharmaceuticals, and electronics. As consumers and governments increasingly prioritize environmental sustainability, companies are investing in recyclable and biodegradable packaging options. Metallized PET films offer several advantages, such as superior barrier properties, light weight, and flexibility, making them ideal for protecting products and maintaining their freshness. In addition, the expanding middle-class population in emerging economies like India and China is boosting the demand for packaged consumer goods, further accelerating the market. However, the high costs of metallized materials like aluminum and silver and lower density limitations may restrict broader adoption. Despite these challenges, the market is expected to grow at a CAGR of 5.11%, reaching a valuation of nearly USD 11 bn by 2034, making metallized PET packaging a key player in the global packaging landscape.

Competitive overview of Metallized PET Packaging Market

The major players operating in the Metallized PET Packaging Market include Hangzhau Hengxin (Jinxin) Filming Packaging, Gaylord Packers, Cosmo Films, Polyplex Corporation, Ester Industries Limited, Alpha Industry Company, Terphane (Tredegar Corporation), Vacmet India Ltd., Toray Plastics and Sumilon Industries.

Metallized PET Packaging Market Leaders

- Hangzhau Hengxin (Jinxin) Filming Packaging

- Gaylord Packers

- Cosmo Films

- Polyplex Corporation

- Ester Industries Limited

Metallized PET Packaging Market - Competitive Rivalry, 2024

Metallized PET Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Metallized PET Packaging Market

- In May 2024, Ester Industries Ltd. and Loop Industries Inc. formed a joint venture to build an Infinite Loop Manufacturing Facility in India, producing polymers from waste polyesters with a lower carbon footprint. This project is expected to advance the sustainable packaging market.

- In December 2023, Loop Industries announced that its Loop branded PET resin had been tested and approved for use in pharmaceutical packaging applications, strengthening its position in the sustainable packaging industry.

- In September 2023, Innovia Films launched RayofaceTM CPE45 and WPE45 label facestock films, thinner and printable options for the packaging and labeling industry, which align with sustainable packaging trends.

Metallized PET Packaging Market Segmentation

- By Type

- Silver Metallized PET Films

- Aluminum Metallized PET Films

- Others

- By Application

- Packaging

- Printing

- Decoration

- Yarn and Fiber

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Metallized PET Packaging Market?

The Global Metallized PET Packaging Market is estimated to be valued at USD 6.6 Bn in 2024 and is expected to reach USD 10.9 Bn by 2031.

What will be the CAGR of the Metallized PET Packaging Market?

The CAGR of the Metallized PET Packaging Market is projected to be 5.2% from 2024 to 2031.

What are the major factors driving the Metallized PET Packaging Market growth?

The growing demand for packaged food products, driven by fast-paced lifestyles and the need for convenience. Increasing demand for sustainable and recyclable packaging materials, such as metallized pet packaging are the major factors driving the Metallized PET Packaging Market.

What are the key factors hampering the growth of the Metallized PET Packaging Market?

The high costs associated with the materials used in metallized pet packaging, such as aluminum and silver and the lower density of metallized pet packaging can limit its application in certain industries are the major factors hampering the growth of the Metallized PET Packaging Market.

Which is the leading Type in the Metallized PET Packaging Market?

The leading Type segment is Silver Metallized PET Films.

Which are the major players operating in the Metallized PET Packaging Market?

Hangzhau Hengxin (Jinxin) Filming Packaging, Gaylord Packers, Cosmo Films, Polyplex Corporation, Ester Industries Limited, Alpha Industry Company, Terphane (Tredegar Corporation), Vacmet India Ltd., Toray Plastics, Sumilon Industries are the major players.