Natural and Organic Cosmetics Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Natural and Organic Cosmetics Market is segmented By Product (Skincare, Hair Care, Oral Care, Make-up Cosmetics, Others), By Distribution Channel (Sto....

Natural and Organic Cosmetics Market Size

Market Size in USD Bn

CAGR17%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 17% |

| Market Concentration | High |

| Major Players | L'Oréal SA, Estée Lauder Companies Inc., Unilever PLC, Coty Inc., The Clorox C and Among Others. |

please let us know !

Natural and Organic Cosmetics Market Analysis

The Global natural and organic cosmetics market is estimated to be valued at USD 40.1 Bn in 2024 and is expected to reach USD 120.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 17% from 2024 to 2031. The market has been experiencing steady growth over the past few years owing to the rising consumer demand for beauty products containing natural ingredients. There has been an increasing preference for organic and natural cosmetics due to rising health and environmental concerns among consumers globally. Moreover, the introduction of innovative products by leading brands is also adding to the growth of this market.

The natural and organic cosmetics market is expected to witness positive growth trends during the forecast period. The increasing influence of social media and digital platforms is creating more awareness about the benefits of natural ingredients. More consumers, especially millennials and generation Z, are opting for sustainable beauty brands that are environmentally conscious. With rising disposable incomes, customers are willing to pay premium prices for natural cosmetics products that are often positioned as more effective and safer choices.

Natural and Organic Cosmetics Market Trends

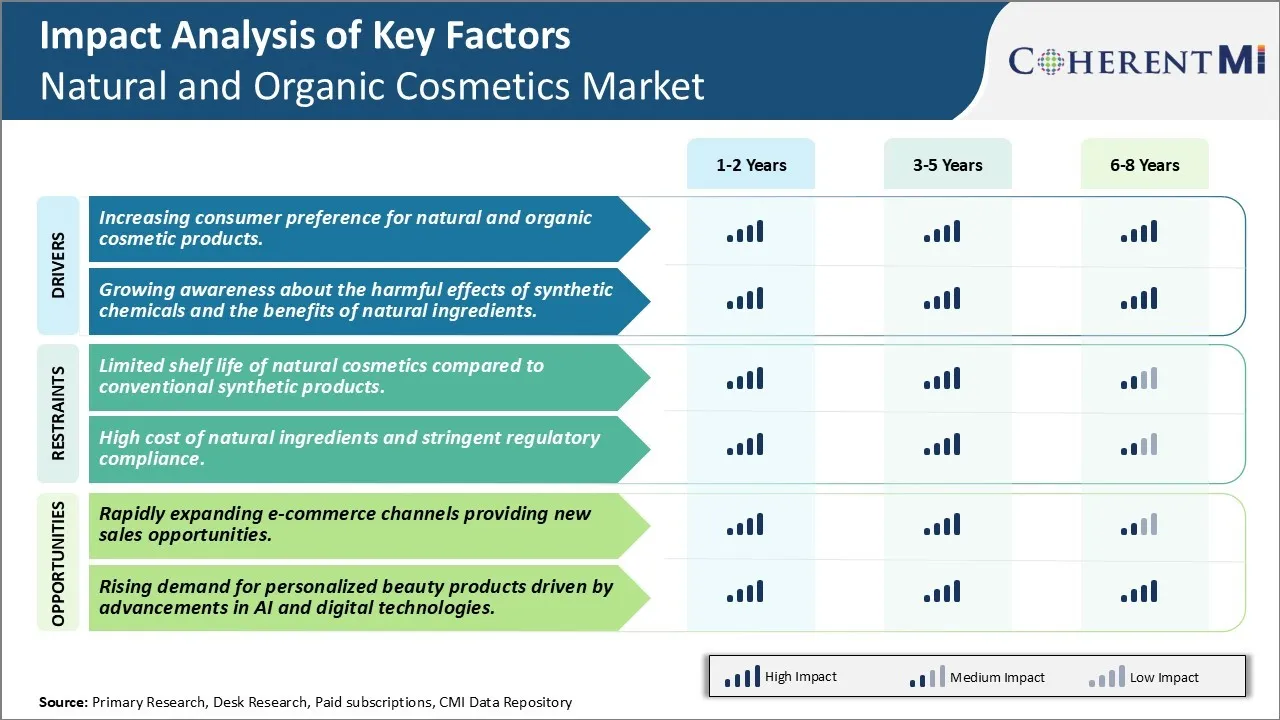

Market Driver - Increasing Consumer Preference for Natural and Organic Cosmetic Products

With increasing health consciousness among consumers, they are becoming more aware of the ingredients used in personal care products and their effects. There is a growing concern regarding the synthetic chemicals used in conventional cosmetics and their potential long-term effects. Consumers want cosmetic products which are as close as possible to nature and have minimal processing. This changing mindset has fueled the demand for natural and organic cosmetic alternatives.

Natural and organic labels enable consumers to identify products with ingredients derived from natural sources. Consumers associate these products with being safer and more skin-friendly compared to conventional options. They believe natural ingredients to have soothing and nourishing properties for the skin without any harsh chemicals. Even for occasional users, natural and organic products are preferred over regular ones for special occasions like weddings or parties where they want their makeup and styling products to be as pure as possible.

This growing consumer preference stands true across all age groups but is more prominent among millennials and generation Z consumers. Younger consumers in particular are very mindful about the ingredients in personal care products and want options developed with sustainability in mind. They are driving much of the demand in the natural beauty space and are willing to pay premium prices for verified natural and organic brands. The willingness to pay more also stems from the idea that natural products work better with the skin in the long run compared to regular products.

Market Driver - Growing Awareness About the Harmful Effects of Synthetic Chemicals and the Benefits of Natural Ingredients

With easy access to information, consumers today are more educated about ingredients and their impact. Various studies and reports in recent times have highlighted the presence of harmful or questionable chemicals like parabens, phthalates, sulphates etc. in popular cosmetic products. This has raised red flags regarding the safety of frequent and long-term use of such chemicals. At the same time, awareness about the benefits of natural actives derived from plants and herbs is increasing. Consumers now understand how certain natural ingredients can nourish, moisturize and protect the skin without any side effects.

Social media has also played a big role in facilitating this change. Health and beauty influencers on various platforms openly discuss and compare natural vs. synthetic ingredients. They recommend natural alternatives and endorse brands developing clean products. This creates positive buzz and trust around natural labels. Similarly, documentaries and articles pointing out synthetic chemicals have been effective in changing general perceptions. As consumers began educating themselves, they started questioning the need for harsh preservatives or fragrances in products claiming natural positioning.

With higher awareness, consumers now carefully read labels to identify natural-origin ingredients and avoid chemical-sounding names that could be potentially harmful. They show inclination for brands that are transparent about sourcing and formulations. The benefits of natural actives are also key criterion while making purchase decisions. Overall, consumers have become discerning and are shifting to natural options not just for perceived safety but also for functional benefits like moisturization, repair and anti-ageing effects of botanical ingredients.

Market Challenge - Limited Shelf Life of Natural Cosmetics Compared to Conventional Synthetic Products

One of the key challenges facing the natural and organic cosmetics market is the limited shelf life of natural products compared to conventional synthetic cosmetics. Natural ingredients such as essential oils, plant extracts and butters that are commonly used in organic formulations tend to decompose or oxidize faster than their synthetic counterparts. This limits how long natural cosmetics can remain stable without changing color, smell or texture before their expiration date. The shelf life of natural cosmetics is typically between 6-12 months compared to over 2 years for many regular cosmetic items. This shorter durability requires more careful handling by both manufacturers and consumers to avoid product deterioration on retail shelves or at home. It also means natural brands must plan production runs more frequently to maintain fresh inventory. The limited shelf life sometimes prevents natural products from being distributed as widely or remaining on sale as long as regular cosmetics. This can impair a company's revenue potential if customers cannot consistently find products in stores before they expire. Extending the longevity of natural cosmetics without comprising ingredients is a major technical challenge the industry is trying to address.

Market Opportunity - Rapidly Expanding E-commerce Channels to Create Novel Opportunities in the Coming Years

One significant opportunity for the natural and organic cosmetics market is the rapidly expanding e-commerce channels providing new sales opportunities. As more consumers go online for shopping, natural beauty brands can reach wider audiences conveniently without being limited by shelf space in physical stores. E-commerce also allows companies to sell directly to customers rather than relying solely on brick-and-mortar retail partners. This provides better pricing flexibility as well as more data collection ability. Through their own websites and online marketplaces like Amazon, natural cosmetics brands are able to market straight to an increasingly tech-savvy demographic that is driving industry growth. Live streaming, social selling and personalized product recommendations further enrich the digital experience. The interactive nature of e-commerce helps natural brands better engage sustainability-minded customers and build loyalty in a way that cannot always be replicated offline. This evolving omni-channel environment opens new avenues to boost visibility and sales of natural cosmetics.

Key winning strategies adopted by key players of Natural and Organic Cosmetics Market

Focus on innovative product development - Companies are focusing on developing innovative natural and organic products to meet the evolving needs of consumers.

Adopt sustainability practices - Leading brands are ensuring sustainable and eco-friendly practices across their supply chain to strengthen their natural and organic positioning.

Engage through social media - Social media marketing has been a key enabler for brands to engage with younger consumers and promote their natural/clean attributes. For example, Tata Harper grew considerably from 2014 to 2018 through Instagram marketing of its natural skincare range.

Offer targeted and affordable product ranges - Companies cater to different consumer segments by offering targeted yet affordable natural product ranges.

Thus, focusing on innovative products, sustainability, social media engagement and targeted affordable offerings have been the winning strategies adopted by leading natural and organic cosmetics brands to drive market share and growth over the past five years. Data shows the natural beauty market grew over 9% annually during 2014-2018 supported by these strategic moves.

Segmental Analysis of Natural and Organic Cosmetics Market

Insights, By Product, The Growing Demand for Natural Ingredients Drives the Skincare Segment's Dominance

By Product, Skincare segment is expected to contribute 61.2% in 2024 due to increasing consumer awareness about the benefits of natural products for skincare. Traditionally, synthetic ingredients were widely used in skincare formulations due to their functional benefits. However, consumers are now becoming more knowledgeable about potential detrimental impacts of chemicals on skin health. There is a growing preference for natural active ingredients that are gentle yet effective. Plant-derived emollients, moisturizers, antioxidants and exfoliants are appealing to customers looking for mild, toxin-free alternatives. Natural formulations are also perceived as suitable for sensitive skin conditions. Brands catering to this demand through innovative natural skincare lines have seen significant sales growth in recent times. Increased focus on an organic lifestyle and holistic wellness further drives the popularity of natural skincare over other cosmetics categories. The skincare segment thus continues to attract more market share owing to strong customer motivation for ingredient transparency and sustainability in personal care products.

Insights, By Distribution Channel, Retail Stores Foster Customer Trial and Trust in Natural Brands

By Distribution Channel, store based segment is expected to contribute 58.4% in 2024. Natural and organic cosmetic brands rely heavily on brick-and-mortar retail channels to establish authenticity and win customer confidence. Many conscious customers still prefer visiting physical stores to inspect products personally and consult experts before purchase. Stores provide an opportunity to customers to trial and experience textures of natural formulations. This helps address common concerns around performance and effectiveness of natural variants. Brand showcasing and visual merchandising techniques at stores further aid discovery. Retail environments also build relationships between brands and local wellness communities through experiential marketing. Strong retail partnerships allow natural brands an edge over DTC upstarts in terms of coverage and trustworthiness. The interpersonal engagement facilitated through stores continues to make them a critical pillar driving higher market shares for natural cosmetic players.

Insights, By End-user, Female Users Represent the Core Audience for Natural Attributes

By End-user, male contributes the highest share of the market. While the natural cosmetics market has traditionally catered mainly to female audiences, male customers are increasingly appreciating the mindful attributes and ingredient transparency offered by natural products. Minimalist formulations suitable for daily grooming are finding acceptance among progressive male consumers interested in wellbeing and sustainability. Products addressing specific skincare concerns like beard care see steady uptake from male shoppers. Brands addressing this niche through responsible marketing stand to gain initial foothold in the otherwise untapped male segment. As natural attributes gain broader understanding, the segment is anticipated to rise at a promising rate in the coming times. An overall lift in consciousness around health could thus motivate even greater gender inclusiveness for the natural cosmetics industry.

Additional Insights of Natural and Organic Cosmetics Market

Increasing awareness about the potential health risks associated with synthetic chemicals in traditional cosmetics has fueled demand for natural and organic alternatives. Consumers are more focused on the ingredients used in their skincare, haircare, and beauty products, seeking items that are free from harmful chemicals like parabens, sulfates, and phthalates.

The trend toward healthier lifestyles and eco-friendly living is pushing more consumers to choose products with naturally sourced ingredients. This has especially resonated with Millennials and Gen Z, who are often more environmentally conscious. Natural and organic cosmetic brands are increasingly focusing on sustainable sourcing of ingredients, cruelty-free production processes, and eco-friendly packaging. The emphasis on sustainability not only includes product ingredients but also extends to minimizing plastic packaging and waste through the use of recyclable or biodegradable materials. Ethical production practices and certifications (like USDA Organic, Fair Trade, and Vegan certifications) are becoming key differentiators for brands to attract environmentally and ethically conscious consumers.

Regional Insights:

North America held the largest share of the global natural and organic cosmetics market in 2023, accounting for around 37% of the global market. The region's market dominance is driven by high disposable incomes, strong consumer awareness of health and environmental sustainability, and a growing focus on personal grooming. The U.S. in particular has witnessed a significant demand for natural and organic beauty products, fueled by increased awareness of the potential risks of synthetic chemicals in personal care items.

Europe is another significant market for natural and organic cosmetics, driven by stringent regulations surrounding beauty and personal care products. The European Union has some of the strictest regulatory frameworks when it comes to cosmetics safety, which encourages brands to adopt cleaner formulations. European consumers are highly conscious of the environmental and ethical impact of their purchases, which drives demand for organic, vegan, and cruelty-free products. The rising focus on sustainability and reducing plastic waste has led to innovations in eco-friendly packaging and natural ingredient sourcing.

Competitive overview of Natural and Organic Cosmetics Market

The major players operating in the Natural and Organic Cosmetics Market include L'Oréal SA, Estée Lauder Companies Inc., Unilever PLC, Coty Inc., The Clorox Co., FANCL Corp., Jurlique International Pty. Limited, Laboratoire Nuxe, Bare Escentuals, Inc., Aubrey Organics, Inc. and Nature's Gate.

Natural and Organic Cosmetics Market Leaders

- L'Oréal SA

- Estée Lauder Companies Inc.

- Unilever PLC

- Coty Inc.

- The Clorox C

Natural and Organic Cosmetics Market - Competitive Rivalry, 2024

Natural and Organic Cosmetics Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Natural and Organic Cosmetics Market

- In August 2023, L'Oréal announced the acquisition of Aesop, a luxury beauty brand known for its natural and organic product lines. This acquisition will help L'Oréal strengthen its position in the premium natural beauty market, particularly in the Asia-Pacific region where Aesop has a significant presence.

- In September 2023, True Botanicals, a premium natural skincare brand, secured Series B funding from NextWorld Evergreen, a San Francisco-based growth equity firm.

- In September 2023, Naturals Skincare Products launched the “Pearl” line, which includes 18 new chemical-free organic beauty products for both skin and hair care.

Natural and Organic Cosmetics Market Segmentation

- By Product

- Skincare

- Hair Care

- Oral Care

- Make-up Cosmetics

- Others

- By Distribution Channel

- Store based

- Non-store based

- By End-user

- Male

- Female

- Unisex

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Natural and Organic Cosmetics Market?

The Global natural and organic cosmetics market is estimated to be valued at USD 40.1 Bn in 2024 and is expected to reach USD 120.3 Bn by 2031.

What will be the CAGR of the Natural and Organic Cosmetics Market?

The CAGR of the Natural and Organic Cosmetics Market is projected to be 17% from 2024 to 2031.

What are the major factors driving the Natural and Organic Cosmetics Market growth?

The increasing consumer preference for natural and organic cosmetic products and growing awareness about the harmful effects of synthetic chemicals and the benefits of natural ingredients, are the major factors driving the Natural and Organic Cosmetics Market growth.

What are the key factors hampering the growth of the Natural and Organic Cosmetics Market?

The limited shelf life of natural cosmetics compared to conventional synthetic products, high cost of natural ingredients and stringent regulatory compliance are the major factors hampering the growth of the Natural and Organic Cosmetics Market.

Which is the leading Product in the Natural and Organic Cosmetics Market?

Skincare is the leading Product segment.

Which are the major players operating in the Natural and Organic Cosmetics Market?

L'Oréal SA, Estée Lauder Companies Inc., Unilever PLC, Coty Inc., The Clorox Co., FANCL Corp., Jurlique International Pty. Limited, Laboratoire Nuxe, Bare Escentuals, Inc., Aubrey Organics, Inc., Nature's Gate are the major players.