Offshore Drilling Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Offshore Drilling Market is segmented By Rig Type (Drillships, Semisubmersibles, Jackups), By Water Depth (Deepwater, Shallow Water, Ultra-deepwater),....

Offshore Drilling Market Size

Market Size in USD Bn

CAGR8.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.2% |

| Market Concentration | High |

| Major Players | Archer Well Company, Borr Drilling, Odfjell Drilling, Shelf Drilling, Maersk Drilling and Among Others. |

please let us know !

Offshore Drilling Market Analysis

The offshore drilling market is estimated to be valued at USD 46.45 Bn in 2024 and is expected to reach USD 80.64 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2031. The offshore drilling market is expected to witness steady growth driven by recovery in oil prices from pandemic lows encouraging new offshore exploration projects.

Offshore Drilling Market Trends

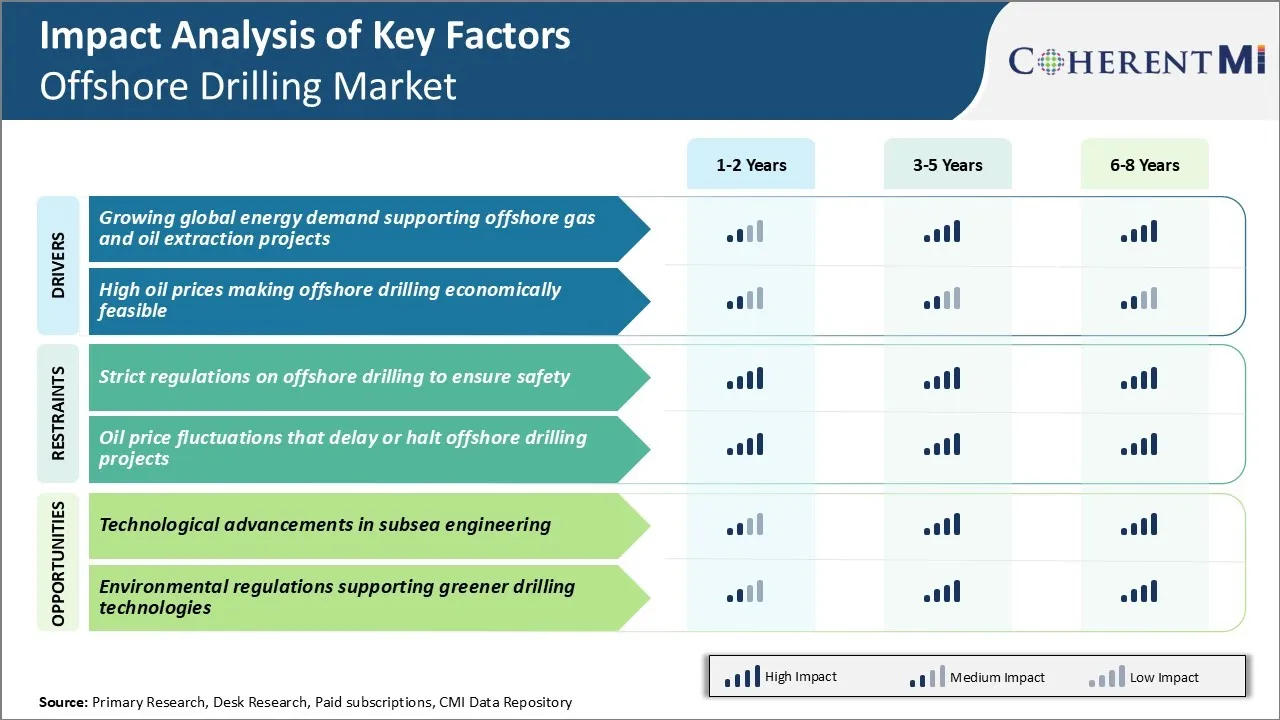

Market Driver - Growing Global Energy Demand Supporting Offshore Gas and Oil Extraction Projects

As the world population continues to rise, so too does demand for energy resources. Though renewable sources are expanding rapidly, energy derived from oil and natural gas offshore reserves remains vital to sustain the world's growing appetite for power.

Many onshore oil and gas deposits have already been extensively tapped over past decades, with relatively easy-to-access reserves now dwindling. Advanced drilling and production technologies have enabled energy companies to exploit reserves previously considered uneconomical or too challenging technically.

The International Energy Agency estimates that offshore areas still hold around 30% of undiscovered technically recoverable oil and gas globally. This is spurring intensified interest in extracting offshore reserves that can help satiate their vast and growing appetite for petroleum.

Securing long-term energy supply is an urgent national priority for both established and developing nations. Harnessing the substantial known and projected offshore oil and gas reserves will be central to ensuring supply can match demand. This is expected to drive growth for the offshore drilling market.

Market Driver - High Oil Prices Making Offshore Drilling Economically Feasible

The offshore oil and gas industry requires massive upfront capital expenditures that push project breakeven costs high.

For operators to justify high expenditures, project economics must stack up. This means oil prices need to remain sufficiently high to cover capital outlays plus operating expenses while still delivering respectable rates of return. The past decade saw benchmark oil prices average over $80 per barrel, with prolonged periods well above $100 including a peak of $147 in 2008. Such high price levels made even the most expensive offshore endeavours commercially viable. Operators could recover mounting investment costs within reasonably prompt timeframes at those prices.

While prices have fallen from peaks and remain volatile, long-term trends point to oil generally holding above $60 in real terms according to numerous analysts and agencies. This is expected to have a substantial impact on the growth of the offshore drilling market in the coming years.

Market Challenge - Strict Regulations on Offshore Drilling to Ensure Safety

One of the major challenges facing the offshore drilling market is the implementation of increasingly strict regulations to ensure safety. In the aftermath of accidents like the Deepwater Horizon oil spill in 2010, governments and regulatory bodies have understood the need to prevent such disasters in the future.

As a result, compliance requirements have been strengthened significantly. Drillers now need to obtain various permits demonstrating rigorous safety protocols and emergency response plans. They also face closer scrutiny of their drilling equipment and operations. Complying with the complex and frequent changes in regulations involves heavy capital investments and raises operating costs. It influences the viability of projects, especially for smaller players.

Offshore drilling companies also struggle to hire personnel qualified to navigate the compliance landscape. The tight regulatory environment has made the offshore drilling market uncertain. It also makes the market tilted the balance towards larger corporations with deep pockets and resources to absorb additional compliance costs.

Market Opportunity - Technological Advancements in Subsea Engineering for Market Growth

One major opportunity for growth in the offshore drilling market centers around technological advancements in subsea engineering. As drilling activity moves to deeper waters with more challenging terrains, the need for sophisticated subsea technologies becomes paramount.

Advanced subsea production systems allow operators to maximize recovery from reservoirs located far below the ocean surface. New deepwater robotics, remotely operated vehicles, and automation solutions help overcome obstacles and improve efficiency of offshore operations. 3D printing applications are enhancing repair and maintenance solutions in remote offshore locations.

Ongoing development of hybrid- and fully-electric subsea production systems with renewable energy integration can significantly reduce carbon footprint of offshore fields. With increasing capital investments in research and development, the frontier of subsea technologies continues to expand. This allows offshore drillers to monetize reserves previously considered uneconomical, thereby driving future opportunities in offshore drilling market.

Key winning strategies adopted by key players of Offshore Drilling Market

Focus on advanced technology and innovation: Leading players like Transocean, Diamond Offshore Drilling and Noble Corporation have invested heavily in research and development to develop advanced offshore drilling rigs equipped with the latest technology.

Fleet modernization and upgrades: Many drilling companies have actively upgraded their rig fleets over the past few years to high specification rigs that can operate in harsh environments.

Cost leadership: Leading offshore drilling companies like Noble Corporation and Valaris have been successful in maintaining one of the lowest cost structures in the industry. For example, Noble was able to reduce overall operating costs per day by over 20% between 2014-2016 through the implementation of more efficient processes and rig designs.

Focus on deepwater and global operations: Drillers have benefitted from focusing operations on high demand deepwater regions like the U.S. Gulf of Mexico and offshore regions in Brazil, West Africa, and Mediterranean.

Segmental Analysis of Offshore Drilling Market

Insights, By Rig Type: Drillships Dominate the Offshore Drilling Market Due to Their Capabilities

Of the three main rig types in the offshore drilling market, drillships contribute 34.3% share of the offshore drilling market in 2024. This is largely due to drillships' unparalleled mobility and ability to operate in deeper waters compared to other rigs. Drillships are self-propelled rigs that can move between drilling locations under their own steam. This makes them highly flexible and enables operators to utilize drillships across a wide geographic area without needing specialized vessels for transport.

Perhaps most crucially, modern drillships are designed to operate in water depths of up to 12,000 feet, far exceeding the capabilities of other rigs. The demand for drillships is further reinforced by growing activity in pre-salt plays off the coasts of Brazil, West Africa, and the Gulf of Mexico, which can only be economically developed using drillships. As long as exploration continues pushing the boundaries of water depth, drillships are likely to dominate the high-value deepwater segment.

Insights, Water Depth: Deepwater Reserves are Crucial for Future Supply, Driving Activity

The deepwater segment, including water depths between 1,000-5,000 feet, accounts 43.2% share of the offshore drilling market. This is primarily due to the strategic importance of these reservoirs for global energy supplies going forward.

Resources tucked away in deepwater formations represent a significant untapped prize, with estimates suggesting deepwater could yield over 100 billion barrels of oil. Major hydrocarbon deposits located offshore Brazil, the Gulf of Mexico, and West Africa have revitalized deepwater exploration by oil majors. Specialized floating production systems and subsea facilities allow economic development of reservoirs in over 1,000 feet of water.

For energy security and future supply reasons, deepwater reserves lying in the 1,000-5,000 feet range will attract intense industry focus. Their importance to global supply sustains major investments and underpins deepwater drilling activity levels.

Additional Insights of Offshore Drilling Market

- The Asia-Pacific leads the offshore drilling market with a 43% share in 2023, while Latin America is the fastest-growing region, driven by advancements in offshore drilling technology.

- Europe’s offshore drilling market size is anticipated to reach USD 22.18 billion by 2033 with a CAGR of 8.42%.

- Offshore drilling faces fluctuating regulations globally, affecting operations and strategies.

Competitive overview of Offshore Drilling Market

The major players operating in the offshore drilling market include Archer Well Company, Borr Drilling, Odfjell Drilling, Shelf Drilling, Maersk Drilling, KCA Deutag, COSL – China Oilfield Services Limited, Diamond Offshore Drilling, Inc., Saipem, Nabors Industries, Pacific Drilling, Noble Drilling, Valaris plc, and Transocean.

Offshore Drilling Market Leaders

- Archer Well Company

- Borr Drilling

- Odfjell Drilling

- Shelf Drilling

- Maersk Drilling

Offshore Drilling Market - Competitive Rivalry, 2024

Offshore Drilling Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Offshore Drilling Market

- In May 2024, the Indian Register of Shipping (IRS) announced the successful launch of two sister vessels, Sonalika and Sarovar, at the San Marine yard in Kakinada. These 34-meter-long tugs are part of a four-vessel contract and are designed to the highest standards of safety, reliability, and performance.

- In December 2023, Risavika Gjenvinning was established in Norway to develop innovative solutions for treating waste from petroleum operations, with the goal of reducing environmental impact. The company focuses on creating new technologies and processes for handling offshore drilling waste.

- In September 2023, TotalEnergies announced the initiation of development studies for a significant offshore oil project in Block 58, Suriname. This project aims to develop the Sapakara South and Krabdagu oil discoveries, which have combined recoverable resources estimated at approximately 700 million barrels.

- In August 2023, Bulgaria's Council of Ministers announced a tender for the exploration of oil and natural gas in Block 1-26 Khan Tervel, located in the Black Sea. This initiative aims to assess the area's petroleum potential and enhance resource identification.

Offshore Drilling Market Segmentation

- By Rig Type

- Drillships

- Semisubmersibles

- Jackups

- By Water Depth

- Deepwater

- Shallow Water

- Ultra-deepwater

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the offshore drilling market?

The offshore drilling market is estimated to be valued at USD 46.45 Bn in 2024 and is expected to reach USD 80.64 Bn by 2031.

What are the key factors hampering the growth of the offshore drilling market?

Strict regulations on offshore drilling to ensure safety and oil price fluctuations that delay or halt offshore drilling projects are the major factors hampering the growth of the offshore drilling market.

What are the major factors driving the offshore drilling market growth?

Growing global energy demand supporting offshore gas and oil extraction projects and high oil prices making offshore drilling economically feasible are the major factors driving the offshore drilling market.

Which is the leading rig type in the offshore drilling market?

The leading rig type segment is drillships.

Which are the major players operating in the offshore drilling market?

Archer Well Company, Borr Drilling, Odfjell Drilling, Shelf Drilling, Maersk Drilling, KCA Deutag, COSL – China Oilfield Services Limited, Diamond Offshore Drilling, Inc., Saipem, Nabors Industries, Pacific Drilling, Noble Drilling, Valaris plc, Transocean are the major players.

What will be the CAGR of the offshore drilling market?

The CAGR of the offshore drilling market is projected to be 8.2% from 2024-2031.