On-the-Go Packaging Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

On-the-Go Packaging Market is segmented By Material (Plastic, Polyethylene, Polypropylene, Polyethylene Terephthalate, Others, Paper & Paperboard, Met....

On-the-Go Packaging Market Size

Market Size in USD Bn

CAGR4.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.6% |

| Market Concentration | Medium |

| Major Players | Berry Global Group, Smurfit Kappa Group, Sealed Air Corporation, WestRock Company, Huhtamaki Oyj and Among Others. |

please let us know !

On-the-Go Packaging Market Analysis

The on-the-go packaging market is estimated to be valued at USD 2.72 Bn in 2024 and is expected to reach USD 3.73 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.6% from 2024 to 2031. The market has seen steady growth driven by the fast-paced lifestyle embraced by millennials and Gen Z. Growth in the travel and tourism industry along with increasing urbanization are also fueling the need for on-the-go packaging solutions.

On-the-Go Packaging Market Trends

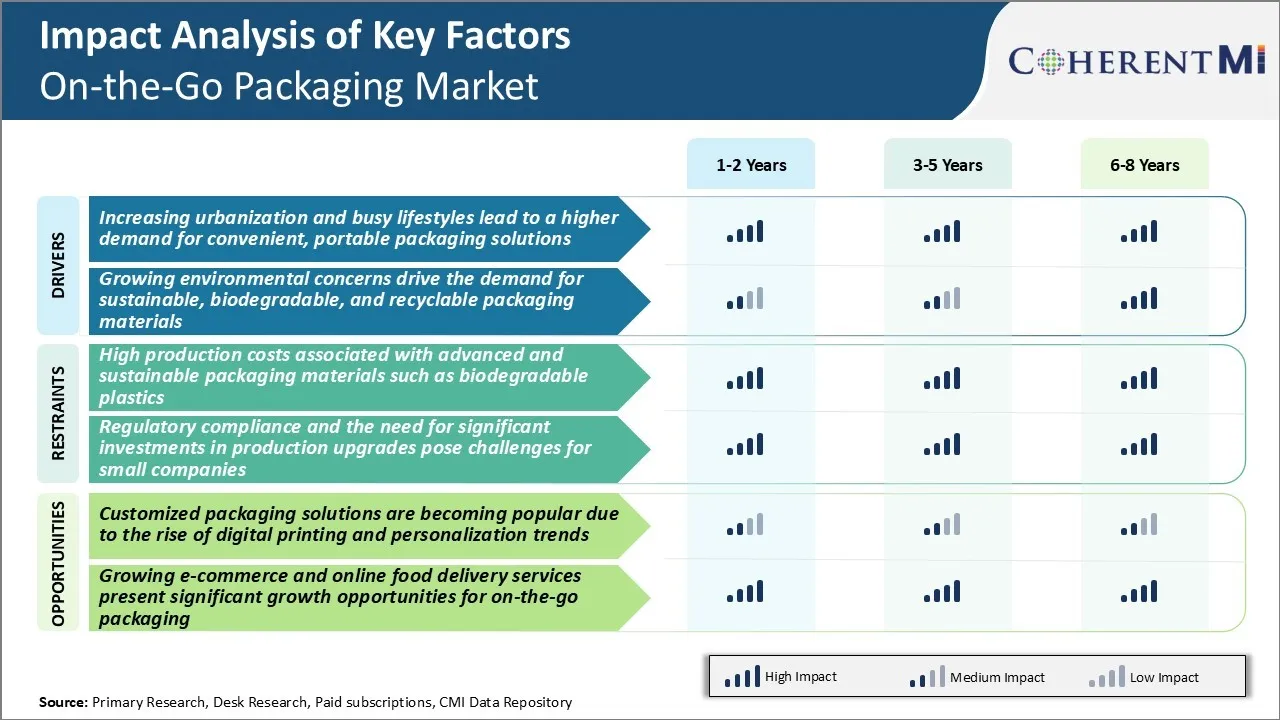

Market Driver - Increasing Urbanization and Busy Lifestyles Lead to a Higher Demand for Convenient, On-the-Go Packaging Solutions

Consumers today lead increasingly busier lifestyles, with long working hours, commute times, and responsibilities filling every part of their day. As urbanization continues its rapid pace across the globe, more people are living in densely populated cities. This has put significant pressure on modern consumers to find solutions that enable them to save time and remain on-the-go.

To address these needs, food brands and retailers have expanded their on-the-go packaging offerings significantly. Singles and small format packs have grown in popularity as they allow portion control and portability without wastage. Flexible pouches, cups, and paper-based wraps have been designed for grab-and-go eating with just one hand. Drink pouches, squeeze tubes, and portable snack bars offer optimal convenience for consumption on the move.

Such consumer-centric innovations in on-the-go packaging have seen rapid uptake, which has propelled the growth of the on-the-go packaging market.

Market Driver- Growing Environmental Concerns Drive Demand for Biodegradable and Recyclable On-the-Go Packaging Materials

In on-the-go packaging market, concern about plastic pollution and carbon footprint are driving greater scrutiny. Biodegradable, compostable, and recyclable solutions that can re-enter the value chain as productive resources are favored over single-use plastics that choke landfills and pollute ecosystems.

For on-the-go packaging especially, where disposability is essential due to hygiene and portability needs, eliminating plastics without compromising on performance and experience is an urgent challenge.

Packaging manufacturers have recognized the business opportunity in meeting this demand for sustainability. Many major brands are investing heavily in developing plant-based, fiber-based and recyclable packaging alternatives that can serve on-the-go purposes as effectively as plastics with a much lower environmental impact.

The use of materials like paper, bagasse, bamboo, wheat straw, and wood pulp in on-the-go cups, plates, cutlery, and food wrapping is growing significantly. This is driving a new trend in the on-the-go packaging market.

Market Challenge - High Production Costs Associated with Advanced and Sustainable Packaging Materials

One of the key challenges currently faced by the on-the-go packaging market is the high production costs associated with advanced and sustainable packaging materials such as biodegradable plastics. While there is a growing demand for eco-friendly packaging from consumers as well as regulations pushing for sustainability, biodegradable plastics that can replace conventional plastics cost nearly two to three times as much to produce.

The need for specialized production processes and infrastructure to manufacture compostable bioplastic films and thermoformed containers has resulted in significant capital investment requirements. Manufacturers in the on-the-go packaging market relying on such sustainable packaging solutions struggle to keep their prices competitive since the raw material costs alone are much higher.

Additionally, there are also limitations and higher costs associated with recycling or disposal of compostable packaging which creates further economic challenges. Unless production costs come down substantially, greater adoption of bioplastics and other sustainable materials may remain restricted for on-the-go packaging applications.

Market Opportunity - Customized Packaging Solutions Becoming Popular with Rise of Digital Printing and Personalization Trends

With the rising demand for personalized customer experiences, the opportunity around customized on-the-go packaging solutions is increasing. Digital printing technologies have made it possible to produce smaller run sizes of packaging economically. This is giving brands in the on-the-go packaging market the ability to customize packaging based on customer preferences, occasion, location, or other factors.

Companies across industries like food, cosmetics and consumer goods are actively experimenting with utilizing variable data on cartons, cups and bags to enhance customer engagement. Digital printing also enables just-in-time production closer to the point of consumption. The growing uptake of customized on-the-go packaging driven by digital printing and personalization trends is opening up new revenue streams for manufacturers catering to on-the-go packaging requirements.

Key winning strategies adopted by key players of On-the-Go Packaging Market

Key players in the on-the-go packaging market have focused on product innovations to meet the changing consumer preferences for convenient packaging. In 2015, Amcor launched its AmLite Ultra Recyclable packaging which is 100% recyclable and provides extended shelf life for food and snacks.

Players have also adopted the strategy of acquisitions and partnerships to expand their product portfolio and market reach. For example, in 2017, Berry Global acquired AEP Industries' flexible packaging business to become one of the leading suppliers of flexible and on-the-go packaging solutions in North America.

Companies are actively partnering with brand owners to launch custom packaging solutions. In 2018, Ampac partnered with Conagra Brands to develop and launch on-the-go re-closable flexible pouches for its Orville Redenbacher's popcorn brand. These microwavable pouches were 30% lighter than previous stand-up pouches, thus supporting Conagra's sustainability goals.

Market leaders are focusing on strategic geographic expansion into fast-growing markets. In 2020, Sonoco acquired Peninsula Packaging of Canada to expand its product offerings and customer base in North America.

Segmental Analysis of On-the-Go Packaging Market

Insights, By Material: Rise of Pouch Packaging Driving Plastic Segment Growth

In terms of material, plastic contributes 52.7% share of on-the-go packaging market in 2024, owning to the rising prominence of pouch packaging formats. Plastic pouches offer multiple advantages over rigid packages for on-the-go consumption including being lightweight, resealable, portable and affordable to produce at scale.

The rising demand for convenience and hygienic packaging from busy consumers on the go has driven rapid uptake of plastic pouches for food and beverage products over the past decade. Advances in plastic material sciences have also enabled manufacturers to make plastic pouches with high barrier qualities, allowing longer shelf-life for perishable items.

Furthermore, plastic resins such as polyethylene and polypropylene can be easily molded into attractive shapes and graphics at high speeds to attract consumers. Switching to plastic pouches also allows brands to reduce transportation and storage costs.

With makers of snacks, confectionaries and ready meals increasingly prioritizing pouch formats, the plastic segment is expected to capture a growing share of the on-the-go packaging market.

Insights, By Type: Dominance of Bags and Pouches in Portable, On-the-Go Packaging

In terms of type, pouches & bags contributes 46.3% share of on-the-go packaging market in 2024. The need for truly portable packaging that can withstand bumps and squeezing during transport is fueling the dominance of bags and pouches in on-the-go packaging.

Flexible bags and stand-up pouches allow packaged items to maintain their intact state and shelf life even when squeezed or tossed in bags. Various spout, zipper and straw pouch designs further enhance the ease of accessing contents on the move.

Bags and pouches occupy less space in luggage or backpacks compared to rigid containers like bottles. Their lightweight nature also makes them more economical for consumers to dispose of after single use. With packaging formats like cups, tubs and trays being less suited for uncontrolled transport conditions, bags and pouches are increasingly preferred by food producers for convenient and protected on-the-go consumption options.

Insights, By End User: Popularity of Quick Service Driving Food Service Outlets Segment

In terms of end user, food service outlets contribute the highest share of the market. The popularity of quick service restaurants and fast casual dining chains serves to boost the food service outlets segment of the on-the-go packaging market. Their business models center around providing reliable takeaway and delivery options using lightweight, portable and tamper-proof food packages.

A variety of snacks, sandwiches, salads, rice bowls and beverages need protective on-the-go packaging designed for frequent handling without spillage or crushing. Food service outlets therefore see on-the-go packaging as essential infrastructure for offering hassle-free consumption away from premises.

The normalization of delayed or distributed eating behaviors has further increased dependence on food service outlets for portable meal solutions. Given their scale and supply chain efficiencies, food service outlets procure on-the-go packaging directly from manufacturers on a large volume basis.

Additional Insights of On-the-Go Packaging Market

- North America accounts for the largest share of 39% of the global on-the-go packaging market, with the U.S. playing a leading role due to its advanced manufacturing and smart packaging technologies.

- Asia-Pacific Region Leads Growth: The Asia-Pacific region is experiencing the fastest growth in the on-the-go packaging market due to rising disposable incomes and changing consumer behaviors.

- Consumer Preference Trends: There is a notable trend towards smaller pack sizes in on-the-go packaging, catering to single-use and convenience needs.

- The shift towards biodegradable and compostable packaging has gained momentum, with companies investing in research and development to create sustainable alternatives.

- E-commerce growth has increased the demand for robust on-the-go packaging solutions that can withstand shipping while maintaining product integrity.

Competitive overview of On-the-Go Packaging Market

The major players operating in the on-the-go packaging market include Berry Global Group, Smurfit Kappa Group, Sealed Air Corporation, WestRock Company, Huhtamaki Oyj, Tetra Pak International S.A., Gerogia-Pacific LLC, Amcor plc, Mondi Group, Sonoco Products Company, Constantia Flexibles, and Bemis Company, Inc.

On-the-Go Packaging Market Leaders

- Berry Global Group

- Smurfit Kappa Group

- Sealed Air Corporation

- WestRock Company

- Huhtamaki Oyj

On-the-Go Packaging Market - Competitive Rivalry, 2024

On-the-Go Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in On-the-Go Packaging Market

- In September 2023, Sealed Air Corporation acquired a stake in a biodegradable materials startup to incorporate sustainable materials into their product line, enhancing their sustainability profile. This acquisition primarily focuses on flexible packaging solutions rather than directly involving a biodegradable materials startup. Sealed Air has emphasized its commitment to sustainability, with goals to make all its packaging recyclable or reusable by 2025 and to achieve net-zero carbon emissions by 2040.

- In July 2023, Berry Global announced the opening of a new manufacturing facility in Vietnam. This expansion is part of their strategy to meet the increasing demand in the Asia-Pacific region, particularly for healthcare products. Additionally, earlier in the year, they had also opened a facility in Bangalore, India, which further emphasizes their commitment to expanding their operations in Asia.

- In March 2023, Amcor announced the launch of a new line of recyclable packaging solutions, which is part of their ongoing commitment to sustainability. This initiative aims to reduce environmental impact and is expected to enhance their market position, particularly among eco-conscious consumers.

On-the-Go Packaging Market Segmentation

- By Material

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Others

- Paper & Paperboard

- Metal

- By Type

- Pouches & Bags

- Bottles & Jars

- Trays & Clamshells

- Cans

- By End User

- Food Service Outlets

- Institutional Food Services

- Online Food Delivery

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the on-the-go packaging market?

The on-the-go packaging market is estimated to be valued at USD 2.72 Bn in 2024 and is expected to reach USD 3.73 Bn by 2031.

What are the key factors hampering the growth of the on-the-go packaging market?

High production costs associated with advanced and sustainable packaging materials, regulatory compliance, and the need for significant investments in production upgrades are the major factors hampering the growth of the on-the-go packaging market.

What are the major factors driving the on-the-go packaging market growth?

Increasing urbanization and busy lifestyles lead to a higher demand for convenient, portable packaging solutions. Further, growing environmental concerns drive the demand for sustainable, biodegradable, and recyclable packaging materials. These are the major factors driving the on-the-go packaging market.

Which is the leading material in the on-the-go packaging market?

The leading material segment is plastic.

Which are the major players operating in the on-the-go packaging market?

Berry Global Group, Smurfit Kappa Group, Sealed Air Corporation, WestRock Company, Huhtamaki Oyj, Tetra Pak International S.A., Gerogia-Pacific LLC, Amcor plc, Mondi Group, Sonoco Products Company, Constantia Flexibles, and Bemis Company, Inc. are the major players.

What will be the CAGR of the on-the-go packaging market?

The CAGR of the on-the-go packaging market is projected to be 4.6% from 2024-2031.