Passenger Vehicles Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Passenger Vehicles Market is segmented By Type (Compact Vehicles, Midsize Vehicles, Premium Vehicles, Luxury Vehicles, Others), By Application (SUV, M....

Passenger Vehicles Market Size

Market Size in USD Bn

CAGR7.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.5% |

| Market Concentration | Medium |

| Major Players | Ford Motor Company, General Motors, Tesla Inc., BMW AG, Volkswagen AG and Among Others. |

please let us know !

Passenger Vehicles Market Analysis

The passenger vehicles market is estimated to be valued at USD 2.01 Bn in 2024 and is expected to reach USD 3.34 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2031. Increase in disposable income, development of road infrastructure and preference for personal mobility are driving growth of the passenger vehicles market.

Passenger Vehicles Market Trends

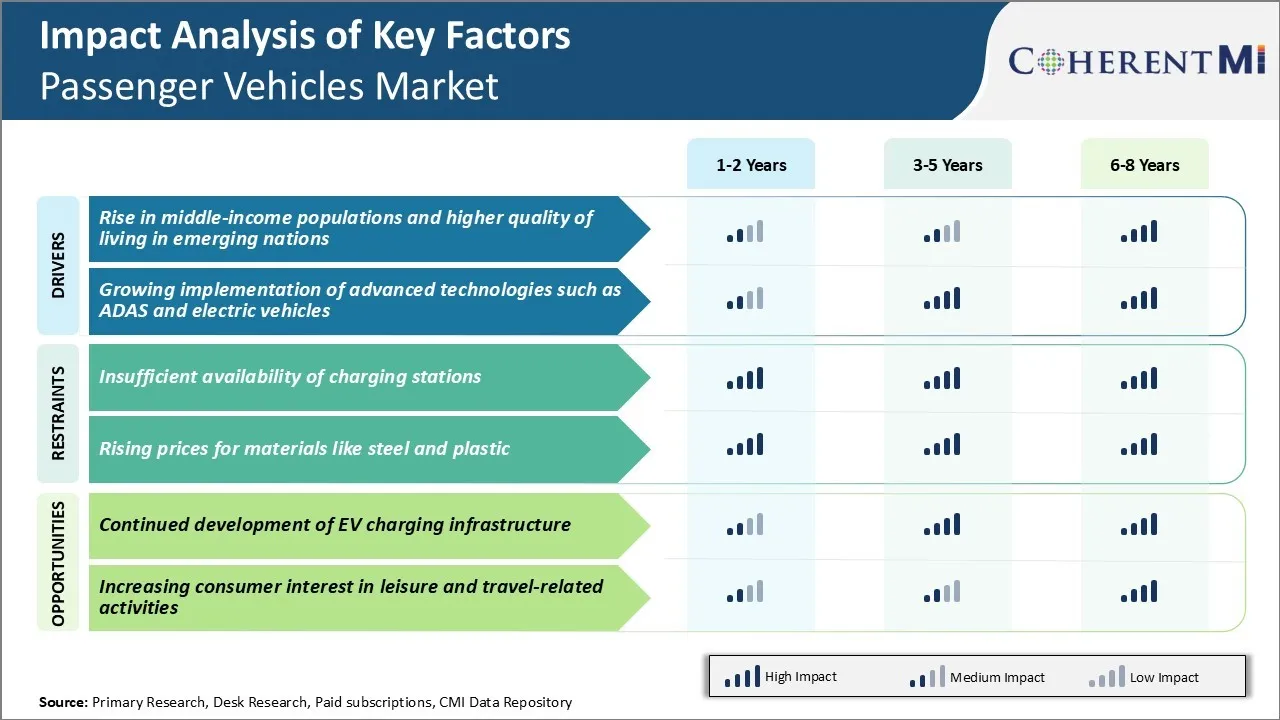

Market Driver - Rise in Middle-income Populations and Higher Quality of Living in Emerging Nations

There has been a substantial increase in the size of middle-income populations within these nations over the past decade. Countries such as India, Indonesia, and various nations in Latin America have witnessed a significant transformation of their socio-economic profiles.

Importantly, having stable jobs and financial security allows these evolving middle-income consumers to consider bigger-ticket purchases such as passenger vehicles. Manufacturers in the passenger vehicles market have recognized the burgeoning opportunities within the untapped middle-income segments in emerging countries and have tailored more affordable passenger vehicle models. Various financing options from auto financiers have further facilitated vehicle acquisition.

As the size of middle-income populace widens their spending scope beyond necessities, passenger vehicles remain one of their priority consideration sets. Additionally, imminent upgrades in road infrastructure across developing regions will augment vehicle ownership as driving becomes more hassle-free. This steady expansion of middle-income populations nested with higher standards of living continues to stimulate consistent vehicle demand within emerging markets. This will make it a critical driver sustaining long-term growth prospects for the global passenger vehicle market.

Market Driver - Growing Implementation of Advanced Technologies

The rising incorporation of sophisticated automotive technologies across new vehicle models is revolutionizing both the engineering makeup and value propositions of passenger vehicles. Vehicle safety has been taken to newer heights with the widespread deployment of active and passive safety features through ADAS. Technologies like automatic emergency braking, adaptive cruise control, blind-spot monitoring, parking assist are now commonly available even on compact and mid-sized vehicles, providing unmatched protection to lives inside and around cars.

Electric vehicles are further augmenting this technological acceleration within the passenger vehicles market. Apart from their minimization of emissions, EVs promote far greater efficiency and performance than petrol or diesel equivalents. Continuous enhancements in battery technology have also eliminated driving range anxiety over time.

Steadily maturing autonomous capabilities showcased through Tesla, BMW and Mercedes foreshadow how self-driving cars may transport people independently with utmost convenience in the near future. These widespread and ongoing enhancements in technologies powering modern vehicles are certain to maintain strong patronage for new models. This will elevate overall sales volumes significantly across the passenger vehicles market in the coming years.

Market Challenge - Insufficient Availability of Charging Stations

There is a significant challenge related to insufficient availability of charging stations for electric passenger vehicles. As more electric vehicles are adopted by consumers, there is an increasing demand for public charging infrastructure to enable longer distance travel. However, many countries and cities still lack standardized and ubiquitous fast-charging networks that can handle higher volumes. This makes consumers hesitant about fully switching to electric passenger vehicles given the range anxiety of not being able to charge easily during long trips.

Automakers and governments need to work collaboratively to scale up investments into building more high-powered rapid and ultra-rapid charging stations along major highways and roads. Standardization of connectors and payment methods is also required to create a seamless charging experience.

With current limited availability, the mass adoption of electric vehicles may get negatively impacted. It is important that this challenge is addressed timely by players in the passenger vehicles market through coordinated policy support and infrastructure build-up.

Market Opportunity - Continued Development of EV Charging Infrastructure

One of the major opportunities for the electric passenger vehicle market is the continued development of EV charging infrastructure. More investments are flowing into adding new public charging points across cities and countries. This helps to reduce range anxiety among consumers and improves the convenience of electric vehicle usage.

The growth of AC charging stations at workplaces, commercial areas and apartment complexes supplements public fast-charging networks. Additionally, companies are focusing on innovative technologies like dynamic wireless charging and vehicle-to-grid charging integration. These developments are likely to boost electric vehicle adoption rates going forward.

With more standardized high powered connectors and seamless payments, long distance travel also becomes more viable. As infrastructure matures further, it can drive down the total cost of ownership of EVs compared to gasoline passenger vehicles. This, in turn, strengthens the case for many customers to switch to electric.

Key winning strategies adopted by key players of Passenger Vehicles Market

Focus on new technologies: Automakers like Tesla, BMW and Volkswagen have seen great success by focusing heavily on new technologies like electric powertrains and autonomous driving features.

Global expansion: Toyota expanded globally over the last few decades by establishing local manufacturing facilities on other continents.

Luxury brand positioning: German brands like Mercedes-Benz and Audi have focused on crafting an image of luxury, performance and advanced engineering. Even their mainstream models are positioned as offering a more luxurious experience than other brands.

Focus on customer experience: Tesla is transforming the car buying process through a seamless online purchase journey and minimalist store layouts. Customers can fully configure their vehicle, including advanced features, sitting on their couch.

Segmental Analysis of Passenger Vehicles Market

Insights, By Type: Affordability and Efficiency Drive Demand for Compact Vehicles

In terms of type, compact vehicles contributes 30.7% share of the passenger vehicles market owning to their affordability and fuel efficiency. Compact cars appeal widely to first-time buyers and those with smaller budgets due to their lower purchase price compared to other passenger vehicle types.

Compact body designs allow for nimbler handling and maneuverability, making these cars well-suited for congested urban driving conditions. Passenger vehicles market players have expanded compact vehicle lines in recent years to cater to growing demand. This will offer new features and comforts previously seen only in larger passenger vehicles.

The proliferation of affordable yet modern compact car options entices even those who may have otherwise purchased a midsize vehicle. This continues to drive Compact Vehicles' dominance in the passenger vehicles market segmentation.

Insights, By Application: Convenience and Flexibility Fuel SUV Preference

In terms of application, SUV contributes 45.3% share of the passenger vehicles market in 2024, owing to the versatility and convenience they offer. SUVs provide sufficient passenger and cargo capacity for both personal and family use. Their raised seating position enhances visibility and makes it easier to get in and out compared to lower-slung vehicles. This makes SUVs attractive for customers with young children or older passengers.

SUV designs incorporating all-wheel or four-wheel drive have further augmented their popularity, as this adds capability and traction for inclement weather conditions or outdoors excursions off paved roads. Overall, SUV flexibility to fulfill a variety of transportation needs has made the segment many consumers' top choice.

Insights, By End Use: Personal Transportation Preference Sustains Market Lead

In terms of end use, Personal usage contributes the highest share of the passenger vehicles market owing to individual mobility needs and preferences. Despite the availability of public transportation in many areas, personal vehicles remain indispensable for a significant majority to travel directly between home and work or activities.

Even in metropolitan regions served well by mass transit, the personal vehicles is still preferred for its door-to-door convenience without scheduling constraints. Shifting demographic and lifestyle trends have also stimulated greater demand, evidenced by the growing popularity of SUVs and premium/luxury cars particularly among dual-income households and wealthy retirees.

Personal passenger car ownership holds strong cultural and social significance beyond mere utility as well. These deep-rooted personal transportation needs will likely ensure the segment maintains passenger vehicles market supremacy for the foreseeable future.

Additional Insights of Passenger Vehicles Market

- Canadian Government Regulations (December 2022): New zero-emission passenger vehicle sales targets were introduced.

- BYD Auto's Debut in India (October 2022): BYD launched the Atto 3, targeting 40% of India's EV market by 2030.

- EV Market Growth: By July 2022, 40% of all new passenger vehicles in the EU were petrol, 19.6% were diesel, and 18% were electric or plug-in hybrids.

- SUV Market Demand: Global SUV sales grew over 10% between 2020 and 2021, with SUVs making up 45% of all new vehicle sales globally.

Competitive overview of Passenger Vehicles Market

The major players operating in the passenger vehicles market include Ford Motor Company, General Motors, Tesla Inc., BMW AG, Volkswagen AG, Hyundai Motor Company, Daimler AG, BYD Company Ltd., Toyota Motor Corporation, and Nissan Motor Co., Ltd.

Passenger Vehicles Market Leaders

- Ford Motor Company

- General Motors

- Tesla Inc.

- BMW AG

- Volkswagen AG

Passenger Vehicles Market - Competitive Rivalry, 2024

Passenger Vehicles Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Passenger Vehicles Market

- In January 2023, Tesla experienced a significant increase in China-made electric vehicle (EV) sales compared to the previous month, December 2022. Tesla reported 66,051 units sold in January, which was a substantial rise, reflecting an 18% increase in sales compared to December 2022.

- In January 2023, Mercedes-Benz reported a 4% increase in passenger car sales in the U.S. and a 1% increase in Europe. The company also highlighted a significant rise in battery-electric vehicle (BEV) sales as part of their ongoing transition toward electrification.

- In December 2022, the Canadian government did announce regulations aimed at accelerating the transition to zero-emission vehicles (ZEVs). The regulation requires that by 2026, at least 20% of all new vehicles sold in Canada be zero-emission, with the goal of achieving 100% zero-emission vehicle sales by 2035.

Passenger Vehicles Market Segmentation

- By Type

- Compact Vehicles

- Midsize Vehicles

- Premium Vehicles

- Luxury Vehicles

- Others

- By Application

- SUV

- MPV

- Hatchback

- Sedan

- Others

- By End Use

- Personal

- Commercial

- Electric

- By Fuel Type

- Petrol

- Diesel

- CNG

- EV (Electric Vehicle)

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the passenger vehicles market?

The passenger vehicles market is estimated to be valued at USD 2.01 Bn in 2024 and is expected to reach USD 3.34 Bn by 2031.

What are the key factors hampering the growth of the passenger vehicles market?

Insufficient availability of charging stations and rising prices for materials like steel and plastic are the major factors hampering the growth of the passenger vehicles market.

What are the major factors driving the passenger vehicles market growth?

Rise in middle-income populations and higher quality of living in emerging nations and growing implementation of advanced technologies such as ADAS and electric vehicles are the major factors driving the passenger vehicles market.

Which is the leading type in the passenger vehicles market?

The leading type segment is compact vehicles.

Which are the major players operating in the passenger vehicles market?

Ford Motor Company, General Motors, Tesla Inc., BMW AG, Volkswagen AG, Hyundai Motor Company, Daimler AG, BYD Company Ltd., Toyota Motor Corporation, and Nissan Motor Co., Ltd. are the major players.

What will be the CAGR of the passenger vehicles market?

The CAGR of the passenger vehicles market is projected to be 7.5% from 2024-2031.