Patient Engagement Software Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Patient Engagement Software Market is segmented By Deployment Option (Cloud-based Solutions, On-prem...

Patient Engagement Software Market Size - Analysis

The patient engagement software market is estimated to be valued at USD 8.12 Billion in 2024 and is expected to reach USD 28.38 Billion by 2031, growing at a compound annual growth rate (CAGR) of 19.6% from 2024 to 2031. Increasing demand for patient-centric care and emphasis on population health management are major factors driving significant growth in this space.

Market Size in USD Bn

CAGR19.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 19.6% |

| Market Concentration | Medium |

| Major Players | Athenahealth, Coviu, GetWellNetwork, Health Catalyst, Luma Health and Among Others |

please let us know !

Patient Engagement Software Market Trends

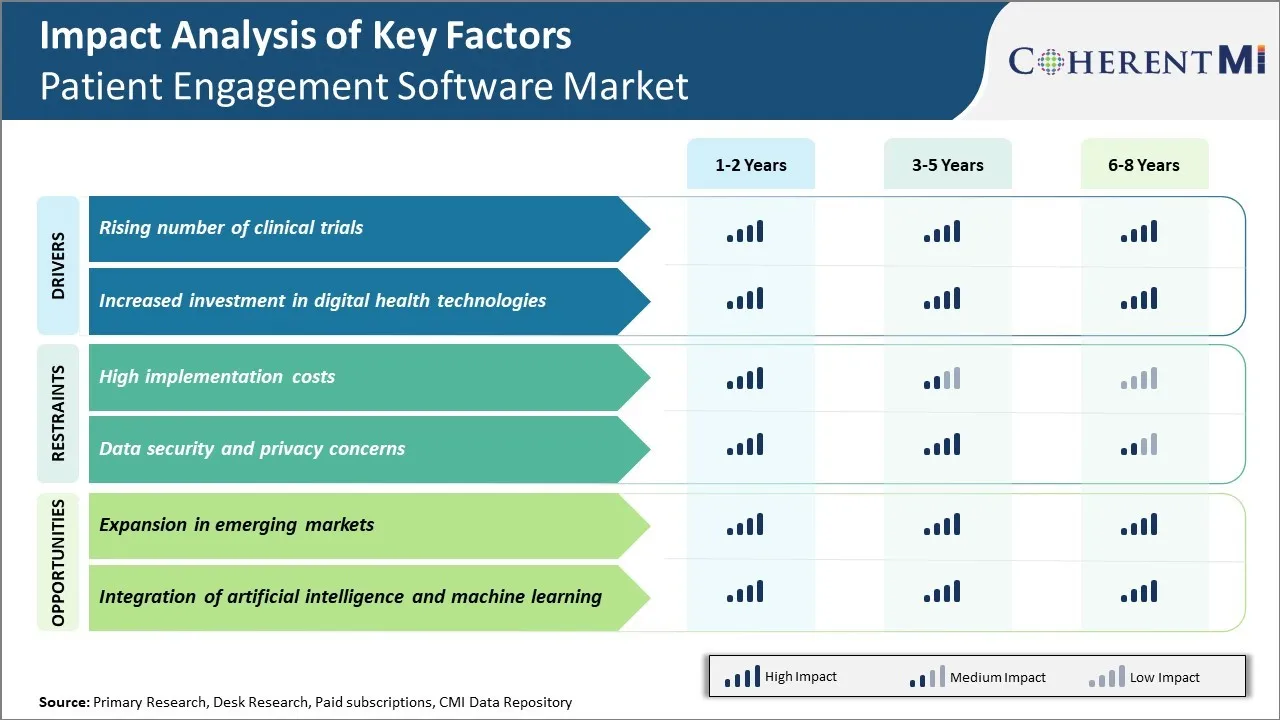

Market Driver - Rising Number of Clinical Trials

With continuous advancements in medical science and technologies, the pharmaceutical industry has witnessed an exponential rise in new drug development activities globally. As the research pipeline expands, clinical trials have emerged as a crucial phase in the drug development lifecycle for testing experimental treatments and gathering evidence on clinical safety and efficacy before approval and market launch.

However, managing the complex workflows and operational requirements of clinical trials has traditionally remained a considerable challenge for pharma sponsors due to fragmented processes across decentralized research sites. Recognizing the need for streamlining clinical trials, many organizations have now started leveraging patient engagement platforms that employ digital solutions to facilitate oversight, recruitment, adherence and retention throughout the trial journey.

Patient engagement software allows sponsors to screen and enroll candidates through online portals while capturing consent electronically. This not only expands the potential patient pool beyond geographic boundaries but also enables easier communication wherein sites can periodically check-in on participants through virtual visits using video calling functions.

Overall, by digitizing workflows and enhancing participant experience, these solutions are playing a key role in expediting trial timelines, thereby addressing challenges of patient recruitment and retention faced by sponsors amid rising trial activity.

Market Driver - Increased Investment in Digital Health Technologies

Over the past decade, digital innovations in healthcare have greatly influenced how care is delivered as well as received. Advancements in remote patient monitoring, telehealth, artificial intelligence and other allied areas are increasingly enabling decentralized and value-based models of treatment. Alongside, considerable venture capital funding has poured into this transforming industry domain, giving rise to new cohorts of digital health startups developing cutting-edge solutions.

One of the focus areas receiving substantial investments is patient engagement platforms. By leveraging these tools, providers aim to extend their reach, establish continuous care pathways and support chronic illness management virtually. Simultaneously, payers see an opportunity to curtail unnecessary utilization through proactive interventions and preventive measures delivered via engagement channels. For patients as well, such platforms offer around-the-clock access to personal health records, appointments, test results as well as educational resources from any location.

Collectively, these benefits are viewed by all stakeholders as ways to improve affordability, quality and experience over the long-run. Numerous strategic funding rounds into prominent engagement software companies reflect the industry's confidence in digitally-driven, person-centered models as the future of sustainable healthcare.

Market Challenge – High Implementation Costs

One of the major challenges faced by companies operating in the patient engagement software market is the high implementation costs associated with these solutions. Adopting patient engagement platforms requires significant investments in terms of purchasing licenses, customizing the software as per organizational needs, integrating it with other healthcare IT systems, onboarding and training staff and patients, etc. This results in six-figure implementation costs for most organizations. Considering healthcare budgets are already stretched thin, convincing administrators to allocate large sums towards engagement software can be an uphill task.

Vendors also need to prove their solutions deliver a strong return on investment through metrics like improved patient outcomes, higher satisfaction scores and reduced costs from preventable readmissions in the long run. Otherwise, the high upfront expenditure poses a major adoption barrier, especially for smaller healthcare providers. To address this, vendors are focusing on offering modular, flexible pricing models and implementation services that allow customers to customize and adopt solutions gradually based on their budget.

Market Opportunity - Expansion in Emerging Markets

One of the significant opportunities for companies in the patient engagement software market is the scope for expansion into emerging healthcare markets. While developed countries currently account for the bulk of overall revenues, demand is steadily rising in developing economies as they look to modernize their healthcare infrastructure and shift focus towards value-based care.

The large patient pools and growing investments towards digital health adoption in nations like India, Brazil, China, Indonesia, Mexico, etc. provide a substantial business case. Vendors that can offer localized, affordable solutions tailored for resource-constrained settings stand to benefit immensely. Partnerships with local medical technology firms, favorable government policies supporting eHealth initiatives and rising internet penetration are helping boost software deployments across rural clinics, community health centers and public hospitals in emerging markets.

This presents ample chances for player expansion through strategic acquisitions, establishing localized offices or developing products specifically for these high growth regions. Tapping into these untapped opportunities will be crucial for sustaining long term revenue streams.

Key winning strategies adopted by key players of Patient Engagement Software Market

Player: Epic Systems Corporation

Strategy: Acquisitions and expansion into new markets

Example: In 2018, Epic acquired Medflow to expand its patient engagement portfolio with secure messaging capabilities. Through this acquisition, Epic was able to integrate Medflow's patient portal and messaging platform into its existing electronic health record (EHR) system.

Player: Cerner Corporation

Strategy: Integrated product offerings and partnerships

Example: In 2019, Cerner partnered with Amazon to make its patient engagement platform available in the Alexa voice app ecosystem. This allowed patients access health records and communicate with care teams using smart speakers. It made Cerner's software more accessible and convenient for consumers.

Player: McKesson Corporation

Strategies: Focus on usability and consumer experience

Example: In 2020, McKesson launched a major redesign of its patient portal, RelayHealth, with a cleaner interface and easier navigation optimized for mobile use. Usage of the portal saw a 30% increase as patients found it more intuitive.

Player: Allscripts Healthcare Solutions

Strategies: Leverage existing client relationships

Example: Allscripts extended its EHR platform to include a patient engagement module, FollowMyHealth. By bundling this with its core offering, Allscripts was able to quickly sign-up existing healthcare organization clients without additional sales efforts.

Segmental Analysis of Patient Engagement Software Market

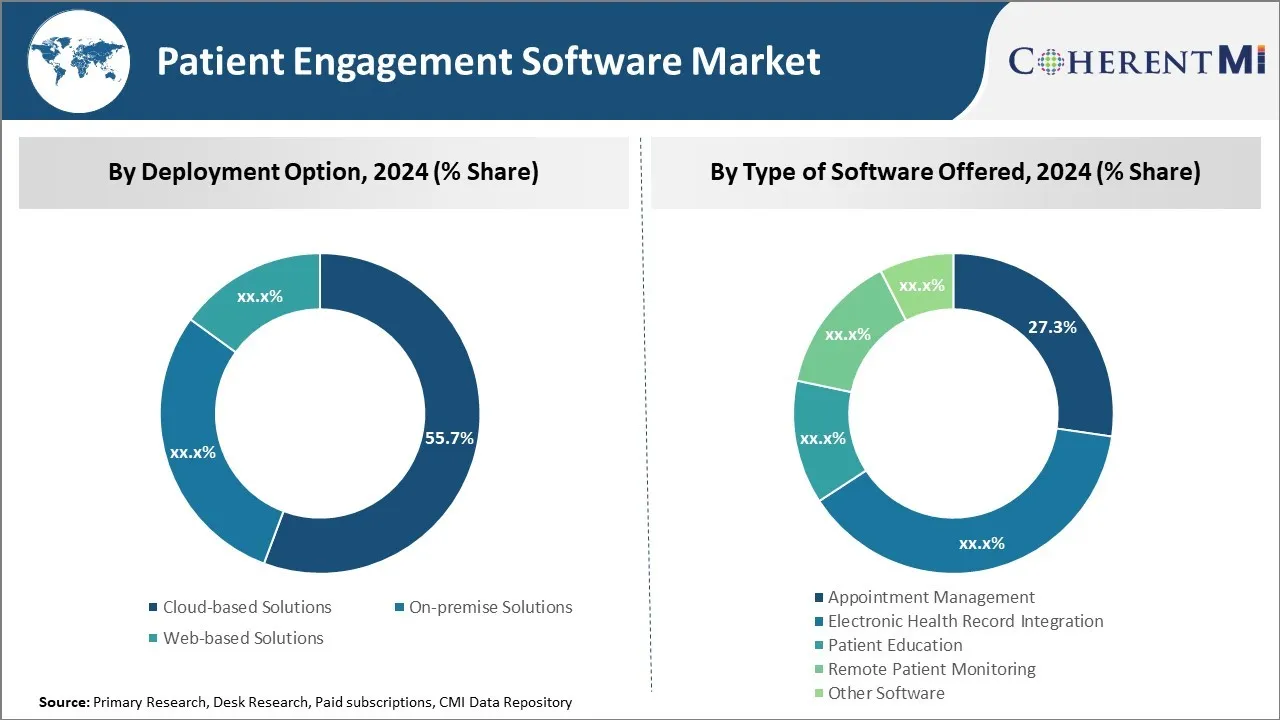

Insights, By Deployment Option - Accessibility and Efficiency Drive Growth of Cloud-based Solutions

In terms of deployment option, cloud-based solutions contribute the highest share of the market owning to its accessibility and efficiency advantages. Cloud-based patient engagement software does not require any upfront infrastructure investment for hardware, servers, or related IT resources. This makes it very affordable for healthcare providers of all sizes to adopt such solutions. The usage-based pricing models of cloud deployments allow providers to only pay for what they use each month, keeping costs predictable.

Cloud solutions also offer advantages in terms of accessibility. Being internet-based, they allow secure access to patient records and appointment scheduling from anywhere using mobile devices or computers. This facilitates more convenient engagement between providers and patients. Doctors can review patient details and histories while on call. Patients can book and change appointments remotely according to their schedules. The 24/7 accessibility also boosts engagement.

From an operational efficiency point of view, cloud-based patient engagement platforms require minimal on-site support and maintenance. Software updates are automatically handled in the cloud without disrupting patient workflows. Data storage, backup and security also become easier to manage for providers without having dedicated on-premise IT teams. This lowers long term costs and resource requirements drastically.

Insights, By Type of Software Offered - Appointment Management Dominates due to Central Role in Patient Lifecyle

In terms of the type of software offered, appointment management contributes the highest share of the market owing to its critical role in facilitating the entire patient lifecycle and care delivery process. Effective appointment scheduling and management are essential functions that providers must fulfill to run their operations smoothly. It forms the primary point of contact between patients and the healthcare system.

Appointment management software handles booking requests, allocates time slots, sends reminders, and enables paperless confirmations and rescheduling. This eases the administrative workload on staff. It also streamlines the process for patients, reducing waiting periods, no-shows and reschedules. Timely communication helps promote higher engagement.

Being the entry point for receiving care, appointment management sets the tone for overall patient experience and satisfaction levels. This impacts loyalty, referrals as well as revenue cycles for providers. Optimizing scheduling is thus a top priority and the returns are highly evident.

Advanced appointment solutions also integrate with other software like EHR and billing to pull relevant patient data, populate calendars and trigger downstream processes. This synchronous flow of information across platforms enhances coordination and handoffs within complex care delivery workflows. Such connected functionality cements its importance.

Insights, By Application Area - Financial Health Management Gains Momentum Due to Cost Pressures

In terms of application area, financial health management contributes the highest share of the market as healthcare costs continue to rise globally. The COVID-19 pandemic has also spurred demand by worsening financial distress for patients and the overall economic slowdown exacerbating budget constraints across the board.

Financial health management software empowers patients to track expenses, access cost estimates for procedures upfront, understand benefits and out-of-pocket responsibilities clearly. This facilitates better budgeting and financial preparedness for healthcare needs. It also prevents unwanted surprises owing to inaccurate expectations. Transparency avoids disagreements and non-payment issues later.

At the same time, healthcare providers are under significant pressure to rein in costs through measures like pre-authorization, value-based arrangements, and incentives for affordable in-network care usage. Financial management solutions enable streamlined insurance verification and pre-certification processes. Workflows for claim management, denials, appeals are automated. Detailed cost and utilization reporting enables hotspot analysis to optimize network management and budgets.

Government agencies also utilize such software to manage public program reimbursements properly and crack down on fraud, waste or over-treatment scenarios effectively. The three-way collaboration between patients, providers and payers establishes a mutually-beneficial framework for affordable and accountable healthcare delivery over the long run.

Additional Insights of Patient Engagement Software Market

- The report highlights the role of patient engagement software in improving clinical trials by enhancing recruitment, retention, and overall patient experience, particularly with the rise of decentralized trials.

- North America is expected to capture 31% of the market share in 2024, with the Middle East and North Africa region growing at a CAGR of 21.4%.

Competitive overview of Patient Engagement Software Market

The major players operating in the Patient Engagement Software Market include Athenahealth, Coviu, GetWellNetwork, Health Catalyst, Luma Health, Mocero Health, Orion Health, Physitrack, SolvEdge, Veradigm (formerly Allscript), WellBeat, and Wolters Kluwer.

Patient Engagement Software Market Leaders

- Athenahealth

- Coviu

- GetWellNetwork

- Health Catalyst

- Luma Health

Patient Engagement Software Market - Competitive Rivalry

Patient Engagement Software Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Patient Engagement Software Market

- In December 2023, GetWellNetwork expanded into the health plan space with Christian Bagge, who is leading the Payer Strategy department.

- In October 2023, Big Band Software acquired Inphonite, enhancing its dental and medical practice services.

- In August 2023, NextGen Healthcare and Luma Health formed a strategic alliance for AIenhanced patient engagement solutions.

Patient Engagement Software Market Segmentation

- By Deployment Option

- Cloud-based Solutions

- On-premise Solutions

- Web-based Solutions

- By Type of Software Offered

- Appointment Management

- Electronic Health Record Integration

- Patient Education

- Remote Patient Monitoring

- Other Software

- By Application Area

- Financial Health Management

- Fitness and Wellbeing

- Home Health Management

- Research and Development

- Social Health Management

- By End User

- Healthcare Providers

- Individuals

- Payers

- Other End Users

Would you like to explore the option of buyingindividual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

Frequently Asked Questions :

What are the key factors hampering the growth of the patient engagement software market?

The high implementation costs and data security and privacy concerns are the major factor hampering the growth of the patient engagement software market.

What are the major factors driving the patient engagement software market growth?

The rising number of clinical trials and increased investment in digital health technologies are the major factor driving the patient engagement software market.

Which is the leading deployment option in the patient engagement software market?

The leading deployment option segment is cloud-based solutions.

which are the major players operating in the patient engagement software market?

Mocero Health, Orion Health, Physitrack, SolvEdge, Veradigm (formerly Allscript), WellBeat, and Wolters Kluwer are the major players.

What will be the CAGR of the patient engagement software market?

The CAGR of the patient engagement software market is projected to be 19.6% from 2024-2031.