Philippines Construction Aggregates Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Philippines Construction Aggregates Market is Segmented By Product Type (Crushed Stone, Sand, Gravel, Other Aggregates), By End Use (Infrastructure, R....

Philippines Construction Aggregates Market Size

Market Size in USD Bn

CAGR5.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.5% |

| Market Concentration | Medium |

| Major Players | Holcim Philippines Inc, Metrocem Cement Ltd, Eagle Cement Corp, Island Quarry & Aggregates Corporation, Pacific Cement Phils Inc and Among Others. |

please let us know !

Philippines Construction Aggregates Market Analysis

The Philippines Construction Aggregates Market is estimated to be valued at USD 3.76 Bn in 2024 and is expected to reach USD 4.86 Bn by 2031, growing at a CAGR of 5.5% from 2024 to 2031.

The market is expected to witness positive growth over the forecast period owing to the growth of the construction industry in the country such as infrastructure development projects and housing construction activities.

Philippines Construction Aggregates Market Trends

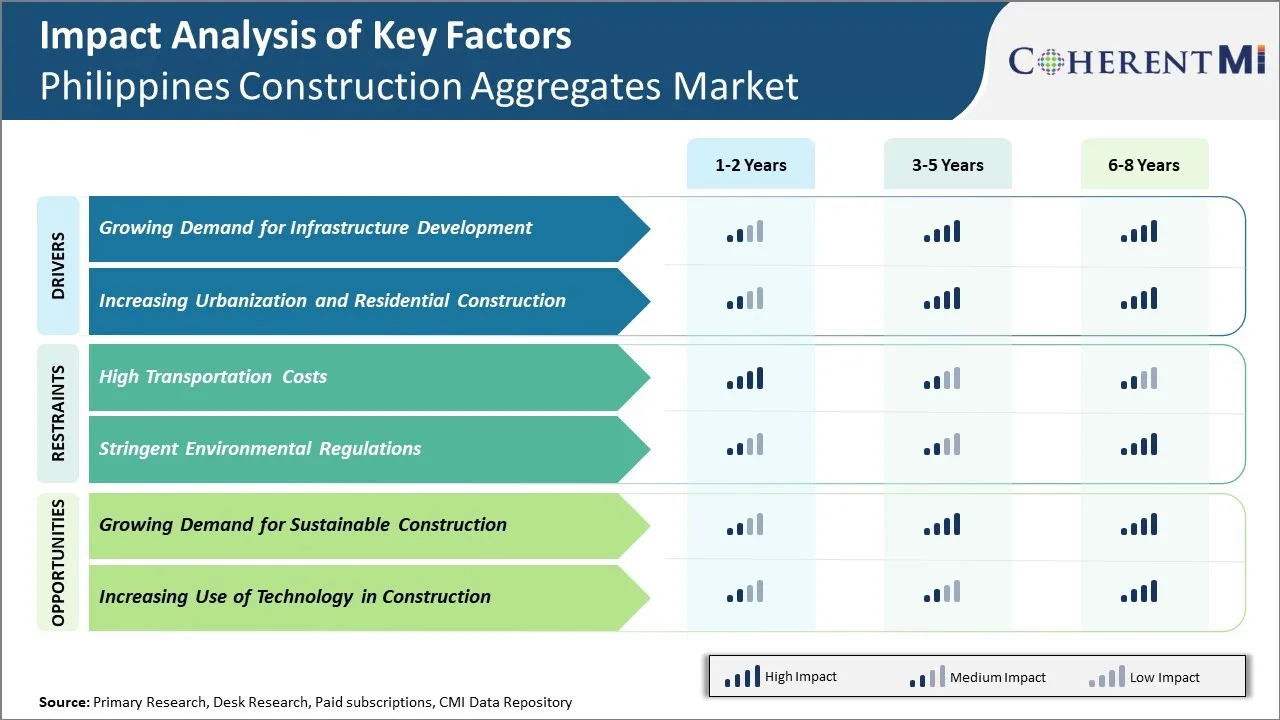

Market Driver – Growing Demand for Infrastructure Development

The growing demand for infrastructure development across major cities and regions in the Philippines is one of the key factors positively impacting the growth of the construction aggregates market in the country. The government's massive investments and initiatives to rapidly enhance transportation and connectivity infrastructure are directly translating to increased consumption of crushed stone, sand, and gravel in large volumes.

Recent projects under major programs such as 'Build, Build, Build' and those aimed at strengthening roads, rail, airports and sea ports have significantly lifted the demand for aggregates. For instance, construction activity related to Metro Manila subway project that started in 2020 is using huge amounts of crushed stones and sand on a daily basis. As per Department of Public Works and Highways, the daily requirement of coarse and fine aggregates for the different phases of this single metro project is estimated to be over 10,000 metric tons. This is indicative of the scale of aggregates needed to complete large infrastructure projects of national importance.

Additionally, active developmental projects in different sectors are also propelling the market growth.

Market Driver – Increasing Urbanization and Residential Construction

The rapid urbanization and growth of residential construction in major cities of the Philippines is one of the key factors augmenting the demand for construction aggregates in the country. Over the past decade, there has been a steady migration of people from rural areas to urban centers in search of employment and better livelihood opportunities. This has placed tremendous pressure on the existing housing and infrastructure facilities. As per data from the Philippine Statistics Authority, the urban population in the Philippines grew from 52% in 2015 to over 54% in 2020 and is expected to reach 58% by 2025.

In order to accommodate the burgeoning urban population, local administrations are investing heavily in residential construction activities. For instance, the National Housing Authority has planned to construct over 500,000 housing units across Metro Manila and key urban areas by 2023, as stated in its reports. Similarly, private real estate developers have ongoing projects to develop nearly 1 million new homes during the same period. This rapid growth in housing and residential building development has fueled the demand for quarry materials.

Market Challenge – High Transportation Costs

High transportation costs have significantly restrained the growth of Philippines construction aggregates market in recent years. The Philippines is an archipelago comprising over 7,000 islands, with many construction projects located in remote, isolated areas that are difficult and expensive to access. Transporting heavy construction materials like sand, gravel and crushed stone over long distances to these projects entails high logistic costs. The poor condition of roads and other infrastructure in many parts of the country also leads to higher wear and tear of vehicles, as well as delays during transportation. According to data from the World Bank, the average time taken to transport goods within the Philippines is 203 hours, which is substantially higher than other Southeast Asian countries.

Additionally, the limited availability of suitable modes of transportation in certain parts of the Philippines poses further challenges. Transportation has to rely more on smaller boats or trucks, which have much lesser capacity. This forces more trips to transport equivalent volumes of aggregates. The Philippines Department of Transportation data from 2021 shows that over 60% of municipalities still lack road connectivity, hampering transportation of construction materials even within many islands.

Market Opportunity – Growing Demand for Sustainable Construction

The growing demand for sustainable construction presents a major opportunity for the Philippines construction aggregates market. There is increasing awareness amongst builders, developers and consumers about the need to reduce carbon footprint of infrastructure and building projects. This focuses attention on using construction materials that are environment friendly and sourced through responsible mining practices.

Aggregates form the basic raw material used in cement, concrete and asphalt manufacturing that are indispensable for building activities. The large quantities required make it important to opt for construction aggregates that are sustainably extracted and produced. Mining operations need to follow strict norms for waste disposal, recycling, rehabilitation and ensure minimal damage to land, air and water resources. Aggregates suppliers well-versed with best practices for sustainable sourcing will be better placed to benefit from the shifts in demand.

As the Philippine government works towards limiting greenhouse gas emissions and transitioning to renewable energy as per its commitments under the Paris Agreement, it is formulating more stringent norms for industries. The "Philippine Strategy Towards a Climate Change Resilient and Low Carbon Future" outlined by the Climate Change Commission targets increased investments to upgrade infrastructure and buildings to higher resilience and energy efficiency standards by 2030.

Segmental Analysis of Philippines Construction Aggregates Market

Insights, By Product Type: Crushed Stone Among the Most Versatile Construction Materials

In terms of product type, crushed stone sub-segment contributes the highest share of 45.6% in the market owing to its high versatility and strength.

Crushed stone is one of the most versatile construction materials and remains highly demanded across major infrastructure and building projects in the Philippines. Comprising around 45% of the total aggregates market, crushed stone enjoys consistent popularity due to its high compressive strength and resistance to wear and tear.

Being one of the hardest and densest natural resources, crushed stone retains its shape and structure even under extreme pressure. This gives it an advantage over other aggregates as it allows for building and packing at narrow spaces without adverse settlement issues. Its angular and irregular texture also results in tighter interlocking, lending greater stability and load-bearing capacity to constructions.

Additionally, crushed stone forms a strong and durable base for roads, highways and other groundwork. Its resistance to weathering ensures long operational life of infrastructure. This is a primary reason why it dominates government-led projects in the transportation and urban development sectors. Rising allocation towards modernizing national road networks and building new cities continues to spur the uptake of crushed stone.

Insights, By End Use: Ongoing Construction Boom Drives the Segment Growth

Infrastructure contributes the highest share of 43.1% in the market owing to ongoing construction boom.

The infrastructure segment constitutes the largest consumer of construction aggregates in the Philippines. Representing close to 35% of total end-use, infrastructure activities such as roadworks, rail projects, ports development, and utility works remain the pillar of aggregates consumption.

Fuelled by strong public spending as well as growing private investment, the construction industry is undergoing a visible boom cycle in the country. Major infrastructure projects lined up under the government's flagship Build Program will require immense volumes of aggregates to complete. These projects include new airports, seaports, rail transits, energy and water supply projects - all of which involve heavy earthworks and foundation activities supporting the aggregates industry.

At the same time, ongoing infrastructure repairs and maintenance of existing roads, bridges and public utilities also drive steady demand. The industrialization push by the government through development of special economic zones further increases the need for industrial estate construction, using huge quantities of aggregates.

With more funding expected to flow into expanding transportation and social infrastructure over the coming years as part of nationwide development objectives, the infrastructure segment is positioned to remain the prime mover of aggregates consumption.

Competitive overview of Philippines Construction Aggregates Market

The major players operating in the Philippines Construction Aggregates Market include Holcim Philippines Inc, Metrocem Cement Ltd, Eagle Cement Corp, Island Quarry & Aggregates Corporation, Pacific Cement Phils Inc, Union Galvasteel Corporation (UGC), San Miguel Northern Cement Inc. (SBNCI), Atlanta Industries Inc., Concrete Stone Corp, and Mav Companies Aggregates Inc.

Philippines Construction Aggregates Market Leaders

- Holcim Philippines Inc

- Metrocem Cement Ltd

- Eagle Cement Corp

- Island Quarry & Aggregates Corporation

- Pacific Cement Phils Inc

Philippines Construction Aggregates Market - Competitive Rivalry, 2024

Philippines Construction Aggregates Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Philippines Construction Aggregates Market

- In January 2022, Holcim Philippines Inc announced plans to expand its cement and construction materials operations in the Philippines, including the construction of a new cement plant and the expansion of its aggregate production capacity.

- In September 2022, Metrocem Cement Ltd signed a deal to supply cement and construction materials to a major infrastructure project in the Philippines, including the construction of a new highway and several bridges.

Philippines Construction Aggregates Market Segmentation

- By Product Type

- Crushed Stone

- Sand

- Gravel

- Other Aggregates

- By End Use

- Infrastructure

- Residential

- Industrial

- Commercial

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Philippines Construction Aggregates Market?

The high transportation costs and stringent environmental regulations are the major factors hampering the growth of the Philippines Construction Aggregates Market.

What are the major factors driving the Philippines Construction Aggregates Market growth?

The growing demand for infrastructure development and increasing urbanization and residential construction are the major factors driving the Philippines Construction Aggregates Market.

Which is the leading Product Type in the Philippines Construction Aggregates Market?

The leading Product Type segment is Crushed Stone.

Which are the major players operating in the Philippines Construction Aggregates Market?

Holcim Philippines Inc, Metrocem Cement Ltd, Eagle Cement Corp, Island Quarry & Aggregates Corporation, Pacific Cement Phils Inc, Union Galvasteel Corporation (UGC), San Miguel Northern Cement Inc. (SBNCI), Atlanta Industries Inc., Concrete Stone Corp, and Mav Companies Aggregates Inc are the major players.

What will be the CAGR of the Philippines Construction Aggregates Market?

The CAGR of the Philippines Construction Aggregates Market is projected to be 5.5% from 2024-2031.