Plant-based Packaging Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Plant-based Packaging Market is segmented By Material (Bioplastics, Starch-based Materials, Bagasse, Cellulose, Others), By Packaging Type (Flexible P....

Plant-based Packaging Market Size

Market Size in USD Mn

CAGR9.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.7% |

| Market Concentration | High |

| Major Players | Evergreen Packaging, The Coca-Cola Company, Amcor, Vegware, Tetra Pak International SA and Among Others. |

please let us know !

Plant-based Packaging Market Analysis

The plant-based packaging market is estimated to be valued at USD 135.94 Mn in 2024 and is expected to reach USD 259.98 Mn by 2031, growing at a compound annual growth rate (CAGR) of 9.7% from 2024 to 2031. The plant-based packaging market is expected to witness significant growth over the forecast period due to stricter environmental regulations regarding single-use plastics and plastic waste.

Plant-based Packaging Market Trends

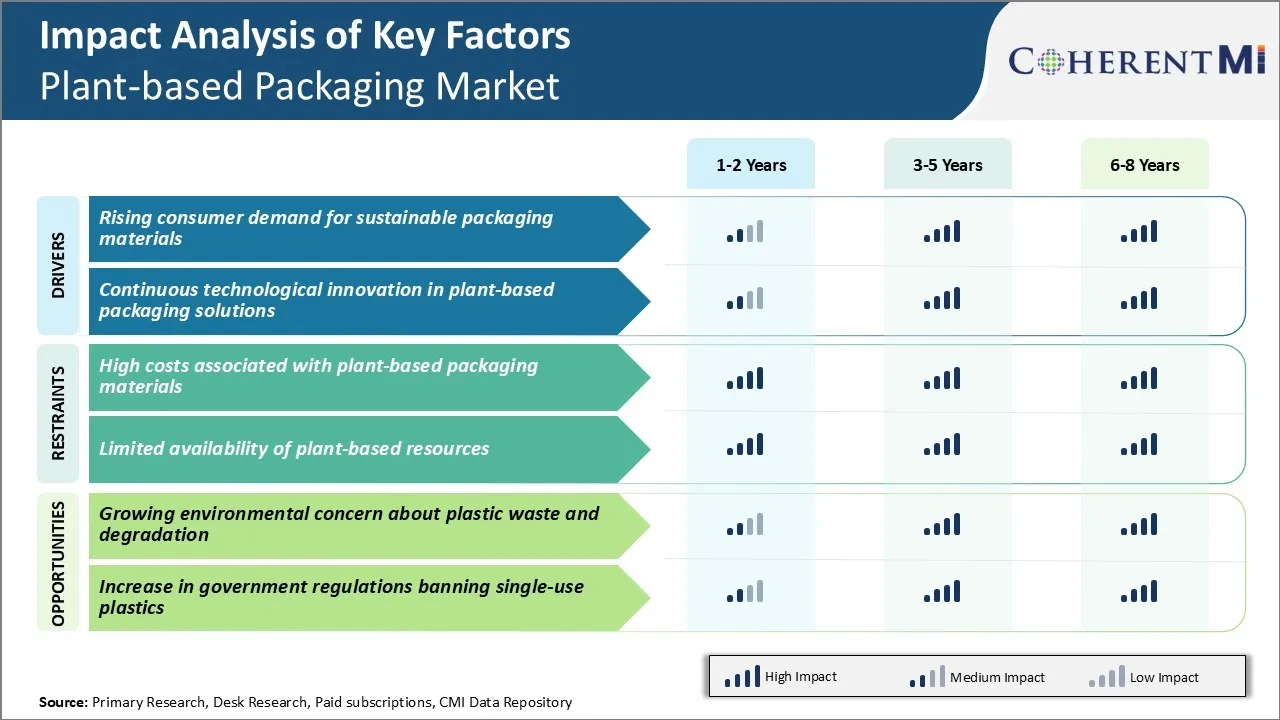

Market Driver - Rising Consumer Demand for Sustainable Packaging Materials

Rising environmental concerns among consumers have increased the demand for more sustainable packaging options. Consumers, especially millennials, and Gen Z, have shown an increasing willingness to pay more for brands that use plant-based packaging materials.

Even businesses recognize the benefits of adopting sustainable packaging strategies to appeal to this growing demographic and enhance their corporate social responsibility credentials. The ubiquitous presence of plant-based packaging on store shelves signals to consumers that the company cares about minimizing plastic waste.

Additionally, many governments worldwide have imposed regulations like bans on specific single-use plastics to promote more sustainable options. This shifts brand and consumer behavior towards seeking out eco-friendly, plant-based packaging alternatives.

Plant-based packaging offers a sense of sustainability with materials like paper clearly holding natural origins. Overall, rising demand for sustainable options and mindful consumption present a large market opportunity for innovations in the plant-based packaging market.

Market Driver - Continuous Technological Innovation in Plant-based Packaging Solutions

Technological advancements have expanded the functionality and viability of plant-based packaging. Where previously plant-derived options may have been limited in performance or applicable only for certain products, innovative processing and material design have increased usefulness. Packaging technologists and manufacturers continue working to develop plant-based packaging materials that can compete with oil-based plastics on various parameters like strength, barrier properties, and shelf-life extension capabilities.

Furthermore, innovation has given rise to new plant-based material categories like bioplastics. Developed through fermentation of starch or sugar, bioplastics offer plastic-like behavior with the ability to fully degrade without toxic residue. Partnerships between academic researchers and corporations actively pursue discovery of novel sustainable biopolymers from abundant plant feedstocks.

Additionally, through continuous process engineering, plant-based packaging production has become more streamlined and resource-efficient. Supply chain integration along with beneficial cooperation across industries has increased availability of plant raw materials on a commercial scale. This accelerates momentum for the plant-based packaging market by addressing consumer needs as well as industry priorities around sustainability and supply chain resilience.

Market Challenge - High Costs Associated with Plant-based Packaging Materials

One of the key challenges currently being faced by the plant-based packaging market is the high costs associated with plant-based materials compared to plastic. While plant-based materials offer sustainability benefits by reducing plastic waste, the production costs for these alternative materials are still higher than traditional plastics. Producing plant-based materials at commercial scale requires substantial investments in R&D, specialized production facilities, and supply chain infrastructure.

Raw materials for plant-based packaging such as paper, agricultural waste and plant fibers also have higher base costs compared to petroleum which is used to produce plastics. These higher input costs ultimately make plant-based packaging options more expensive for brand owners and consumers.

For the plant-based packaging market to transition at a larger scale, costs of plant-based packaging need to come down significantly. Thereby, the high relative costs pose a major adoption challenge for the plant-based packaging market currently.

Market Opportunity - Growing Environmental Concern About Plastic Waste and Degradation

One of the key opportunities for the plant-based packaging market is the rapidly growing environmental concern about plastic waste and degradation. Plastics have emerged as one of the biggest pollutants with huge volumes of single-use plastic packaging ending up in landfills and oceans each year.

Plastic pollution is causing severe damage to ecosystems and has become a global environmental crisis. This is leading to governments and brand owners facing mounting pressure from customers and environmental groups to move away from current plastic packaging formats.

Plant-based packaging materials are emerging as one of the most viable alternatives to curb plastic usage. As consumers become more environmentally conscious and seek out sustainable options, there is a growing market opportunity for plant-based packaging manufacturers to cater to this demand. Favorable regulatory push towards banning specific single-use plastic items and encouraging biodegradability will also help drive higher adoption of plant-based packaging formats in the coming years.

Key winning strategies adopted by key players of Plant-based Packaging Market

Focus on sustainability and environmental friendliness: Major players like NatureWorks, BASF, Novamont and Innovia Films have focused on developing and marketing plant-based materials that are compostable and biodegradable. This aligns well with the growing consumer demand for sustainable options.

Diversification of product portfolio: Leaders in plant-based packaging market have diversified their portfolio beyond petroleum-based plastics to cater to different brand requirements. Novamont offers Mater-Bi range of biopolymers suitable for flexible, rigid and multi-layered structures.

Strategic partnerships and scaling operations: Companies in the plant-based packaging market have partnered with global packaging majors for increased production capacities to meet demand. In 2010, NatureWorks partnered with Ire Chemical to set up a 140,000 metric ton PLA plant in Korea, enabling wider Asia market penetration.

Advocacy and education: Focused advocacy initiatives created awareness. European Bioplastics, a Novamont led consortium, conducted educational workshops for brand owners and policy makers since 2005.

Segmental Analysis of Plant-based Packaging Market

Insights, By Material: Sustainable Approach Driving Bioplastics Adoption

In terms of material, bioplastics are projected to hold 35.3% share of the plant-based packaging market in 2024, owning to growing sustainability concerns. Bioplastics are manufactured from renewable plant-based sources such as corn, sugarcane or cellulosic biomass rather than fossil fuels.

Additionally, organizations across industries are committed to reducing their carbon footprint and transitioning to more eco-friendly alternatives. Bioplastics allow them to market their products as sustainable and environment-friendly. Governments worldwide are also implementing policies and incentives to promote the production and consumption of biodegradable materials over conventional plastics.

With focus growing on a circular economy approach, bioplastics are positioned to play a leading role in the plant-based packaging segment. Continuous innovation is further enhancing the functionality and properties of bioplastics to match conventional plastics. These advantages around sustainability are driving significant adoption of bioplastics among consumers as well as industrial and institutional users.

Insights, By Packaging Type: Flexibility Enhancing User Experience in Flexible Packaging

In terms of packaging type, flexible packaging is expected to account for 58.3% share of the plant-based packaging market in 2024, owing to enhanced user convenience. Flexible packs can be easily molded into various shapes and sizes to suit varied product types. They efficiently use material through downgauging and require smaller footprints for storage and transportation. This makes them ideal for snack foods, fresh produce, ready meals and various other products.

Flexible plant-based materials replicate the barrier properties of plastic films and foil laminates. They provide moisture, gas and grease resistance to extend shelf-life without compromising on flexibility. The lightweight and easy to use nature of flexible packs enhances the overall consumer experience.

Flexible plant-based packaging has transformed how consumers interact with and consume packaged foods on-the-go. Retailers prefer the branding opportunities and compact storage offered by flexible solutions as well. Owing to their all-round advantages, flexible options dominate the plant-based packaging segment.

Insights, By End Use: Health Perceptions Boosting Demand for Food and Beverage Packaging

In terms of end use, food and beverage contributes the highest share of the plant-based packaging market driven by positive health sentiments. Increasingly health-conscious consumers are attracted to plant-based alternatives due to perceptions around naturalness. They feel plant-derived packaging for food items conveys the product is healthier and more nutritious.

Food and beverage brands therefore promote their sustainability commitments through plant-based primary and secondary packaging. The segment also witnesses demand from organic brands and vegan products capitalizing on packaging made from renewable resources.

Recent studies associating BPA, phthalates and other chemicals used in plastics with various health issues have raised questions. This has boosted confidence and trials in natural plant-based solutions for all types of food contact applications. With awareness increasing around responsible consumption and immunity-boosting diets, plant-based packaging for food and drinks is primed to see strong future take-up.

Additional Insights of Plant-based Packaging Market

- The global production of plastic waste is around 400 million tons annually, with only a small fraction recycled. 40 million tons of plastic waste were generated in the U.S. in 2021, of which only about 5% was recycled.

- The European Union’s ban on single-use plastics by 2030, aimed at reducing plastic waste and promoting sustainable packaging alternatives.

- The U.S. commitment of $75 million for global efforts to combat plastic pollution announced at the United Nations Environmental Assembly (UNEA) in 2022.

- Companies like Nestlé have committed to using 100% recyclable or reusable packaging by 2025, significantly impacting the demand for plant-based packaging materials. Coca-Cola unveiled a prototype bottle made from 100% plant-based plastic, demonstrating the industry's shift towards sustainable packaging options.

- The food and beverage industry accounts for the largest share of the plant-based packaging market due to high consumption rates and the necessity for plant-based packaging solutions.

Competitive overview of Plant-based Packaging Market

The major players operating in the plant-based packaging market include Evergreen Packaging, The Coca-Cola Company, Amcor, Vegware, Tetra Pak International SA, Mondi Group PLC, BASF, Biorgani, Berry Global, and WestRock.

Plant-based Packaging Market Leaders

- Evergreen Packaging

- The Coca-Cola Company

- Amcor

- Vegware

- Tetra Pak International SA

Plant-based Packaging Market - Competitive Rivalry, 2024

Plant-based Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Plant-based Packaging Market

- In June 2024, Mondi partnered with traceless, a biomaterials start-up, to develop and scale plant-based packaging coating solutions derived from agricultural by-products. This collaboration aims to reduce the use of plastic in paper packaging, providing an eco-friendlier alternative.

- In April 2024, Savor Brands launched COMPOST+, a plant-based, industrial compostable packaging film specifically designed for the specialty coffee industry. The product was introduced at the Specialty Coffee Expo in Chicago and is aimed at promoting sustainability in coffee packaging. COMPOST+ is fully certified by the Biodegradable Products Institute (BPI) and Europe-based DIN CERTCO, ensuring its eco-friendly credentials.

- In November 2023, Xampla entered into a partnership with 2M Group of Companies to scale up the production and distribution of its biodegradable plant-based packaging materials. This collaboration is aimed at accelerating their adoption in plant-based packaging market in the food industry, particularly through the large-scale manufacturing of Xampla’s "Morro" materials.

Plant-based Packaging Market Segmentation

- By Material

- Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-based Materials

- Bagasse

- Cellulose

- Others

- Bioplastics

- By Packaging Type

- Flexible Packaging

- Rigid Packaging

- By End Use

- Food and Beverage

- Cosmetics

- Pharmaceutical

- Industrial

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the plant-based packaging market?

The plant-based packaging market is estimated to be valued at USD 135.94 Mn in 2024 and is expected to reach USD 259.98 Mn by 2031.

What are the key factors hampering the growth of the plant-based packaging market?

High costs associated with plant-based packaging materials and limited availability of plant-based resources are the major factors hampering the growth of the plant-based packaging market.

What are the major factors driving the plant-based packaging market growth?

Rising consumer demand for sustainable packaging materials and continuous technological innovation in plant-based packaging solutions are the major factors driving the plant-based packaging market.

Which is the leading material in the plant-based packaging market?

The leading material segment is bioplastics.

Which are the major players operating in the plant-based packaging market?

Evergreen Packaging, The Coca-Cola Company, Amcor, Vegware, Tetra Pak International SA, Mondi Group PLC, BASF, Biorgani, Berry Global, and WestRock are the major players.

What will be the CAGR of the plant-based packaging market?

The CAGR of the plant-based packaging market is projected to be 9.7% from 2024-2031.