Robotic Welding Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Robotic Welding Market is segmented By Type (Spot Welding, Arc Welding, Metal Inert Gas (MIG), Tungsten Inert Gas (TIG), Laser Welding), By End Use In....

Robotic Welding Market Size

Market Size in USD Bn

CAGR10.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 10.2% |

| Market Concentration | Medium |

| Major Players | Yaskawa Electric Corporation, Kuka AG, ABB Ltd., Panasonic Corporation, Fanuc Corporation and Among Others. |

please let us know !

Robotic Welding Market Analysis

The robotic welding market is estimated to be valued at USD 9.49 Bn in 2024 and is expected to reach USD 18.73 Bn by 2031, growing at a compound annual growth rate (CAGR) of 10.2% from 2024 to 2031. The trend in the robotic welding market has been positive over the past few years with major automobile and electronics manufacturers incorporating more automation in their assembly lines using robotic welding solutions.

Robotic Welding Market Trends

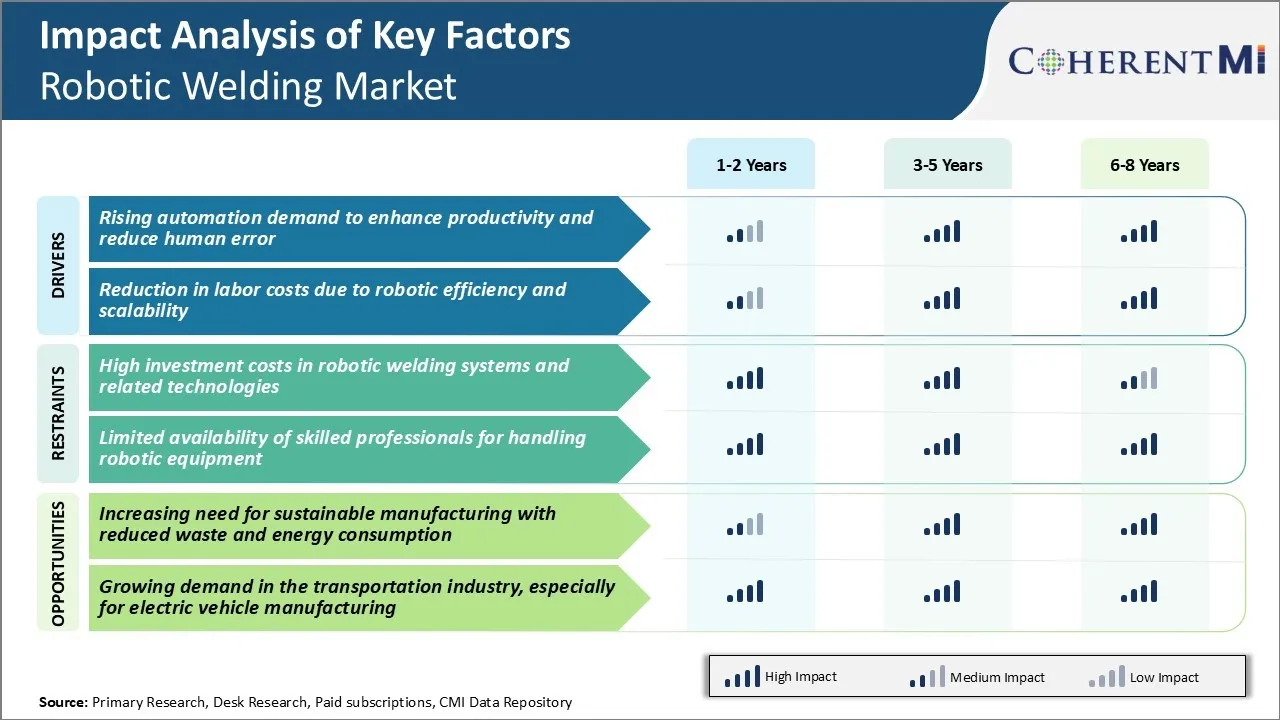

Market Driver - Rising Demand for Automation to Enhance Productivity and Reduce Errors

Over the past few decades, manufacturers have been increasingly looking to automate various processes on their production floors to boost productivity and prevent human errors. One area that has seen significant uptake of robotics is welding. With robotics, manufacturers are able to automate repetitive welding tasks and achieve finer precision and consistency compared to manual welding.

The reduced dependency on skilled labor has also helped many companies cope with acute shortages of welders. This is particularly for specialized welding types that require extensive training and experience. Given current demographic trends, shortages are expected to worsen in the coming years, further driving the demand for robotic welding solutions.

From an operational perspective, robotic welding cells are highly configurable and modular. Additional robots can be added or removed easily based on changing production volumes without disrupting the workflow. This makes robotic welding highly scalable compared to manual lines that need to be expanded or reconfigured.

Market Driver - Reduction in Labor Costs through Robotic Efficiency and Scalability

Alongside the productivity and quality benefits, a key factor driving wider uptake of robotic welding solutions is the reduction in long-term labor costs for manufacturers. The initial capital outlay for robotics welding system installation is high. However, manufacturers realize significant savings in labor costs within a few years of deployment through greater efficiency and scalability. Robotic welders can complete welding tasks much faster compared to manual methods as they are not bound by human constraints and can work continuously.

Another major cost advantage stems from the multi-tasking capability of robots. Advanced welding robots today can perform complex welding sequences involving different joint types, materials, and positions in a single operation. It replaces the need for multiple dedicated manual welding stations.

Lastly, robotic systems provide scalability in production without additional labor requirements. As volumes fluctuate, manufacturers can simply activate or deactivate robots as needed rather than hiring and training new welders or laying them off during downturns. All these factors contribute to robotic welding market’s growth.

Market Challenge - High Investment Costs in Robotic Welding Systems and Related Technologies

The initial investment required for robotic welding systems and related technologies presents a major challenge for widespread expansion of the robotic welding market. The high capital expenditure discourages many small and medium enterprises from automating their welding processes. Robotic cells can range in price from tens of thousands to over a million dollars depending on the type, payload capability and complexity of operations.

Additional costs are incurred for system integration, tooling, safety enclosures and operator training. Financing options from equipment suppliers and the complexity of ROI calculations also pose challenges. Given the technical sophistication of these systems, high maintenance and support costs further impact the total cost of ownership over the lifecycle.

With competitive pressures to reduce costs and maximize margins, many manufacturers are reluctant to make such sizable investments unless optimal capacity utilization levels can be assured over several years to properly amortize the costs.

Market Opportunity - Increasing Need for Sustainable Manufacturing with Reduced Waste and Energy Consumption

There is a rising need among manufacturers to reduce the environmental impact of their operations and transition to more sustainable production methods. Robotic welding market presents promising opportunities in this area by enabling waste reduction techniques and improving energy efficiency compared to manual welding.

Properly programmed robots can achieve critical seam quality consistently with little to no defects or rework. This significantly lowers metal waste generation which would otherwise require re-melting and reprocessing. Their precision also supports the use of narrower weld joints and grades of material.

Additionally, robotic welding processes such as laser welding use less energy than arc welding, resulting in lower carbon footprint and utility costs for manufacturers. With sustainable manufacturing gaining importance, these advantages of robotic systems provide a compelling business case for players in the robotic welding market.

Key winning strategies adopted by key players of Robotic Welding Market

A major strategy adopted by players in the robotic welding market has been investing heavily in R&D to develop advanced robotic welding technologies. For example, in 2019, ABB launched the new IRB 6700 robot series for arc welding applications. The robots offer flexibility, precision and speed to significantly boost production outputs.

Another effective strategy has been developing domain expertise and industry-specific welding solutions. For instance, in 2016 Yaskawa acquired Motoman to strengthen its expertise in arc welding technologies. For Volkswagen, Yaskawa developed modular robotic weld lines that increased productivity by 30%. Similarly, Kuka has gained prominence in shipbuilding by creating robotic welding systems integrated with motion compensation for larger vessels.

Forming strategic partnerships has also proven beneficial. In 2018, FANUC partnered with Lincoln Electric to integrate Lincoln's welding technologies with FANUC robots. This allowed FANUC to offer a one-stop-shop for customers and helped increase its share in North American robotic welding market by 15% over 2 years.

Segmental Analysis of Robotic Welding Market

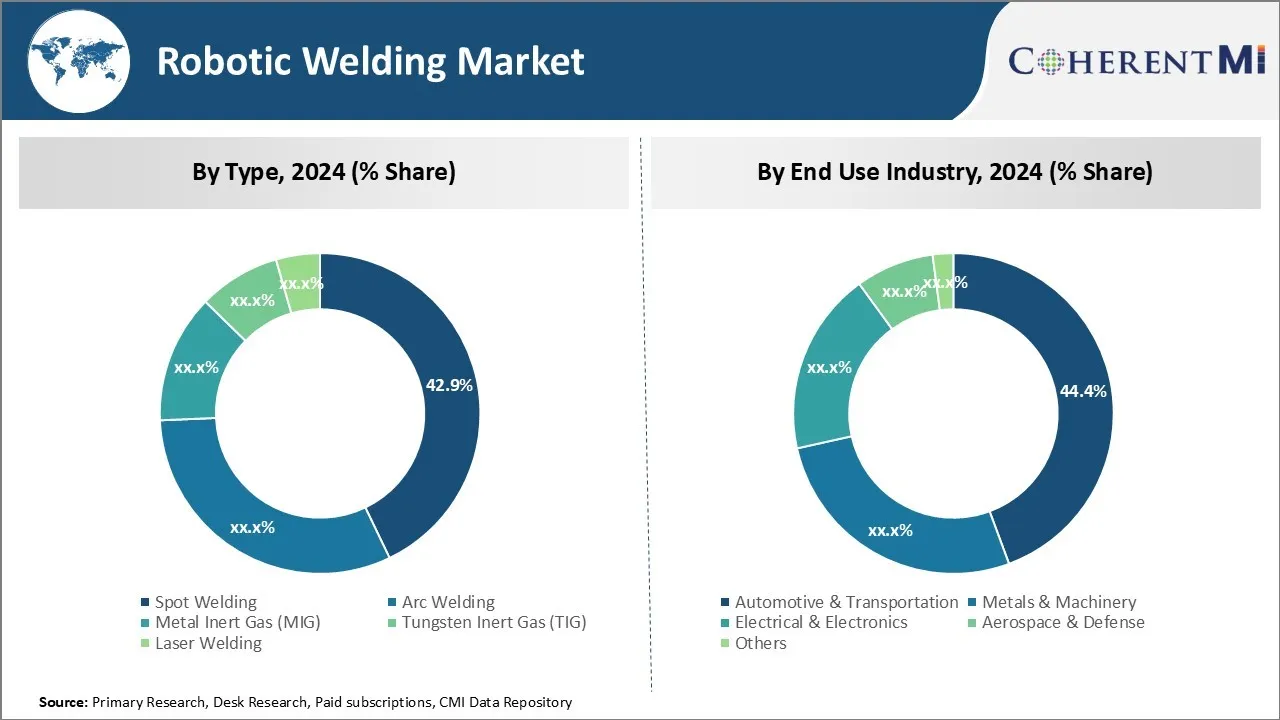

Insights, By Type: Cost Savings Drive Spot Welding Segment Growth

In terms of type, spot welding contributes 42.9% share of the robotic welding market in 2024. This is mainly due to its ability to offer substantial cost savings compared to other welding types. Spot welding requires less preparation and is faster than arc or laser welding. It allows manufacturers to join multiple metal sheets simultaneously with high precision and speed. This significantly improves production throughput and reduces labor costs.

Additionally, spot welding electrodes can be easily replaced, resulting in lower consumable costs over time compared to other welding techniques. Given the high volume and cost-sensitive nature of applications in the automotive and transportation sectors, spot welding provides the most economically viable robotic welding solution.

Insights, By End Use Industry: Manufacturing Flexibility Boosts Automotive Demand

In terms of end use industry, automotive & transportation contributes 44.4% share of the robotic welding market in 2024. This is owing to its unique demand for flexible and efficient manufacturing processes. Robotic welding allows automakers to achieve the tight production tolerances needed for automotive body assemblies while accommodating frequent design changes.

Welding robots can handle a variety of welding tasks and seamlessly switch between different welding types based on the specific job requirements. Their precision and consistency also ensure uniform weld quality across high volumes. This gives automotive plants superior flexibility to ramp up production of new vehicle models quickly. Adoption of robotic welding in automotive industry further enhances workplace safety by isolating workers from hazardous welding fumes and heat.

Insights, By Component: Hardware Components Drive Overall Expenditures

In terms of component, hardware components contribute the highest share of the robotic welding market owing to the large capital investments required for robotic welding equipment. Hardware components such as robots, welding torches and power supplies represent significant portions of the total expenditure for any robotic welding system.

While software, programming and service costs recur periodically, hardware purchasing accounts for the bulk of upfront implementation investments. Given their direct role in the welding process, robotic arms and welding tools require high-grade performance specifications and precision engineering to ensure regulatory compliance and quality output.

Overall, the demand for frequent hardware refreshes and technological upgrades in industrial robotics drives continuous trends in the robotic welding market.

Additional Insights of Robotic Welding Market

- Regional Dominance: The Asia Pacific region dominates the global robotic welding market, attributed to rapid industrialization, a robust manufacturing sector, and significant investments in automation technologies. Countries like China and Japan are at the forefront due to their extensive automotive and electronics industries.

- End-Use Industry Growth: The automotive sector is a major end-user industry in robotic welding market. The industry's push towards electric vehicles and the need for lightweight materials have increased the reliance on precise and efficient welding technologies.

Competitive overview of Robotic Welding Market

The major players operating in the robotic welding market include Yaskawa Electric Corporation, Kuka AG, ABB Ltd., Panasonic Corporation, Fanuc Corporation, Denso Corporation, Daihen Corporation, Nachi-Fujikoshi Corp., Comau S.p.A, Kawasaki Heavy Industries Ltd., Huazhong CNC, Carl CLOOS Schweisstechnik GmbH, OSAKA Titanium technologies Co. Ltd., and Hyundai Motor Company.

Robotic Welding Market Leaders

- Yaskawa Electric Corporation

- Kuka AG

- ABB Ltd.

- Panasonic Corporation

- Fanuc Corporation

Robotic Welding Market - Competitive Rivalry, 2024

Robotic Welding Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Robotic Welding Market

- In August 2024, Gauge Capital announced a strategic growth investment in AGT Robotics, a leading provider of robotic welding solutions for the structural steel and heavy metal fabrication industry. This partnership aims to provide growth capital and recapitalize AGT, supporting the company's mission to deliver world-class products to its clients.

- In March 2024, Kane Robotics introduced the GRIT Vision System, an AI-powered visual sensor designed to replicate human vision. This system enhances robotic welding by assessing uneven surfaces and enabling collaborative robots (cobots) to make real-time adjustments during grinding tasks.

- In October 2023, Miller UK, a manufacturer of buckets and couplers, upgraded its suite of welding robots to enhance production capabilities. The company invested in five new robots developed by CLOOS, including three QRC 410-2.0 models for welding attachments for machines up to 45 tonnes, and two QRC 350-E models capable of handling attachments for machines up to 100 tonnes.

- In September 2023, ABB Group announced a $280 million investment to establish a new robotics hub in Västerås, Sweden. This initiative aims to expand ABB's European manufacturing capacity by 50%, enhancing their ability to meet the growing demand for automation and robotics solutions in the region.

- In August 2023, Novarc Technologies, a Vancouver-based provider of advanced robotics solutions, completed a Series A fundraising round with Caterpillar Venture Capital Inc., a subsidiary of Caterpillar Inc. This investment aims to accelerate the development of Novarc's AI-powered robotic welding solutions, enhancing manufacturing automation.

Robotic Welding Market Segmentation

- By Type

- Spot Welding

- Arc Welding

- Metal Inert Gas (MIG)

- Tungsten Inert Gas (TIG)

- Laser Welding

- By End Use Industry

- Automotive & Transportation

- Metals & Machinery

- Electrical & Electronics

- Aerospace & Defense

- Others

- By Component

- Hardware

- Robots

- Welding Equipment

- Sensors and Vision Systems

- Software

- Controller and Software

- Programming Tools

- Simulation Software

- Services

- Hardware

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the robotic welding market?

The robotic welding market is estimated to be valued at USD 9.49 Bn in 2024 and is expected to reach USD 18.73 Bn by 2031.

What are the key factors hampering the growth of the robotic welding market?

High investment costs in robotic welding systems and limited availability of skilled professionals for handling robotic equipment are the major factors hampering the growth of the robotic welding market.

What are the major factors driving the robotic welding market growth?

Rising automation demand to enhance productivity, and reduction in labor costs due to robotic efficiency and scalability are the major factors driving the robotic welding market.

Which is the leading type in the robotic welding market?

The leading type segment is spot welding.

Which are the major players operating in the robotic welding market?

Yaskawa Electric Corporation, Kuka AG, ABB Ltd., Panasonic Corporation, Fanuc Corporation, Denso Corporation, Daihen Corporation, Nachi-Fujikoshi Corp., Comau S.p.A, Kawasaki Heavy Industries Ltd., Huazhong CNC, Carl CLOOS Schweisstechnik GmbH, OSAKA Titanium technologies Co. Ltd., and Hyundai Motor Company are the major players.

What will be the CAGR of the robotic welding market?

The CAGR of the robotic welding market is projected to be 10.2% from 2024-2031.