Smart Water Metering Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Smart Water Metering Market is segmented By Meter Type (Ultrasonic Meters, Smart Mechanical Meters, Electromagnetic Meters), By Technology (AMR, AMI),....

Smart Water Metering Market Size

Market Size in USD Bn

CAGR11.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 11.7% |

| Market Concentration | Medium |

| Major Players | Apator S.A., Aclara Technologies LLC, Arad Group, BMETERS Srl, Badger Meter, Inc. and Among Others. |

please let us know !

Smart Water Metering Market Analysis

The smart water metering market is estimated to be valued at USD 4.68 Bn in 2024 and is expected to reach USD 10.15 Bn by 2031, growing at a compound annual growth rate (CAGR) of 11.7% from 2024 to 2031. Growth of the smart water metering market can be attributed to the implementation of smart metering systems across developed regions to detect leakages and monitor water usage.

Smart Water Metering Market Trends

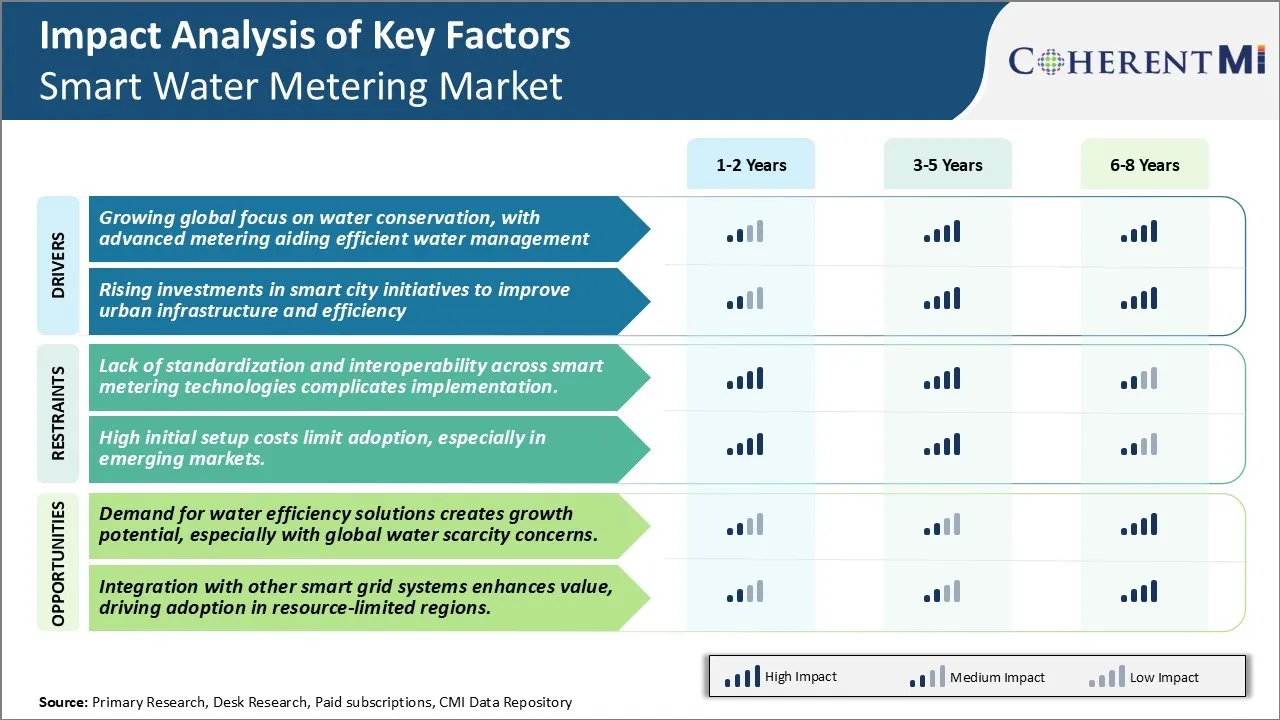

Market Driver - Growing Global Focus on Water Conservation

Many regions around the world are facing water scarcity issues, with some predicting potential water crises if consumption and loss is not curtailed. As a result, there is a growing impetus on implementing strategies and technologies that promote the efficient and sustainable use of this precious resource. Advanced, smart water metering infrastructure has been identified as a valuable tool in aiding conservation efforts and reducing non-revenue water losses.

Smart water metering allows for automated and remote meter reading, eliminating the need for manual readings and tackling the inaccuracies this can sometimes introduce. Utilities have real-time visibility to detect leaks or unusual usage that may indicate wastage. They can better target initiatives to encourage behavioral changes in high usage areas or during peak times.

Residential customers also benefit from smart metering by having access to their own water use details. Seeing the quantifiable impact of habits helps raise awareness of unnecessary consumption. It can also drive growth of the smart water metering market over the long-run.

Market Driver - Rising Investments in Smart City Initiatives

City administrators worldwide today, are seeking innovative ways to modernize aging infrastructure and cope with increasing pressures on resources and liveability. Smart city initiatives aim to leverage emerging technologies across sectors like transportation, energy management, and urban planning in creating more efficient, sustainable, and inclusive urban environments.

Investments are pouring into upgrading ageing water networks with IoT-enabled solutions. Smart metering finds itself at the core of these digitization drives. Automating meter reading and introducing analytics enables proactive leak detection and demand management. This results in significant savings through reduced non-revenue water and optimized resource utilization.

Utilities tapping into global expertise and financing for smart transformation have been able to strengthen resilience, enhance service quality and gain operational efficiencies through digital intervention in water management. As more cities worldwide invest billions into smart infrastructure developments, the opportunities for players in the smart water metering market.

Market Challenge - Lack of Standardization and Interoperability

The lack of standardization and interoperability across different smart water metering technologies presents a major challenge for wider implementation. Currently, there are a variety of proprietary hardware and software solutions available in the market.

However, these solutions often do not follow common standards and protocols, making them incompatible with one another. This severely limits utility companies and municipalities' ability to integrate different technologies into a single coordinated system. Incompatible systems also increase costs associated with upgrading existing infrastructure. Interfacing disparate systems requires additional software, hardware modifications, and custom integration work.

The heterogeneous landscape of technologies further complicates data aggregation and analysis at a network level. If smart water metering is to achieve large scale adoption, developing globally recognized standards for device communication, data formats, and cybersecurity will be essential.

Market Opportunity - Demand for Water Efficiency Solutions Creates Growth Potential

Growing concerns around global water scarcity are creating significant market potential for water efficiency solutions like smart water metering. Population growth, rising incomes, and urbanization are straining water resources in many parts of the world.

At the same time, aging water infrastructure is contributing to high non-revenue water losses through leaks and breaks. Advanced metering infrastructure offers utilities the ability to more accurately monitor real-time water usage, detect leaks and reduce non-revenue water. They also empower customers to better manage their water consumption through mobile apps and data access.

As water scarcity risks intensify with climate change, demand is increasing for smart water metering solutions that maximize efficiencies. This macro trend will continue driving the adoption of smart water metering globally as countries aim to sustainably manage this critical resource through demand reductions, efficiencies, and increased conservation.

Key winning strategies adopted by key players of Smart Water Metering Market

Strategy 1: Focus on technology innovation and adoption of IoT solutions

In 2018, Itron launched an IoT-enabled smart water solution called "Itron IntelliServe" which leverages cellular connectivity to provide real-time consumption data. This helped utilities optimize operations and enhanced customer experience.

Strategy 2: Offer smart metering as a service (MaaS)

In 2019, Badger Meter launched the "@ticity" platform that provides smart water meters, installation, management, and data analytics as a service to 1000+ municipalities in North America.

Strategy 3: Pursue strategic acquisitions for geographical expansion

Large players in smart water metering market are actively acquiring regional companies to expand globally. For instance, in 2021, Honeywell acquired the utility software company OpenWay to enter the European smart water metering market.

Segmental Analysis of Smart Water Metering Market

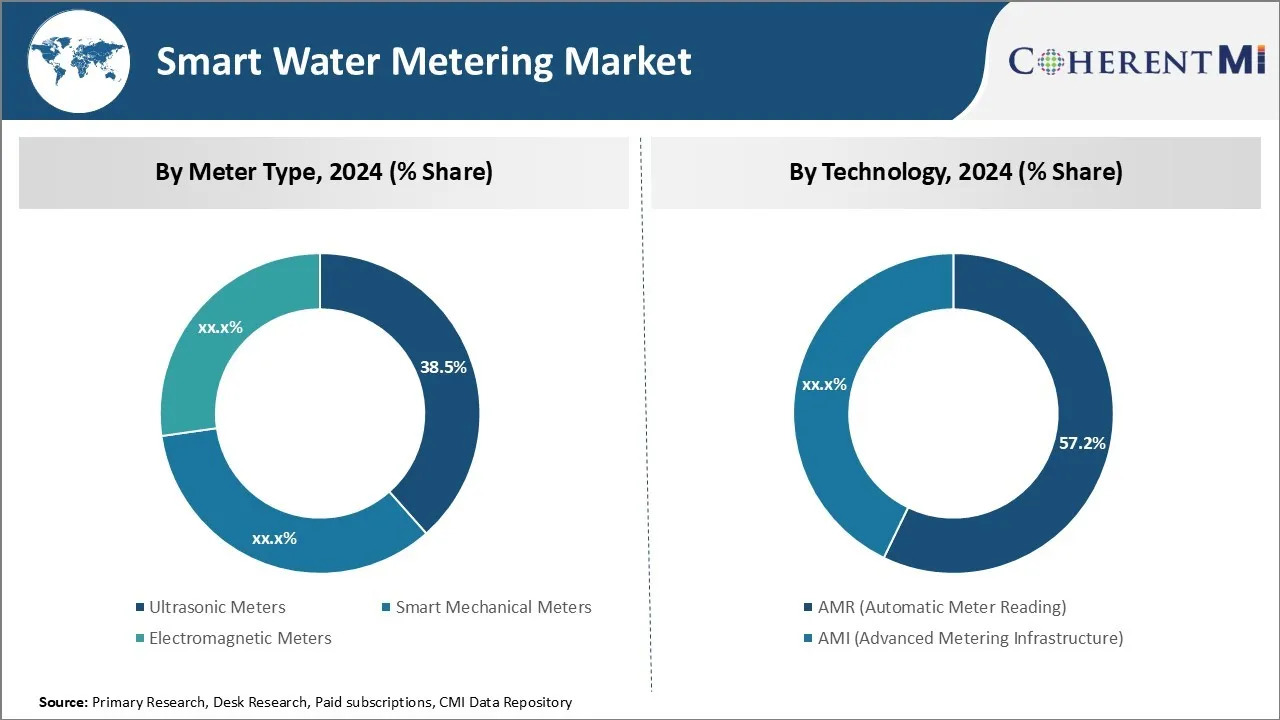

Insights, By Meter Type: Ultrasonic Meters - The Superior Accuracy Factor

In terms of meter type, ultrasonic meters contribute 38.5% share of the smart water metering market in 2024, owning to their superior accuracy over other meter types. Ultrasonic meters employ non-intrusive technology to detect water flow using ultrasonic transit time which means it does not come in direct contact with water flow.

Contactless measurement mechanism enables ultrasonic meters to provide very high accuracy readings unaffected by variations in water temperature or quality. High degree of accuracy is a key driver for their popularity as municipalities and utilities prefer ultrasonic meters for smart metering programs to minimize errors in billing and boost customer satisfaction.

Additionally, being a non-intrusive technology also means ultrasonic meters have very low failure rates and require almost no maintenance. Their long operational life without accuracy deterioration further reinforces their prevalence in the smart water metering market.

Insights, By Technology: Connectivity Convenience of AMR

In terms of technology, AMR (automatic meter reading) contributes 57.2% share of the smart water metering market in 2024, owing to its connectivity convenience. AMR technology allows water utilities to remotely obtain meter readings using fixed network or drive-by collection methods without physically visiting customer premises. This brings significant operational efficiency by streamlining the meter reading process and abolishing manual readings.

The connectivity convenience of AMR simplifies meter data collection on a large scale and helps utilities optimize field workforce. It also enables useful functions for customers like detecting leaks promptly. Additionally, the connectivity of AMR technology supports ancillary applications such as usage monitoring, consumption analytics and alert services. These added functionalities increase its appeal among water utilities.

Insights, By Component: Comprehensive IT Solution Scope

In terms of component, IT solutions contribute the highest share of the smart water metering market in 2024, due to its comprehensive solution scope. An IT solution provides an end-to-end software framework that integrates all the components of a smart metering system from meter data collection and management to analytics and business applications.

As a complete solution, IT component addresses diverse needs of utilities from commercial to technical to enhance overall productivity. Its broader scope compared to individual hardware components makes IT solution a preferred choice. An integrated IT platform also streamlines meter-to-cash processes, improves customer services and enhances operational efficiency. This comprehensive functionality of IT solution is a prime factor for its leading position in the smart water metering market.

Additional Insights of Smart Water Metering Market

- Smart water meters play a crucial role in optimizing water use and reducing waste, aligning with smart city goals.

- AI integration in smart water meters facilitates predictive analysis and resource optimization, essential for sustainable water management.

- Asia Pacific held the largest share in smart water metering market in 2023, driven by urbanization in China and India.

- North America is expected to grow at the fastest rate due to strong regulatory standards and advanced infrastructure accelerating growth of the smart water metering market.

Competitive overview of Smart Water Metering Market

The major players operating in the smart water metering market include Apator S.A., Aclara Technologies LLC, Arad Group, BMETERS Srl, Badger Meter, Inc., Diehl Stiftung & Co. KG, Honeywell International Inc., Itron Inc., Kamstrup, Landis+Gyr, Ningbo Water Meter Co., Ltd., Neptune Technology Group Inc., Schneider Electric, Sensus, Sontex SA, Siemens, and ZENNER International GmbH & Co. KG.

Smart Water Metering Market Leaders

- Apator S.A.

- Aclara Technologies LLC

- Arad Group

- BMETERS Srl

- Badger Meter, Inc.

Smart Water Metering Market - Competitive Rivalry, 2024

Smart Water Metering Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Smart Water Metering Market

- In April 2024, SUEZ and Vodafone announced a global partnership to accelerate the deployment of smart water meters using Narrowband IoT (NB-IoT) technology, with a target of installing over 2 million units by 2030.

- In February 2024, Diehl Metering introduced the ALTAIR V5 MANIFOLD, a volumetric water meter designed for efficient measurement. This latest generation meter is compact, robust, and adaptable to various water qualities and demanding environments.

- In November 2022, Landis+Gyr introduced the W270 and W370 ultrasonic smart water meters, adhering to their Green Design principles. These meters are 100% recyclable after a lifespan exceeding 15 years.

- In March 2023, Avnet, Inc. renewed its Master Distribution Agreement (MDA) with Huizhong, a leading ultrasonic water meter manufacturer, to distribute smart water meters in Australia and New Zealand.

Smart Water Metering Market Segmentation

- By Meter Type

- Ultrasonic Meters

- Smart Mechanical Meters

- Electromagnetic Meters

- By Technology

- AMR (Automatic Meter Reading)

- AMI (Advanced Metering Infrastructure)

- By Component

- IT Solution

- Meter & Accessories

- Communications

- By Application

- Industries

- Water Utilities

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the smart water metering market?

The smart water metering market is estimated to be valued at USD 4.68 Bn in 2024 and is expected to reach USD 10.15 Bn by 2031.

What are the key factors hampering the growth of the smart water metering market?

Lack of standardization and interoperability across smart metering technologies complicates implementation, and high initial setup costs limit adoption are the major factors hampering the growth of the smart water metering market.

What are the major factors driving the smart water metering market growth?

Growing global focus on water conservation, with advanced metering aiding efficient water management and rising investments in smart city initiatives are the major factors driving the Smart water metering market.

Which is the leading meter type in the smart water metering market?

The leading meter type segment is ultrasonic meters.

Which are the major players operating in the smart water metering market?

Apator S.A., Aclara Technologies LLC, Arad Group, BMETERS Srl, Badger Meter, Inc., Diehl Stiftung & Co. KG, Honeywell International Inc., Itron Inc., Kamstrup, Landis+Gyr, Ningbo Water Meter Co., Ltd., Neptune Technology Group Inc., Schneider Electric, Sensus, Sontex SA, Siemens, and ZENNER International GmbH & Co. KG are the major players.

What will be the CAGR of the smart water metering market?

The CAGR of the smart water metering market is projected to be 11.7% from 2024-2031.