South Korea Biodegradable Packaging Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

South Korea Biodegradable Packaging Market is Segmented By Material (Paper, Plastic), By Application (Food Packaging, Beverage Packaging, Personal/Hom....

South Korea Biodegradable Packaging Market Size

Market Size in USD Mn

CAGR6.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.5% |

| Market Concentration | Medium |

| Major Players | Amcor, Mondi Plc, Smurfit Kappa, serimbng co.,ltd., ANKOR Bioplastics and Among Others. |

please let us know !

South Korea Biodegradable Packaging Market Analysis

The South Korea Biodegradable Packaging Market is estimated to be valued at USD 581.0 Mn in 2024 and is expected to reach USD 902.9 Mn by 2031, growing at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2031.

The market for biodegradable packaging in South Korea has been witnessing positive trends driven by increasing customer awareness about environmental protection.

South Korea Biodegradable Packaging Market Trends

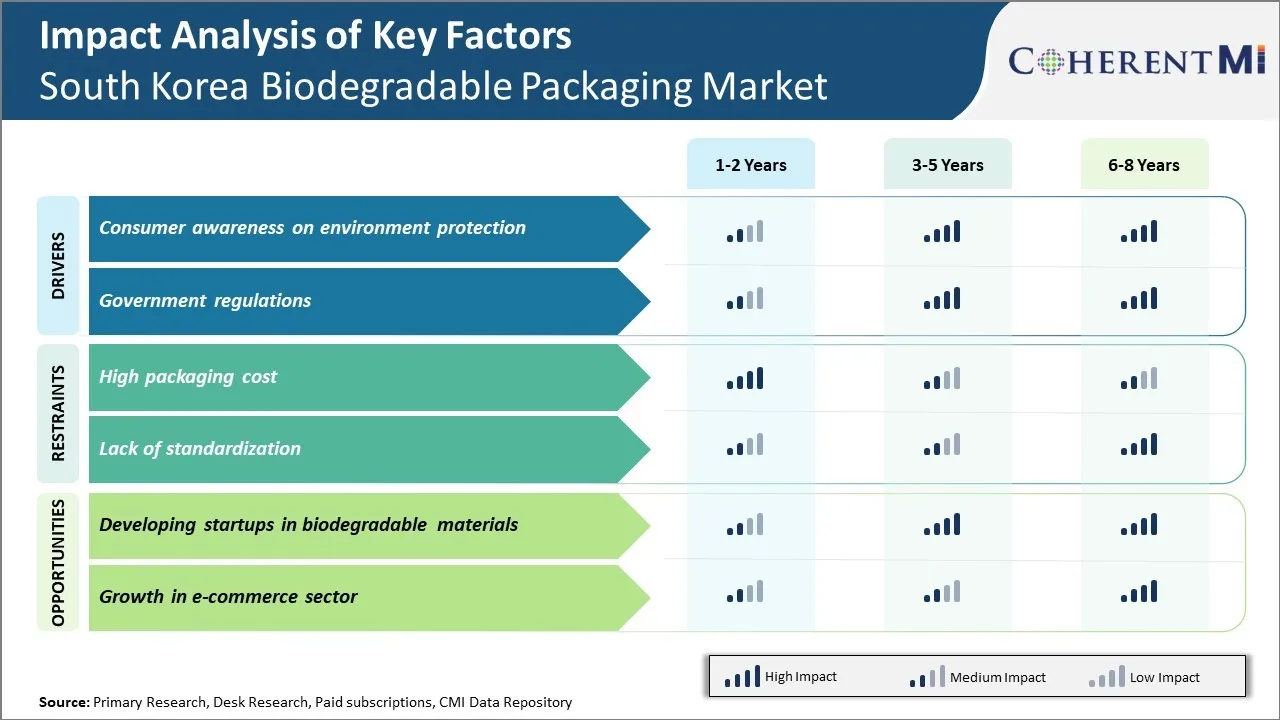

Market Driver – Consumer Awareness on Environment Protection

There has been steady growth in the awareness among South Korean consumers regarding the importance of environment protection and sustainability. More and more people understand how conventional plastic packaging is creating waste and polluting the land and water bodies. Young population in particular is concerned about the threat plastic poses to the environment. Rising education levels and access to internet have enabled effective information dissemination around plastic pollution crisis. People are realizing small changes in their daily routine like refusing plastic bags or straws, reducing usage of disposable cutlery and items can contribute significantly towards waste management. Growing popularity of slow living concept has motivated consumers to make responsible choices and switch to eco-friendly alternatives.

Educating huge customer base through campaigns by NGOs and socially responsible companies has triggered mindset change at grassroots level. Customers have started supporting brands which adopt green packaging solutions. Social media is playing a vital role in raising issues around non-biodegradable plastics through shares and discussions. With increased awareness, demand for sustainable products has picked up substantially. Consumers now carefully read labels to identify certified compostable or recyclable packaging and actively look for such options while shopping.

Market Driver – Government Regulations

Government of South Korea has acknowledged plastic waste as serious environmental challenge. Issuing strict regulations has become important tool to curb plastic pollution and move the country towards circular economy. Mandating biodegradability standards for packaging is a significant step taken to phase out harmful single use plastics. Manufacturers and retailers now have limited time to ensure their product wrappings and carry bags meet the specified degradation time limits under organic conditions. Ban on specific petroleum-based plastics like Polystyrene food containers and shopping bags below certain microns has come into effect from past year.

Regular compliance checks are conducted to monitor adherence to the new laws and penalize violations. Higher reuse and recycling targets have been assigned to plastic producers as part of extended producer responsibility guidelines. Financial incentives are offered for development of advanced recycling technologies and setting up necessary waste infrastructure. Public procurement preference is given to vendors utilizing bio-packaging made from renewable resources. Upcoming regulations on carbon labeling and eco-labels will further promote selection of climate-friendly options in the market. While regulations impose compliance cost for organizations, it has accelerated innovation in bioplastics domain on a large scale.

Market Challenge – High Packaging Cost

One of the major challenges currently being faced by the South Korea biodegradable packaging market is the high packaging cost associated with biodegradable materials compared to traditional plastics. While biodegradable packaging helps reduce environmental pollution caused by plastic waste, the raw materials required for their production such as PHAs, PLA, starch blends etc. are generally more expensive than regular plastics. The additional costs arise due to small production volumes of bioplastic resins as well as high research and development investments made by manufacturers in order to make the materials economically feasible. This premium pricing of biodegradable packaging solutions makes them unattractive for widespread adoption for cost-sensitive consumers and industries.

However, packaging producers are constantly working on improvements to bring down the price differential through economies of scale, innovation in production techniques and supply chain optimization.

Market Opportunity – Developing Startups in Biodegradable Materials

The growing awareness about sustainability has opened up significant opportunities for startups working in the domain of biodegradable materials in South Korea. Several entrepreneurial ventures are engaged in developing novel bio-based polymers, composites and packaging formats that can replace conventional plastics while addressing concerns around functionality and affordability.

Some startups are focusing on utilizing agricultural waste and byproducts to manufacture bioplastics, thus reducing manufacturing costs. There is an active accelerator and incubator ecosystem in South Korea that is guiding and mentoring new businesses. The Korean government is also supporting these startups through funding programs and technical assistance. If successful, these startups can help dramatically accelerate the commercialization of advanced biodegradable solutions and drive widespread adoption across different end-use industries.

Segmental Analysis of South Korea Biodegradable Packaging Market

Insights, By Material: Paper Sub-segment Dominates the Material Segment

In terms of material, paper sub-segment contributes the highest share of 91.9% in the South Korea biodegradable packaging market, owing to its widespread acceptability and sustainability. Paper is a natural and renewable resource that is easily recyclable, compostable, and breaks down quickly without harmful toxins. It is perceived by consumers as an environmentally-friendly alternative to plastic that leaves little environmental impact.

Paper packaging appeals strongly to Korean consumers who are increasingly health-conscious and care about responsible consumption. The soft textures and breathable qualities of paper are preferred for packaging food and cosmetics. Paper gives brands an opportunity to showcase products attractively through creative designs, textures, and complex shapes not possible with plastic. It allows for vibrant visual communication through print that catches consumer attention on shelves.

Beyond consumer preferences, paper also meets the needs of Korean brands. Many want to build sustainability into their business strategies and brand positioning to gain a competitive edge. Paper packaging visibly demonstrates corporate social responsibility (CSR) efforts to reduce waste and carbon footprint. It strengthens relationships with socially-conscious and eco-friendly customers. From a production perspective, paper is readily available domestically compared to other materials, keeping supply chain costs low.

Insights, By Application: Food Packaging Sub-segment Dominates Applications

Within applications, food packaging sub-segment accounts for the highest share of 33.8% in the South Korea biodegradable packaging market. As a highly food-centric culture, Koreans purchase groceries and prepared meals frequently in small amounts. Effective and convenient packaging is essential to preserve freshness, portion meals, and enable on-the-go consumption. Biodegradable materials like paper prevent plastic pollution from all the individual food items that are purchased daily.

Food packaging demands barrier properties and printing versatility to showcase food attractively. Paper and bioplastics meet these needs well through laminated and coated varieties. They allow creativity in shapes, window areas, and designs inspired by traditional Korean motifs that appeal to local tastes. Brands are incorporating these high-quality yet sustainable materials into not just processed foods but bakery, deli, produce, and other perishable categories.

Individual food packaging is also strongly influenced by new lifestyles. Long work schedules leave less time for home-cooked meals, driving demand for ready-to-eat options. Well-packaged snacks and mini-meals are convenient to grab on the go. Younger consumers especially expect transparency into ingredients and eco-friendly values from the brands they choose. Biodegradable materials fulfill all these emerging needs and preferences for high-quality yet sustainable on-the-go packaging in South Korea's dynamic food industry.

Competitive overview of South Korea Biodegradable Packaging Market

The major players operating in the South Korea Biodegradable Packaging Market include Hanchang Paper Co., Ltd, Amcor Specialty Cartons South Korea, Mondi Plc, Smurfit Kappa, Green Whale Global Co., Ltd., Green Dot Bioplastics, serimbng co.,ltd., and ANKOR Bioplastics.

South Korea Biodegradable Packaging Market Leaders

- Amcor

- Mondi Plc

- Smurfit Kappa

- serimbng co.,ltd.

- ANKOR Bioplastics

South Korea Biodegradable Packaging Market - Competitive Rivalry, 2024

South Korea Biodegradable Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in South Korea Biodegradable Packaging Market

- On January 24, 2024, Smurfit Kappa created a sustainable packaging solution to transport bees for Biobest, a world leader in biological crop protection and pollination.

South Korea Biodegradable Packaging Market Segmentation

- By Material

- Paper

- Plastic

- By Application

- Food Packaging

- Beverage Packaging

- Personal/Homecare Packaging

- Other Applications

- Pharmaceutical Packaging

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the South Korea Biodegradable Packaging Market?

The high packaging cost and lack of standardization are the major factors hampering the growth of the South Korea Biodegradable Packaging Market.

What are the major factors driving the South Korea Biodegradable Packaging Market growth?

The consumer awareness on environment protection and government regulations are the major factors driving the South Korea Biodegradable Packaging Market.

Which is the leading Material in the South Korea Biodegradable Packaging Market?

The leading Material segment is Paper.

Which are the major players operating in the South Korea Biodegradable Packaging Market?

Hanchang Paper Co., Ltd, Amcor Specialty Cartons South Korea, Mondi Plc, Smurfit Kappa, Green Whale Global Co., Ltd., Green Dot Bioplastics, serimbng co.,ltd., and ANKOR Bioplastics are the major players.

What will be the CAGR of the South Korea Biodegradable Packaging Market?

The CAGR of the South Korea Biodegradable Packaging Market is projected to be 6.5% from 2024-2031.