Textile Processing Machinery Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Textile Processing Machinery Market is segmented By Process (Washing Machine, Bleaching, Drying Machines, Ironing Machines & Presses, Others), By Mate....

Textile Processing Machinery Market Size

Market Size in USD Bn

CAGR7.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.1% |

| Market Concentration | Medium |

| Major Players | Rieter Holding AG, Lakshmi Machine Works Ltd., Saurer Intelligent Technology AG, TMT Machinery Inc., Trutzschler Group and Among Others |

please let us know !

Textile Processing Machinery Market Analysis

The Global Textile Processing Machinery Market is estimated to be valued at USD 29.5 Bn in 2024 and is expected to reach USD 50.9 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031. The rising population, increasing disposable incomes, and changing lifestyles and fashion trends in developing economies are driving higher demand for textiles. This is propelling the need for advanced textile processing machinery to cater to this growing demand.

The market is witnessing positive trends with growing investments in machinery upgrades by textile companies to boost processing efficiency and meet international quality standards. Adoption of novel technologies like automation, artificial intelligence and internet of things solutions in textile machinery is gaining traction. This is expected to significantly improve productivity and quality of processed textiles.

Textile Processing Machinery Market Trends

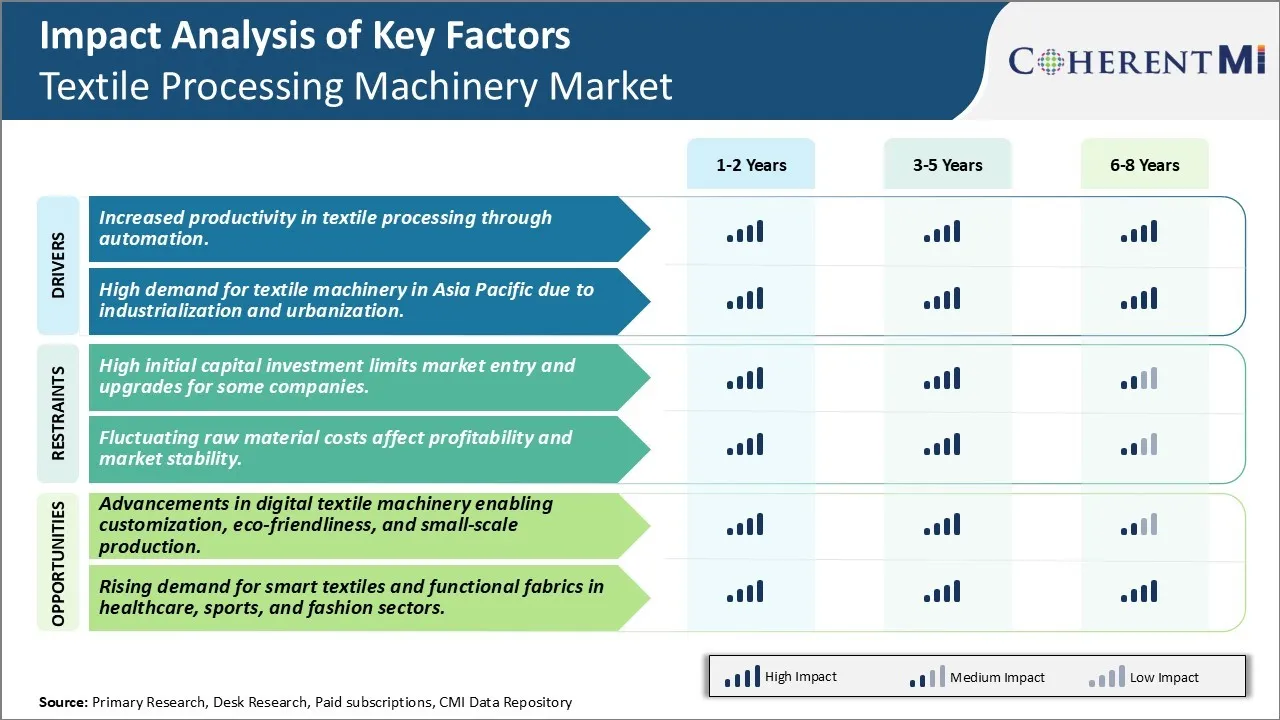

Market Driver - Increased Productivity in Textile Processing Through Automation

One of the primary drivers pushing growth in the textile processing machinery market is the increased need for automation in textile mills and textile processing plants. There has been rising labor costs especially in developed markets of North America and Europe coupled with acute shortage of labor. At the same time, requirements for higher productivity and quality consistency have been increasing. This has necessitated textile companies to invest heavily in automation technologies to reduce dependency on human labor and improve efficiency of textile processing operations.

Automation allows companies to easily scale up or down their production capacity according to demand fluctuations. This brings in much needed flexibility. Manual labor on the other hand cannot be rapidly adjusted and managing a large workforce is challenging and expensive. Moreover, automated machinery minimizes human errors and delivers greater accuracy and consistency in textile processing tasks such as spinning, weaving, knitting and other pre- and post-processing functions. This ensures superior quality of finished textile products. Many textile companies are now achieving over 95% accuracy and consistency through robotics automation which was nearly impossible with humans.

Advanced technologies like artificial intelligence, internet of things and machine learning are being integrated into textile machinery. This has enabled unprecedented control and visibility. Textile processors can now remotely monitor production lines, automatically detect defects and downtimes, optimize processes on the fly, and minimize waste and rework. Such intelligent machinery requires much less manual supervision further improving cost economics. Additionally, automated looms, spinning machines and others can run for 24 hours non-stop without breaks while maintaining strict safety and quality standards. This significantly multiplies the productive capacity of textile mills.

Market Driver - High Demand for Textile Machinery in Asia Pacific Due to Industrialization and Urbanization

The Asia Pacific region, home to rapidly industrializing economies such as China, India, Bangladesh and Vietnam, account for a major share of global demand for textile machinery. There are strong socio-economic trends in these Asian countries that are driving significant growth. Rapid urbanization has been taking place as millions migrate from rural areas to cities each year in search of employment and improved standards of living. This is leading to a massive surge in domestic consumption and demand for apparel and home textiles from a ballooning middle class population.

At the same time, these developing nations desire to become global manufacturing powerhouses and see textiles and garments as a strategic industry to generate employment and export revenues. Their governments are vigorously supporting the development of large-scale integrated textile parks through fiscal incentives and policy reforms. Numerous textile companies from both domestic private sector as well as foreign multinationals are establishing or expanding manufacturing bases in Asia to cater to the huge and growing local and international demand. For example, the "China + 1" strategy of many global brands to diversify production outside of China has opened up new opportunities for countries like Vietnam and India.

All this industrial activity requires a great deal of new advanced textile machinery for setting up greenfield textile mills as well as upgrades and expansions. Asian textile companies are procuring cutting-edge equipment and technologies for all stages including spinning, weaving, knitting, processing and garmenting. Asia Pacific has emerged as a major manufacturing and exporting hub globally so textile machinery makers are rapidly increasing their presence through local manufacturing, sales and support channels to capitalize on this strategic opportunity.

Market Challenge - High Initial Capital Investment Limits Market Entry and Upgrades for Some Companies

The textile processing machinery market faces significant challenges due to the huge upfront capital requirement needed to enter this market or upgrade existing machinery. Setting up a textile processing plant or procuring new advanced machinery such as spinning, weaving, and knitting machines involves a substantial capital outlay running into millions of dollars. This high initial investment deters many small and medium enterprises from investing in new advanced machinery that can improve production efficiency. The challenge is more pronounced for companies operating in developing nations given tighter access to capital. Further, for companies working on low margins, it is difficult to justify such large investments that often have long payback periods of 5-7 years. This limits their ability to adopt new technologies and scale up operations. The high capital costs also put pressure on existing players to fully utilize existing machinery, sometimes delaying necessary upgrades, and thereby impacting their competitiveness in the long run. Overall, the need for deep pockets and access to low-cost funding sources remain a crucial challenge for both new entrants and incumbents in this industry.

Market Opportunity- Advancements in Digital Textile Machinery Enabling Customization, Eco-Friendliness, And Small-Scale Production

There are significant opportunities emerging in the textile machinery market driven by the latest technology advancements. Digitization is enabling greater customization of textile products as digital machinery allows for swift changeovers between different fabrics, designs and orders in minimum time. This opens up opportunities to cater to smaller batch sizes and provide customized products quickly. Moreover, the new generation of smart, networked machinery requires low set-up times and minimizes fabric wastage, making small-scale decentralized production viable. Digitization is also powering more sustainable practices - new machinery utilizes eco-friendly raw materials, reduces energy and water footprint during processing. Features like remote monitoring also optimize resource usage. Overall, the ongoing transformation towards digital, smart and sustainable machinery presents lucrative growth prospects. It enables smaller producers to adopt advanced technologies and tackle mass customization opportunities previously out of reach. This democratization of textile machinery ushers in an innovative, decentralized future for this industry.

Key winning strategies adopted by key players of Textile Processing Machinery Market

Emphasis on Automation and Digitalization

- With Industry 4.0, companies integrate automation and digital technologies like IoT, AI, and machine learning to improve efficiency, reduce labor costs, and enhance precision.

- Real-time monitoring and predictive maintenance capabilities help in reducing downtime and ensuring optimal performance.

- Digital solutions such as automated color matching, pattern programming, and process optimization streamline operations and improve product quality.

Focus on Sustainable and Eco-Friendly Solutions

- Due to increasing environmental regulations and consumer demand for sustainable products, players develop machinery that minimizes water, energy, and chemical consumption.

- Technologies for waterless dyeing, low-impact chemicals, and energy-efficient drying and finishing processes are being prioritized.

- Partnerships with eco-certification bodies help companies offer machines that align with global sustainability standards, appealing to environmentally conscious brands.

Expansion into Emerging Markets

- As textile manufacturing shifts toward Asia-Pacific, Latin America, and Africa, key players invest in these regions to tap into high demand and low labor costs.

- Establishing regional manufacturing and service facilities helps reduce logistics costs, enhance after-sales support, and address specific market needs.

- Offering tailored financing and leasing options attracts customers in emerging economies where capital-intensive purchases may be challenging.

Customization and Product Diversification

- Customizable machinery solutions cater to diverse textile segments such as apparel, home textiles, technical textiles, and industrial textiles.

- Developing specialized machinery for niche markets (e.g., medical textiles, protective wear) helps companies diversify their product portfolios and reduce market risk.

- Modular designs enable customers to adapt machinery for multiple applications, enhancing flexibility and maximizing return on investment.

Strategic Partnerships and Collaborations

- Collaborating with textile manufacturers, research institutions, and chemical companies facilitates innovation and helps align product offerings with industry requirements.

- Joint ventures with local companies in target regions increase market penetration, build brand presence, and leverage local market expertise.

- Working with software and IT firms enables integration of advanced digital technologies in machinery, enhancing functionality and ease of use.

These strategies help companies in the textile processing machinery market adapt to technological shifts, meet regulatory requirements, and align with industry demands for efficiency, sustainability, and market expansion.

Segmental Analysis of Textile Processing Machinery Market

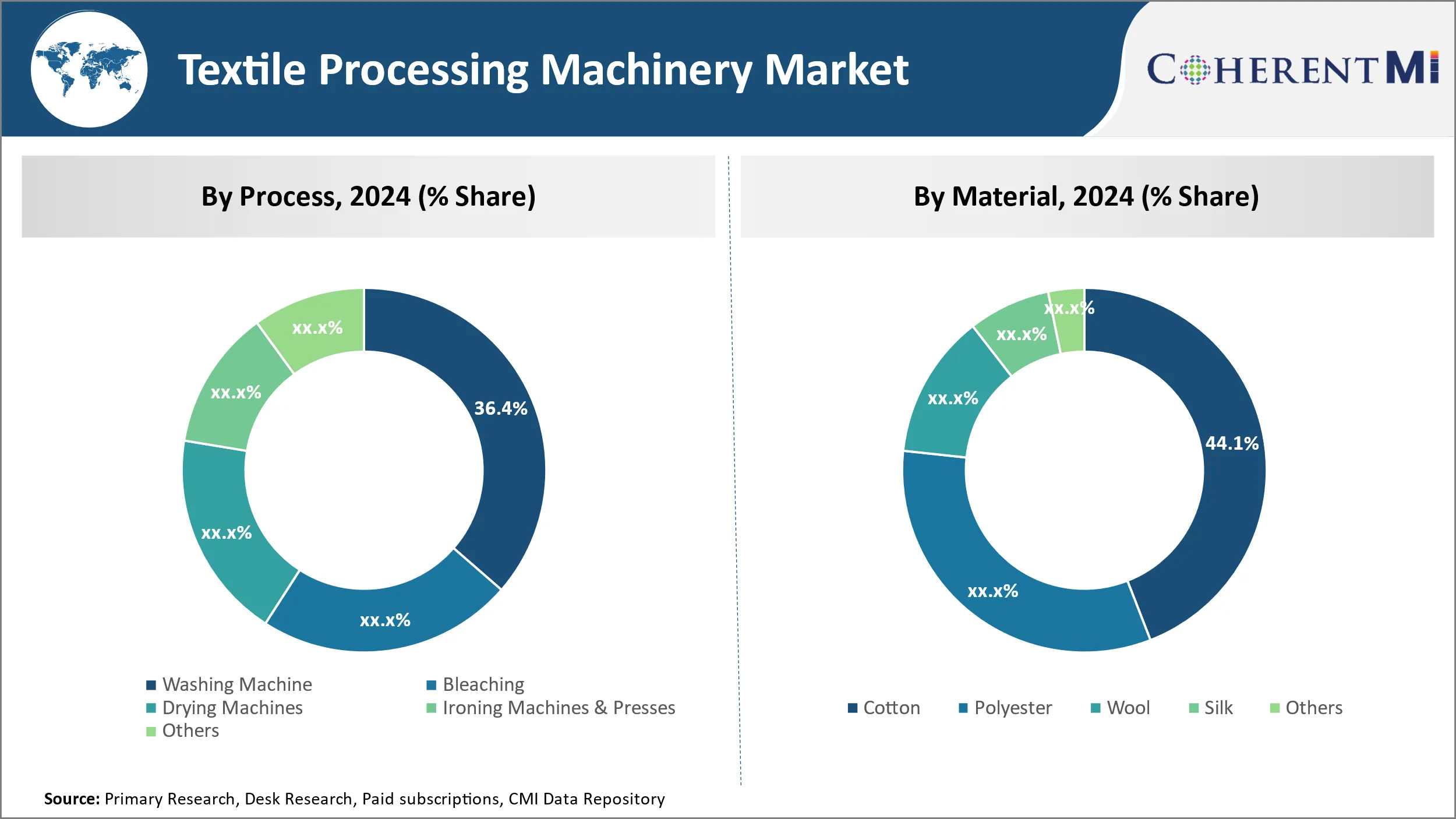

Insights, By Process, Ease and Efficiency Drive Washing Machine Dominance

By Process, Washing Machine is projected to contribute 36.1% in 2024 owing to the ease and efficiency offered by automated machines. Washing machines have gained widespread acceptance among both commercial and household users as they reduce the time and effort involved in laundry. The machine washes clothing using a mix of water and detergent, and provides cycles customized for different fabric types. This saves users the tedious job of manually scrubbing each item. Additionally, washing machines ensure more consistent and thorough cleaning compared to handwashing. Their powerful agitation and rinsing actions remove deep-set dirt and stains better. The consistent nature of machine washing also results in uniform washing across loads, avoiding the variance introduced by human factors in handwashing. Washing machines offer consumers convenience by handling multiple loads of laundry simultaneously. Their automation has freed up time for users to attend to other chores and tasks. This boost in efficiency coupled with the consistent results have made washing machines irreplaceable in textile processing.

Insights, By Material, Cotton's Popularity Stems from Its Comfort and Workability

By Material, Cotton is expected to contribute 44.1% in 2024 owing to its unparalleled comfort and versatile nature. Cotton is a highly breathable fabric that feels soft against the skin. It effectively wicks away moisture from the skin to outer fabric layers, keeping wearers cool and dry. This makes cotton comfortable for wear even in hot and humid conditions. Cotton is also highly absorbent and capable of removing sweat and moisture effectively. Its superior moisture-management abilities have made cotton a top choice for everything from undergarments and home textiles to casual clothing. Additionally, cotton is durable and withstands frequent washing and wear-and-tear better than other materials. Its comfort properties and durability have cemented cotton's status as the most popular textile material. Cotton is also easy to dye and print on, allowing design flexibility for fashion apparel and household textiles. Designers and manufacturers favor cotton for its workability and ability to retain vibrant colors after multiple washes.

Insights By Application, Apparel Dominate Due to Fashion Trends and Lifestyles Changes

By Application, Garments & Apparels contributes the highest share of the market driven by evolving fashion trends and changing consumer lifestyles. The apparel industry is constantly innovating to keep up with the latest trends and consumer preferences in fabrics, designs, fits and finishes. Fast fashion has accelerated the apparel replacement cycle, benefiting textile processors. Consumers now refresh their wardrobes more frequently instead of periodic overhauling. This has significantly increased the volumes of apparel production globally. Additionally, rising disposable incomes have empowered consumers to indulge in fashion more often. They are willing to spend on high quality, on-trend apparel that matches their evolving fashion-conscious lifestyles. Apparel manufacturers also target new consumer segments such as women professionals and Millennials who are assertive about self-expression through unique apparel choices. Such demographic and behavioral shifts have driven a huge demand for textile processing of various apparel fabrics. The need to cater to dynamic consumer demand cycles makes apparel an important application segment for textile processors worldwide.

Additional Insights of Textile Processing Machinery Market

The Textile Processing Machinery Market is rapidly growing due to automation, urbanization, and rising demand in diverse applications. In Asia Pacific, especially China and India, this demand is fueled by industrial expansion and the adoption of advanced machinery in textile manufacturing. Innovations in textile technology, like digital printing and energy-efficient dryers, cater to market demands for customization and eco-friendliness, facilitating small-scale and high-quality production. The garment sector leads in applications, driven by fashion industry demands, while household textiles are seeing significant growth due to urban lifestyle changes. Despite challenges like high capital costs, technological advancements in textile machinery offer opportunities for market growth, emphasizing automation and efficiency across sectors. North America remains a key player due to its advanced infrastructure, with the U.S. leading in textile and apparel exports.

Competitive overview of Textile Processing Machinery Market

The major players operating in the Textile Processing Machinery Market include Rieter Holding AG, Lakshmi Machine Works Ltd., Saurer Intelligent Technology AG, TMT Machinery Inc., Trutzschler Group, Savio Macchine Tessili S.p.A, Mayer & Cie. GmbH & Co. KG, Santoni S.p.A., A.T.E. Enterprises Private Limited, Kirloskar Toyoda Pvt. Ltd., Picanol Group, Murata Machinery Ltd., Benninger AG, Itema S.p.A and Batliboi Ltd.

Textile Processing Machinery Market Leaders

- Rieter Holding AG

- Lakshmi Machine Works Ltd.

- Saurer Intelligent Technology AG

- TMT Machinery Inc.

- Trutzschler Group

Textile Processing Machinery Market - Competitive Rivalry

Textile Processing Machinery Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Textile Processing Machinery Market

- In September 2023, CEMATEX, in partnership with CTMA and CCPIT-Tex, launched a new application space for the 2024 textile machinery exhibition, highlighting innovations in textile processing.

- In May 2023, Eliar Elektronic San (Turkey) presented its specialized automation systems for the textile industry at ITMA 2023, emphasizing its role in efficiency improvements.

- In July 2023, Steiger introduced a computerized four-needle bed knitting machine, KS3-60MC-II, for garment manufacturing, which was showcased at ITMA 2023.

Textile Processing Machinery Market Segmentation

- By Process

- Washing Machine

- Bleaching

- Drying Machines

- Ironing Machines & Presses

- Others

- By Material

- Cotton

- Polyester

- Wool

- Silk

- Others

- By Application

- Garments & Apparels

- Household & Home Textiles

- Technical Textiles

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How Big is the Textile Processing Machinery Market?

The Global Textile Processing Machinery Market is estimated to be valued at USD 29.5 Bn in 2024 and is expected to reach USD 50.9 Bn by 2031.

What will be the CAGR of the Textile Processing Machinery Market?

The CAGR of the Textile Processing Machinery Market is projected to be 7.1% from 2024 to 2031.

What are the major factors driving the Textile Processing Machinery Market growth?

The increased productivity in textile processing through automation. and high demand for textile machinery in Asia pacific due to industrialization and urbanization are the major factors driving the Textile Processing Machinery Market.

What are the key factors hampering the growth of the Textile Processing Machinery Market?

The high initial capital investment limits market entry and upgrades for some companies and fluctuating raw material costs affect profitability and market stability are the major factors hampering the growth of the Textile Processing Machinery Market.

Which is the leading Process in the Textile Processing Machinery Market?

Washing Machine is the leading Process segment.

Which are the major players operating in the Textile Processing Machinery Market?

Rieter Holding AG, Lakshmi Machine Works Ltd., Saurer Intelligent Technology AG, TMT Machinery Inc., Trutzschler Group, Savio Macchine Tessili S.p.A, Mayer & Cie. GmbH & Co. KG, Santoni S.p.A., A.T.E. Enterprises Private Limited, Kirloskar Toyoda Pvt. Ltd., Picanol Group, Murata Machinery Ltd., Benninger AG, Itema S.p.A, Batliboi Ltd. are the major players.