Traction Motor Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Traction Motor Market is segmented By Type (AC Traction Motors, DC Traction Motors, Permanent Magnet Synchronous Motors), By Application (Railways, Au....

Traction Motor Market Size

Market Size in USD Bn

CAGR9.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.6% |

| Market Concentration | Medium |

| Major Players | Siemens AG, ABB Ltd., General Electric Company, Bosch Limited, Nidec Corporation and Among Others. |

please let us know !

Traction Motor Market Analysis

The traction motor market is estimated to be valued at USD 14.04 Bn in 2024 and is expected to reach USD 26.75 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 9.6% from 2024 to 2031. The traction motor market is expected to witness strong growth during the forecast period owing to rising sales of electric vehicles worldwide.

Traction Motor Market Trends

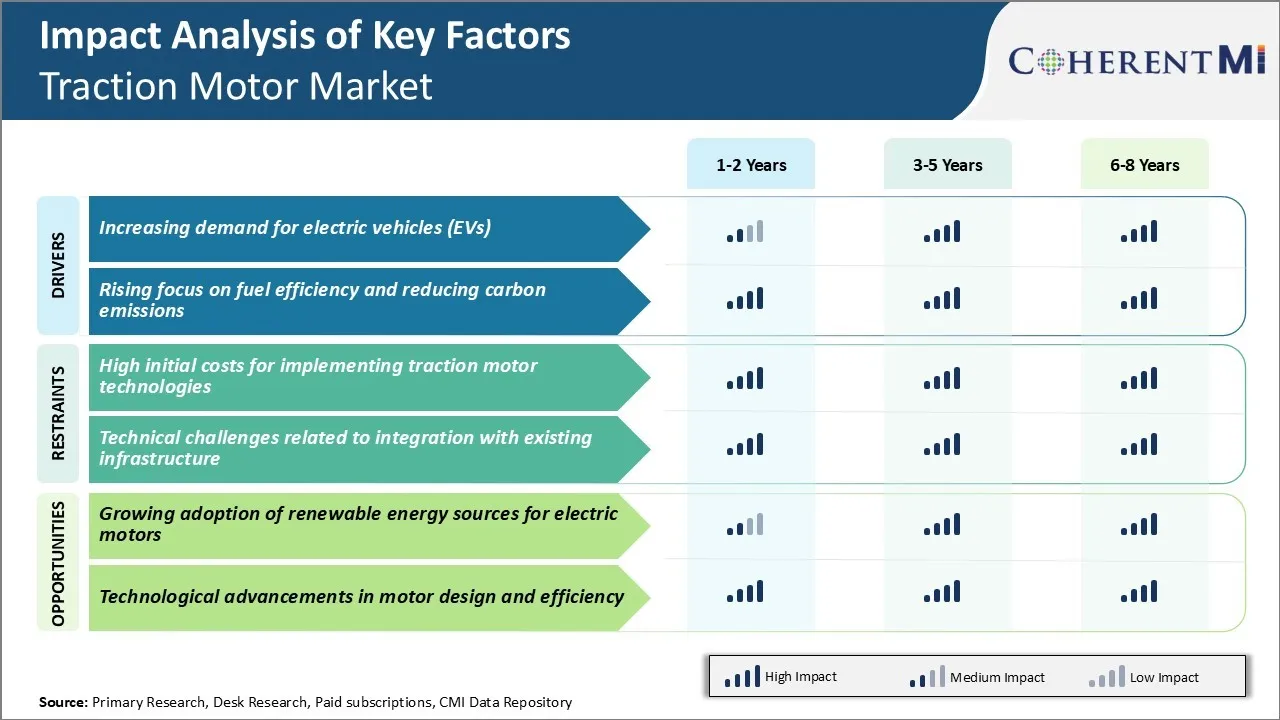

Market Driver - Increasing Demand for Electric Vehicles (EVs)

The automotive industry has seen rapid growth in demand for electric vehicles in recent years. Battery-powered EVs provide numerous benefits over internal combustion engine vehicles such as lower operating costs, less reliance on fossil fuels, and quieter operation.

Government policies promoting EVs have also driven this shift. Several countries and states/provinces have implemented subsidies, rebates or tax credits for EV purchases to help lower the upfront costs relative to gas vehicles. Manufacturers rising to meet the targets set out in these zero-emission regulations reinforces the long term outlook that EV growth has ahead of it.

On the production side, automakers have heavily invested in their electric lineups, planning dozens of new EV nameplates over the next few years. Mainstream brands are marketing EVs to the masses rather than just niche audiences. These factors alleviate barriers that may have existed previously in the traction motor market.

Market Driver - Rising Focus on Fuel Efficiency and Reducing Carbon Emissions

Tightening emissions regulations around the world have put pressure on automakers and suppliers to enhance fuel economy across their product portfolios. Transitioning to electrified systems is a practical way for manufacturers to comply with increasingly stringent Corporate Average Fuel Economy (CAFE) standards, and greenhouse gas limits. Hybrids, plug-in hybrids, and battery EVs help lower a company's fleetwide carbon footprint, avoiding substantial fines for falling short of these benchmarks.

In addition, climate change has risen up the public agenda. Younger generations in particular favor brands that demonstrate leadership on sustainability issues. Against this backdrop, automakers recognize putting greater numbers of EVs on the road as a necessity to appease regulators and retain licenses to sell in high-volume markets.

Pressure continues to mount on society from all angles to decarbonize at an escalating pace. Consequently, low-emission traction motors will play an important part in transport sector reductions over the coming decades.

Market Challenge - High Initial Costs for Implementing Traction Motor Technologies

One of the key challenges being faced by the traction motor market is the high initial costs associated with implementing new traction motor technologies. Transitioning to electrified powertrains requires significant investment in R&D to develop advanced traction motors as well as setting up manufacturing facilities which have the capability and scale to produce these specialized motors.

Traction motor manufacturers also face challenges related to developing ecosystems around new technologies and ensuring adequate support infrastructure is in place to provide parts, services and repairs for electric vehicles. With upfront costs being considerably higher compared to conventional internal combustion engine vehicles, it hampers the pace at which the traction motor market can transition to more sustainable powertrain options. Finding ways to reduce production costs through economies of scale, innovation, and supply chain integration will be important for the future growth prospects of the traction motor market.

Market Opportunity - Growing adoption of renewable energy sources for electric motors

One of the major opportunities for the traction motor market is the increased focus and support for renewable energy sources across the globe. Many countries are formulating policies and introducing regulations to expand the generation and adoption of renewable energy. This includes incentives for solar panels, wind power projects as well as investments in charging infrastructure for electric vehicles.

The growing integration of renewables into national power grids and their increasing cost competitiveness provides a reliable source of clean energy to power electric traction motors. As renewable energy starts meeting a larger portion of electricity demand, it can significantly boost the credentials of EVs and rail systems that rely on electric traction motors.

The ability of electric powertrains to leverage clean and indigenous renewable energy resources strengthens the business case for transitioning to electrified transportation. It also helps electric traction motor powered vehicles and equipment contribute to emissions reductions targets in the transportation sector.

Key winning strategies adopted by key players of Traction Motor Market

Focus on technology innovation: Companies like CRRC, SainSunt Ltd., and Siemens have achieved success by continuously innovating their traction motor technologies.

Partnerships and collaborations: Major OEMs likeABB, Alstom, and Siemens have partnered with rail operators to offer customized solutions. For example, in 2018 Alstom partnered with Amtrak to supply traction motors optimized for the Acela Express train sets.

Focus on aftermarket services: Players like Crrc and TMH are focusing more on product reliability and after-sales services. For example, CRRC established maintenance centers close to major rail routes in China and India. This helped CRRC win over 50% of the aftermarket services contracts in these regions.

Mergers and acquisitions: Consolidation has helped players achieve scale and capabilities. For example, Siemens' 2017 acquisition of Heathcote expanded its presence in North America.

Segmental Analysis of Traction Motor Market

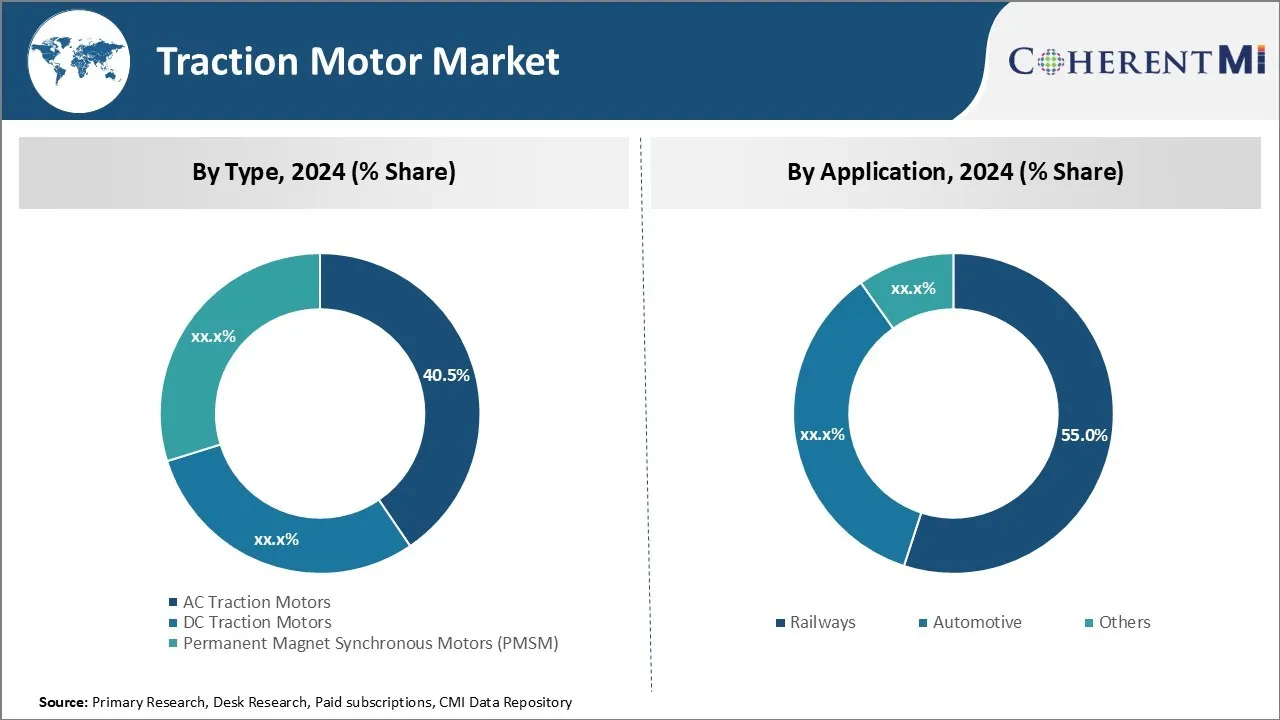

Insights, By Type: Electrification of Rail Routes Drives Growth of AC Traction Motors

In terms of type, AC traction motors contributes 40.5% share of the traction motor market in 2024. This is owning to their suitability for heavy-duty rail operations. AC traction motors are highly efficient and offer advantages over DC motors such as smoother torque, lower maintenance requirements and better longevity.

The ongoing electrification of railway routes across major economies is a key factor propelling the demand for AC traction motors. Countries are aggressively investing in electrification to replace aging diesel locomotives and cut carbon emissions. As rail electrification gathered pace worldwide, it has significantly boosted the installations of AC traction motors in locomotives over the last decade.

Additionally, rapid urbanization and growing passenger traffic have expedited railway capacity expansion projects, which in turn has increased traction motor procurement. The share of AC motors in the traction motor market is expected to increase steadily in the coming years.

Insights, By Application: Automotive Sector's Focus on Electrification Aids Growth of in-wheel Traction Motors

In terms of application, the railways segment contributes 55% share of the traction motor market currently. However, the automotive segment is emerging as an important end-use industry for traction motors, driven by the rising electrification of vehicles. Within the automotive segment, in-wheel traction motors are gaining traction due to their suitability for electric vehicles (EVs) with in-wheel motor architecture.

In-wheel motors provide benefits like very high traction, precise torque control and minimal energy losses. They replace conventional drive trains and differentials, facilitating design simplification in EVs. Moreover, in-wheel motorized EVs have enhanced operational performance and safety. With governments introducing stringent norms to curb emissions, automakers are making huge investments in electric and hybrid technologies.

The focus on electrification is fueling prototyping and testing of EVs featuring innovative in-wheel motor technology. In-wheel traction motors may displace conventional traction motors and propel the automotive segment to higher shares in the overall traction motor market.

Insights, By Voltage: Advancements in High Power Wide Band-gap Semiconductors

In terms of voltage, the low voltage segment currently dominates the traction motor market owing to extensive use of low power motors in railways and automotives. However, advancements in power electronics are anticipated to spur higher demand for high voltage permanent magnet synchronous motors (PMSM) going forward.

PMSMs are gaining prominence for their high efficiency, reliability and compact design. To meet the power requirements of heavy duty engines and machinery, PMSMs need to be rated for high voltages. Wide band-gap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) allow higher operating temperatures and frequencies compared to conventional silicon. This enables more compact, lightweight and powerful motor drive systems.

The use of high power SiC and GaN transistors in PMSM drive units is making the motor technology more viable for medium and high voltage industrial applications. Thus, continuous advancements in wide band-gap semiconductor switches are likely to increase the market opportunities for PMSMs specifically in the medium and high voltage segments.

Additional Insights of Traction Motor Market

- Siemens and Hitachi have been making joint efforts in Asia to develop energy-efficient traction motors for the emerging traction motor market.

- GE’s involvement in North America includes collaboration with automakers to provide integrated electric propulsion systems for commercial vehicles.

- Asia-Pacific leads the traction motor market in terms of production, owing to the high demand for electric motors in China and India.

- The traction motor market has seen significant growth due to the surge in electric vehicle demand. The rail sector, in particular, is moving toward more eco-friendly and efficient traction motors.

Competitive overview of Traction Motor Market

The major players operating in the traction motor market include Siemens AG, ABB Ltd., General Electric Company, Bosch Limited, Nidec Corporation, Toshiba Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Rockwell Automation, Inc., Regal Beloit Corporation, Schneider Electric SE, WEG S.A., Hyundai Rotem Company, CRRC Corporation Limited, and Dana Incorporated.

Traction Motor Market Leaders

- Siemens AG

- ABB Ltd.

- General Electric Company

- Bosch Limited

- Nidec Corporation

Traction Motor Market - Competitive Rivalry, 2024

Traction Motor Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Traction Motor Market

- In June 2024, Siemens AG announced a new energy-efficient traction motor for railways, which is expected to reduce energy consumption by 10%. This will make rail transport more cost-effective and eco-friendlier.

- In April 2024, Toshiba Corporation unveiled an advanced permanent magnet motor with integrated AI-based diagnostics, improving motor lifespan and operational efficiency.

Traction Motor Market Segmentation

- By Type

- AC Traction Motors

- DC Traction Motors

- Permanent Magnet Synchronous Motors (PMSM)

- By Application

- Railways

- Automotive

- Others

- By Voltage

- Low Voltage (Below 1 kV)

- Medium Voltage (1 kV – 3 kV)

- High Voltage (Above 3 kV)

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the traction motor market?

The traction motor market is estimated to be valued at USD 14.04 Bn in 2024 and is expected to reach USD 26.75 Bn by 2031.

What are the key factors hampering the growth of the traction motor market?

High initial costs for implementing traction motor technologies and technical challenges related to integration with existing infrastructure are the major factors hampering the growth of the traction motor market.

What are the major factors driving the traction motor market growth?

Increasing demand for electric vehicles (EVs) and rising focus on fuel efficiency and reducing carbon emissions are the major factors driving the traction motor market.

Which is the leading type in the traction motor market?

The leading type segment is AC traction motors.

Which are the major players operating in the traction motor market?

Siemens AG, ABB Ltd., General Electric Company, Bosch Limited, Nidec Corporation, Toshiba Corporation, Hitachi, Ltd., Mitsubishi Electric Corporation, Rockwell Automation, Inc., Regal Beloit Corporation, Schneider Electric SE, WEG S.A., Hyundai Rotem Company, CRRC Corporation Limited, and Dana Incorporated are the major players.

What will be the CAGR of the traction motor market?

The CAGR of the traction motor market is projected to be 9.6% from 2024-2031.