United States Methyl Methacrylate (MMA) Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

United States Methyl Methacrylate (MMA) Market is Segmented By Product Type (Chemical Intermediate, Surface Coating, Others), By End Use Industry (Bui....

United States Methyl Methacrylate (MMA) Market Size

Market Size in USD Bn

CAGR4.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.8% |

| Market Concentration | High |

| Major Players | Mitsubishi Chemical Corporation, Röhm, The Dow Chemical Company, Huntsman Corporation, Evonik Industries AG and Among Others. |

please let us know !

United States Methyl Methacrylate (MMA) Market Analysis

The United States Methyl Methacrylate Market is estimated to be valued at USD 1.86 Bn in 2024 and is expected to reach USD 2.46 Bn by 2031, growing at a CAGR of 4.8% from 2024 to 2031.

The growth of the market is attributed to increasing uses of methyl methacrylate in various industries including automotive, electronics, construction and others.

United States Methyl Methacrylate (MMA) Market Trends

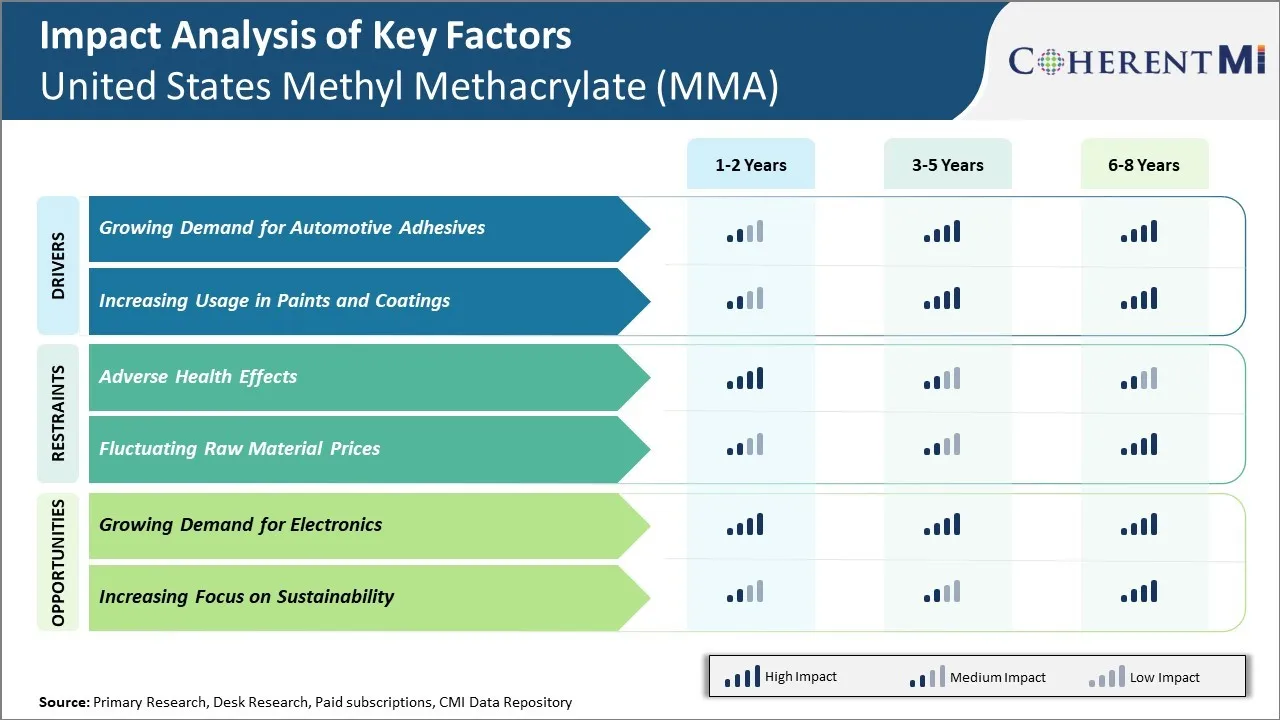

Market Driver – Growing Demand for Automotive Adhesives

The automotive industry in the United States has seen significant growth in recent years, with rising vehicle production and sales fueling demand. As automakers look to make vehicles lighter yet more durable, the use of advanced adhesives and composite materials in automotive manufacturing has increased substantially. Methyl methacrylate is a key raw material used in the production of various automotive adhesives and coatings that bond plastics, composites and other lightweight materials in vehicles.

With stricter fuel efficiency and emissions norms, automakers are focusing more on weight reduction through increased use of engineered plastics and composites replacing metal parts. Adhesives play a vital role in uniting dissimilar material types and replacing welding in modern vehicle design. The growing need for high-performance structural adhesives has boosted consumption of MMA, which provides excellent adhesion along with resistance to heat, chemicals and weathering. According to the United States Department of Transportation, over 17 million new light vehicles were sold in America in 2021. project this number to grow around 2% annually through 2023.

As automotive production volumes continue rising to meet demand in the coming years, the need for advanced lightweight materials and efficient assembly technologies will also increase.

Market Driver – Increasing Usage in Paints And Coatings

Methyl methacrylate (MMA) is widely used in paints and coatings applications due to its excellent weather resistance, high clarity and gloss retention properties. It is used as a key raw material in production of polymethyl methacrylate (PMMA) which finds major usage in acrylic paints and coatings. The paints and coatings industry in the US has been witnessing steady growth over the past few years and this trend is expected to continue going forward. According to the US Census Bureau, shipments from paint and coating manufacturing increased by 3.4% year-on-year to $28.2 billion in 2020. Improving construction activity along with rising home improvement and renovation expenditures have boosted demand for paints and coatings from both residential and commercial sectors.

As the usage of MMA in paints and coatings applications is quite high, accounting for over 40% of total MMA consumption, the growth in paints industry naturally drives the demand for MMA. Additionally, there is a growing preference for acrylic and hybrid paints over conventional oil-based paints due to various advantages like fast drying, water resistance and easier cleaning.

Market Challenge – Adverse Health Affects

Methyl methacrylate (MMA) is used in various industries like construction, automotive and medical due to its unique properties. However, the growth of MMA market in the United States has been restricted due to increasing concerns around its adverse health effects. Exposure to MMA monomer and dust can cause both acute and chronic health issues in humans. Short term exposure leads to irritation in eyes, nose and respiratory tract along with headaches. Prolonged and repeated exposure is known to damage liver and kidneys. MMA is also classified as a possible human carcinogen by various regulatory and health agencies.

This has increased regulatory scrutiny on the production, handling and usage of MMA. Stricter safety measures and protocols need to be followed across the supply chain to limit exposure and protect worker health. This has significantly increased the compliance burden and costs for companies involved in MMA business. For example, additional ventilation, protective gear for employees and stringent monomer containment practices during production processes have become mandatory as per OSHA guidelines. Such increased operational expenses reduce the profit margins, especially for smaller players.

Market Opportunity – Growing Demand for Electronics

The growing demand for consumer electronics in the United States presents a huge opportunity for the methyl methacrylate (MMA) market. MMA is used extensively in the manufacturing of a wide variety of electronics due to its optical clarity and resistance to aging.

As digital technology becomes more ubiquitous, demand for computers, smartphones, tablets and other smart devices is on the rise. According to the U.S. Census Bureau, e-commerce sales in 2021 grew 14.3% over 2020 levels to hit $870 billion, highlighting increasing consumer appetite for electronics that are enabled by online connectivity. Additionally, advanced communication technologies like 5G networks are enabling new applications in virtual/augmented reality and artificial intelligence. Electronics companies are ramping up production to meet demand for innovative 5G-enabled devices that require MMA for their clear casings and precision molding.

As electric vehicles see wider acceptance, automakers are investing heavily in innovative cockpit touchscreen interfaces that improve the driver experience. For instance, a report from the International Energy Agency states that electric car sales in the U.S. doubled to over 330,000 units in 2021 compared to 2020.

Segmental Analysis of United States Methyl Methacrylate (MMA) Market

Insights, By Product Type: Increasing Demand From Building And Construction Industry

In terms of product type, chemical intermediate sub-segment contributes the highest share of 59.5% in the market owning to increasing demand from building and construction industry.

The chemical intermediate segment currently holds the highest share in the United States methyl methacrylate market owing to its wide usage as an intermediate in numerous chemical processes and reactions. Methyl methacrylate acts as an essential raw material for the manufacturing of polymers such as polymethyl methacrylate (PMMA) which finds significant application in the building and construction industry. The rising activities in the construction sector have been propelling the demand for PMMA sheets and granules which in turn spurs the need for methyl methacrylate as a prime feedstock. Some of the major construction applications of PMMA include roofing, railings, laminates among others due to benefits such as durability, scratch resistance, high transparency and shine retention. Additionally, methyl methacrylate also plays a pivotal role in the synthesis of other important industrial intermediates like artificial leather, impact modifiers, and MMA copolymers. With the growing use of these substances across end-use domains, the demand for methyl methacrylate from chemical companies is experiencing consistent rise.

Insights, By End Use Industry: Increasing Usage of Polymethyl Methacrylate

Building & construction sub-segment contributes the highest share of 43.1% in the market driven by increasing usage of polymethyl methacrylate.

Within the end use industry segment of the United States methyl methacrylate market, building & construction has been account for the major consumption over the years. This can be attributed to the widening usage of polymethyl methacrylate (PMMA) in myriad construction applications such as façade systems, illuminated signages, roofing sheets etc. owing to its outstanding properties. PMMA exhibits high light transmission, scratch and breakage resistance along with UV stability which makes it a material of choice for glazing, daylighting and lighting cover applications. It also offers benefits such as ease of fabrication, transparency and robustness compared to traditional construction materials such as glass. Moreover, PMMA grades are non-combustible and do not require much maintenance. With growth in residential as well as non-residential building projects, the utilization of PMMA is increasing tremendously thereby driving the parent demand for methyl methacrylate in the building & construction segment. PMMA finds widespread usage as an alternative to glass especially in applications where safety from breakage is a concern.

Competitive overview of United States Methyl Methacrylate (MMA) Market

The major players operating in the United States Methyl Methacrylate (MMA) Market include Mitsubishi Chemical Corporation, Röhm, The Dow Chemical Company, Huntsman Corporation, Evonik Industries AG, BASF SE, Lucite International, and Plaskolite.

United States Methyl Methacrylate (MMA) Market Leaders

- Mitsubishi Chemical Corporation

- Röhm

- The Dow Chemical Company

- Huntsman Corporation

- Evonik Industries AG

United States Methyl Methacrylate (MMA) Market - Competitive Rivalry, 2024

United States Methyl Methacrylate (MMA) Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States Methyl Methacrylate (MMA) Market

- In February 2024, Mitsubishi Chemical America announced plans for a new MMA plant in the US, with a final investment decision expected in the second quarter. The plant, named MCA Geismar Site, is set to produce 350,000 tons/year using the Alpha process technology, with a potential start-up in 2028.

- In October 2023, Rohm signed an agreement to supply a custom catalyst for Evonik's new MMA production plant in Texas, USA, scheduled to open in 2024. This plant will utilize the LiMA technology, known for its sustainability advantages and efficient resource use in MMA production.

United States Methyl Methacrylate (MMA) Market Segmentation

- By Product Type

- Chemical Intermediate

- Surface Coating

- Others (Emulsion Polymer)

- By End Use Industry

- Building & Construction

- Automotive

- Electronics

- Paints & Coatings

- Others (Aerospace, etc.)

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the United States Methyl Methacrylate (MMA) Market?

The adverse health effects and fluctuating raw material prices are the major factors hampering the growth of the United States Methyl Methacrylate (MMA) Market.

What are the major factors driving the United States Methyl Methacrylate (MMA) Market growth?

The growing demand for automotive adhesives and increasing usage in paints and coatings are the major factors driving the United States Methyl Methacrylate (MMA) Market.

Which is the leading Product Type in the United States Methyl Methacrylate (MMA) Market?

The leading Product Type segment is Chemical Intermediate.

Which are the major players operating in the United States Methyl Methacrylate (MMA) Market?

Mitsubishi Chemical Corporation, Röhm, The Dow Chemical Company, Huntsman Corporation, Evonik Industries AG, BASF SE, Lucite International, and Plaskolite are the major players.

What will be the CAGR of the United States Methyl Methacrylate (MMA) Market?

The CAGR of the United States Methyl Methacrylate (MMA) Market is projected to be 4.8% from 2024-2031.