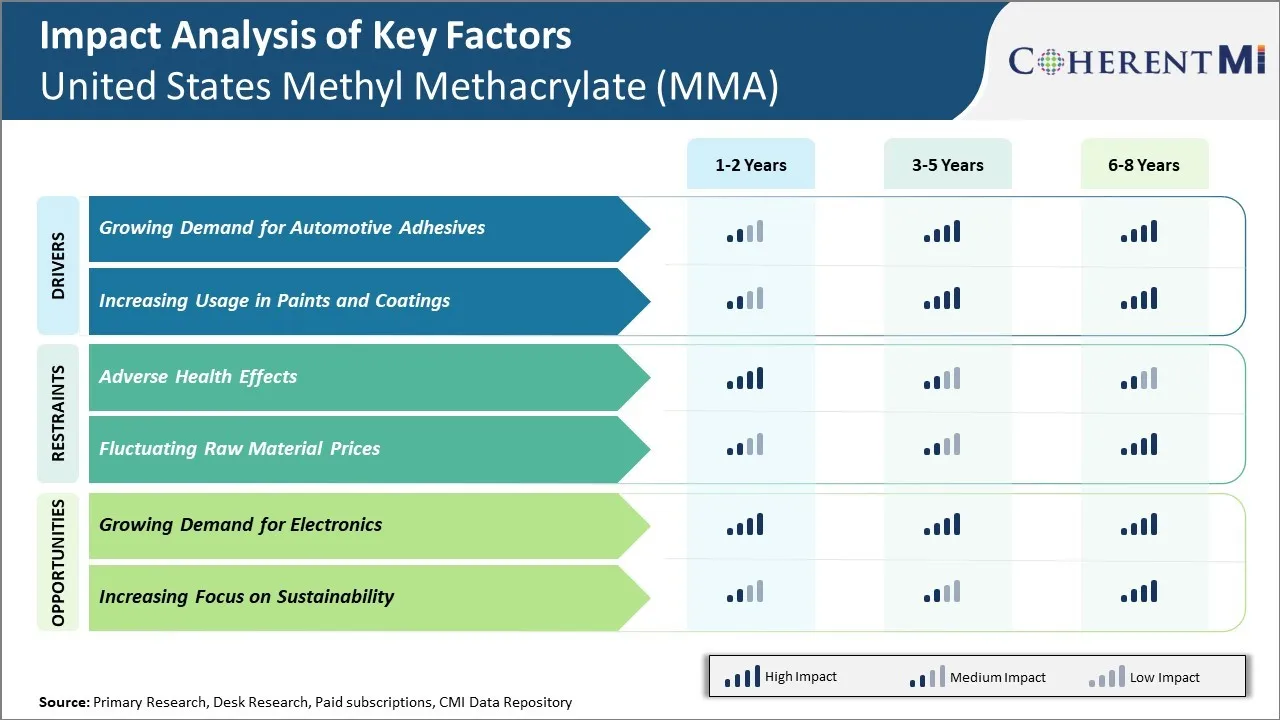

United States Methyl Methacrylate (MMA) Market Trends

Market Driver – Growing Demand for Automotive Adhesives

The automotive industry in the United States has seen significant growth in recent years, with rising vehicle production and sales fueling demand. As automakers look to make vehicles lighter yet more durable, the use of advanced adhesives and composite materials in automotive manufacturing has increased substantially. Methyl methacrylate is a key raw material used in the production of various automotive adhesives and coatings that bond plastics, composites and other lightweight materials in vehicles.

With stricter fuel efficiency and emissions norms, automakers are focusing more on weight reduction through increased use of engineered plastics and composites replacing metal parts. Adhesives play a vital role in uniting dissimilar material types and replacing welding in modern vehicle design. The growing need for high-performance structural adhesives has boosted consumption of MMA, which provides excellent adhesion along with resistance to heat, chemicals and weathering. According to the United States Department of Transportation, over 17 million new light vehicles were sold in America in 2021. project this number to grow around 2% annually through 2023.

As automotive production volumes continue rising to meet demand in the coming years, the need for advanced lightweight materials and efficient assembly technologies will also increase.

Market Driver – Increasing Usage in Paints And Coatings

Methyl methacrylate (MMA) is widely used in paints and coatings applications due to its excellent weather resistance, high clarity and gloss retention properties. It is used as a key raw material in production of polymethyl methacrylate (PMMA) which finds major usage in acrylic paints and coatings. The paints and coatings industry in the US has been witnessing steady growth over the past few years and this trend is expected to continue going forward. According to the US Census Bureau, shipments from paint and coating manufacturing increased by 3.4% year-on-year to $28.2 billion in 2020. Improving construction activity along with rising home improvement and renovation expenditures have boosted demand for paints and coatings from both residential and commercial sectors.

As the usage of MMA in paints and coatings applications is quite high, accounting for over 40% of total MMA consumption, the growth in paints industry naturally drives the demand for MMA. Additionally, there is a growing preference for acrylic and hybrid paints over conventional oil-based paints due to various advantages like fast drying, water resistance and easier cleaning.

Market Challenge – Adverse Health Affects

Methyl methacrylate (MMA) is used in various industries like construction, automotive and medical due to its unique properties. However, the growth of MMA market in the United States has been restricted due to increasing concerns around its adverse health effects. Exposure to MMA monomer and dust can cause both acute and chronic health issues in humans. Short term exposure leads to irritation in eyes, nose and respiratory tract along with headaches. Prolonged and repeated exposure is known to damage liver and kidneys. MMA is also classified as a possible human carcinogen by various regulatory and health agencies.

This has increased regulatory scrutiny on the production, handling and usage of MMA. Stricter safety measures and protocols need to be followed across the supply chain to limit exposure and protect worker health. This has significantly increased the compliance burden and costs for companies involved in MMA business. For example, additional ventilation, protective gear for employees and stringent monomer containment practices during production processes have become mandatory as per OSHA guidelines. Such increased operational expenses reduce the profit margins, especially for smaller players.

Market Opportunity – Growing Demand for Electronics

The growing demand for consumer electronics in the United States presents a huge opportunity for the methyl methacrylate (MMA) market. MMA is used extensively in the manufacturing of a wide variety of electronics due to its optical clarity and resistance to aging.

As digital technology becomes more ubiquitous, demand for computers, smartphones, tablets and other smart devices is on the rise. According to the U.S. Census Bureau, e-commerce sales in 2021 grew 14.3% over 2020 levels to hit $870 billion, highlighting increasing consumer appetite for electronics that are enabled by online connectivity. Additionally, advanced communication technologies like 5G networks are enabling new applications in virtual/augmented reality and artificial intelligence. Electronics companies are ramping up production to meet demand for innovative 5G-enabled devices that require MMA for their clear casings and precision molding.

As electric vehicles see wider acceptance, automakers are investing heavily in innovative cockpit touchscreen interfaces that improve the driver experience. For instance, a report from the International Energy Agency states that electric car sales in the U.S. doubled to over 330,000 units in 2021 compared to 2020.