Acid Sphingomyelinase Deficiency (ASMD) Market Size - Analysis

Market Size in USD Mn

CAGR12.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 12.3% |

| Market Concentration | High |

| Major Players | Sanofi, Orphazyme, Takeda Pharmaceutical, Actelion Pharmaceuticals and Among Others |

please let us know !

Acid Sphingomyelinase Deficiency (ASMD) Market Trends

ASMD is an extremely rare lysosomal storage disease caused by mutations in the SMPD1 gene which result in a deficiency of the acid sphingomyelinase enzyme. This genetic defect prevents the normal breakdown of sphingomyelin, a fatty substance found in membranes of cells, causing it to accumulate to harmful levels over time.

As the true prevalence of ASMD comes into better focus, efforts are ongoing to raise awareness about the condition among the medical community and public. Patient advocacy groups play an important role in educating about signs, symptoms and available testing options. Diagnosis traditionally relied on invasive bone marrow biopsy but new dry blood spot tests allow for more convenient newborn screening and diagnosis of late-onset patients. Increased overall awareness combined with easier diagnostic pathways is facilitating the identification and confirmation of more ASMD cases worldwide.

Market Driver - FDA Approval of XENPOZYME and its Strong Market Demand in the US and Europe

XENPOZYME represents the first ever disease-modifying treatment option for ASMD which was previously managed solely through symptomatic care. Clinicians recognize it has the potential to meaningfully impact the often-devastating multisystem complications of this progressive condition. Initial real-world experience supports the positive efficacy and safety demonstrated in clinical trials.

Market Challenge - High Costs Associated with Drug Development and Enzyme Replacement Therapy

Additionally, the approved enzyme replacement therapy called Cerdelga is priced at over $300,000 per year, making it too costly for many healthcare systems and patients. The small patient numbers mean the overall size of acid sphingomyelinase deficiency (ASMD) market is limited, providing little revenue potential for pharmaceutical companies to recoup their drug development investments.

The approval and commercialization of the new ASMD drug XENPOZYME represents a major opportunity to expand the market size for this condition. XENPOZYME, developed by Xenetic Biosciences, has demonstrated safety and efficacy in clinical trials.

As XENPOZYME gains uptake among eligible patients, it could start to offset some of the market currently held by Cerdelga. This market expansion would help improve the return on investment for companies developing therapies for this rare disease population.

Prescribers preferences of Acid Sphingomyelinase Deficiency (ASMD) Market

Acid sphingomyelinase deficiency (ASMD) is a rarelysosomal storage disorder where the lysosomal enzyme acid sphingomyelinase is deficient or absent. Prescribers follow a step-wise treatment approach depending on the stage and severity of the disease.

As the condition progresses, enzyme replacement therapy (ERT) becomes the standard first-line treatment. For infantile neuroaxonal ASMD, Cerliponase alfa (Brineura) is prescribed as intrathecal ERT via infusion every other week. This helps degrade sphingomyelin accumulation in the central nervous system, slowing neurological decline.

In severe later-stage disease, hematopoietic stem cell transplantation may be considered. However, given the rarity of disease and limited long-term outcome data, prescribers are cautious in recommending this invasive procedure. Cost of treatment also influences preferences, with ERT being preferred over SRT due to proven efficacy in neurologic forms.

Treatment Option Analysis of Acid Sphingomyelinase Deficiency (ASMD) Market

In early or mild stages, supportive management is provided to address individual symptoms as they arise. Physical, occupational and speech therapies may be recommended. Antibiotics are given to prevent infections.

For patients who are not candidates for or do not respond to ERT, a bone marrow transplant may be considered. This aims to replace the defective gene through donor stem cells. While carrying risks, it provides a permanent correction if successful.

Key winning strategies adopted by key players of Acid Sphingomyelinase Deficiency (ASMD) Market

Early market entry with first FDA approved treatment: In 2017, Alexion Pharmaceuticals gained first-mover advantage by obtaining FDA approval for Kanuma (sebelipase alfa), the first and only approved treatment for ASMD. This early market entry allowed Alexion to dominate the market in the crucial initial years by providing the only approved treatment option to patients. Kanuma quickly became the standard of care and generated over $100 million in annual sales.

Commitment to ongoing R&D of new treatments: To maintain its leadership position, Alexion is investing in clinical trials of an experimental intravenous formulation of sebelipase alfa that may offer more convenient dosing. It is also supporting academic research into novel gene therapies and other treatment modalities for ASMD.

Segmental Analysis of Acid Sphingomyelinase Deficiency (ASMD) Market

XENPOZYME is an enzyme replacement therapy developed specifically for Acid Sphingomyelinase Deficiency (ASMD), a rare and life-threatening genetic disorder. It works by replenishing deficient or defective acid sphingomyelinase enzyme levels in patients, thereby addressing the underlying cause of ASMD.

XENPOZYME's targeted approach at restoring acid sphingomyelinase activity makes it a more effective treatment Option for ASMD compared to other non-specific supportive therapies. Its effectiveness at improving organ function and symptoms has helped establish it as the standard of care for ASMD patients. Additional benefits like convenient routes of administration further enhance treatment adherence for patients.

-market-by-therapy.webp)

Additional Insights of Acid Sphingomyelinase Deficiency (ASMD) Market

- XENPOZYME Market Impact: XENPOZYME, Sanofi’s enzyme replacement therapy, revolutionized treatment for non-CNS manifestations of ASMD, particularly in the US, Japan, and Europe. Its approvals highlight the strong demand and need for such therapies in managing rare diseases.

- Limited Pipeline Activity: Despite the recent advances in enzyme replacement therapies, the ASMD field still faces challenges due to its rarity and high costs, leaving significant unmet needs in the market.

- The US and Europe together account for over 90% of the market share, showing a strong concentration in these regions.

- The prevalence of ASMD is approximately 2,000 patients in the United States, Europe, and Japan, with pediatric cases forming a significant portion.

Competitive overview of Acid Sphingomyelinase Deficiency (ASMD) Market

The major players operating in the acid sphingomyelinase deficiency (ASMD) Market include Sanofi, Orphazyme, Takeda Pharmaceutical, and Actelion Pharmaceuticals.

Acid Sphingomyelinase Deficiency (ASMD) Market Leaders

- Sanofi

- Orphazyme

- Takeda Pharmaceutical

- Actelion Pharmaceuticals

Acid Sphingomyelinase Deficiency (ASMD) Market - Competitive Rivalry

Acid Sphingomyelinase Deficiency (ASMD) Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Acid Sphingomyelinase Deficiency (ASMD) Market

- In August 2022, the U.S. FDA approved Sanofi's XENPOZYME (olipudase alfa) as the first enzyme replacement therapy specifically for treating non-CNS (non-central nervous system) manifestations of Acid Sphingomyelinase Deficiency (ASMD), also known as Niemann-Pick disease types A and B. This approval was a significant step in addressing a rare genetic disorder that impacts the body's ability to break down certain fats. The FDA granted XENPOZYME Breakthrough Therapy and Priority Review designations, emphasizing its potential to substantially improve patient outcomes.

- In March 2022, XENPOZYME (olipudase alfa) received its first global approval in Japan under the SAKIGAKE designation. XENPOZYME is used to treat acid sphingomyelinase deficiency (ASMD), a rare genetic disorder, and the SAKIGAKE designation is a fast-track approval pathway for innovative medicines in Japan.

- In June 2022, the European Commission (EC) granted approval for XENPOZYME (olipudase alfa), a treatment for non-central nervous system (CNS) manifestations of Acid Sphingomyelinase Deficiency (ASMD), also known as Niemann-Pick disease types A and B. This approval allows XENPOZYME to be marketed across the European Union and European Economic Area.

Acid Sphingomyelinase Deficiency (ASMD) Market Segmentation

- By Therapy

- XENPOZYME (olipudase alfa)

- Other Enzyme Replacement Therapies (ERT)

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the acid sphingomyelinase deficiency (ASMD) market?

The acid sphingomyelinase deficiency (ASMD) market is estimated to be valued at USD 151.2 Mn in 2025 and is expected to reach USD 340.6 Mn by 2032.

What are the key factors hampering the growth of the acid sphingomyelinase deficiency (ASMD) market?

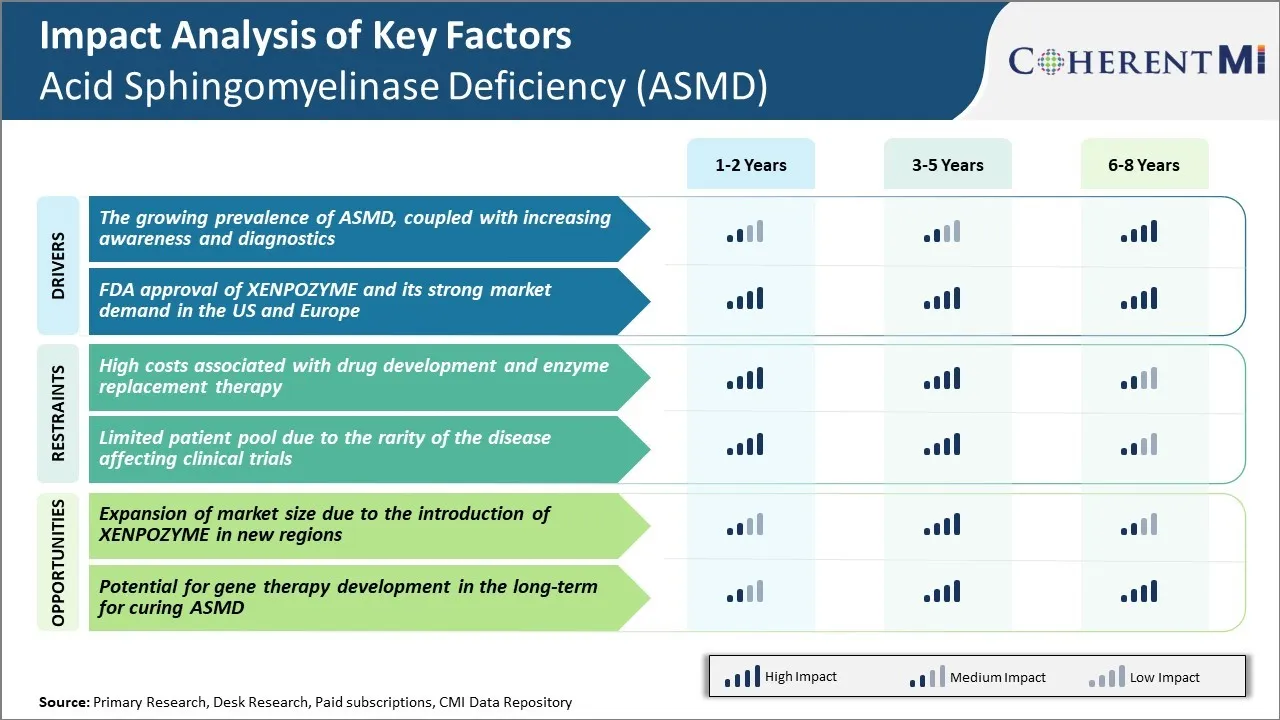

The high costs associated with drug development and enzyme replacement therapy and limited patient pool due to the rarity of the disease affecting clinical trials are the major factors hampering the growth of the acid sphingomyelinase deficiency (ASMD) market.

What are the major factors driving the acid sphingomyelinase deficiency (ASMD) market growth?

The growing prevalence of ASMD, coupled with increasing awareness and diagnostics and FDA approval of XENPOZYME and its strong market demand in the US and Europe are the major factors driving the acid sphingomyelinase deficiency (ASMD) market.

Which is the leading therapy in the acid sphingomyelinase deficiency (ASMD) market?

The leading therapy segment is XENPOZYME (olipudase alfa).

Which are the major players operating in the acid sphingomyelinase deficiency (ASMD) Market?

Sanofi, Orphazyme, Takeda Pharmaceutical, and Actelion Pharmaceuticals are the major players.

What will be the CAGR of the acid sphingomyelinase deficiency (ASMD) market?

The CAGR of the acid sphingomyelinase deficiency (ASMD) market is projected to be 12.3% from 2025-2032.