Acute Coronary Syndrome Market Size - Analysis

The Global Acute Coronary Syndrome Market is estimated to be valued at USD 14.06 Bn in 2025 and is expected to reach USD 23.02 billion by 2032, growing at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2032. The market is driven by increasing prevalence of cardiovascular diseases, growing geriatric population, rising levels of obesity and a sedentary lifestyle.

The market is witnessing positive trends with advanced diagnostic technologies helping in early diagnosis and increasing awareness about heart diseases among people. Manufacturers are investing heavily in research and development of innovative drugs and devices for treatment of acute coronary syndrome. Several new drug launches and pipeline products are expected to enter the market in coming years, further propelling market growth.

Market Size in USD Bn

CAGR7.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.3% |

| Market Concentration | Low |

| Major Players | DalCor Pharmaceuticals, Novartis Pharmaceuticals, Genentech, Sanofi and Among Others |

please let us know !

Acute Coronary Syndrome Market Trends

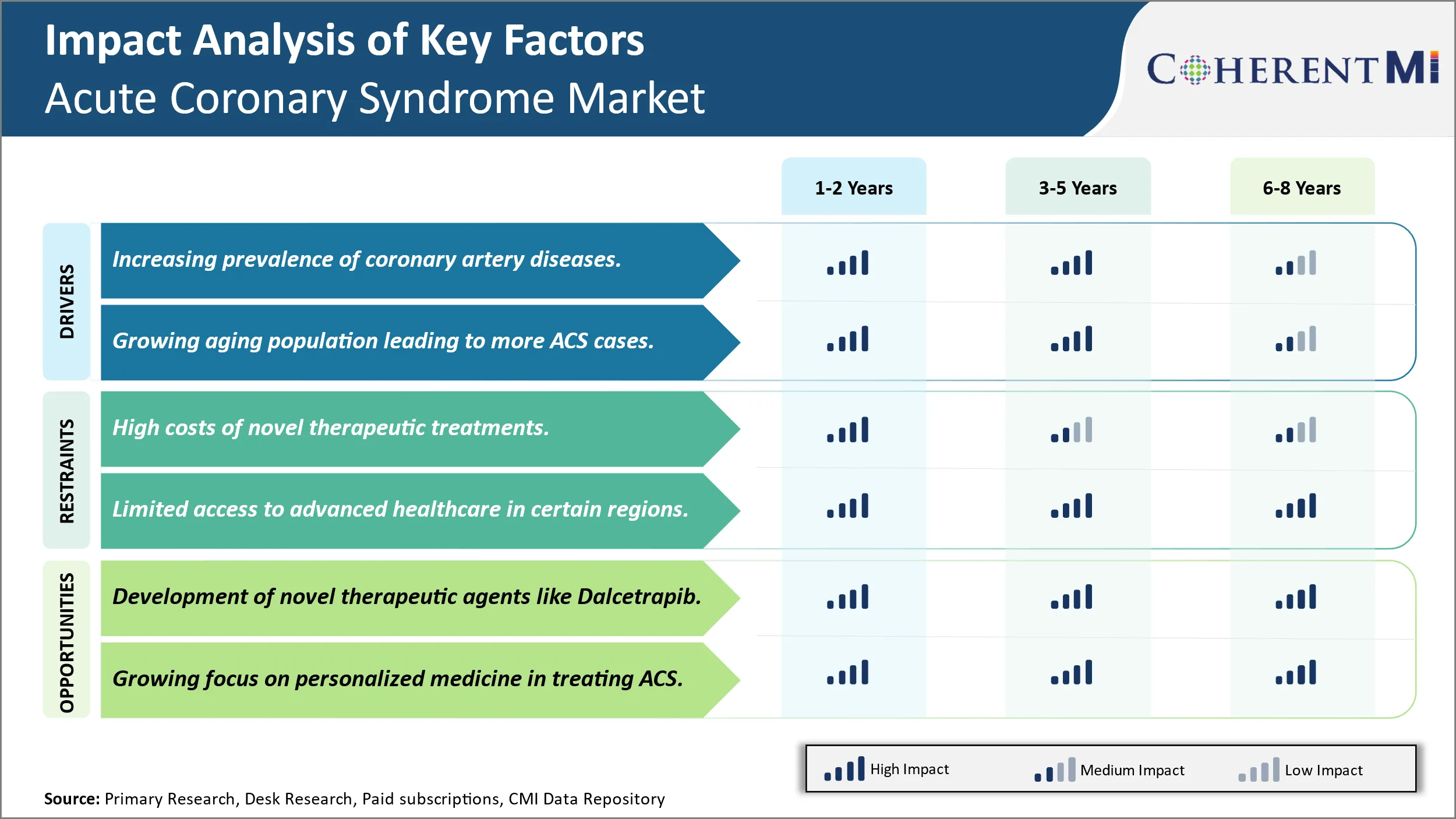

Market Driver - Increasing Prevalence of Coronary Artery Diseases Drives the Need for Diagnosis.

The prevalence of coronary artery diseases has been rising significantly across the world over the past few decades. Coronary artery diseases mainly occur due to the buildup of plaques or deposits of fatty substances, cholesterol and other particles in the arteries that supply blood to the heart. This plaque buildup causes the arteries to narrow over time, reducing blood flow to the heart. Multiple factors are contributing to the increasing occurrence of coronary artery diseases globally. Changing lifestyle and dietary patterns have led to a rise in obesity levels, physical inactivity and smoking habits-all major risk factors for the development of artery blockages.

Additional stresses of modern living along with environmental pollution are also blamed for worsening cardiovascular health. Genetic predisposition also plays a role, as some individuals remain at a higher risk compared to others due to biological factors. Consequently, conditions requiring management of coronary artery diseases like acute coronary syndrome have witnessed a parallel rise globally over time. Early detection and treatment remain challenging in developing nations partly due to lack of screening and diagnostic resources as well as awareness regarding heart health. Unless effective preventive measures are implemented, the trend of growing coronary artery diseases is likely to sustain the demand for treatment and associated drugs and devices.

Market Driver - Growing Aging Population Leading to More Cases of Acute Coronary Syndrome.

The proportion of elderly individuals has expanded significantly in both developed and developing countries. Medical advancements have improved life expectancy worldwide while declining birth rates have resulted in graying populations. Aging is a top risk factor for developing acute coronary syndrome as cardiovascular health naturally depreciates with increased age. The body's arteries tend to lose elasticity over time making them stiffer and narrower, raising the likelihood of plaque formation. In addition, age-related conditions like diabetes and high blood pressure that harm the cardiovascular system become more prevalent. Most healthcare experts and industry analysts agree that populations around the globe will continue growing older in the coming decades. By 2050, over one in six people across the planet will be over the age 65 mark. Notably, those aged 80 and above – the segment facing highest risk of acute coronary syndrome—is growing at the fastest pace. As populations globally are projected have a larger share of elderly individuals prone to heart issues, the number of cases of ACS requiring emergent intervention are expected to register substantial rise in the future without major medicals breakthroughs. Catering to the healthcare demands of the surging geriatric demographic will test the capabilities of medical services and drive the need for more advanced ACS treatments, diagnostics and cardiac medications.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Costs of Novel Therapeutic Treatments Limits the Market Growth.

The global acute coronary syndrome market faces the major challenge of high costs associated with novel therapeutic treatments. Developing innovative drugs and devices that can effectively treat the syndrome comes with significant research and development expenditures. Further clinical trials to test efficacy and safety of these novel therapies adds tremendously to overall costs. This means pharmaceutical companies endeavor to recoup massive investments by pricing new drugs highly. However, high prices pose affordability challenges, especially in developing nations with budget constraints in healthcare. Moreover, premium pricing often limits widespread insurance coverage and patient access to life-saving therapies. To address the heavy financial burden, payers and providers constantly seek ways to curb healthcare expenditures through value-based arrangements. Nevertheless, the market still grapples with the dilemma of fostering medical innovation while enhancing accessibility and affordability of novel treatment options for ACS patients worldwide.

Market Opportunity- Development of Novel Therapeutic Agents Like Dalcetrapib.

The global acute coronary syndrome market possesses opportunities arising from development of novel therapeutic agents. One such example is Dalcetrapib, a cholesteryl ester transfer protein inhibitor under phase-3 trials. If approved, Dalcetrapib can potentially become the first pharmacotherapy for raising HDL cholesterol levels beyond statin therapy. By regulating reverse cholesterol transport and reducing atherosclerotic plaque growth, Dalcetrapib aims to provide clinicians an effective option to lower cardiovascular risk in ACS patients. Its novel mechanism of action presents prospects for incremental healthcare benefits. Additionally, a new drug entity in the market will attract institutional capital, spurring further R&D into innovative medicines. Novel therapies are important to address unmet needs, improve clinical outcomes, and tackle the growing disease burden of ACS. Their successful development and commercialization can expand the market size while enriching treatment guidelines with better therapeutic alternatives.

Prescribers preferences of Acute Coronary Syndrome Market

Coronary syndrome stems from a reduction in blood flow to the heart and encompasses a spectrum from stable angina to heart attack. Treatment approaches vary based on disease severity and progression.

For stable angina with minimal symptoms, lifestyle modifications and medications like beta-blockers (e.g. metoprolol succinate branded as Toprol-XL) and calcium channel blockers (e.g. amlodipine besylate branded as Norvasc) are usually first-line. Prescribers may prefer ones with longer half-lives that provide steady coverage throughout the day.

In more advanced stable angina or unstable angina with worsening symptoms, dual antiplatelet therapy with aspirin and a P2Y12 inhibitor like clopidogrel (Plavix) or ticagrelor (Brilinta) is recommended on top of anti-anginals. Prescribers consider efficacy as well as potential bleeding risks, with newer alternatives like ticagrelor favored for faster onset of action.

For heart attacks, prescriptions start with antiplatelets and anticoagulants like heparin or enoxaparin (Lovenox) along with statins to reduce cholesterol levels and recurrence risk. For revascularization, prescriptions depend on whether PCI with a stent or CABG surgery is performed, with antiplatelets continued for at least 12 months and often lifelong to prevent clots and restenosis.

Access to the latest medications, guideline recommendations, and physicians' tolerance for side effects also affects prescribing choices. Ongoing education helps physicians stay aware of treatment advances.

Treatment Option Analysis of Acute Coronary Syndrome Market

Coronary syndrome is characterized by various stages depending on the severity of the blockages or narrowing of the arteries supplying blood to the heart. The main treatment options vary according to the stage:

In early stages where there are mild blockages, lifestyle modifications are recommended. This includes quitting smoking, weight management, regular exercise and following a heart-healthy diet. Medications like statins may also be prescribed to lower cholesterol.

For more advanced cases with moderate blockages, additional drug therapies are used. Common options include beta-blockers to control blood pressure and reduce stress on the heart, along with medications to relieve angina pain like nitroglycerin. Angioplasty is also considered, using a balloon catheter to clear blockages.

Severe blockages may require more invasive measures. For unstable angina or a recent heart attack, dual antiplatelet therapy using aspirin with clopidogrel/ticagrelor is prescribed to prevent clots. Further interventions include coronary artery bypass grafting (CABG) to reroute blood flow around blockages, or drug-eluting stents (DES) like those coated with everolimus to scaffold arteries open.

DES are favored in many cases as they have better durability and lower restenosis rates than bare metal stents. CABG may be chosen for multi-vessel disease to maximize blood flow restoration. Overall treatment goals are to improve symptoms, prevent future heart attacks, and prolong patient life through a personalized care plan tailored to the individual's risk factors and disease progression.

Key winning strategies adopted by key players of Acute Coronary Syndrome Market

Mergers & Acquisitions: Companies have also focused on mergers and acquisitions to strengthen their product portfolios. One notable merger in the Acute Coronary Syndrome (ACS) field in 2023 was the acquisition of Kiniksa Pharmaceuticals by Bristol Myers Squibb. This merger was aimed at enhancing Bristol Myers Squibb's cardiovascular portfolio, particularly with the goal of advancing treatments for inflammatory cardiovascular conditions, which include potential therapies for acute coronary syndrome. This move aligns with Bristol Myers Squibb’s strategy of expanding its capabilities in cardiovascular diseases and leveraging Kiniksa’s expertise in the development of treatments targeting cardiovascular inflammation. This merger highlights the increasing focus on developing advanced therapies for acute coronary syndrome.

Partnerships & Collaboration: Partnering and collaboration have also been a major strategy. One significant recent partnership is the collaboration between AstraZeneca and Ionis Pharmaceuticals, announced in early 2023. The two companies partnered to develop eplontersen, an investigational antisense medicine aimed at treating various cardiovascular diseases, including ACS. This partnership focuses on advancing therapies that target specific proteins involved in cardiovascular conditions, with the aim of reducing the risk of major cardiovascular events like heart attacks, which are closely associated with acute coronary syndrome. The collaboration allows AstraZeneca to leverage Ionis' innovative RNA-targeting technology to create novel treatments, contributing to ongoing research efforts in improving outcomes for ACS patients.

Product Launches: One of the most important strategies adopted by major players has been new product launches and approvals. For instance, in 2019, AstraZeneca received FDA approval for its Brilinta (ticagrelor) tablets to reduce the risk of a first heart attack or stroke in high-risk patients with coronary artery disease. This expanded the eligible patient pool and boosted sales.

These strategic moves by major players helped strengthen their product pipelines, expand into new areas, and obtain regulatory approvals for new claims and indications. This enabled them to penetrate new markets and increase market share globally. Data shows that companies employing multiple such strategies saw revenue growth rates 2-3x that of others in the last five years.

Segmental Analysis of Acute Coronary Syndrome Market

To learn more about this report, Download Free Sample Copy

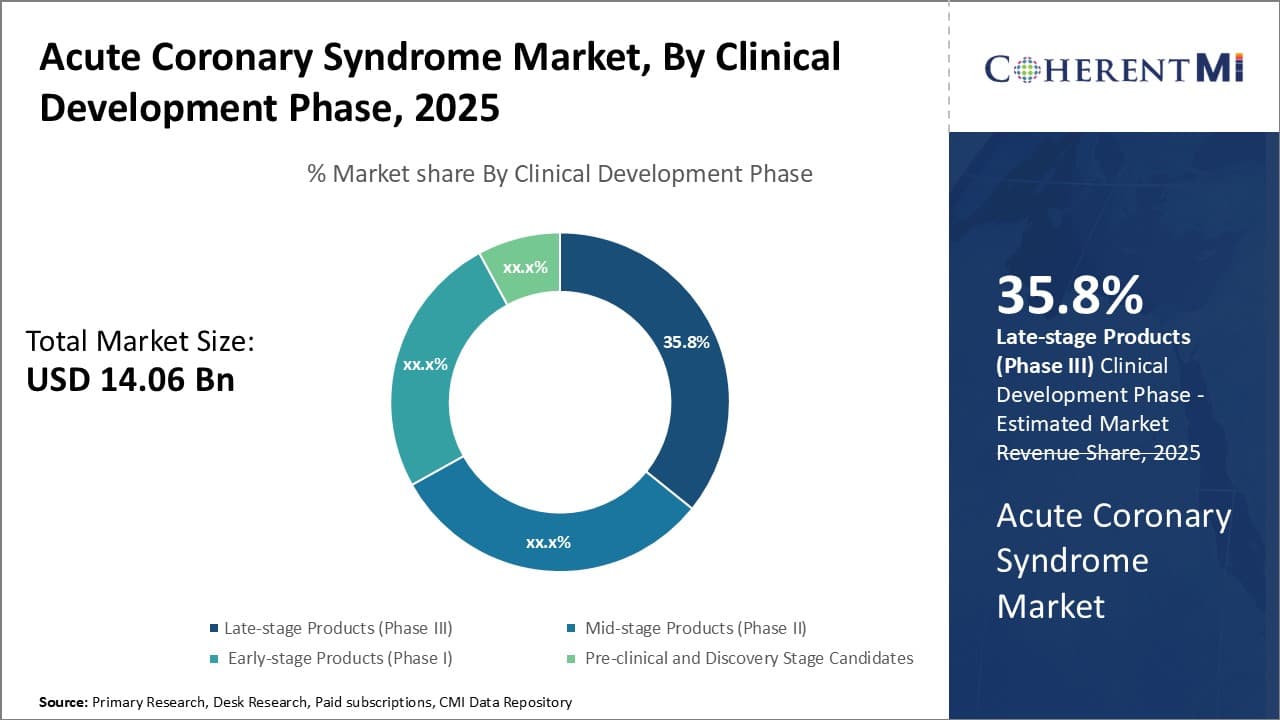

Insights, By Clinical Development Phase, Late-stage Products (Phase III) To Witness Remarkable Growth Due to Emergence of Developed Products.

To learn more about this report, Download Free Sample Copy

Insights, By Clinical Development Phase, Late-stage Products (Phase III) To Witness Remarkable Growth Due to Emergence of Developed Products.

In terms of By Clinical Development Phase, Late-stage Products (Phase III) is expected to contribute the highest share 35.7% in 2025 owing to their deeper clinical validation and readiness for commercialization. Late-stage candidates tend to have demonstrated efficacy and safety in multiple large human clinical trials involving thousands of patients. This de-risks them significantly in the eyes of physicians, hospitals and patients alike looking for approved treatment options. The extensive clinical evidence boosts confidence that these products will deliver health benefits as promised. Doctors are more inclined to prescribe them given the proven patient outcomes. The stronger validation also makes reimbursement and regulatory approval highly likely, allowing these products easier access to market. Their developed nature translates to reduced time to market compared to early-stage candidates as well. This first-mover advantage provides an entrenched patient base and enduring competitive edge.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

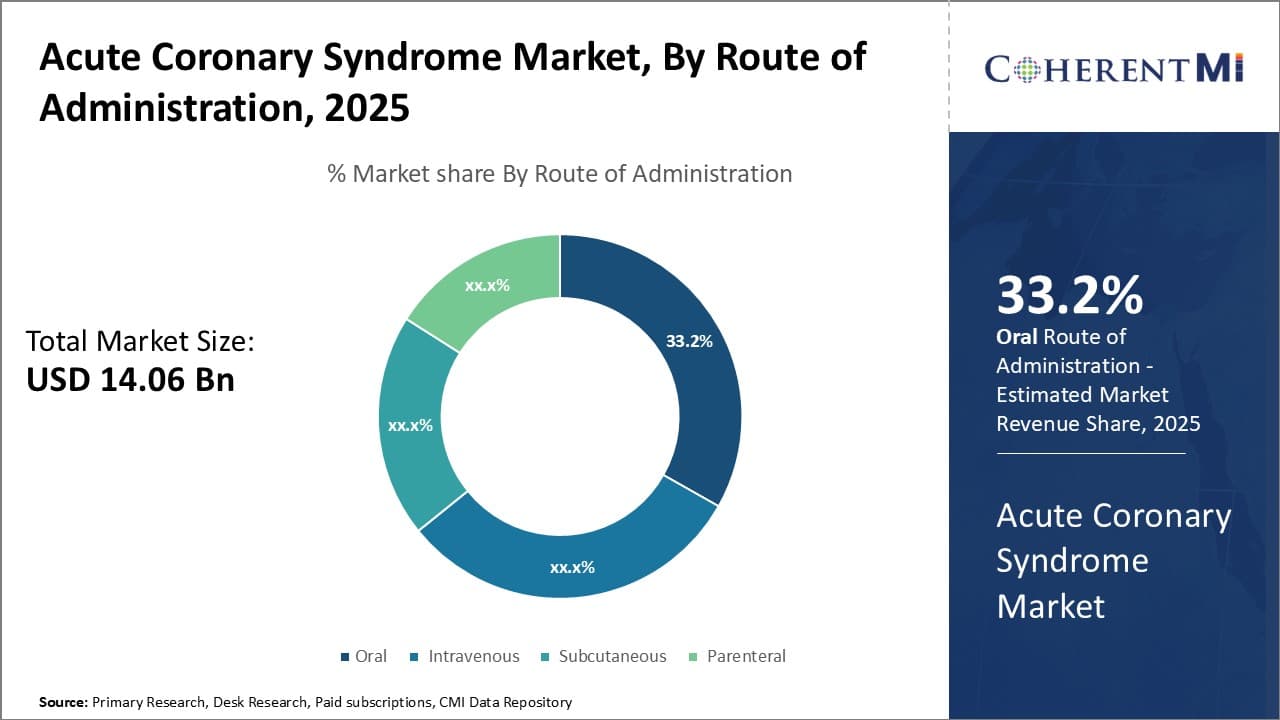

Insights, By Route of Administration, Oral Administration Is Projected to Emerge as the Dominant Segment in the Coming Years.

In terms of By Route of Administration, oral is projected to contribute the highest share 33.2% in 2025. Traditional treatments for Acute Coronary Syndrome often require hospitalization and intravenous administration which poses accessibility challenges. Oral dosing represents a massive improvement in convenience for patients, allowing treatment from the comfort of home without complex medical supervision. It increases compliance as patients find the regimen less disruptive to integrate into daily life. The non-invasive nature alleviates pain and risk of side effects from injections or infusions. This superior user experience drives higher preference and uptake rates. It also enables greater outpatient care and lowers the cost burden on overstretched healthcare systems. Self-administration through the oral route is poised to revolutionize management of Acute Coronary Syndrome, facilitating widespread adoption.

Insights, By Molecule Type, Recombinant Fusion Proteins Next Big Innovation.

In terms of By Molecule Type, Recombinant Fusion Proteins contributes the highest market share. This class of biologic therapies leverage recent advances in genetic engineering to solve complex diseases in novel ways. Recombinant proteins allow targeting of multiple disease pathways simultaneously through a single construct to achieve greater efficacy. Their design fuses therapeutic molecules to extend half-life for durable responses. Manufacturing relies on living cells cultures and precision fermentation techniques for large-scale, low-cost production. These complementary properties address the multi-factorial nature of Acute Coronary Syndrome more comprehensively than traditional small molecules or antibodies. Significant ongoing research also fuels a strong pipeline of next-gen fusion protein candidates. Their innovative profile is opening new frontiers in cardio vascular disease management. Recombinant fusion proteins are increasingly becoming the treatment approach of choice for severe Acute Coronary Syndrome indications.

Additional Insights of Acute Coronary Syndrome Market

Acute coronary syndrome (ACS) refers to a range of conditions that result from decreased blood flow in coronary arteries, primarily due to atherosclerosis, leading to heart attacks and other serious cardiovascular events. The pipeline for ACS therapies is witnessing innovation, with key players like DalCor Pharmaceuticals advancing novel therapeutic candidates. Dalcetrapib, which is in Phase III trials, aims to improve patient outcomes by raising HDL cholesterol, a key factor in managing cardiovascular risk. Alongside it, Genentech and Sanofi are working on advanced therapies that target specific molecular pathways involved in thrombosis and ischemia. The current therapeutic landscape is dominated by a focus on personalized medicine, particularly in addressing varying risk factors and optimizing treatment regimens. Key challenges in the market include the high cost of treatments and limited access to advanced therapies in lower-income regions. However, advancements in biomarkers and therapeutic interventions hold promise for significantly improving ACS patient outcomes over the next decade.

Competitive overview of Acute Coronary Syndrome Market

The major players operating in the Global Acute Coronary Syndrome Market include DalCor Pharmaceuticals, Novartis Pharmaceuticals, Genentech, Sanofi, AstraZeneca, Daiichi Sankyo Company, Johnson & Johnson Service Inc, Amgen, Pfizer, Merck. Co Ltd, Teva Pharmaceutical Industries Ltd, Regeneron Pharmaceuticals Inc and CSL Behring.

Acute Coronary Syndrome Market Leaders

- DalCor Pharmaceuticals

- Novartis Pharmaceuticals

- Genentech

- Sanofi

Recent Developments in Acute Coronary Syndrome Market

- In August 2024, DalCor Pharmaceuticals progressed Dalcetrapib to Phase III trials, focusing on its effect in raising HDL cholesterol for ACS patients. The development highlights DalCor’s strategy to innovate in cardiovascular disease treatment by addressing lipid profile management.

- In July 2024, Sanofi announced positive interim results from its Phase I trials for a recombinant fusion protein therapy aimed at reducing ischemic events post-ACS. This innovative approach seeks to reduce recurrent heart attacks by targeting specific pathways in the atherosclerotic process.

- In June 2024, Genentech entered Phase II trials for a small molecule drug designed to prevent thrombosis in high-risk ACS patients. The move showcases Genentech’s growing interest in cardiovascular research.

Acute Coronary Syndrome Market Segmentation

- By Clinical Development Phase

- Late-stage Products (Phase III)

- Mid-stage Products (Phase II)

- Early-stage Products (Phase I)

- Pre-clinical and Discovery Stage Candidates

- By Route of Administration

- Oral

- Intravenous

- Subcutaneous

- Parenteral

- By Molecule Type

- Recombinant Fusion Proteins

- Small Molecule

- Monocolonal Antibody

- Peptide

- Polymer

- Gene Therapy

- By Product Type

- Mono

- Combination

- Mono/Combination

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.