Advanced Cancer Pain Management Market Size - Analysis

The Advanced Cancer Pain Management market is expected to grow steadily over the forecast period owing to rising incidences of cancer and increasing adoption of advanced pain therapies. The market is witnessing introduction of novel drug delivery methods and combination therapies that help provide better pain relief with lesser side effects. Moreover, increased awareness among patients, healthcare providers as well as government support are also expected to boost the demand for effective pain management in advanced cancer treatment.

Market Size in USD Bn

CAGR5.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.8% |

| Market Concentration | High |

| Major Players | Tetra Bio-Pharma, Medlab Clinical Ltd, GW Pharmaceuticals, Pharmascience Inc., PharmaCielo and Among Others |

please let us know !

Advanced Cancer Pain Management Market Trends

As the prevalence of advanced stage cancers continues to rise across major regions of the world, the need for effective pain management options has become increasingly important. Various statistics indicate that globally, cancer incidence and related mortality have been growing at an alarming pace over the past few decades. According to estimates by health experts, there will be a significant rise in the number of new cancer cases every year until 2030. A bulk of these new cases are expected to be diagnosed at later or advanced stages when the disease has often already metastasized.

Scientists have long been investigating the therapeutic potential of cannabinoids, the active chemical components in cannabis, for pain management. This interest has spiked in recent years following the legalization of medical marijuana in many regions across the globe. A notable area of focus has been on developing cannabinoid-based treatments for cancer pain which has proven very difficult to control using conventional analgesics alone. Various technological advancements are now allowing researchers to better understand the binding mechanisms of specific phytocannabinoids to endogenous cannabinoid receptors in the body as well as their downstream signaling effects.

Market Challenge - High Costs and Regulatory Hurdles Associated with the Development of Advanced Cancer Pain Management Drugs.

An emerging opportunity lies in the growing acceptance and exploration of alternative approaches to treating advanced cancer pain that avoid the dangers of opioid addiction and side effects. Cannabinoids derived from marijuana, namely THC and CBD, are demonstrating potential as natural remedies. Studies show they may help reduce pain, nausea and other symptoms. Their non-addictive nature relative to opioids also alleviates risks. More clinical evidence on dosage and formulations is needed, but research interest is rising given the demand for non-opioid options. In parallel, non-opioid pharmacological therapies are in development. These include lidocaine patches, antidepressants, and nerve blockers that relieve pain via non-opioid mechanisms. As understanding of cancer pain pathophysiology expands, more targeted non-opioid treatments may be identified. With greater societal support for medical cannabis and focus on the opioid crisis, cannabinoids and complementary non-narcotic therapies represent a largely untapped market segment. Growth looks promising as awareness of these alternative spreads within oncology and palliative care provider circles and cancer patients seek solutions beyond conventional opioids. Both pharmaceutical companies and cannabis product firms see gains to be made by establishing innovative offerings in this burgeoning niche.

Prescribers preferences of Advanced Cancer Pain Management Market

For late-stage cancers, treatment follows several lines as the disease progresses and adapts. For first-line treatment of metastatic cancers, chemotherapy remains standard due to favorable risk-benefit ratios. Combination regimens including platinum drugs like carboplatin (Paraplatin) paired with taxanes like paclitaxel (Taxol) are commonly prescribed.

For patients progressing on immunotherapy or with tumor types less amenable, targeted therapies offer an alternative second-line approach if specific mutations are present. For example, osimertinib (Tagrisso) is prescribed for EGFR+ non-small cell lung cancer after earlier EGFR inhibitors fail.

Overall treatment costs also exert influence, especially in the community setting where out-of-pocket costs impact patient access and adherence. This drives physicians to carefully assess therapeutic value at each line of therapy.

Treatment Option Analysis of Advanced Cancer Pain Management Market

Advanced cancer refers to cancer that has spread beyond the original site to other parts of the body. Treatment depends on the type and stage of cancer, as well as the patient's overall health and preferences. For many advanced solid tumor cancers, the standard of care involves chemotherapy.

For cancers still progressing on second-line therapy, third-line options are limited and often involve clinical trials of newer regimens or drugs. Immunotherapy has also emerged as an important treatment approach, with checkpoint inhibitors like nivolumab, pembrolizumab and atezolizumab approved for various tumor types. These are generally used after chemotherapy fails due to their favorable side effect profile. For select tumor mutations, targeted therapies blocking specific cancer-driving genes are also options when available. aggressive tumor removal surgery or radiation therapy may provide local control and improve quality of life when appropriate.

Key winning strategies adopted by key players of Advanced Cancer Pain Management Market

Product Innovation: Pain therapies and technologies for cancer pain management are rapidly evolving. One of the most effective strategies adopted by leading players has been continuous investment and focus on R&D to develop novel and more effective products.

Targeted Marketing Strategies: Given the heterogeneity of cancer pain and the need for customized treatments, players have launched aggressive promotion efforts towards both patients and physicians. They conduct extensive market research to understand specialty groups and tailor educational campaigns accordingly.

Segmental Analysis of Advanced Cancer Pain Management Market

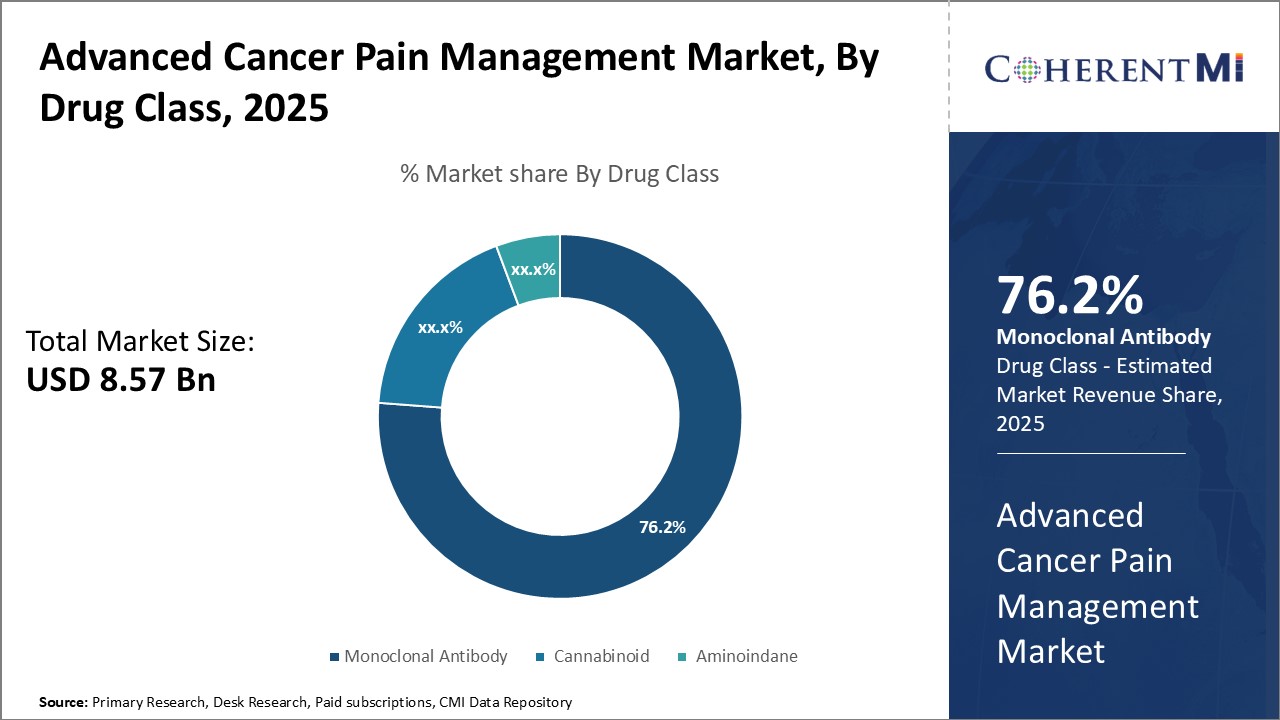

Insights, By Drug Class, Advanced Treatment Options Drive Monoclonal Antibody Dominance.

Compared to other drug classes like opioids which provide broad systemic pain relief but carry significant safety risks, monoclonal antibodies offer a more targeted approach of blocking pain signals directly at their source. This superior mechanism of action has resulted in monoclonal antibodies demonstrating robust pain reduction in clinical trials with fewer side effects than alternative options. Their development has also been driven by the need for more durable and advanced therapies to manage cancer pain as patients live longer with metastatic disease.

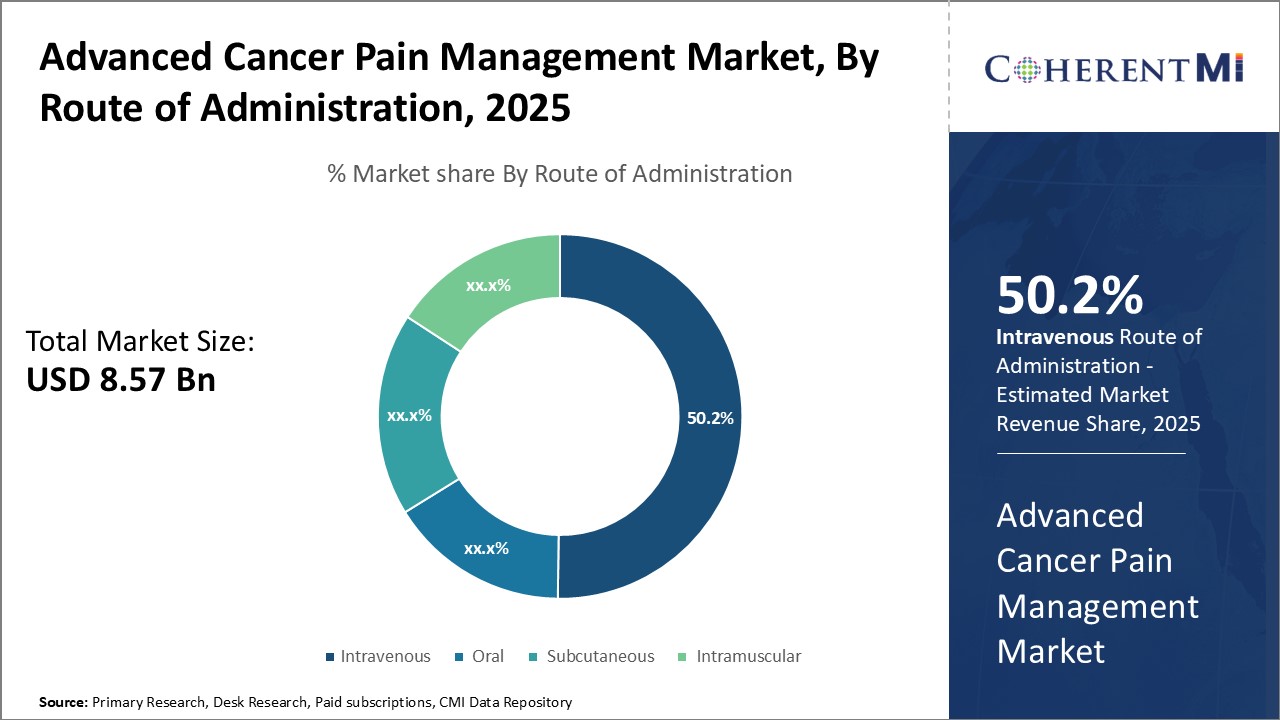

Insights, By Route of Administration, Increasing Administration Options Fuel Intravenous Segment Dominance.

Insights, By Route of Administration, Increasing Administration Options Fuel Intravenous Segment Dominance.By route of administration, intravenous is expected to contribute 50.2% share in 2025 owing to advantages over other administration routes. While oral administration provides patient convenience, many cancer pain therapies have poor oral bioavailability or require high doses to achieve therapeutic levels systemically. This can lead to inconsistent absorption and side effects from high drug levels in the liver and gastrointestinal tract.

Furthermore, many patients with advanced cancer experience issues like nausea, vomiting or difficulty swallowing that limit oral intake as the disease progresses. The intravenous route circumvents these problems and ensures medications are delivered effectively regardless of performance status. Self-administered options like subcutaneous or intramuscular injections also require stable physical and mental conditions. Thus, for critically ill cancer patients with severe pain, intravenous therapy remains the gold standard administration method.

Insights, By Distribution Channel, Prevalence of Hospital Based Care Boosts Hospital Pharmacies Segment.

During active treatment phases involving complex regimens and frequent monitoring, most cancer pain medications are also initiated and titrated under medical supervision in hospitals. This allows for closer observation of patients for adverse reactions or complications from high-risk drugs like opioids. It also guarantees consistent supply of medications tailored to rapidly changing care plans as a patient’s condition and pain levels fluctuate through therapy.

With the majority of cancer management still centered around hospitals, it follows that hospital pharmacies would dominate the distribution of affiliated pain management drugs. Their integration within healthcare systems allows for seamless fulfilment of prescriptions compared to external retail sources. This positions hospital pharmacies as the core supply channel for the Advanced Cancer Pain Management market.

Additional Insights of Advanced Cancer Pain Management Market

Advanced cancer pain management remains a critical area of need in oncology care. Patients with advanced cancer often experience severe pain that can affect their quality of life and adherence to treatment. Traditional pain management approaches, such as opioids, while effective, pose significant risks, including addiction and adverse side effects. The emerging pipeline of drugs, such as Tetra Bio-Pharma's QIXLEEF and Medlab Clinical Ltd's NanaBis, represents a shift towards cannabinoid-based therapies that offer potential benefits with fewer risks compared to opioids. These cannabinoid-derived drugs target specific pain pathways and offer a natural alternative for patients suffering from uncontrolled cancer pain. Additionally, ongoing collaborations between pharmaceutical companies, such as the partnership between Medlab Clinical Ltd and Pharmascience Inc., are expected to enhance the availability of these innovative treatments globally. The future of advanced cancer pain management is likely to focus on personalized, non-opioid treatments that improve both pain relief and patient outcomes.

Competitive overview of Advanced Cancer Pain Management Market

The major players operating in the Advanced Cancer Pain Management Market include Tetra Bio-Pharma, Medlab Clinical Ltd, GW Pharmaceuticals, Pharmascience Inc., PharmaCielo, Tilray Pharmaceuticals, WEX Pharmaceuticals, Pfizer, eurofins, Sigma-Aldrich, GSK plc and Recipharm.

Advanced Cancer Pain Management Market Leaders

- Tetra Bio-Pharma

- Medlab Clinical Ltd

- GW Pharmaceuticals

- Pharmascience Inc.

- PharmaCielo

Advanced Cancer Pain Management Market - Competitive Rivalry

Advanced Cancer Pain Management Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Advanced Cancer Pain Management Market

- In May 2024, Tetra Bio-Pharma advanced its QIXLEEF drug to Phase II trials, targeting cannabinoid-based pain relief for advanced cancer patients. The drug aims to provide a non-opioid option for pain management and improve quality of life for patients.

- In March 2024, Medlab Clinical Ltd partnered with Pharmascience Inc. to further develop and distribute its NanaBis drug globally, expanding access to non-opioid treatments for advanced cancer pain management.

Advanced Cancer Pain Management Market Segmentation

- By Drug Class

- Monoclonal Antibody

- Cannabinoid

- Aminoindane

- By Route of Administration

- Intravenous

- Oral

- Subcutaneous

- Intramuscular

- By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How Big is the Advanced Cancer Pain Management Market?

The Global Advanced Cancer Pain Management Market is estimated to be valued at USD 8.57 Bn in 2025 and is expected to reach USD 12.72 Bn by 2032.

What will be the CAGR of the Advanced Cancer Pain Management Market?

The CAGR of the Advanced Cancer Pain Management Market is projected to be 5.6% from 2024 to 2031.

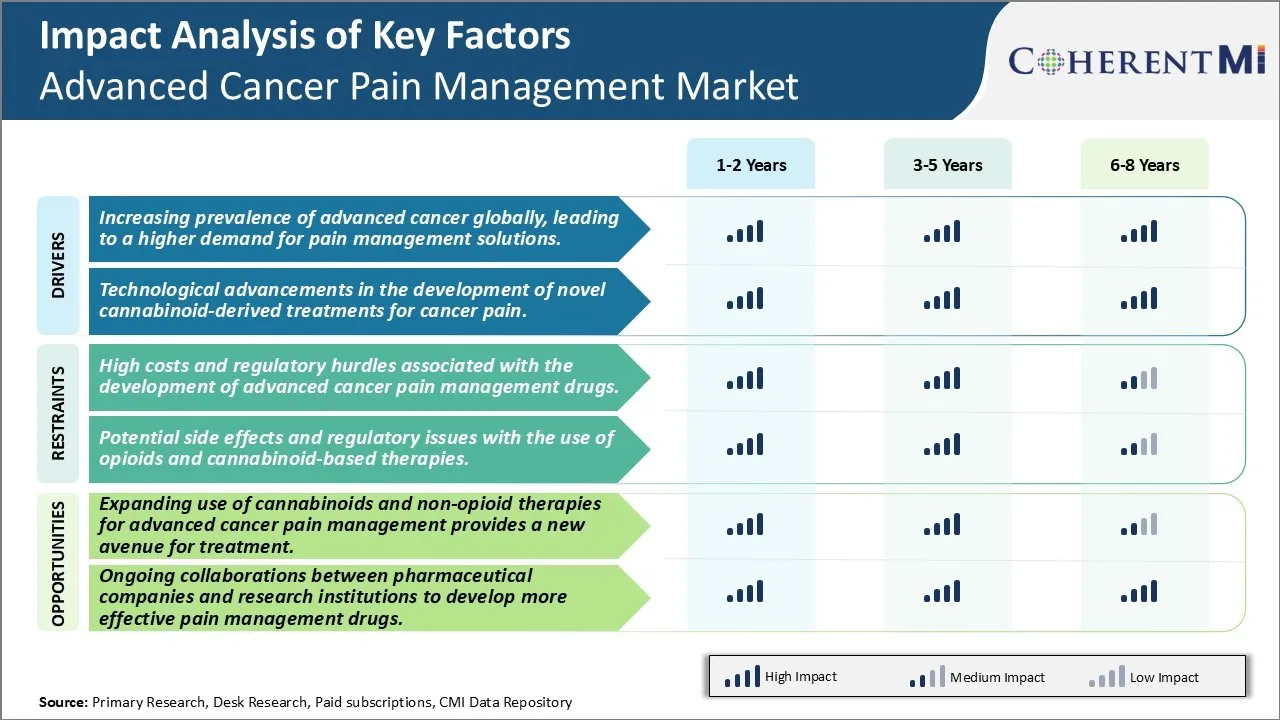

What are the major factors driving the Advanced Cancer Pain Management Market growth?

The increasing prevalence of advanced cancer globally, leading to a higher demand for pain management solutions and technological advancements in the development of novel cannabinoid-derived treatments for cancer pain. These are the major factors driving the Advanced Cancer Pain Management Market.

What are the key factors hampering the growth of the Advanced Cancer Pain Management Market?

The high costs and regulatory hurdles associated with the development of advanced cancer pain management drugs and potential side effects and regulatory issues with the use of opioids and cannabinoid-based therapies. These are the major factors hampering the growth of the Advanced Cancer Pain Management Market.

Which is the leading Drug Class in the Advanced Cancer Pain Management Market?

Monoclonal Antibody is the leading Drug Class segment.

Which are the major players operating in the Advanced Cancer Pain Management Market?

Tetra Bio-Pharma, Medlab Clinical Ltd, GW Pharmaceuticals, Pharmascience Inc., PharmaCielo, Tilray Pharmaceuticals, WEX Pharmaceuticals, Pfizer, eurofins, Sigma-Aldrich, GSK plc, Recipharm are the major players.