Animal Feed Market Trends

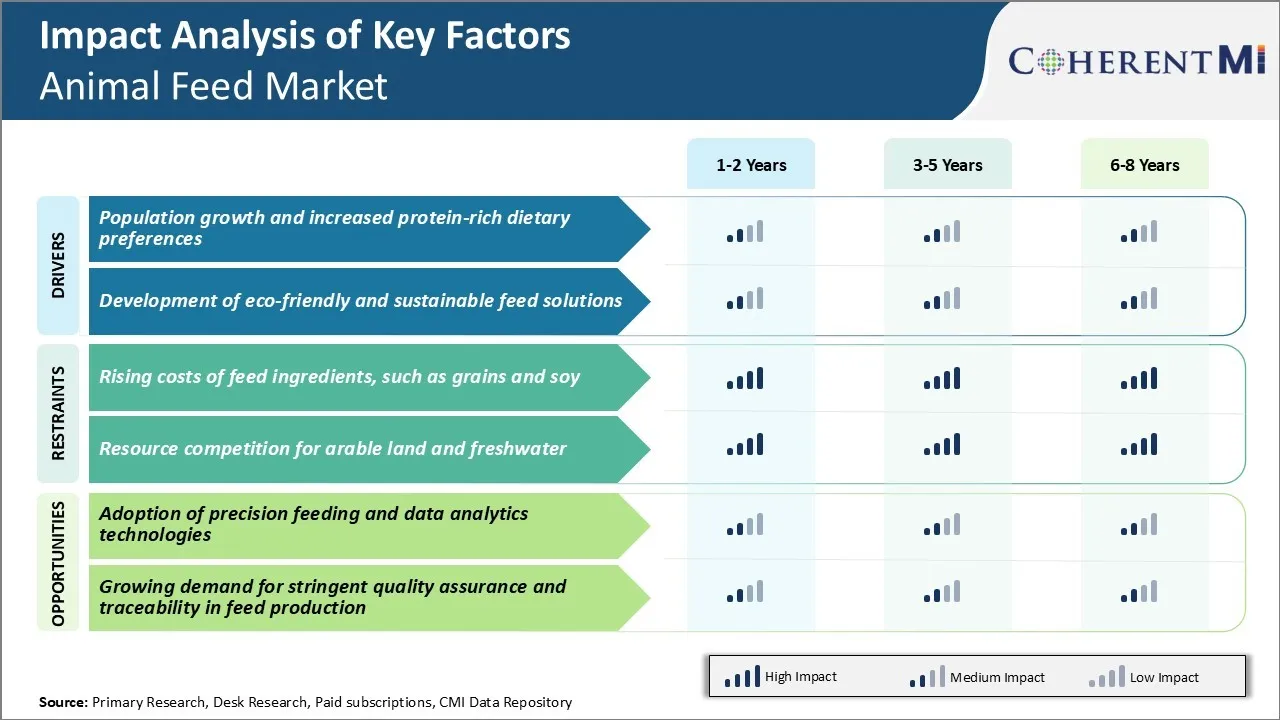

Market Driver - Population Growth and Increased Protein-Rich Dietary Preferences

Over 7 billion people now inhabit the planet and estimates suggesting there may be close to 10 billion people by 2050. Thereby, overall demand for food and nutrition has also swelled dramatically. While various plant-based options provide viable sources of protein, cultural preferences in many developing regions still favor animal meat products in their diets. This represents a massive untapped market potential for feed producers to help meet the nutritional needs.

As economies grow and personal incomes rise across middle and developing markets, consumers are able to diversify their diets beyond basic carbohydrate needs. Protein intake becomes a priority, with animal foods like meat, poultry, fish, eggs and dairy serving as preferred choices. Social trends also play a role where animal protein is seen as a symbol of status and wealth. When supplemented by shifting preferences towards animal proteins, it magnifies the imperative for the global animal feed market.

Market Driver - Development of Eco-Friendly and Sustainable Feed Solutions

There is increasing pressure on players in the feed industry to adopt greener practices and develop innovative solutions that are environmentally sustainable. With agricultural activities and intensive livestock production facing scrutiny for their carbon footprint and emissions levels, feed companies must proactively respond to these challenges. Those leveraging organic byproducts and waste streams through closed-loop systems also align with circular economy goals.

Government regulations in major regions are also incentivizing feed formulations with reduced environmental impact. Subsidies and initiatives exist to promote feedstocks like insects and algae that offer planetary benefits like mitigating greenhouse gases. Consumers too are educating themselves and willing to pay premiums for brands demonstrating sustainability commitments through their supply chain practices and solutions.

This emerging market dynamic compels animal feed manufacturers to invest heavily in research capacity driving product innovation. Those delivering nutritious options with verifiably lighter resource usage will gain competitive edge. Overall, sustainability presents a driver not just due to compliance needs but also growing commercial opportunities for companies cognizant of these societal and industry shifts.

Market Challenge - Rising Costs of Feed Ingredients, such as Grains and Soy

The animal feed market is facing significant challenges due to the rising costs of key feed ingredients such as grains and soy. Globally, the prices of corn and soybeans have risen substantially in the past year due to multiple factors. Adverse weather conditions like droughts in major producing regions have led to reduced harvests and lower supply.

Additionally, a large portion of corn and soybean production is being diverted for uses other than feed, such as biofuel production. This has further tightened availability for the animal feed market. The rising feed ingredient costs have squeezed profits for feed producers and livestock farmers. With commodity prices expected to remain volatile, it is challenging for players across the supply chain to plan budgets and pass on higher costs to consumers.

Unpredictable input price fluctuations also make long-term strategic planning difficult. Overall, escalating feed input costs pose a major threat to the profitability and stability of the global animal feed market.

Market Opportunity - Adoption of Precision Feeding and Data Analytics Technologies

The animal feed market is seeing growing opportunities from the adoption of advanced technologies that help improve production efficiency. Livestock farmers and feed producers are increasingly using precision feeding solutions and data analytics to optimize feed usage and animal performance. Precision feeding involves tailoring feed rations based on the unique nutritional needs of different groups of animals. This entails detailed nutritional profiling and adjusting ingredient compositions.

Meanwhile, data analytics technologies are enabling real-time monitoring of herd health, consumption patterns and growth rates. By leveraging sensors, IoT and cloud computing, players can collect vast amounts of farm data. Advanced data models then provide actionable insights into fine-tuning feeding programs. Going forward, the continued uptake of precision feeding and data analytics presents major opportunities for innovative solution providers in the animal feed market to grow revenues.