The at home testing kits market is estimated to be valued at USD 21.71 Bn in 2025 and is expected to reach USD 33.52 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032. Convenience and ability to test from the comfort of one's home is driving more consumers to opt for at home testing kits over visiting diagnostic centers or laboratories. Rising awareness about early disease detection and preventive healthcare is further contributing to the growth of this market.

The at home testing kits market is expected to experience positive trends over the forecast period. Factors such as the COVID-19 pandemic, increasing preference for self-monitoring among consumers and an aging population susceptible to chronic diseases will drive demand. Furthermore, technological advancements enabling tests that were traditionally administered by professionals to now be performed using diagnostic kits at home, will support the market's growth during this time.

Market Size in USD Bn

CAGR6.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.4% |

| Market Concentration | High |

| Major Players | ACON Laboratories, AdvaCare Pharma USA, Apex Biotechnology, i-SENS, Oak Tree Health and Among Others |

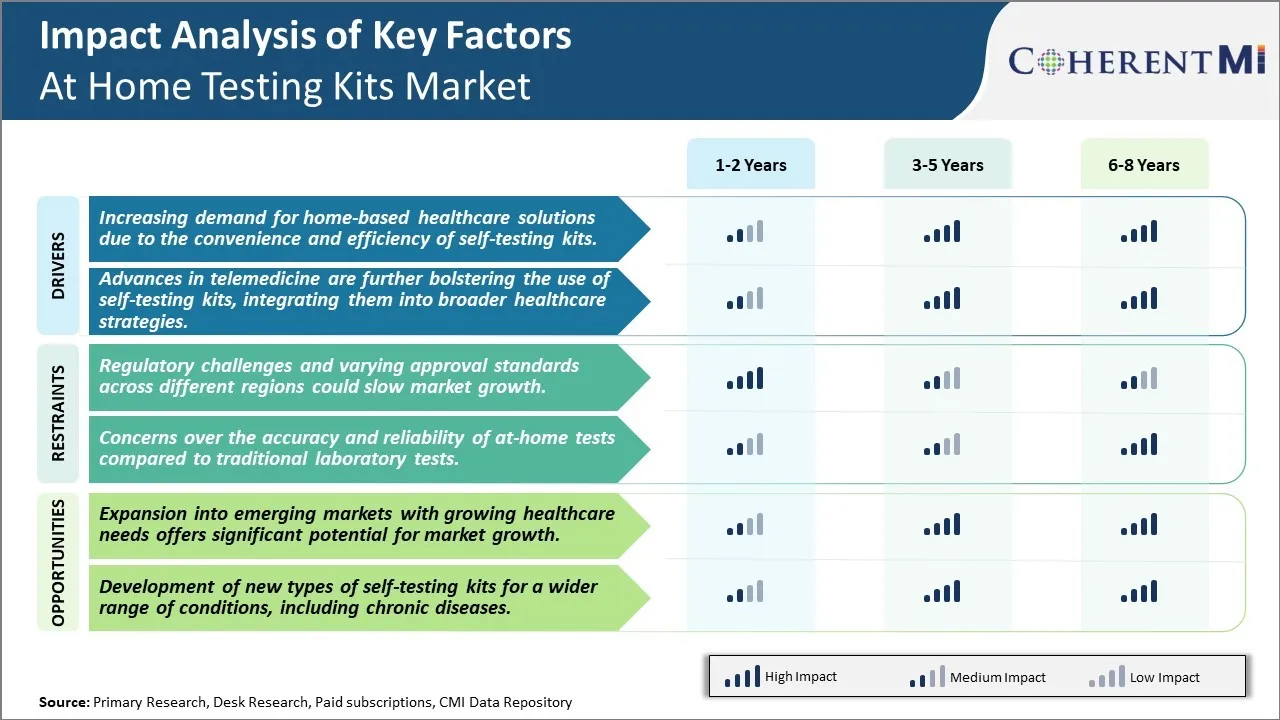

Market Driver - Increasing demand for home-based healthcare solutions due to the convenience and efficiency of self-testing kits

The hectic lifestyles that most people lead in modern times leaves little time to visit healthcare facilities for basic health checks or medical tests. Waiting at clinics and laboratories often means having to take time off from work or adjust other schedules, which is very inconvenient. Furthermore, visiting medical facilities exposes people to the risk of contracting infections. As a result, there has been a rising demand for convenient healthcare solutions that can be availed from the comfort of one's home.

At-home testing kits have emerged as a very practical option to fulfill this increasing need for easy and comfortable healthcare access. These self-testing kits allow people to monitor their health and perform basic diagnostic tests with minimal effort from the privacy of their homes. A variety of parameters can be checked including blood glucose, pregnancy, ovulation, UTI etc. The testing procedure is simple to follow with detailed instructions provided. Results are available within 15-30 minutes in most cases, allowing people to take prompt action if needed.

The added benefits of saving travel time and avoid exposure to germs in clinics further contributes to the popularity of at-home testing. Busy individuals struggling to schedule appointments can integrate self-testing into their routines quite seamlessly. Employers and corporations are also promoting workplace wellness through distribution of at-home healthcare products. With remote work becoming more common, the dependence on virtual doctor consultations and home sample collection is slated to rise substantially.

Market Driver - Integrating at-home testing kits into advanced telemedicine strategies

Technological advancements have massively disrupted the healthcare industry in recent years. Telemedicine in particular has emerged as a revolutionary concept that can address issues of limited access, rising costs and stretch resources. Video calls and remote monitoring solutions enable doctors to evaluate and assist patients virtually without the need for an in-person visit. When paired with self-testing kits, telemedicine has the potential to transform preventive and chronic care.

At-home testing provides objective health data that patients can easily share with doctors online. This integration of diagnostics sampling and virtual consultations facilitates continuous tracking of health parameters without frequent visits. For example, diabetics can monitor blood sugar from home and discuss readings with endocrinologists over video calls. Expecting mothers can test samples and get guidance from ob-gyns regarding pregnancy progress and any concerns. Telehealth also supports medication management and post-hospitalization follow-ups quite effectively with assistance of self-testing.

As telemedicine models evolve further, at-home diagnostics are playing a central role by serving as the physical connection between virtual care and patients. Test results fuel discussion during tele-visits, leading to more informed diagnosis and treatment planning. The combination of remote consultations and self-sampling is poised to drastically reduce healthcare costs while enhancing outcomes and experience for users. With further optimization, this integration of telehealth and self-testing could reshape widespread chronic and preventive care delivery.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Regulatory challenges and varying approval standards across different regions could slow market growth

One of the key challenges facing the at home testing kits market is regulatory challenges and varying approval standards across different regions. At home testing kits are considered medical devices and need approval from regulatory bodies like the FDA in the US and other equivalent bodies in other countries before being allowed to be sold commercially. The process of getting these approvals is lengthy and involves clinical validation of the kit's performance. This ensures the tests are accurate and provide reliable results. However, the standards and requirements for approval can differ between countries and regions making it difficult for companies to get simultaneous approvals. Getting approved in Europe involves a different process than in Asia or Latin America for example. This fragmented regulatory landscape means companies have to navigate different dossiers, clinical trials and compliance norms to get their products certified in multiple markets. The need to tailor products, labels and documentation to individual market needs increases costs and complexity. It also introduces delays in entering new markets which could slow the overall growth pace of this industry globally. Standardizing regulatory frameworks or having mutual recognition of certain approvals between countries could help streamline and accelerate market access.

Market Opportunity - Expansion into emerging markets

One major opportunity for growth in the at home testing kits market is the potential to expand into emerging markets. Several developing nations are experiencing rapid economic growth and improvements in socioeconomic conditions. This has led to a rise in healthcare awareness and need for affordable diagnostics among the public in these countries. At home testing kits offer a convenient and low-cost solution for self-testing of common health conditions like diabetes, heart disease risk factors, fertility etc from the comfort of one's home. Their ease of use and affordability makes them well-suited for emerging market consumers. Pregnancy and fertility also remain key focus areas where self-testing is gaining traction. By entering these markets early and tailoring affordable product portfolios, testing kit manufacturers can capitalize on rising spend capacities and tap into huge untapped customer pools. This presents significant potential for driving the next phase of market expansion and revenue growth globally.

One of the main strategies adopted by leaders like Everlywell and Anthropic has been focusing on convenience. Their kits allow users to self-administer tests like STD, COVID-19 etc from the comfort of their homes. This removes the barriers of visiting labs or clinics. Early leaders like Everlywell launched their at-home STD kits in 2015 eliminating the embarrassment or inconvenience of in-person testing.

Players are leveraging latest technologies to improve user experience. For example, Anthropic's COVID-19 test kits use AI-powered video review to guide users through sample collection. This improved experience has boosted their market share. In the past, test providers relied only on written/picture instructions which often led to inaccurate sampling. Anthropic's strategy of incorporating AI helped improve accuracy and drove repeat customers.

Leaders are launching new test categories continuously to address customer needs. For example, as COVID-19 testing gained prominence in 2020, major players like Labcorp and Quest expanded into at-home collection kits leveraging their lab infrastructure. Likewise, Everlywell recognized an opportunity in women's health and launched fertility, pregnancy, menopause etc tests. This expanded service portfolio strengthened their first-mover advantage.

Players are partnering with retailers, pharmacies and insurance providers for better reach. For example, Labcorp partners with Walmart, CVS and insurance majors to distribute and process their at-home COVID tests. Everlywell partners with companies to provide corporate wellness programs. These partnership strategies helped players scale nationally and gain recurring bulk orders.

To learn more about this report, Download Free Sample Copy

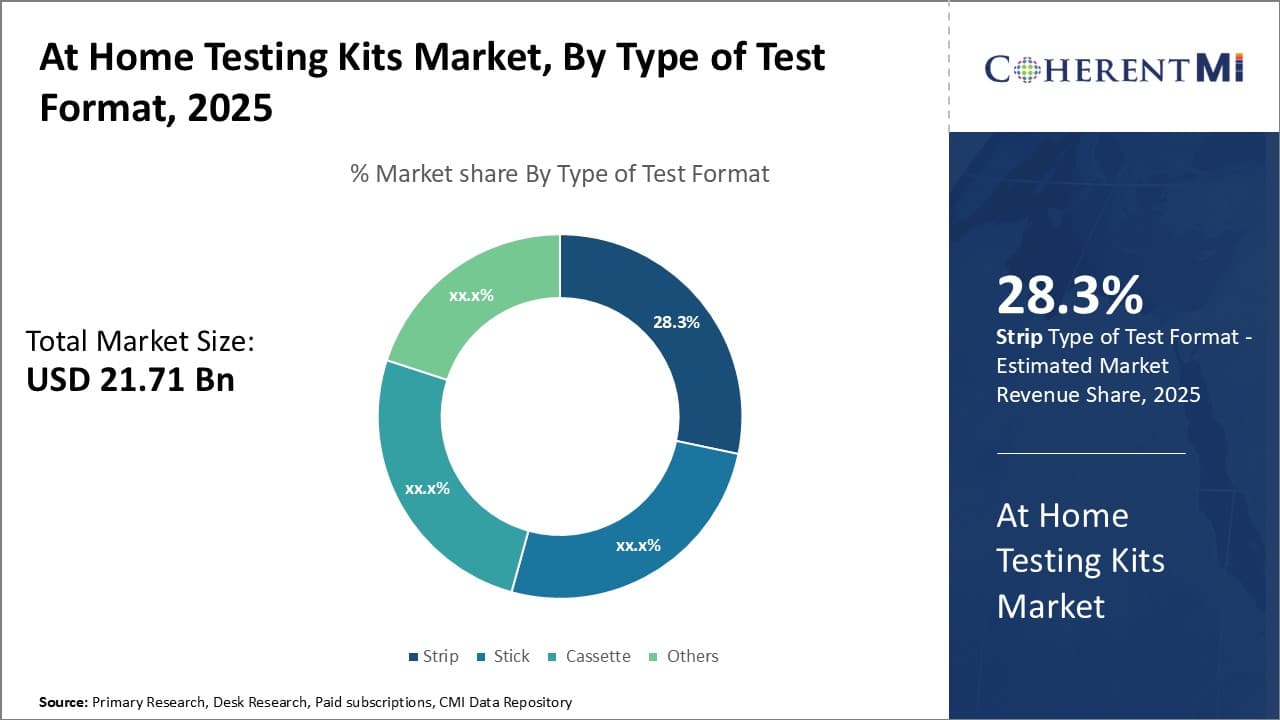

Insights, By Type of Test Format: Strip sub-segment dominates due to ease of use and accuracy

To learn more about this report, Download Free Sample Copy

Insights, By Type of Test Format: Strip sub-segment dominates due to ease of use and accuracy

The strip sub-segment contributes the largest share of 28.3% in the at-home testing kits market due to its ease of use and accuracy. Strips are very simple to administer, requiring users to only hold the strip in a urine or blood sample for a few seconds and then wait for results. This simple process makes strips entirely self-administrable with no training needed. Their conduciveness to quick self-testing empowers individuals to monitor their health conveniently in the privacy of their own home.

Strips' accuracy is also a major factor in their dominance. Modern strip technology can detect even trace amounts of targeted substances in samples through biochemical reactions between capture reagents on the strip and biomarkers in the fluid. Multiple control and test lines help ensure reliable results. Strips' consistency in delivering accurate readings gives users confidence in the health information provided. Whether for conditions like pregnancy, diabetes, or covid status, correct results are essential for informed next steps.

The compact, disposable nature of strips also gives them an advantage over other format types. Strips take up little storage space and produce minimal waste. Users face no hassle in disposing of used strips. This convenience leads to high compliance with manufacturers' recommended testing frequencies. Frequent, ongoing self-monitoring is important for managing many health issues, so strips remove barriers that could otherwise interfere with consistent tracking.

Consumers have come to trust the accuracy and simplicity that strips provide. As more people conduct healthcare monitoring independently, strips will likely remain the favored at-home testing solution due to their user-friendly qualities that maximize access to personal health insights.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

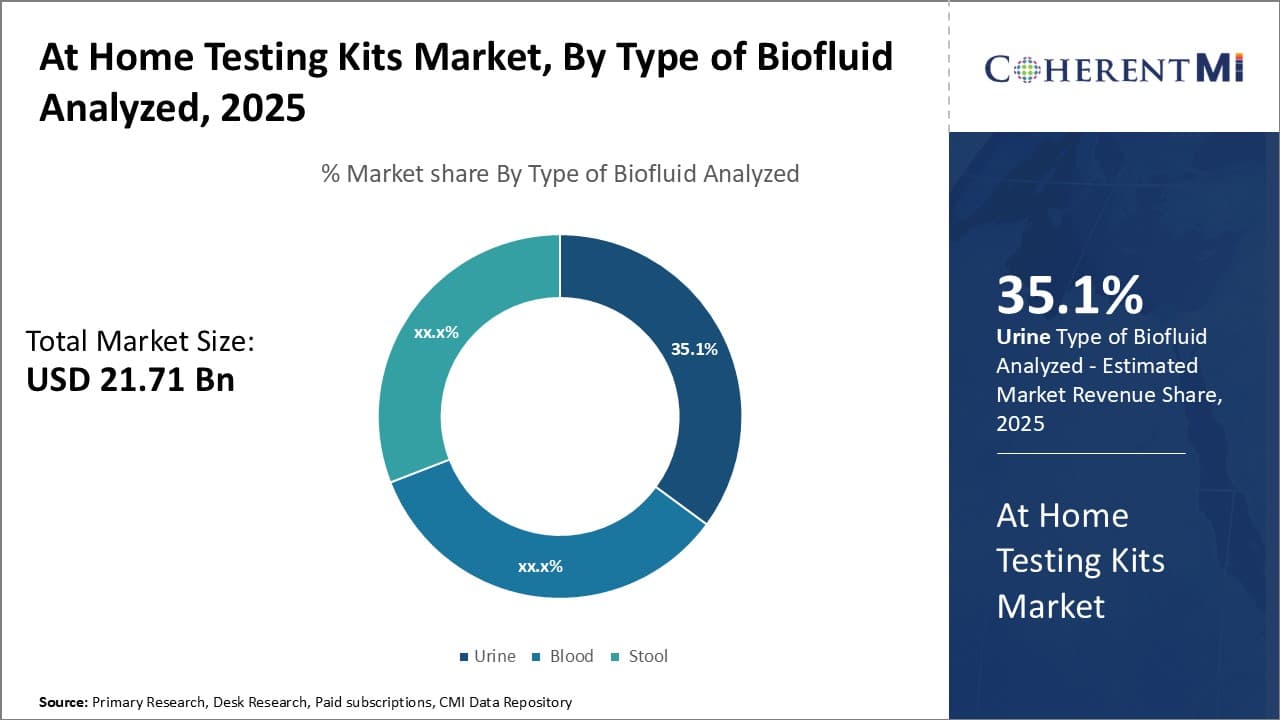

Insights, By Type of Biofluid Analyzed: Urine sub-segment dominates as the most common biofluid analyzed

Of the biofluids which can be analyzed with at-home testing kits - urine, blood, or stool - urine sub-segment contributes the highest market share of 35.1%. This is due to urine being easily accessible, non-invasive to collect, and information-rich for diagnostic purposes. Urine can be produced and collected safely and hygienically in the privacy of one's home, requiring no experience or medical training. Its painless provision avoids putting off potential users and increases compliance with routine testing plans.

Urine is also a practical biofluid because it conveys a variety of health data. Tests of urine electrolyte and metabolite levels can offer signs of conditions like diabetes and kidney disease. Urine pregnancy tests have become a relied-upon method for finding out about expected motherhood. Even markers of overall wellness like hydration and nutrition levels can be gleaned. Due to urine's ability to indicate multiple facets of one's condition without hassle, it remains the predominant analyzed fluid in at-home settings.

As self-monitoring continues growing in importance, urine is poised to retain its position as the go-to biofluid sample for personalized care. With non-invasiveness and rich diagnostic possibilities, urine hits the criteria for convenient, insightful home healthcare that more individuals will come to depend on for proactive health oversight. Its simple provision, straightforward sample collection, and communication of diverse condition alerts cement urine as the primary analyzed material within at-home testing kits.

The major players operating in the at home testing kits market include ACON Laboratories, AdvaCare Pharma USA, Apex Biotechnology, i-SENS, Oak Tree Health, TaiDoc Technology and VivaCheck Laboratories.

Would you like to explore the option of buying individual sections of this report?

Manisha Vibhute is a consultant with over 5 years of experience in market research and consulting. With a strong understanding of market dynamics, Manisha assists clients in developing effective market access strategies. She helps medical device companies navigate pricing, reimbursement, and regulatory pathways to ensure successful product launches.

At Home Testing Kits Market is segmented By Type of Test Format (Strip, Stick, Cassette, Others), By...

At Home Testing Kits Market

How big is the At Home Testing Kits Market?

The At Home Testing Kits Market is estimated to be valued at USD 21.71 in 2025 and is expected to reach USD 33.52 Billion by 2032.

What are the major factors driving the at home testing kits market growth?

The increasing demand for home-based healthcare solutions due to the convenience and efficiency of self-testing kits and advances in telemedicine are further bolstering the use of self-testing kits, integrating them into broader healthcare strategies are the major factors driving the at home testing kits market.

Which is the leading type of test format in the at home testing kits market?

The leading type of test format segment is strip.

Which are the major players operating in the at home testing kits market?

ACON Laboratories, AdvaCare Pharma USA, Apex Biotechnology, i-SENS, Oak Tree Health, TaiDoc Technology, and VivaCheck Laboratories are the major players.

What will be the CAGR of the at home testing kits market?

The CAGR of the at home testing kits market is projected to be 6.4% from 2025-2032.