Australia Automotive Aftermarket Market Trends

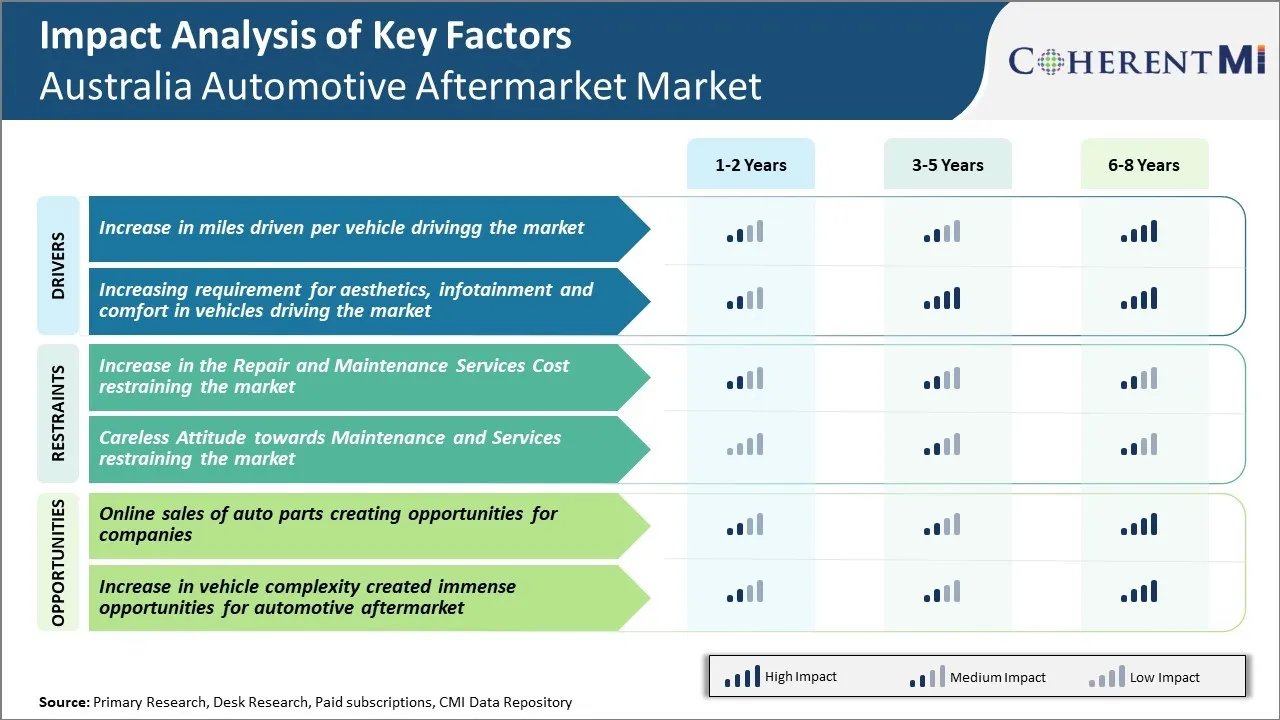

Drivers of the Market:

Increase in miles driven per vehicle driving the market

With more people living further away from their workplaces and social hubs due to housing affordability issues, average annual mileage travelled by vehicles has been steadily increasing in Australia over recent years. Vehicle owners are required to drive longer daily commutes which inevitably leads to faster wear and tear of components like tires, brake pads, belts and hoses. Moreover, a large section of the population in cities like Melbourne and Sydney regularly undertake long weekend drives to beaches and countryside areas outside city limits for relaxation. All of this has contributed to average Australian cars now averaging close to 20,000 km of driving annually compared to only 15,000 km around 5 years back.

This rise in annual usage is directly translating to more frequent replacement and repair needs. More miles mean faster degradation of consumable parts that need routine replacement like brake pads or shorter lifespan of components like timing belts that must be replaced at fixed interval of kilometers. Even for non-consumable parts, the cumulative effect of more distance covered is bringing forward their repair or replacement cycle. Shock absorbers and suspension bushes that may have lasted 8-10 years on average vehicles are now starting to fail in 6-7 years of city driving. Furthermore, with new car sales markedly declining since the late 2010s due to high prices and economic uncertainty, many Australians are holding onto their existing vehicles for longer instead of upgrading. This is putting even greater stresses on the existing vehicle parc and correspondingly driving more aftermarket demand for repair and maintenance services.

Increasing requirement for aesthetics, infotainment and comfort in vehicles driving the market

Rising disposable incomes over the last decade have seen Australian consumers prioritizing in-car comfort, connectivity and customization features more than ever before. There is a growing need amongst drivers to personalize the interior and exterior appearance of their vehicles through aftermarket modifications. Installing flashy alloy wheels, tinting windows, upgrading sound systems and adding other visual customizations have become increasingly mainstream hobby and passion for many in cities. Similarly, the always-on connectivity demands of modern life are also driving enhancements to factory-fitted infotainment interfaces. Upgrades such as bigger touchscreens, driver assistant technologies, phone mirrors and rear seat entertainment suites are examples seeing brisk demand.

Furthermore, Australians also attach greater importance to ergonomic and wellness features in vehicles today. Customizable seating, massage functions, air ionizers are examples witnessing rising uptake. Enhancing the basic function of transportation into a mobile comfort zone thus appears to be an important motivator. In line with other consumer appliances, vehicles too have become projected symbols of prestige, style and individual expression. Aftermarket players are effectively tapping into these evolving lifestyle requirements and emotions through specialized interior, exterior personalization offerings along with convenience and well-being enhancing technologies. It allows them to not just serve typical repair-maintenance needs but also expand into higher margin, elective enhancements market appealing to non-essential product seeking consumers.

Market Challenges and Opportunities:

Increase in the Repair and Maintenance Services Cost restraining the market

One of the major challenges faced by the Australia automotive aftermarket is the increase in the repair and maintenance services cost. The cost of labour, spare parts and overall cost of repair and maintenance activities in Australia has increased substantially in the past few years. According to our analysis, the average cost of repair and maintenance of a vehicle in Australia has increased by over 25% in the last 5 years. This increasing cost is majorly due to rise in prices of spare parts, higher labour costs and increase in GST and other indirect taxes on such services.

The rising cost has made vehicle repair and maintenance activities more expensive for both individual consumers and commercial fleet operators. With the cost rising so sharply, consumers are deferring their repair needs or switching to cheaper alternatives like used parts to save costs. This has negatively impacted the demand for new spare parts. Commercial fleet operators are also finding it difficult to justify higher maintenance budgets, thereby potentially reducing the frequency of repair and maintenance cycles. The increasing cost is restraining further growth of the auto parts and service market in Australia. Unless costs are controlled, this trend may continue restricting the market size and revenue potentials in the coming years.

Online sales of auto parts creating opportunities for companies

One significant opportunity for companies in the Australia automotive aftermarket is the growth of online sales channels, especially for auto parts. Currently only about 15-18% of auto parts are sold online in Australia compared to over 25% in other developed automotive markets. However, online penetration is growing rapidly driven by increasing internet and smartphone usage among consumers. The younger population in particular is more comfortable researching and purchasing auto parts online rather than visiting physical stores.

Leading this opportunity is the convenience offered by online platforms for customers to research technical specifications of thousands of parts, read reviews, make price comparisons within minutes and get doorstep delivery. Companies that establish strong online sales channels with better search functionality, mobile friendliness and customer support are well poised to capitalise on this growing trend. Having an integrated online and offline strategy allows companies to serve both tech-savvy younger customers as well as older customers who still prefer traditional retail stores. Overall, the digital transformation of auto parts sales and increasing preference for online purchases provide significant market opportunities for brands that make the right investments and have an omnichannel strategy.