Australia Office Furniture Market Trends

Market Driver – Increasing number of startups and SMEs

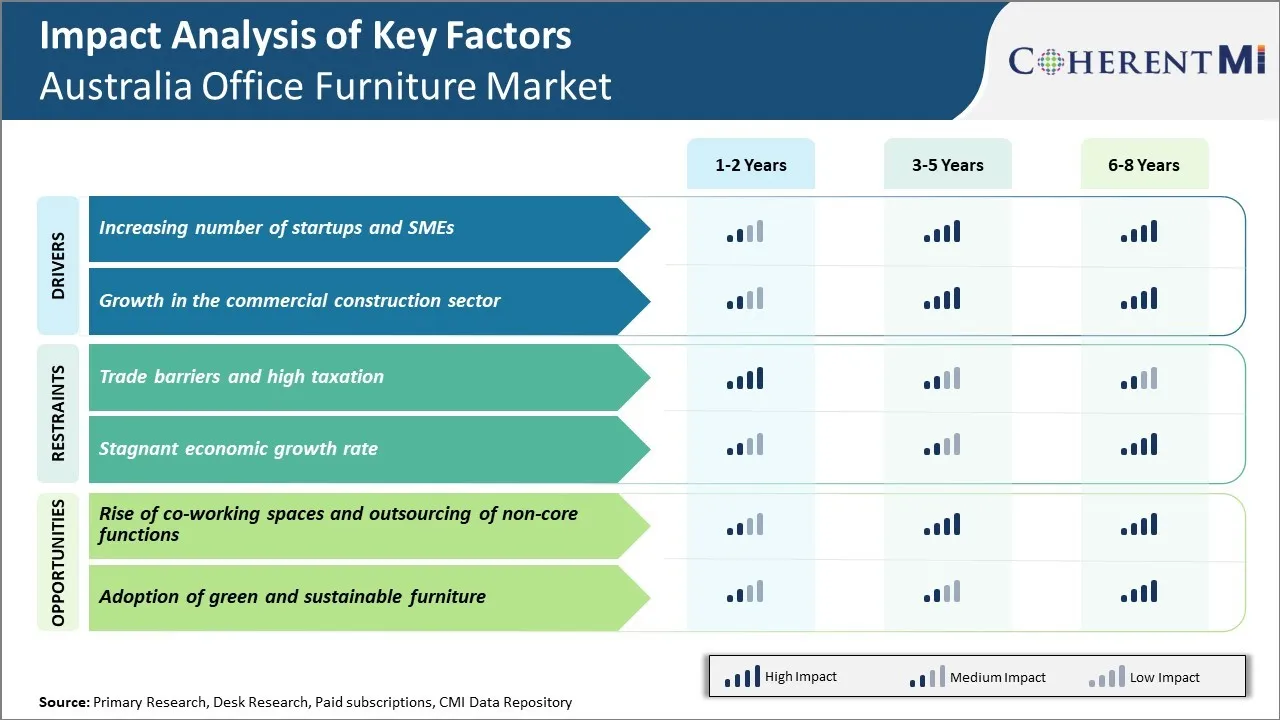

The Australian economy has seen a steady growth in the number of startups and small to medium enterprises in recent years. Ease of doing business, strong intellectual property laws and access to risk capital have made Australia an attractive destination for entrepreneurs. While many global companies have large established offices, it is these new businesses that are driving demand for flexible office furniture solutions.

Startups and young businesses prefer to keep their operating costs low during the initial phases of establishing themselves. Purchasing furniture outright puts pressure on cash flows. This has led to strong interest in flexible furniture leasing and rental options. Major furniture retailers have recognized this emerging trend and have expanded their product lines to cater to these specific needs. Modular furniture systems that can be assembled, reconfigured and scaled up or down based on changing business requirements are proving popular. Co-working spaces have also proliferated across major cities to support collaboration among independent professionals and startups. While early players offered basic amenities, new operators are focusing on design and amenities to attract tenants. This has increased demand for high quality, ergonomic and aesthetically pleasing furniture that matches contemporary office designs. Furniture made from sustainable materials is gaining precedence as businesses want to project responsible credentials.

As these new enterprises mature and expand, their furniture needs also evolve. Reputable furniture brands launched specialized programs to help such businesses upgrade in a phased manner. Equipment financing and professional services for space planning and logistics are part of the proposition. This ensures a smooth transition as a startup grows without large upfront capital outlays.

Market Driver – Growth in the commercial construction sector

Strong population growth as well as significant investment flowing into Australia's commercial real estate market has augured well for businesses in the commercial construction industry. Major cities across the country have ambitious infrastructure and construction plans that involve new business districts, commercial hubs, education precincts and other developments.

This high level of construction activity directly spurs demand for commercial interiors including various types of furniture. Developers work closely with specialist contractors during the outfitting of workplace interiors. Prime office spaces need to be furnished and decorated to a high standard before occupiers move in. This reliably translates to bulk orders for furniture, wall panelling, carpeting, lighting and other fit-out items. As the economy transitions out of the pandemic, corporations are also re-thinking their real estate footprint and office designs. Trends like hybrid work models and focus on employee well-being have prompted renovations and retrofitting of existing office stock. This provides opportunities for furniture and interiors retailers to work on upgrade projects. Customized solutions incorporating modern design principles and technology integrations are gaining traction.

Market Challenges: Trade barriers and high taxation

The Australian office furniture market faces ongoing challenges owing to trade barriers and a high tax environment. Significant import tariffs on office furniture make foreign suppliers' products more expensive in the Australian market compared to locally manufactured goods. This protects local manufacturers but limits choice and affordability for customers. Tariffs as high as 5-10% on imported wooden and metal office furniture restrict access to global designs and latest trends. Additionally, Australia's corporate tax rate of 30% imposes a considerable cost burden on local manufacturers and distributors. The high business taxes eat into company profits and make Australian products less competitive globally. This discourages expansions and investments that could help build economies of scale and address rising production costs from inflation. Stricter emissions standards also drive-up overhead expenses. While trade barriers and taxation aim to shield local jobs, they ultimately make the market smaller and costlier, limiting its long-term growth potential.

Market Opportunities: Rise of co-working spaces and outsourcing of non-core functions

There are also positive trends emerging that present opportunities for suppliers. The rise of co-working and flexible office spaces in major cities is increasing demand for contemporary, modular furniture suitable for hot-desking and freelancers. As more startups and small companies adopt this model to cut costs, the market for such shared workspace fittings is experiencing growth. At the same time, many large enterprises are outsourcing non-core functions like facilities and procurement to specialists. This hands opportunities to contract furniture suppliers who can better handle large-scale installation, customization and lifecycle management services. By offering comprehensive solutions for dynamic workspace needs, suppliers stand to gain recurring revenue streams. They can also target regional centers where firms are decentralizing some functions to reduce rents in capital cities. With the right strategies to capitalize on these developing market shifts, suppliers can partially offset challenges from policy issues.