Automatic Weapons Market Size - Analysis

Automatic weapons by force are used in a large-scale war on land, airtime and marine. These weapons highly include the state-of-the-art technology designed to function at high-ranges and altitudes. The market is expected to witness positive growth over the forecast period supported by rising defense budgets worldwide. Additionally, the growing instances of cross border terrorism and asymmetric warfare has encouraged militaries to focus on procuring smart and automatic weapons with advanced targeting systems. However, political and economic uncertainties amidst major trading partners could adversely impact the procurement budgets of some countries, thereby slowing down the demand growth of automatic weapons during the forecast period.

Market Size in USD Bn

CAGR7.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.4% |

| Market Concentration | High |

| Major Players | Lockheed Martin Corporation, Northrop Grumman Corporation, FN Herstal, Heckler & Koch, Kalashnikov Concern and Among Others |

please let us know !

Automatic Weapons Market Trends

As geopolitical tensions continue to rise across different parts of the world, the instances of cross-border conflicts and violence have seen a marked increase. Whether it is conflicts between neighboring countries over territorial disputes or issues concerning ethnic and religious divide, stockpiles of weapons including heavy-duty automatic weapons are playing a defining role. Many countries caught in the midst of such conflicts see procuring sophisticated arms as essential to gaining an edge over their opponents.

In Africa too, domestic armed insurgencies and civil wars in countries like Somalia, South Sudan, Democratic Republic of Congo etc. have led to protracted violence for decades now. Well-armed militant outfits are actively engaging government forces while also fighting against each other. Their need for replenishing and modernizing weapon supplies regularly creates steady underground demand for automatic infantry weapons. The civil war in Yemen again involves heavy usage of machine guns and automatic grenade launchers on all sides.

Market Driver - Global Military Modernization Programs Focusing on Advanced Weaponry.

Countries like USA, China, India, France, UK are pumping in billion dollars towards ambitious 10-15 years long defense modernization plans. A key element of this overhaul also includes upgrading infantry divisions with next-gen squad weapons, specialized carbines and lightweight automatic grenade launchers. Manufacturers are developing a new breed of smart-linked, digitized and ergonomic automatic weapons with suppressors, tri-mounts and day/thermal sights. These high-tech additions are slowly replacing decades old weapons in military stockpiles globally.

Overall, the strong trend of military modernization among nations coupled with growing Indigenization efforts will continue supporting the growth of global automatic weapons market. Regular up-gradation cycles ensure sustained off-take for manufacturers while addressing the tactical needs of armed forces worldwide.

One of the major challenges currently facing the automatic weapons market is the stringent government regulations imposed on the sale and use of automatic firearms in many countries. In the aftermath of mass shooting incidents involving automatic weapons, governments around the world have strengthened laws controlling civilian access and ownership of such weapons. In the United States as well, several states have enacted restrictions such as increased minimum age limits, comprehensive background checks and bans on certain types of semi-automatic firearms considered as assault weapons. The regulations make it difficult for manufacturers and retailers to expand their legal customer base and market scope. Complying with multiple and changing sets of rules also increases compliance costs for companies operating in this industry. Additionally, international trade and exports of automatic weapons have also faced many barriers due to bilateral and multilateral treaties signed between nations to curb proliferation of such arms. Overall, the tightening regulatory environment poses a major hindrance to the growth prospects of players involved in the automatic weapons market.

Market Opportunity: Growing Demand for the Modernization of Law Enforcement Capabilities.

Key winning strategies adopted by key players of Automatic Weapons Market

Focus on Technological Innovation: Technological innovation has been one of the biggest drivers of growth in the automatic weapons industry. For example, FN Herstal introduced the M249 light machine gun in the early 1980s, which featured an improved gas system that made it lighter and more reliable than previous designs. This helped FN Herstal gain a major foothold in the market. More recently, companies like Colt and Heckler & Koch have invested heavily in research to develop advanced automatic rifles and machine guns using lightweight composite materials, modular designs, and electric/optical firing systems. Such innovation allows companies to command premium pricing and attract military contracts.

Enhance Strategic Alliances: Forming strategic partnerships is a vital strategy for weapons majors to gain scale, share risks, and enter new sectors. For instance, European companies like FN Herstal, Beretta, and Heckler & Koch have benefitted immensely from cross-licensing Deals and joint ventures that allow coordinated bids for large military contracts from NATO allies. Similarly, smaller Indian private companies have tied up with Israeli defense giants like IWI to co-develop advanced small arms and gain expertise. Such alliances strengthen competitive positioning globally.

Segmental Analysis of Automatic Weapons Market

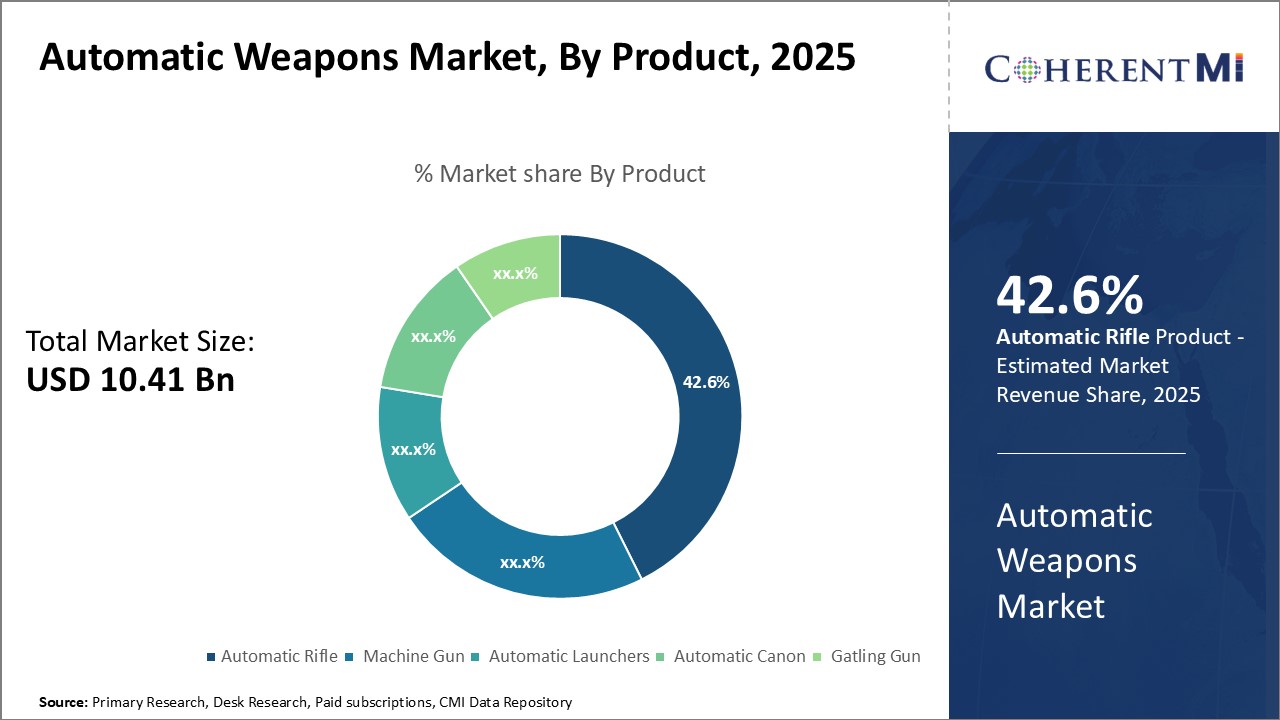

Insights, By Product, Automatic Rifle Is the Leading Product Throughout the Forecast Period.

Insights, By Product, Automatic Rifle Is the Leading Product Throughout the Forecast Period.By Product, Automatic Rifle is expected to contribute 42.6% market share in 2025 owing to its balanced capabilities. Automatic rifles offer mid-range firepower combined with precision targeting abilities. Their intermediate calibers and select-fire mechanisms provide flexibility across combat scenarios. Smaller and lighter than machine guns, automatic rifles allow for sustained suppressive fire while maintaining soldier mobility. Their integrated optics and accessories facilitate accurate engagement of targets at extended distances. Automatic rifles see widespread use as squad support weapons and among special forces. The M4/M16 series from Colt and H&K G36 dominate this segment with global military and law enforcement adoption. Constant modernization keeps improving their ergonomics, reliability, and onboard systems. New integrated rail platforms further expand mounting options for sights, torches, and other modular add-ons. Mass production and established supply chains have made automatic rifles very cost-effective. Their balanced performance profile satisfies the need for volume of fire as well as precision in varied combat theaters from jungles to mountains. This versatility continues to drive the popularity of automatic rifles as the largest product segment.

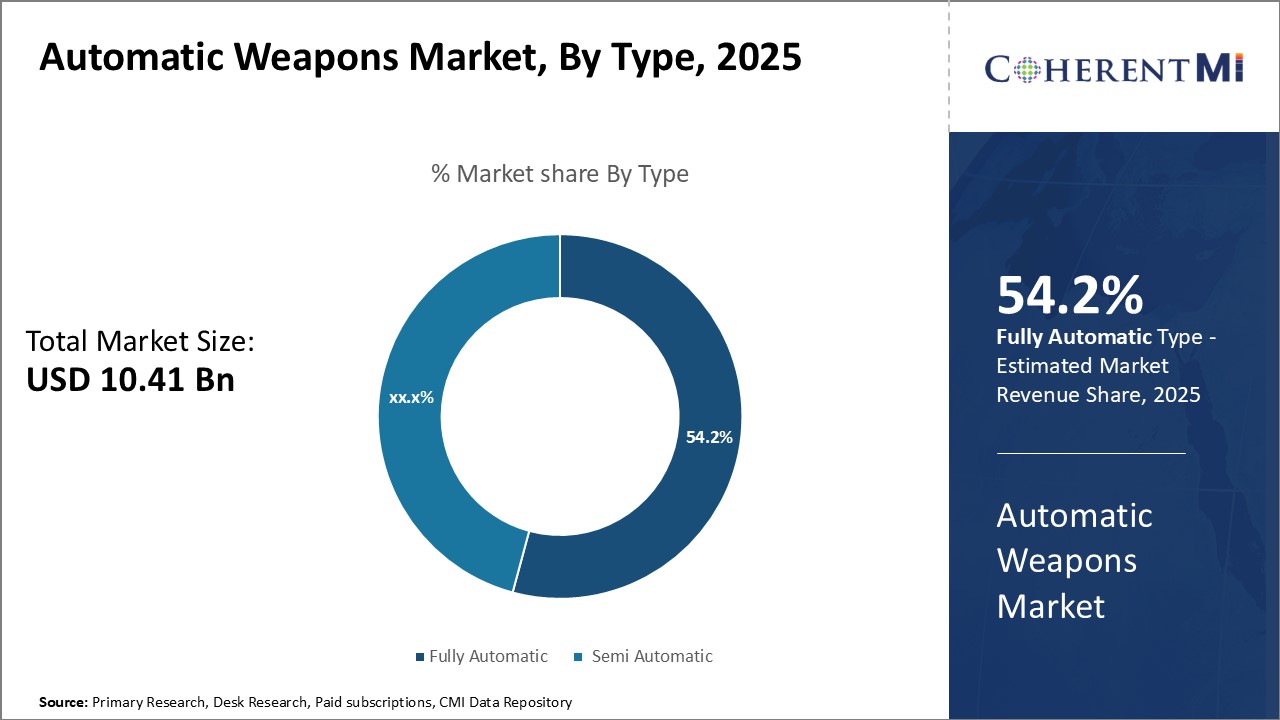

By Type, Fully Automatic weapons are expected to contribute 52.4% market share in 2025 owing to their capability to sustain high volumes of suppressive fire. Fully automatic firearms freely fire multiple rounds with a single pull and release of the trigger. This allows delivering continuous covering fire to pin down or suppress enemy positions. The sustained rate of fire they provide is highly valuable for supporting advances and protecting flanks in open battles. Machine guns like the M2 Browning, PKM, and MG42 have proven their worth in laying down accurate barrages of fire over long periods. Their optimized designs for full-auto operation with cool barrel profiles and quick-change ammunition belts maximize uptime. In entrenched conflicts or infantry assaults, being able to barrage enemy locations non-stop can alter the course of fights. Modernized varieties now often integrate enhanced barrels, stocks, and optional linked ammunition for sustained aimed fire with reduced recoil. This high firepower functionality continues to see widespread use among frontline units and has therefore increased the segment share over time.

Insights, By Caliber, Small Caliber is the Leading Segment Throughout the Forecast Period.

Additional Insights of Automatic Weapons Market

Integration of advanced technologies like artificial intelligence (AI), machine learning, and the Internet of Things (IoT) into automatic weapons. These smart weapons offer enhanced targeting accuracy, reduced human error, and automatic decision-making capabilities, making them desirable for defense forces. The trend toward modular automatic weapons allows users to customize components (barrels, magazines) according to mission requirements. This increases operational flexibility and extends the lifespan of weapons. Special forces worldwide are increasingly demanding lightweight automatic weapons with high firepower. This is driven by a need for greater mobility and efficiency in various combat scenarios, including urban warfare and counterterrorism operations. Despite growing demand, strict government regulations and arms control agreements, such as the Arms Trade Treaty (ATT), could limit market expansion. Compliance with export controls and restrictions on civilian ownership in many countries also pose challenges.

Competitive overview of Automatic Weapons Market

The major players operating in the Automatic Weapons Market include Lockheed Martin Corporation, Northrop Grumman Corporation, FN Herstal, Heckler & Koch, Kalashnikov Concern, Barrett Firearms Manufacturing, Beretta, Colt’s Manufacturing Company, SIG Sauer, Browning Arms Company, Smith & Wesson and Israel Weapon Industries.

Automatic Weapons Market Leaders

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- FN Herstal

- Heckler & Koch

- Kalashnikov Concern

Automatic Weapons Market - Competitive Rivalry

Automatic Weapons Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Automatic Weapons Market

- In July 2024, Zen Technologies launched AI-powered robot Prahasta, which utilizes LiDAR and reinforcement learning for real-time 3D terrain mapping, intended for mission planning and navigation in the defense sector.

- In March 2023, Israel’s IWI was awarded a contract by Estonia's Defense Investment Centre to supply 1,000 NG7 ‘Negev’ light machine guns, replacing older models in the Estonian Army.

- In January 2022, FN America secured a USD 49 million contract to supply M240L medium machine guns to the U.S. Army, focusing on lightweight, durable, and efficient weaponry for military use.

Automatic Weapons Market Segmentation

- By Product

- Automatic Rifle

- Machine Gun

- Automatic Launchers

- Automatic Canon

- Gatling Gun

- By Type

- Fully Automatic

- Semi Automatic

- By Caliber

- Small

- Medium

- Large

- By End-user

- Land

- Maritime

- Airborne

Would you like to explore the option of buying individual sections of this report?

Suraj Bhanudas Jagtap is a seasoned Senior Management Consultant with over 7 years of experience. He has served Fortune 500 companies and startups, helping clients with cross broader expansion and market entry access strategies. He has played significant role in offering strategic viewpoints and actionable insights for various client’s projects including demand analysis, and competitive analysis, identifying right channel partner among others.

Frequently Asked Questions :

How Big is the Automatic Weapons Market?

The Global Automatic Weapons Market is estimated to be valued at USD 10.41 Bn in 2025 and is expected to reach USD 17.16 Bn by 2032.

What will be the CAGR of the Automatic Weapons Market?

The CAGR of the Automatic Weapons Market is projected to be 7.21% from 2024 to 2031.

What are the major factors driving the Automatic Weapons Market growth?

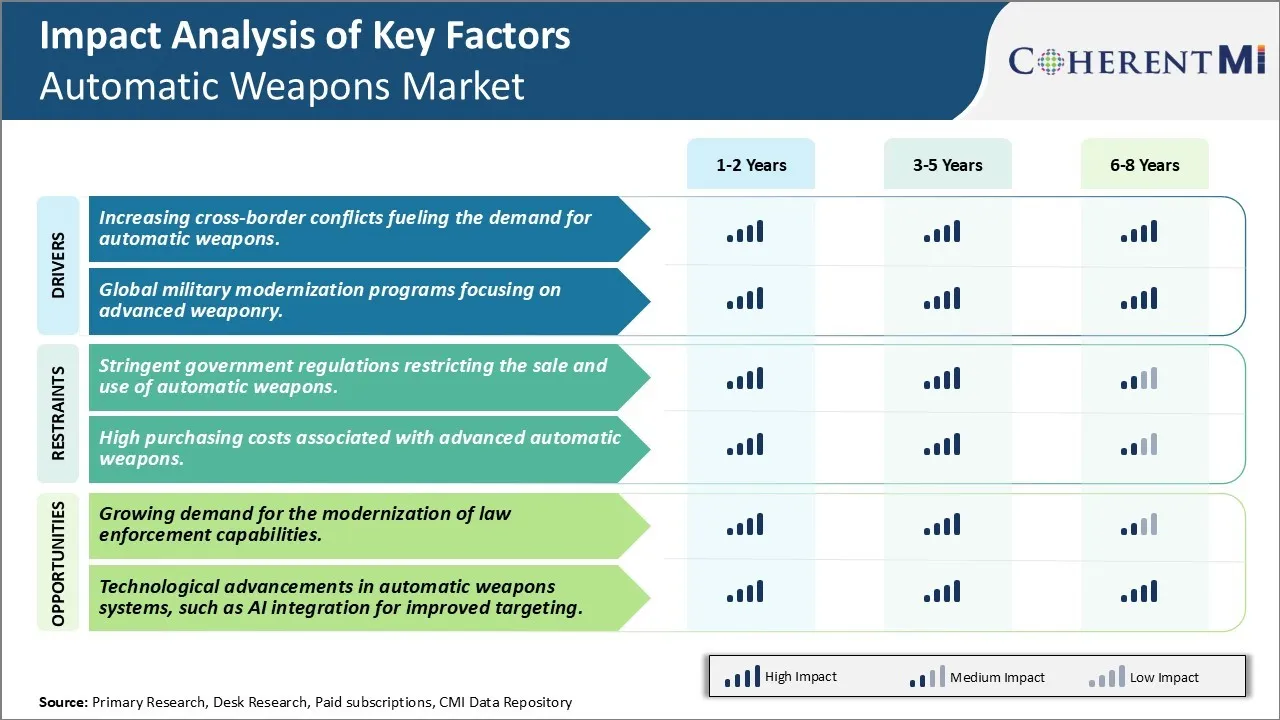

The increasing cross-border conflicts fueling the demand for automatic weapons and global military modernization programs focusing on advanced weaponry are the major factors driving the Automatic Weapons Market.

What are the key factors hampering the growth of the Automatic Weapons Market?

The stringent government regulations restricting the sale and use of automatic weapons. High purchasing costs associated with advanced automatic weapons. These are the major factors hampering the growth of the Automatic Weapons Market.

Which is the leading Product in the Automatic Weapons Market?

Automatic Rifle is the leading Product segment.

Which are the major players operating in the Automatic Weapons Market?

Lockheed Martin Corporation, Northrop Grumman Corporation, FN Herstal, Heckler & Koch, Kalashnikov Concern, Barrett Firearms Manufacturing, Beretta, Colt’s Manufacturing Company, SIG Sauer, Browning Arms Company, Smith & Wesson, Israel Weapon Industries are the major players.