Automotive Cybersecurity Market Trends

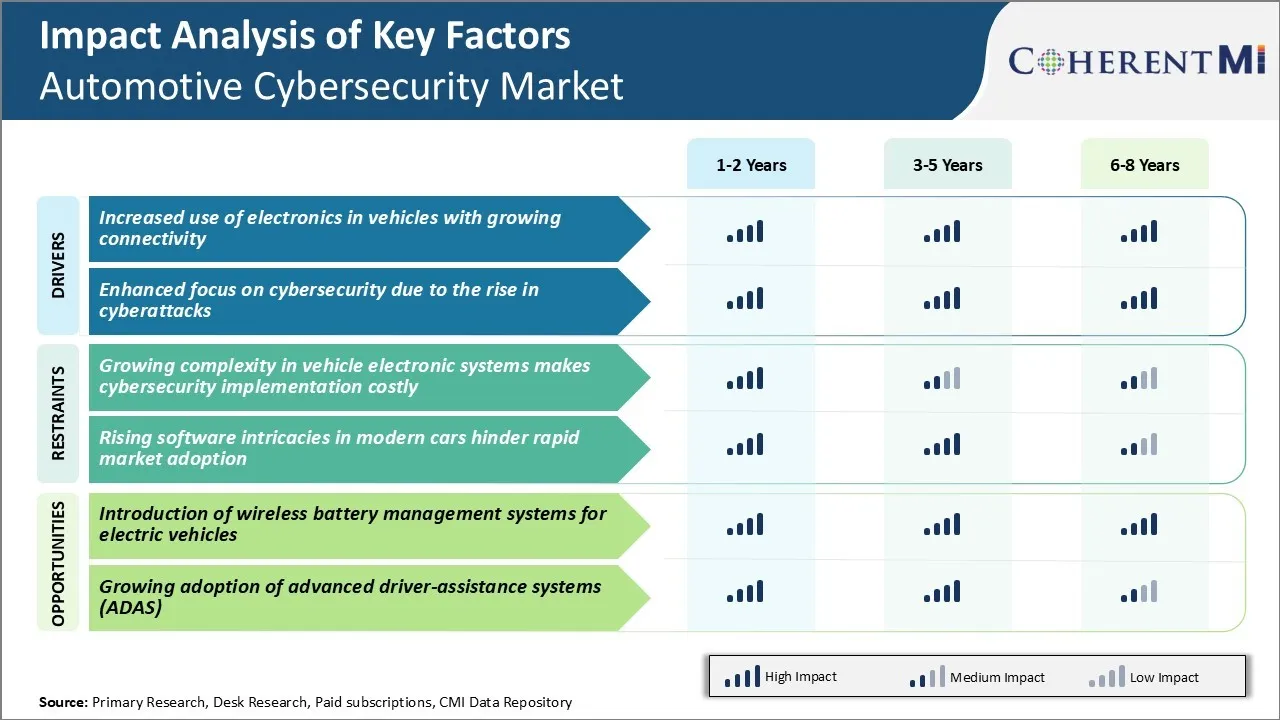

Market Driver - Increased Use of Electronics in Vehicles with Growing Connectivity

As automotive technology continues to evolve at a rapid pace, modern vehicles are becoming more connected and integrated with electronics. Automakers are adding advanced features such as infotainment systems, telematics, driver-assistance technologies, and connectivity options that allow remote access and software updates over-the-air.

Today's vehicles can contain over 100 million lines of code and rely on various electronic control units over the in-vehicle network. This however, exposes these networks of controllers to hackers who can potentially access the vehicle systems remotely and endanger passenger safety.

Going forward, auto manufacturers will have to integrate cybersecurity at the development stage itself across software, hardware, networks, and supply chain. With future mobility solutions promising even higher levels of automation and data sharing, the priority on safeguarding critical vehicle systems and passenger privacy will continue to intensify among automakers. Their ongoing investments and focus on building security into automotive electronic architectures will remain a key driver for the automotive cybersecurity market.

Market Driver - Enhanced Focus on Cybersecurity Due to the Rise in Cyberattacks

The increasing frequency and sophistication of cyberattacks targeted towards connected vehicles is another key factor accelerating investments in the automotive cybersecurity market. While automakers have acknowledged vulnerabilities for some time, successful real-world attacks are compelling greater action.

High-profile security analyses have managed illegal remote access to exposed vehicle networks and components like brakes, ignition systems, and transmissions in recent times. Meanwhile, wider reports have surfaced of cyber-criminals exploiting vulnerable IoT links in keyless entry systems to steal luxury cars.

The proliferation of ransomware and increasing sophistication of cyber-criminal groups have boosted threats to automotive sector. Advanced persistent threat (APT) actors are specifically targeting vehicles and associated networks for financial gains or cyberespionage goals like stealing intellectual property.

Faced with mounting evidence of real cyberattacks moving closer to passenger harm, automakers must bolster vehicle protection at an accelerated pace. Their enhanced focus on proactively addressing cybersecurity threats will remain imperative for the automotive cybersecurity market.

Market Challenge - Growing Complexity in Vehicle Electronic Systems Makes Cybersecurity Implementation Costly

Growing complexity in vehicle electronic architecture and networks poses major challenges for effective automotive cybersecurity. With more ECUs and network points, the usable attack surface is expanding exponentially. This means automotive security specialists need to devote greater efforts towards code review, penetration testing and fixes for each new system/feature added.

Additionally, as ECUs take on more critical functions related to safety and driver assistance, the risks of attacks are magnifying as well. All of this requires significant investments into areas like dedicated security hardware, regular software updates, intrusion detection systems, and incident response teams.

Most players in the automotive cybersecurity market lack prior experience of dealing with such advanced in-vehicle security needs. With price competition already intense in the automotive industry, absorbing these additional cybersecurity costs can negatively impact margins. Standardization of security practices across the fragmented supply chain remains a challenge as well.

Market Opportunity - Introduction of Wireless Battery Management Systems for Electric Vehicles

One major opportunity in the automotive cybersecurity market arises from the growing electric vehicles (EVs) sector. As EVs rely on large and costly lithium-ion battery packs, battery management systems (BMS) have become a critical component.

As EVs continue gaining mainstream acceptance worldwide, big data from extensive wireless BMS (WBMS)-enabled fleets can help improve battery design and lifetime. Automakers are also exploring WBMS for new revenue models involving used battery leasing programs and performance-based warranties.

As WBMS proliferate across EVs, the market potential for suppliers of specialized wireless security solutions and monitoring services is very high. It can drive significant growth opportunities for automotive cybersecurity market players in the coming years.