Automotive Steel Market Size - Analysis

Market Size in USD Bn

CAGR3.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.4% |

| Market Concentration | High |

| Major Players | ArcelorMittal S.A., Thyssenkrupp AG, Nippon Steel Corporation, Hyundai Steel, POSCO (Formerly Pohang Iron and Steel Company) and Among Others |

please let us know !

Automotive Steel Market Trends

The automotive industry has seen growing pressures to improve fuel efficiency and reduce emissions from vehicles. Stricter environmental regulations are pushing automakers to develop technologies that can help lower the carbon footprint of personal transportation. Customers are also becoming increasingly environment-conscious and prefer vehicles that are sustainable.

However, extensive use of aluminum increases production costs significantly. AHSS allows automakers to re-engineer body structures and deploy complicated multi-material joining techniques to shed kilos without compromising on safety. This is a major driver for the automotive steel market to innovate further and introduce new advanced grades of steel that can help optimize weight without penalties.

Market Driver - Increased Adoption of AHSS for Safety and Performance

OEMs are employing these steel types extensively in construction of pillars, door rings, rocker panels and other parts of body-in-white. As per estimates, a vehicle manufactured with AHSS can achieve over 25% weight savings compared to use of conventional steel alone. This is a major factor for driving higher fuel efficiency and performance ability too.

Market Challenge - Volatility in Raw Material Prices, Particularly Iron Ore and Energy Costs

Volatile raw material prices pose serious issues for automotive steel producers to strategize and plan their production costs effectively. The unpredictable nature of input prices makes steel production a high-risk process. It also discourages long term contracts between steelmakers and automakers as steel prices included in such contracts quickly become unviable. The volatility often leads to periods of losses for steel companies when raw material prices surge. Overall, unstable iron ore and energy prices introduce significant challenges around cost management for the automotive steel market.

Market Opportunity - Growth of Electric Vehicles (EVs) Driving Demand for Lightweight Steel Grades

The growing preference for EVs is expected to drive robust demand for these lightweight steel variants in the coming years. Steel producers have begun large investments to ramp up capacities of advanced grades aligned with EV material needs. As automakers aggressively work towards electrification goals, lightweight steels can help steel industry capture a significant share of this growing automotive steel market.

Key winning strategies adopted by key players of Automotive Steel Market

Strategic Focus on Lightweight Materials: As vehicle emissions and fuel efficiency norms get stricter globally, automakers are under increasing pressure to reduce vehicle weight. Leading automotive steel suppliers like ArcelorMittal, POSCO, and Nucor have made sizable investments in R&D for advanced high strength steels (AHSS) that offer equal or better strength at lower weight compared to conventional steels.

Innovation through Collaborations: Given huge R&D investments required, steel makers partner closely with automakers during product development phase.

Segmental Analysis of Automotive Steel Market

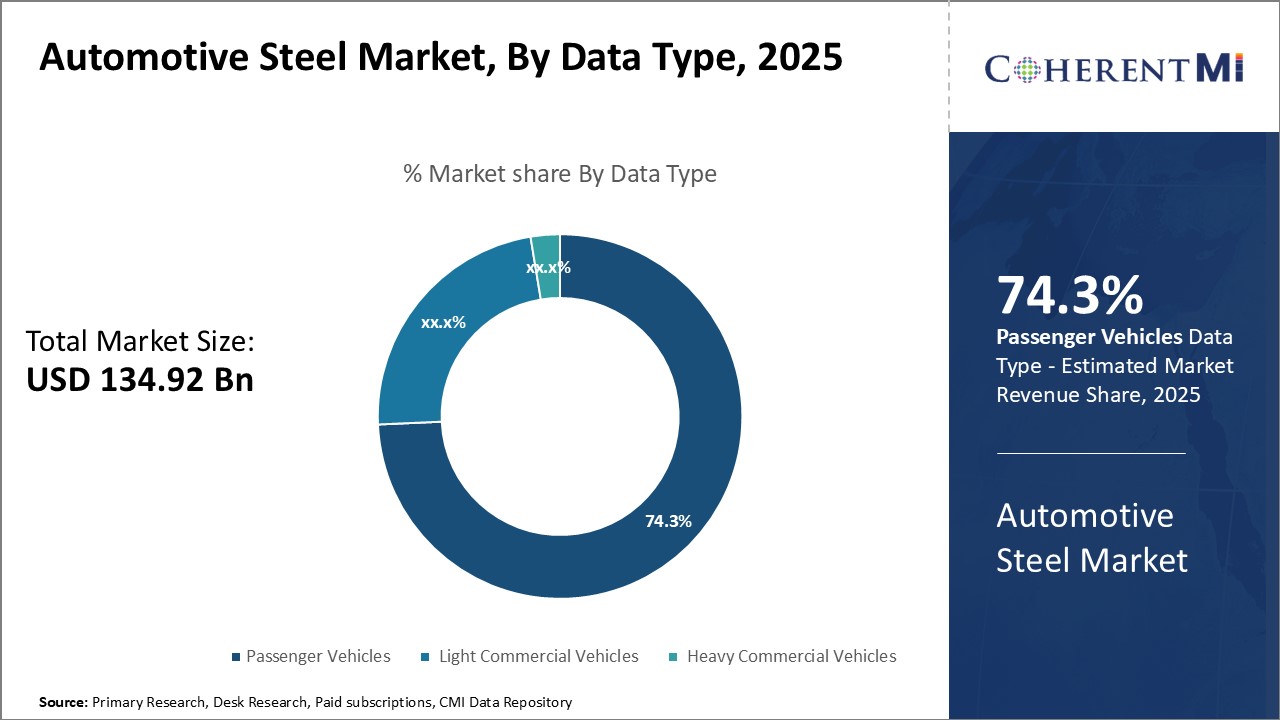

Insights, By Vehicle Type: Rising Standards of Living is Fueling Growth of Passenger Vehicles

Insights, By Vehicle Type: Rising Standards of Living is Fueling Growth of Passenger VehiclesIn terms of vehicle type, passenger vehicles contributes the highest share of the automotive steel market owning to rapidly increasing standards of living across developing nations. Individuals in developing countries are witnessing higher disposable incomes owing to strong GDP growth rates and favorable economic conditions. This has increased their spending power and propelled the sales of personal vehicles for private transportation needs over public transport. The emerging middle class particularly prefers owning a private vehicle as a status symbol of their new-found affluence and social mobility. However, rising fuel prices and traffic congestion in urban areas are major deterrents for buyers, prompting automakers to focus on strengthening their portfolio of compact and fuel-efficient passenger cars. Government initiatives supporting infrastructure development of new townships and roads in suburban areas are also expected to drive the 'commuter culture' further, augmenting auto steel demand from the passenger vehicle segment.

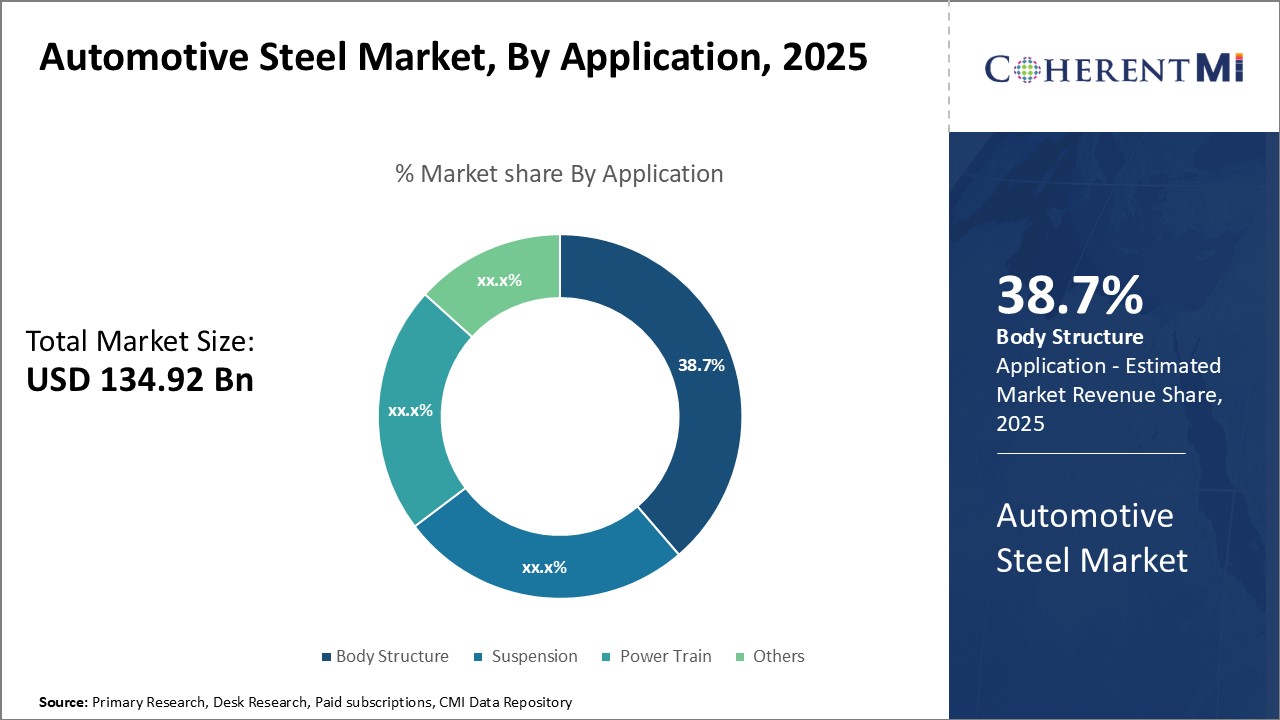

In terms of application, body structure contributes 38.7% share of the automotive steel market in 2025, owing to large-scale infrastructure development activities worldwide. Construction of new highways, flyovers, bridges requires massive quantities of steel, primarily used in body structures which forms the backbone of these projects.

Industry experts expect these infrastructure-oriented investments to stay robust over the coming years, maintaining strong demand flows for auto-grade steel consumed in body structures of construction vehicles and equipment.

Insights, By Steel Type: Strict Safety and Emission Norms are Pushing Adoption of Advanced Steel Grades

Manufacturers are under increasing pressure to comply with stringent CAFE (Corporate Average Fuel Economy) and Euro Norms by making vehicles lighter and more fuel efficient. This has propelled the demand for advanced high-strength steel (AHSS) and ultra-high-strength steel (UHSS) variants which are lighter and stronger than conventional HSS and mild steel.

Additional Insights of Automotive Steel Market

- Collaborations: Automotive OEMs partnering with steel manufacturers to develop custom automotive steel solutions for specific vehicle models.

- Sustainability Efforts: Companies investing in green steel production methods to reduce carbon footprints in line with global environmental regulations.

- Increasing Use of AHSS: Advanced High-Strength Steel usage in vehicles has increased by 15% over the past five years due to its superior properties. This will drive important trends in the automotive steel market.

- Regional Growth: Asia-Pacific region accounts for over 50% of the global automotive steel demand, driven by countries like China and India.

Competitive overview of Automotive Steel Market

The major players operating in the automotive steel market include ArcelorMittal S.A., Thyssenkrupp AG, Nippon Steel Corporation, Hyundai Steel, POSCO (Formerly Pohang Iron and Steel Company), Tata Steel, Baosteel Group Corporation, JFE Steel Corporation, United States Steel Corporation, and SSAB AB.

Automotive Steel Market Leaders

- ArcelorMittal S.A.

- Thyssenkrupp AG

- Nippon Steel Corporation

- Hyundai Steel

- POSCO (Formerly Pohang Iron and Steel Company)

Automotive Steel Market - Competitive Rivalry

Automotive Steel Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Automotive Steel Market

- In June 2024, Tata Steel Nederland introduced "Zeremis® Recycled," a steel product with an allocated 30% recycled content. This initiative aims to assist customers in achieving their circularity goals without compromising on steel quality. The product is particularly targeted at consumer-facing industries, including automotive, packaging, and construction.

- In April 2024, Mahindra Last Mile Mobility Limited (MLMML) introduced the Treo Plus, an electric three-wheeler featuring a metal body for enhanced durability. This update was implemented in response to customer feedback, aiming to improve the vehicle's robustness.

- In January 2024, Chinese automaker BYD surpassed Tesla in global electric vehicle (EV) sales, delivering 526,000 battery electric vehicles (BEVs) in the fourth quarter of 2023, compared to Tesla's 484,500 BEVs during the same period.

- In May 2023, ArcelorMittal introduced new multi-phase ultra-high-strength automotive steel grades at the Great Designs in Steel (GDIS) event in North America. These advanced steel grades are designed to assist automakers in reducing vehicle weight, thereby enhancing fuel efficiency and supporting the transition to electric mobility.

Automotive Steel Market Segmentation

- By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Application

- Body Structure

- Suspension

- Power Train

- Others

- By Steel Type

- High-Strength Steel (HSS)

- Advanced High-Strength Steel (AHSS)

- Ultra High-Strength Steel (UHSS)

- Mild Steel

Would you like to explore the option of buying individual sections of this report?

Ameya Thakkar is a seasoned management consultant with 9+ years of experience optimizing operations and driving growth for companies in the automotive and transportation sector. As a senior consultant at CMI, Ameya has led strategic initiatives that have delivered over $50M in cost savings and revenue gains for clients. Ameya specializes in supply chain optimization, process re-engineering, and identification of deep revenue pockets. He has deep expertise in the automotive industry, having worked with major OEMs and suppliers on complex challenges such as supplier analysis, demand analysis, competitive analysis, and Industry 4.0 implementation.

Frequently Asked Questions :

How big is the automotive steel market?

The automotive steel market is estimated to be valued at USD 134.92 Bn in 2025 and is expected to reach USD 170.50 Bn by 2032.

What are the key factors hampering the growth of the automotive steel market?

Volatility in raw material prices, particularly iron ore and energy costs, and competition from alternative materials like aluminum and composites are the major factors hampering the growth of the automotive steel market.

What are the major factors driving the automotive steel market growth?

Growing demand for lightweight vehicles and increased adoption of advanced high-strength steel (AHSS) for safety and performance are the major factors driving the automotive steel market.

Which is the leading vehicle type in the automotive steel market?

The leading vehicle type segment is passenger vehicles.

Which are the major players operating in the automotive steel market?

ArcelorMittal S.A., Thyssenkrupp AG, Nippon Steel Corporation, Hyundai Steel, POSCO (Formerly Pohang Iron and Steel Company), Tata Steel, Baosteel Group Corporation, JFE Steel Corporation, United States Steel Corporation, SSAB AB are the major players.

What will be the CAGR of the automotive steel market?

The CAGR of the automotive steel market is projected to be 3.4% from 2025-2032.