Freight Railcar Parts Market Size - Analysis

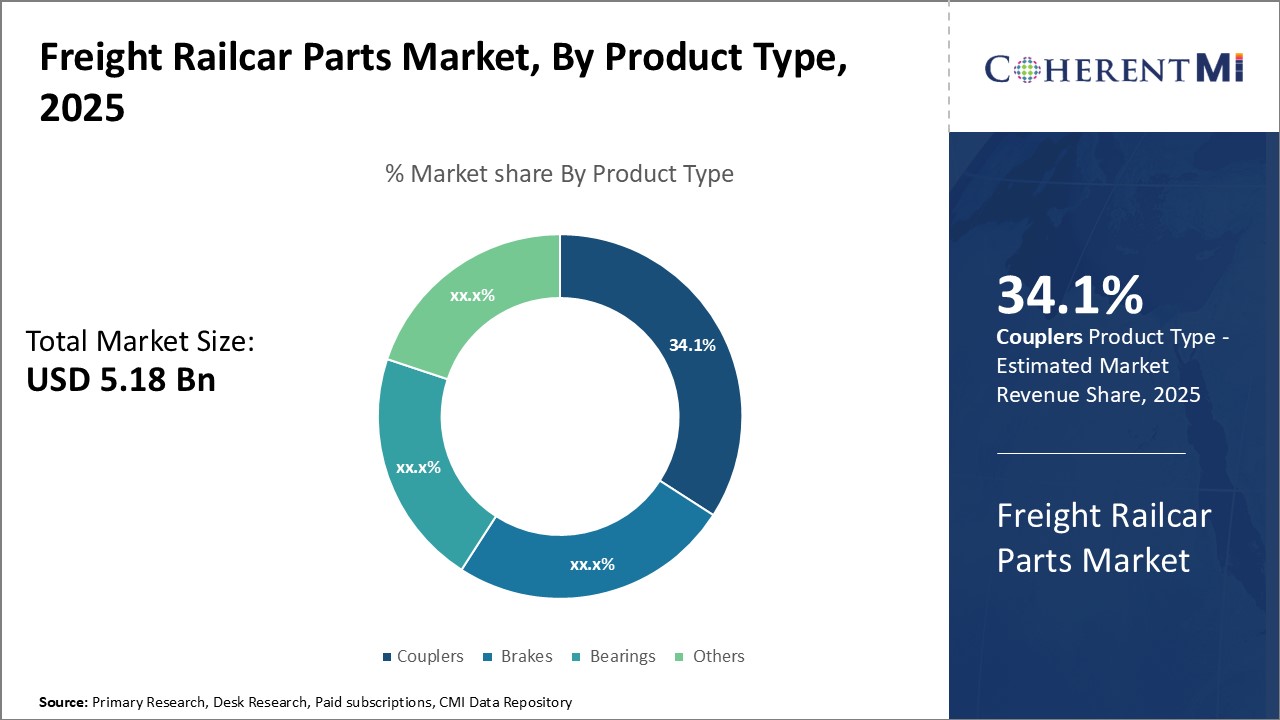

The global Freight Railcar Parts market size was valued at US$ 5.18 billion in 2025 and is expected to reach US$ 8.48 billion by 2032, grow at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2032. Freight railcar parts include components such as couplers, brakes, bearings, axles, wheels, bogies, brake systems, and other structural parts used in freight railcars. The rising demand for freight transportation and the expansion of railway networks globally are driving the growth of the freight railcar parts market.

- Freight rail offers an efficient and cost-effective solution for transporting bulk commodities and finished products over long distances. Railcars require periodic maintenance, repair, and replacement of components to ensure efficient operations. Bearings accounted for the largest share of the freight railcar parts market in 2021. Bearings enable the wheels to rotate freely and smoothly. The high replacement rate of bearings, owing to wear and tear, contributes to the large share of this segment.

- The Freight Railcar Parts Market is segmented by product type, application, material type, component, and region. By application, the rail freight cars segment accounted for the largest share of the market in 2021. The large fleet size of freight railcars globally and the periodic maintenance required for smooth operations drive the demand for replacement parts.

The freight railcar parts market is influenced by factors such as the overall health of the rail transportation industry, economic conditions, and government infrastructure investments. Demand for railcar parts is closely tied to the performance and expansion plans of railway operators, as well as the general trends in freight transportation. Freight railcar parts include various components essential for the operation and maintenance of railcars. These components can range from wheels, axles, and bearings to brake systems, couplers, and draft gears. Advances in materials and technology may also impact the types of components used in modern freight railcars.

Market Size in USD Bn

CAGR7.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.3% |

| Fastest Growing Market | Middle East & Africa |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Wabtec Corporation, Nippon Sharyo, TRSC Companies, Amsted Rail, Greenbrier Companies and Among Others |

please let us know !

Freight Railcar Parts Market Trends

- Adoption of Predictive Maintenance: The adoption of predictive maintenance is an emerging trend in the rail industry. This involves using technologies like IoT sensors, AI, machine learning, and big data analytics to monitor railcar components in real-time. It enables prediction of possible failures and proactive maintenance. Predictive maintenance for railcars minimizes unplanned downtime. It optimizes maintenance schedules, improves safety and extends service life of components. This reduces costs associated with replacements and repairs. As rail operators increasingly adopt predictive maintenance, the demand for advanced IoT enabled railcar parts is expected to rise.

- Incorporation of Lightweight Materials: Manufacturers are increasingly using lightweight composite and alloy materials in production of railcar parts. Replacement of steel components with lightweight materials such as titanium, aluminum, and reinforced plastics can reduce overall weight of railcars. This enhances energy-efficiency, increases cargo capacity and improves running speeds. Lightweighting also facilitates noise reduction and low maintenance. Companies are focused on R&D to develop durable lightweight components including bogies, couplers, doors, brake systems, etc. The lightweighting trend is expected to rise further with focus on efficiency.

- 3D Printing for Prototyping and Production: 3D printing technology is being rapidly adopted in the rail industry for prototyping as well as manufacturing of components. 3D printing enables flexible, cost-effective, and low waste production compared to traditional methods. Parts with complex geometries can be easily 3D printed. Railcar manufacturers use 3D printing to create prototypes for testing. The usage of 3D printing for direct production of small volume parts and custom components is also rising. As the technology matures further, 3D printing is expected to be used for mass production of railcar parts.

- Increasing Use of IoT Connected Parts: The IoT connected railcar parts are experiencing increasing adoption due to benefits such as real-time condition monitoring, predictive maintenance, geotracking and improved fleet analytics. IoT connectivity in components such as doors, brake controllers, temperature sensors, helps monitor their performance and usage data. Rail operators are increasingly demanding IoT connectivity in railcar parts for gaining insights into assets. IoT enables gathering vital data to optimize railcar maintenance and safety. The integration of IoT in railcar parts is expected to rise with focus on connected vehicles.

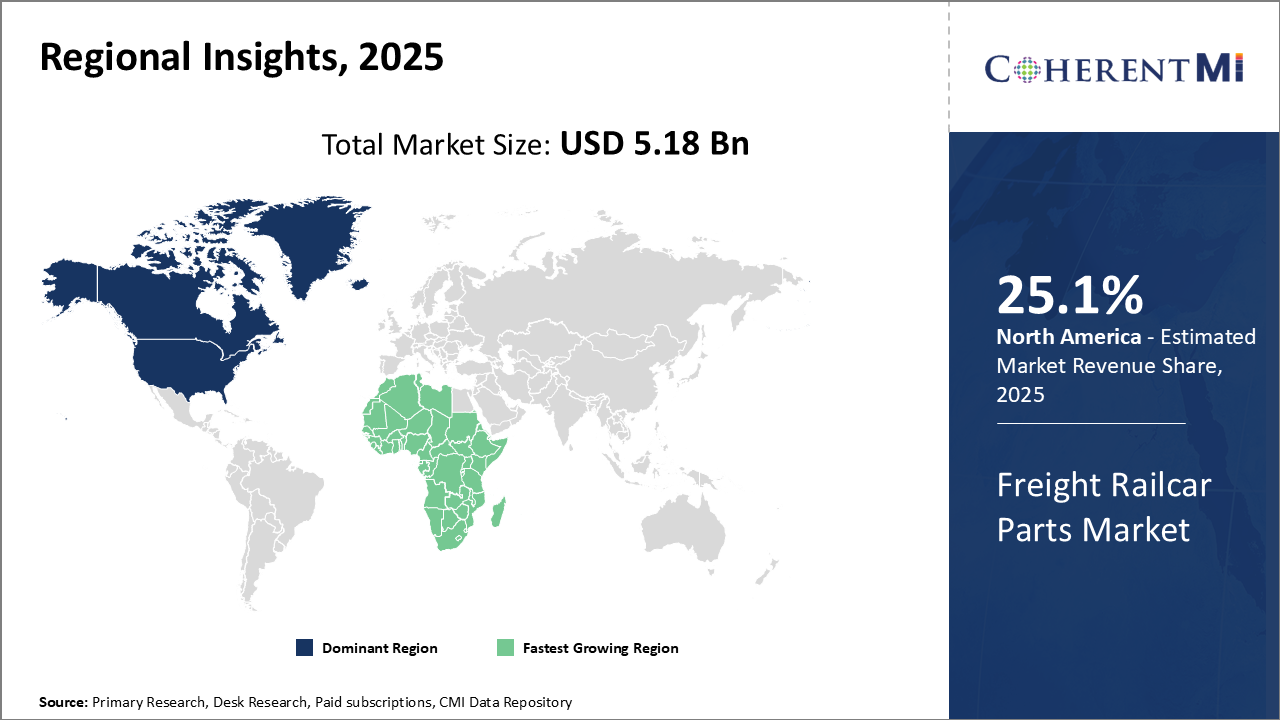

Freight Railcar Parts Market Regional Insights

- North America is expected to be the largest market for Freight Railcar Parts Market during the forecast period, accounting for over 25.1% of the market share in 2025. The growth of the market in North America is attributed to the well-established railroad infrastructure and large fleet of freight railcars in the region.

- The Asia Pacific market is expected to be the second-largest market for Freight Railcar Parts Market, accounting for over 35.2% of the market share in 2025. The growth of the market in is attributed to the rapidly expanding railway sector and government initiatives to improve freight transportation in emerging Asian countries.

- The Middle East & Africa market is expected to be the fastest-growing market for Freight Railcar Parts Market, with a CAGR of over 5.2% during the forecast period. The growth of the market in Middle East & Africa is attributed to the development of new railway lines and increasing demand for freight transportation due to rapid urbanization in the region.

Segmental Analysis of Freight Railcar Parts Market

Competitive overview of Freight Railcar Parts Market

Major players operating in the global freight railcar parts market include Wabtec Corporation, Nippon Sharyo, TRSC Companies, Amsted Rail, Greenbrier Companies, Alstom, Astra Rail Industries, Bombardier Transportation, CAF USA, Siemens Mobility

Freight Railcar Parts Market Leaders

- Wabtec Corporation

- Nippon Sharyo

- TRSC Companies

- Amsted Rail

- Greenbrier Companies

Freight Railcar Parts Market - Competitive Rivalry

Freight Railcar Parts Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Freight Railcar Parts Market

New product launches

- In September 2022, Amsted Rail unveiled Enduraide, its new friction management product for freight rail. Enduraide enhances wheel tread life by up to 300% and reduces lateral friction.

- In January 2022, Greenbrier announced new railcar axle counting tech, Axle CountSM, which uses sensors to monitor axle health and improve safety.

- In April 2022, Knorr-Bremse opened new rail vehicle equipment factory in India to manufacture braking systems locally.

Acquisition and partnerships

- In March 2022, Wabtec acquired MASU's freight car component business to expand capabilities in Scandinavia.

- In January 2021, Amsted Rail acquired Barber Tian Rui Railway Supply to expand presence in China.

- In October 2020, Greenbrier and Amsted entered into a JV - GBX to form a freight railcar equipment provider.

Freight Railcar Parts Market Segmentation

- By Product Type

-

- Couplers

- Brakes

- Bearings

- Others (Axles, Wheels, etc.)

- By Application

-

- Rail Freight Cars

- Rail Passenger Cars

- Locomotives

- High Speed Trains

- Subways/Metros

- Others (Tram, Monorail, etc.)

- By Material Type

-

- Stainless Steel

- Aluminum

- Alloy Steel

- Others (Cast Iron, etc.)

- By Component

-

- Body Structure

- Bogie

- Coupler and Draft Gear

- Brake System

- Others (Doors, Seats, etc.)

- By Region:

-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Would you like to explore the option of buying individual sections of this report?

Ameya Thakkar is a seasoned management consultant with 9+ years of experience optimizing operations and driving growth for companies in the automotive and transportation sector. As a senior consultant at CMI, Ameya has led strategic initiatives that have delivered over $50M in cost savings and revenue gains for clients. Ameya specializes in supply chain optimization, process re-engineering, and identification of deep revenue pockets. He has deep expertise in the automotive industry, having worked with major OEMs and suppliers on complex challenges such as supplier analysis, demand analysis, competitive analysis, and Industry 4.0 implementation.

Frequently Asked Questions :

How big is the Freight Railcar Parts Market?

The Freight Railcar Parts Market is estimated to be valued at USD 5.2 in 2025 and is expected to reach USD 8.5 Billion by 2032.

What are the major factors driving the Freight Railcar Parts Market growth?

Rising freight transportation demand, expansion of railway networks, development of dedicated freight corridors, increasing use of rail for minerals transport are some major growth drivers.

Which is the leading component segment in the Freight Railcar Parts Market?

The leading component segment in the Freight Railcar Parts Market is bearings (account for over 25% share) owing to high replacement rates.

Which are the major players operating in the Freight Railcar Parts Market?

Amsted Rail, Wabtec Corporation, Siemens Mobility, Greenbrier Companies, Alstom are the major players.

Which region will lead the Freight Railcar Parts Market?

Asia Pacific is expected to lead the Freight Railcar Parts Market.

What will be the CAGR of Freight Railcar Parts Market?

The CAGR is expected to be 7.3% from 2025 to 2032.