Singapore Autonomous Cars Market Size - Analysis

Singapore has one of the best transport infrastructures in the world. However, with rising population and traffic congestion emerging as key challenges, the government is promoting autonomous vehicles as a sustainable mobility solution. Autonomous vehicles rely on advanced sensor technology and artificial intelligence to drive without human intervention. They are expected to make transportation more efficient, accessible and environment-friendly. The Land Transport Authority intends to operate driverless buses on fixed routes by 2025 and introduce more autonomous buses, taxis, and delivery vehicles in the coming years. Several firms have begun trials of self-driving vehicles on public roads under regulatory permits. With supportive policies and investment in Research & Development, Singapore is well-positioned to become a leader in autonomous driving technology in Asia.

- Government initiatives and funding: The Singapore government has been strongly pushing autonomous vehicle (AV) technology development and adoption through various initiatives and funding over the past few years. With the introduction of the Autonomous Vehicle Tested programme in 2015, the government aimed to position Singapore as a global hub for trialling and developing autonomous driving technologies. Several test sites were set up across the island for companies to test their AV technologies. Major players like nuTonomy, Grab and Waymo have extensively tested their self-driving cars on public roads in Singapore with the support of the government. The government also offers various incentives like tax exemptions, workforce training programs and R&D grants to attract global AV companies to set up offices, test centers and manufacturing plants in Singapore. For example, Hyundai, Renault-Nissan-Mitsubishi alliance and Sinobil Group have established autonomous driving R&D hubs in Singapore in the 2020, encouraged by these incentives. This is driving considerable foreign investments and growth of local autonomous mobility startups working closely with these global giants.

- Tech savvy population: Singapore has one of the highest internet and smartphone penetration rates in the world. As of 2021, Singapore had an internet penetration rate of over 90% with smartphone ownership over 85%. This tech savvy population has shown a keen interest in emerging technologies like autonomous vehicles. They are early adopters of technological innovations and eager to experience self-driving cars. The high acceptance of new technologies among Singaporeans is creating strong demand for autonomous vehicles. The enthusiastic acceptance of emerging technological solutions among the public makes Singapore an ideal testing ground for autonomous vehicle developers. International players like nuTonomy and Mercedes-Benz have actively tested their self-driving car technologies on the roads of Singapore due to this favorable environment.

- High population density: The government is cognizant of autonomous vehicles being able to address Singapore's urban mobility challenges and has implemented several initiatives to build infrastructure and regulations to support testing and deployment of these vehicles. Furthermore, in 2025 the Land Transport Authority of Singapore announced partnerships with several AV developers for pilots covering daily commutes, with the aim of deploying a limited number of driverless buses and shuttles on public roads by 2025. This proactive government push coupled with the strong economic need is accelerating activity in this sector. Various players like nuTonomy, Grab and Covidien are actively conducting AV trials on public roads. Autonomous vehicles are expected to play a significant part in meeting Singapore's transportation needs in an environmentally conscious and sustainable way as deployments increase near the end of this decade.

- Public transport focus: Public transport focus is significantly driving the growth of autonomous cars market in Singapore. The government is heavily investing in expanding public transport infrastructure to reduce dependency on private vehicles for commuting. Large scale public projects like expansion of Metro Rail Transit or Mass Rapid Transit (MRT) and Light Rail Transit (LRT) networks, introduction of regional fast train services have increased the accessibility and coverage of public transport system across the country. According to Department of Statistics Singapore, public transport ridership grew by 12% from 2020 to 2025, with train ridership rising by 15% during the same period. This has compelled many commuters to switch from private vehicles to public transport. The government also aims to make at least 90% of peak hour trips via public and shared transport by 2040. Thus, there is a major focus on developing integrated mobility solutions combining public transport and on-demand autonomous vehicles. Several firms are working with Land Transport Authority on developing mobility-as-a-service platforms involving autonomous fleets.

Singapore Autonomous Cars Market Opportunities:

- Shared mobility services: Shared mobility services have a great opportunity to capture a large market share in Singapore's autonomous car industry. As land constraints limit private car ownership in Singapore, there is high demand for shared transportation solutions. Shared autonomous vehicles could emerge as a preferred choice, as they allow efficient car-pooling and optimized utilization of vehicles. Shared autonomous vehicles are likely to revolutionize urban transport by reducing traffic congestion and carbon emissions. According to the Land Transport Authority of Singapore, nearly 75% of peak hour traffic is attributed to cars with single occupants. Shared autonomous vehicles can help reduce this number significantly by facilitating ride-sharing. This will in turn help the city-state achieve its goal of becoming a car-lite society by coordinating individual rides and optimizing vehicle usage.

- Logistics and cargo transportation: Transferring logistics from human-driven trucks to self-driving vehicles could improve capacity utilization. Trucks could operate around the clock without breaks or logbook limits on hours. With the use of platooning technology, autonomous vehicles may move in close-knit groups at high speeds to improve aerodynamics and save fuel. Furthermore, real-time electronic data sharing between infrastructure, control centers, and vehicles would allow for dynamic routing depending on traffic and roadwork data.. This could minimize distances traveled and further boost throughput. According to the Maritime and Port Authority of Singapore (MPA), port cargo throughput grew by 13.1% in 2021 to reach a record high of 37.5 million twenty-foot equivalent units (TEUs). This data indicates that Singapore's port performance remained resilient despite the ongoing COVID-19 pandemic. The Port of Singapore remained the world's busiest container transshipment port in 2021. Gradually integrating self-driving trucks and platooning technology into long-haul cargo transportation could strongly support Singapore's vision of increasing logistics capabilities and sustaining trade-led growth well into the future.

- Tourism: Tourism has a huge potential to accelerate the adoption of autonomous cars in Singapore. Autonomous vehicles can enhance tourist experience in the country by providing convenient and safe transportation options. With self-driving cars, travelers will have more flexibility to explore different areas without difficulty in navigating or finding parking spots. They can simply call for an autonomous car from their smartphone and it will pick them up and drop at the desired location without any hassle. This could especially benefit older tourists and people with disabilities by providing door-to-door accessible transportation. Autonomous vehicles are expected to revolutionize the way Singapore transports over 60 million tourists it receives annually. As the travel and tourism sector rebounds and international visitors increase, self-driving cars can efficiently ferry large volumes of passengers within the urban areas and to major tourist attractions. This would help decongest public transport and reduce traffic congestion on roads.

Singapore Autonomous Cars Market Restraints:

- High costs: One of the major factors holding back the growth of autonomous vehicles in Singapore is the high costs associated with the development and adoption of the technology. Autonomous systems require advanced hardware such as high-resolution cameras, radar systems and lidar sensors to navigate roads safely. These technologies come with a hefty price tag that Original Equipment Manufacturers (OEMs) need to recoup through sales volumes. However, with the limited size of Singapore's vehicle market, OEMs may struggle to achieve economies of scale needed to substantially reduce prices in the short to medium term. The Singaporean government could introduce incentives for companies developing AV technology, such as tax breaks, grants, or subsidies, to offset the high initial development costs. Additionally, incentives for consumers could accelerate adoption rates by making autonomous vehicles more affordable

- Technological challenges: Singapore has a very compact city landscape with many tall multistory buildings, narrow lanes and mixed traffic conditions making it difficult for autonomous vehicles to efficiently detect surrounding objects and navigate through complex road networks. The vehicles' sensors often have trouble differentiating between different types of vehicles, pedestrians and other obstacles on the road. This poses serious safety concerns. Even minor glitches in perception and decision making could lead to accidents. Furthermore, Singapore experiences heavy rainfall throughout the year which can reduce sensor visibility and data quality. Adverse weather conditions continue to restrict the real-world testing of autonomous driving systems. Another key issue is the lack of standardized communication protocols between vehicles and infrastructure. For autonomous driving to achieve its true potential, vehicles need to reliably communicate with traffic signals, signs and other surrounding cars in real-time. However, in Singapore there is no unified platform to support such vehicle-to-everything communication. Different brands use distinct wireless technologies making interoperability a challenge. Singapore has a thriving ecosystem for tech innovation, with many companies and startups working on AV technology. In the AV industry, research and development are highly prioritized since they are essential to resolving challenging navigational problems. To promote innovation in the autonomous vehicle industry, Singapore has been the site of partnerships between automakers, tech startups, academic institutions, and governmental organizations.. These collaborations foster the development of unified standards for vehicle communication protocols.

Market Size in USD Mn

CAGR15.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 15.4% |

| Larget Market | Singapore |

| Market Concentration | High |

| Major Players | Hyundai Motor, Renault, Moovita, nuTonomy, Grab and Among Others |

please let us know !

Singapore Autonomous Cars Market Trends

- Connectivity and digitization: Connectivity and digitization is greatly influencing the autonomous cars market in Singapore. With advancements in technologies like 5G, vehicle to everything (V2X) communication and cloud computing, autonomous vehicles are becoming more intelligent, connected and able to process massive amounts of real-time data. This is enhancing their navigational abilities on Singapore's busy roads. Vehicles are now able to communicate with other vehicles, infrastructure like traffic lights and signs, and share safety related alerts in real-time through V2X. This helps them detect potential hazards quicker and coordinate traffic flows better to avoid accidents. The high connectivity also allows car manufacturers to constantly update vehicle software and add new features over-the-air through cloud servers. This type of remote upgradeability was not possible in traditional vehicles and gives autonomous cars a clear upgrade path to keep improving their abilities.

- Electric vehicles: As EVs require less maintenance and have lower fueling costs compared to gasoline vehicles, their total cost of ownership is lower. This makes autonomous EVs more economically viable options for shared mobility services like robotaxis which are expected to be crucial for first mile last mile transportation in Singapore. Companies like Grab and ComfortDelGro have partnered with automakers to introduce EV options to their fleets and conduct trials of driverless EV runs with a safety operator. Their goal is to eventually offer autonomous EV rides to customers without any human driver. As battery charges last longer than refueling of gasoline tanks, autonomous EVs also allow for longer operational hours and higher vehicle utilization rates which will be important for the financial viability of robotaxi services. The Land Transport Authority's 2021 survey found that over 25% of over 2700 respondents were already regularly using or were open to using driverless vehicles (Source - LTA). As autonomous EV technology continues advancing, offering solutions like green, low-cost robotaxis will be crucial to gaining more public acceptance. This is likely to accelerate the commercial deployment of autonomous vehicles in Singapore, benefiting not just commuters but also autonomous vehicle developers and future mobility service providers.

- Artificial intelligence: Artificial intelligence is having a significant impact on advancing autonomous vehicle technology in Singapore. With the government very aggressively pushing development and adoption of self-driving cars, AI has become a core focus. Major players like nuTonomy, Grab and ComfortDelGro have been investing heavily in AI research and development to enhance object detection, navigation and decision making abilities of their test fleet vehicles. This has enabled the capabilities of autonomous vehicles to grow rapidly. For instance, nuTonomy develops and deploys autonomous vehicles and driverless technology, conducted a pilot project in one-north Business Park in 2019 with 6 driverless taxis demonstrating Level 4 autonomy without safety drivers. The vehicles were able to navigate complex scenarios involving pedestrians, cyclists and other vehicles. This project highlighted the progress made through continual upgrades to the AI systems. As AI drives more improvements, consumer confidence in the safety and reliability of autonomous driving is increasing.

Segmental Analysis of Singapore Autonomous Cars Market

Competitive overview of Singapore Autonomous Cars Market

Hyundai Motor, Renault, Moovita, nuTonomy, Grab, Astyx Communication , Ottopia , Autocast

Singapore Autonomous Cars Market Leaders

- Hyundai Motor

- Renault

- Moovita

- nuTonomy

- Grab

Singapore Autonomous Cars Market - Competitive Rivalry

Singapore Autonomous Cars Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Singapore Autonomous Cars Market

New product launches:

- In November 2023, Hyundai Motor Group and Motional, a global autonomous technology leader, jointly developed the all-electric IONIQ 5 robotaxi, which will be manufactured at the Hyundai Motor Group Innovation Center Singapore (HMGICS). The IONIQ 5 robotaxi is one of the first SAE Level 4 autonomous vehicles to be certified under the U.S. Federal Motor Vehicle Safety Standards (FMVSS).

- In May 2022, The Chinese manufacturer of electric vehicles, Nio, has announced that it will open a research and development facility in Singapore dedicated to artificial intelligence and autonomous driving. This center is a component of Nio's plan to work with science and research organizations in Singapore and draw in digital talent. The move by Nio to establish this center in Singapore is a reflection of a larger trend by Chinese automakers as they compete for market share in the autonomous driving space.

Acquisition and partnerships:

- In September 2023, BYD, a Chinese manufacturer of electric vehicles, is actively promoting its products in Singapore and other ASEAN countries. As part of its development into ASEAN, BYD intends to almost treble the number of its sales shops in Singapore. The business has teamed up with Sime Darby Motors is an automotive group, a Singaporean dealership network consisting of seven showrooms. This development is consistent with BYD's plan to establish distribution alliances with sizable regional businesses in order to broaden its market penetration and gauge consumer preferences.

- In December 2022, an open-source robotics software company supported by DARPA has been bought by Alphabet's robotics and artificial intelligence unit Intrinsic. Part of Intrinsic's plan to strengthen its position in the robotics industry is this acquisition. Further evidence of Alphabet's dedication to creating and implementing cutting-edge technologies in the transportation industry comes from the news that Intrinsic is reportedly joining the Singaporean autonomous vehicle market.

*Definition: The Singapore autonomous cars market refers an autonomous vehicle (AV), commonly referred to as a self-driving car, is a car that can sense its surroundings and function without the need for human intervention. The autonomous cars market is comprised of companies and research institutions that are involved in the development, production, and testing of vehicles that are capable of operating with little or no human input.

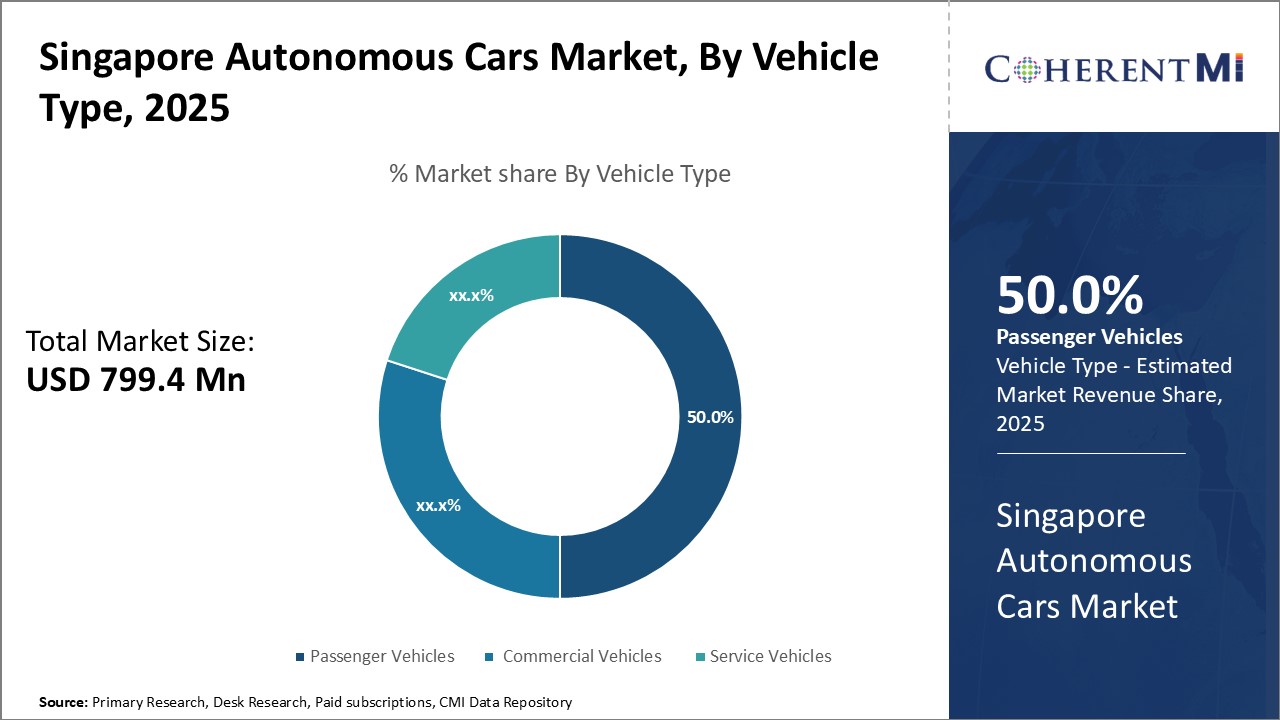

Singapore Autonomous Cars Market Segmentation

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Service Vehicles

- By Level of Automation

- Level 3

- Level 4

- Level 5

- By System

- Camera Systems

- LiDAR Systems

- Radar Systems

- Actuation Systems

- Computing Systems

- By Component

- Suppressor

- Gas Discharge Tube

- Surge Arrestor

- Others (Voltage Suppression Diode, Metal Oxide Varistor)

Would you like to explore the option of buying individual sections of this report?

Ameya Thakkar is a seasoned management consultant with 9+ years of experience optimizing operations and driving growth for companies in the automotive and transportation sector. As a senior consultant at CMI, Ameya has led strategic initiatives that have delivered over $50M in cost savings and revenue gains for clients. Ameya specializes in supply chain optimization, process re-engineering, and identification of deep revenue pockets. He has deep expertise in the automotive industry, having worked with major OEMs and suppliers on complex challenges such as supplier analysis, demand analysis, competitive analysis, and Industry 4.0 implementation.

Frequently Asked Questions :

How big is the Singapore Autonomous Cars Market?

The Singapore Autonomous Cars Market is estimated to be valued at USD 799.4 in 2025 and is expected to reach USD 2178.7 Million by 2032.

What are the major factors driving the Singapore Autonomous Cars Market growth?

The major factors driving Singapore Autonomous Cars growth include government initiatives and funding, tech savvy population, high population density, and public transport focus.

Which is the leading end user segment in the Singapore Autonomous Cars market?

The leading end user segment in the Singapore autonomous cars market is the vehicle type.

Which are the major players operating in the Singapore Autonomous Cars market?

The major players operating in the Singapore autonomous cars market are Hyundai Motor, Renault, Moovita, nuTonomy, Grab, Astyx Communication, Ottopia and Autocast

What will be the CAGR of Singapore Autonomous Cars market?

The CAGR of the Singapore autonomous cars market is projected to be 15.4% from 2025 to 2032.