Bioassay Services Market Trends

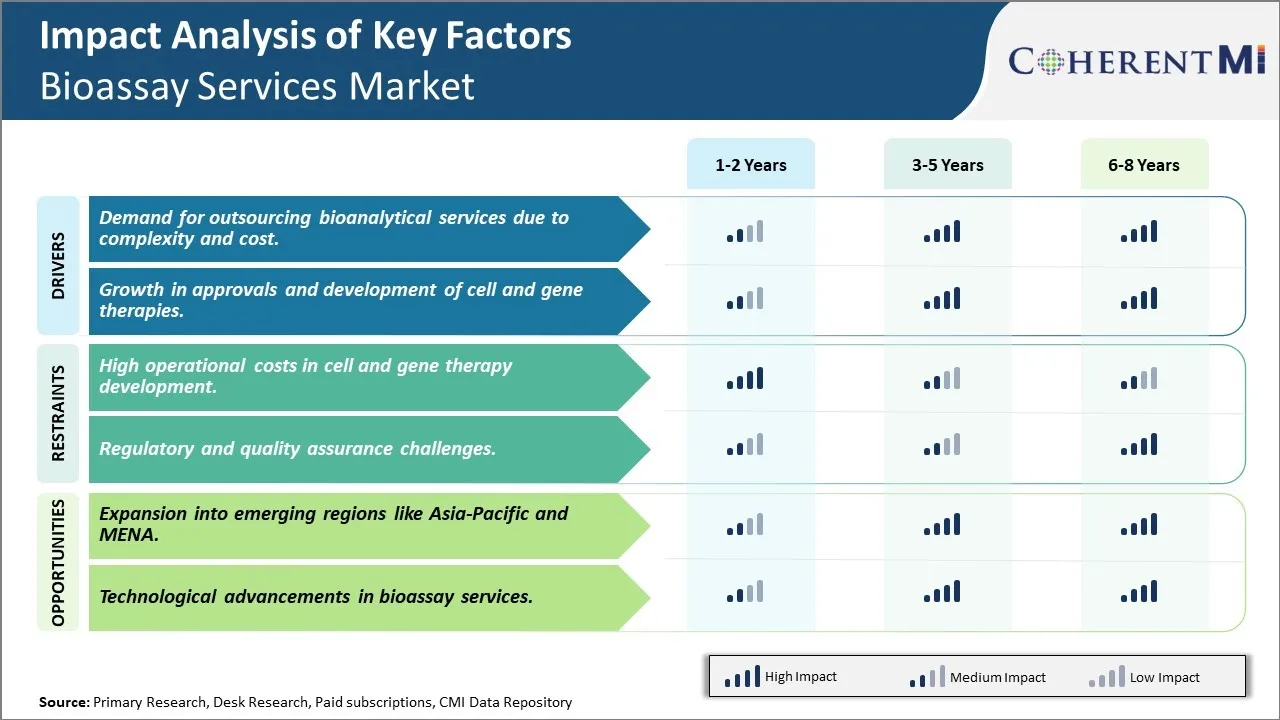

Market Driver - Demand for outsourcing bioanalytical services due to complexity and cost

The development and commercialization process of biological drugs has become highly complex and resource intensive in recent years. Life science companies, particularly small to mid-sized biotech firms, are facing tremendous operational and financial pressure to deliver innovative therapies to patients within strict timelines. The soaring R&D costs have necessitated streamlining of internal operations and focusing core expertise on drug discovery and clinical development. Bioanalysis, being a specialized discipline requiring high-end infrastructure and technical skills, is one such non-core area that is increasingly being outsourced to contract service providers.

Outsourcing bioanalysis allows sponsor companies to leverage the extensive experience and economies of scale of large CROs. With dedicated bioanalytical laboratories operating round-the-clock and employing specialized scientist workforce, CROs are able to optimize resource utilization and turnaround times. They maintain state-of-the-art analytical platforms along with validated bioanalytical methods for different sample types. This helps sponsors save significant costs associated with setting up and maintaining in-house bioanalysis capabilities. Moreover, outsourcing mitigates risks of non-compliance during regulatory audits as CROs are expert in adhering to stringent global bioanalysis guidelines and standards.

The rising complexity of modern biotherapies has also boosted outsourcing trends. Biosimilars, cell and gene therapies, antibodies and other large molecule biologics require complex bioanalytical method development due to their unique structural properties. CROs offer valuable expertise in tackling analytical challenges presented by such novel modalities. Their adept handling of customized bioanalysis needs has attracted many early stage sponsors who earlier relied on in-house resources. The accelerating drug pipeline and emerging modalities are anticipated to continuously augment outsourcing demand in the foreseeable future.

Market Driver - Growth in approvals and development of cell and gene therapies

There has been a tectonic shift in drug development paradigm in last decade with cell and gene therapies emerging at the forefront of innovation. These transformative treatments offer unprecedented capabilities to target root causes of diseases by modifying genes or replacing malfunctioning cells. Sparked by breakthrough approvals and encouraging clinical evidence, cell and gene therapies have generated tremendous interest amongst researchers and investors globally. Government agencies are also prioritizing their review to help bring these novel therapies to patients expeditiously.

The first FDA approval of a gene therapy in 2017 marked the beginning of a new treatment era. Since then, approvals of several cell and gene therapies across indications like cancer, rare diseases and ophthalmology have validated the clinical potential of these modalities. The approvals momentum is further catalyzing investments into early stage pipeline. Market estimates point to over 3000 ongoing clinical trials, a majority of them in Phase 1 and Phase 2 development stages. As these candidates progress through various stages, they will generate unprecedented demand for sophisticated bioanalytical solutions to characterize intricate product profiles and release parameters.

Cell and gene therapy developers also heavily rely on CROs to assist complex developmental activities including assay development, validation, sample analysis and potency testing. Ensuring product safety and maintaining high standards of purity and identity testing require specialized bioanalytical skills which CROs are well equipped with. Their single-use bioprocessing facilities and expertise in handling unique cell and gene therapy samples gain them precedence in outsourcing.

Market Challenge - High operational costs in cell and gene therapy development

One of the major challenges faced by the players in the bioassay services market is the high operational costs associated with cell and gene therapy development. Cell and gene therapy requires specialized laboratory facilities, expensive equipment, and highly skilled staff which significantly adds to the overall R&D expenses. Maintaining cell lines, ensuring sterility and performing analytical testing of multiple candidate molecules under development is a costly affair. Moreover, the regulatory requirements for biosafety and aseptic manufacturing are very stringent for cell and gene therapies which mandates additional capital investments in facilities and processes. Outsourcing certain analytic testing requirements to bioassay service providers helps reduce costs to some extent however overall cell and gene therapy development costs are substantially high compared to conventional drug development. The exorbitant costs pose significant entry barriers for new players and scaling up of these advanced therapies remains a challenge. To address these issues, companies are exploring innovative financing options and collaborations with academic institutions.

Market Opportunity - Expansion into emerging regions like Asia-Pacific and MENA

One of the key opportunities for players in the bioassay services market lies in expanding into emerging healthcare markets in Asia-Pacific and Middle-East and North Africa regions. These regions offer high growth potential owing to rising healthcare spending, growing clinical research outsourcing industry and increasing focus on innovation-driven drug discovery. The Asia-Pacific market in particular stands to benefit from initiatives like making China a global hub for pharmaceutical innovation and development. Additionally, lowering manufacturing costs and availability of skilled resources in these regions provides an added advantage. Leading bioassay service providers can capitalize on this opportunity by establishing local laboratories, partnering with local CROs and investing in sales and marketing activities to raise awareness among pharmaceutical and biotech companies based in emerging markets. This will help drive future growth and diversify business risks for market players.