Cannabis Use Disorder Market Size - Analysis

Market Size in USD Bn

CAGR9.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 9.5% |

| Market Concentration | Medium |

| Major Players | Aelis Farma, Indivior, Pfizer, Corbus Pharmaceuticals, Zynerba Pharmaceuticals and Among Others |

please let us know !

Cannabis Use Disorder Market Trends

With growing social acceptance of cannabis usage, what has also increased remarkably is public awareness about potential harms of substance abuse and addiction. Only in recent years, extensive scientific studies and their reporting in mainstream media has educated general population about diagnosable cannabis use disorder and how it can negatively impact one's personal and professional life if not addressed properly.

Additionally, mental health professionals are more trained today to identify underlying cannabis use issues during routine assessment of patients reporting mood, anxiety or other psychiatric disorders. All this growing recognition has encouraged many individuals with problematic cannabis consumption patterns to openly seek clinical help rather than considering it a casual habit.

This lifting of the veil of ignorance around risks of cannabis is driving up identification of people affected by cannabis use disorder.

Market Driver - Ongoing Advancements in Cannabinoid Receptor-targeting Therapies

Meanwhile natural and synthetic cannabinoids are also being experimented as replacement therapy during treatment induction phase. The substitution approach aims to gradually wean patient off heavy cannabis use by providing regulated alternative until their endocannabinoid tone stabilizes. Aside, medication assisted options such as nabiximols, a balanced mixture of THC and CBD is showing effectiveness as an adjuvant for therapy in cases of relapse prevention and as an add-on to behavioural counseling modules.

All these encouraging advances at the frontier of cannabinoid pharmacology lift spirits of individuals seeking long-lasting recovery and thereby fuel the momentum in cannabis use disorder therapeutics sector.

There are significant regulatory hurdles facing the development and approval of cannabis-based treatments for cannabis use disorder. Cannabis remains a Schedule I substance according to the United States Drug Enforcement Administration, meaning it is considered to have no accepted medical use. This classification creates immense difficulty for researchers seeking to study potential medical applications of cannabis.

Researchers must contend with onerous registration processes, security and monitoring requirements, import and export restrictions, and limited funding options due to cannabis's legal status. These factors collectively slow the pace of research and increase its costs considerably.

There is a significant opportunity for the cannabis use disorder market from emerging research on non-psychoactive cannabinoids and their applications. In particular, cannabidiol (CBD) is being extensively studied for its therapeutic potential without psychoactive side effects. CBD does not directly activate the cannabinoid receptors that are responsible for marijuana's psychoactivity.

The low abuse potential further increases accessibility and commercial viability. Continued preclinical and clinical research focused on isolating therapeutic compounds in cannabis holds great promise to expand options for those struggling with cannabis use disorder.

Prescribers preferences of Cannabis Use Disorder Market

Cannabis Use Disorder (CUD) encompasses a spectrum from mild to severe use, with progressive stages requiring different treatment approaches. For mild CUD, prescribers prefer non-pharmacological options like cognitive behavioral therapy to address underlying causes and develop coping strategies.

If a patient experiences repeated relapses or fails to achieve abstinence, alternative medications are considered. certain Antidepressants like Fluoxetine (Brand name: Prozac) may be prescribed off-label to reduce cravings and co-occurring depression. Prescribers also consider use of anti-epileptics like Topiramate (Brand name: Topamax) that can blunt euphoric effects and discourage further use.

Treatment Option Analysis of Cannabis Use Disorder Market

Cannabis Use Disorder progresses through mild, moderate, and severe stages. Treatment is tailored based on the stage of the disorder.

As the disorder advances to moderate severity, outpatient medication may be added to behavioral treatments. Naltrexone (brand name Revia) is an opioid antagonist that reduces cravings by blocking the dopamine-releasing effects of cannabis. Unlike other addictive substances, no FDA-approved medications exist specifically for cannabis use disorder. However, naltrexone off-label use has shown promise in clinical studies by decreasing relapse risk by half compared to placebo.

The multi-pronged biopsychosocial approach that matches treatment intensity to disease severity has proven most effective long-term for Cannabis Use Disorder.

Key winning strategies adopted by key players of Cannabis Use Disorder Market

One of the most effective strategies adopted by leading companies has been forming strategic partnerships and collaborations. For example, in 2020, Indivior entered into a partnership with Algernon Pharmaceuticals to develop NP-120 (Dextromethorphan + Quinidine) for the treatment of Cannabis Use Disorder.

Acquisitions of Novel Drug Technology Platforms:

Leading players are focusing R&D efforts on developing drugs with novel mechanisms of action. For example, Otsuka is developing brexanolone (SAGE-217), a first-in-class positive allosteric modulator of GABAA receptors for Cannabis Use Disorder.

Geographic Expansion into Emerging Markets:

Segmental Analysis of Cannabis Use Disorder Market

Insights, By Treatment: Growing Preference for Drugs with Fewer Side Effects

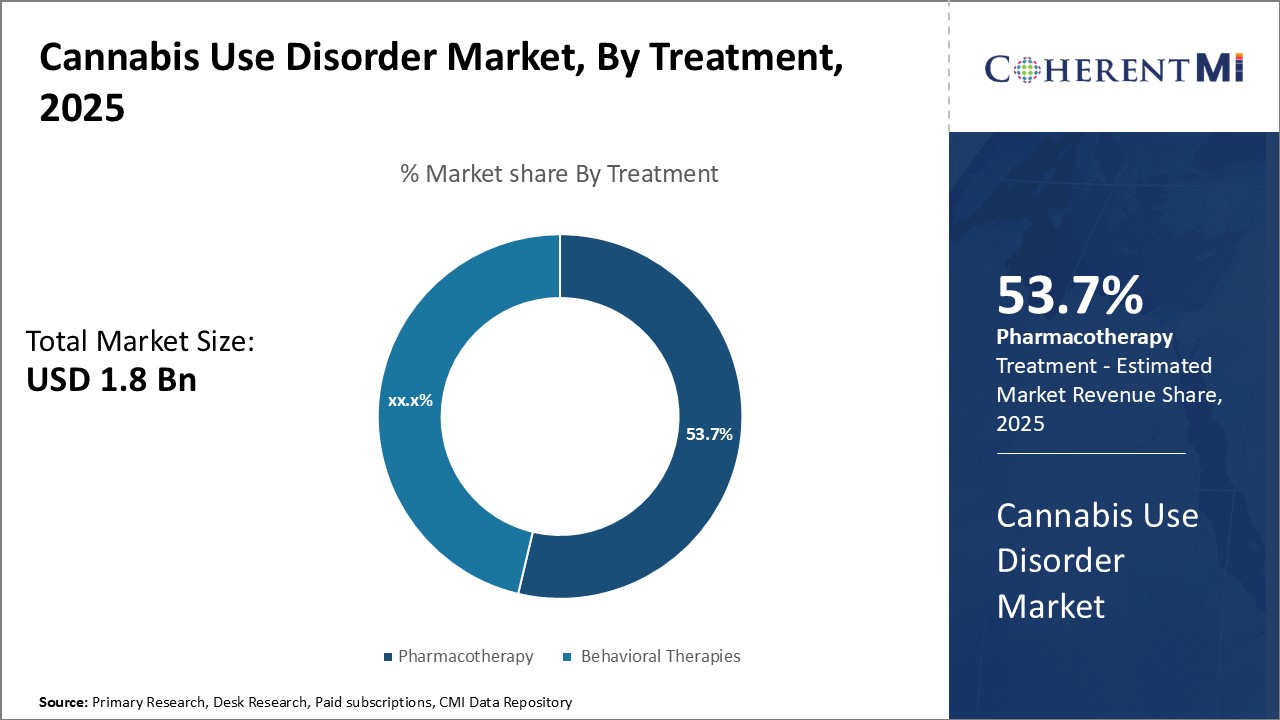

Insights, By Treatment: Growing Preference for Drugs with Fewer Side EffectsIn 2025, pharmacotherapy segment is expected to hold 53.7% share of the cannabis use disorder market owning to various pharmacological options with fewer side effects.

CB1 receptor antagonists such as rimonabant are also gaining prominence due to their ability to competitively bind to CB1 receptors in the brain to reduce the rewarding and reinforcing effects of cannabis. Additionally, antidepressants such as fluoxetine have shown promise in reducing craving and relapse. The availability of such pharmacological options with high efficacy and less risk of side effects has made pharmacotherapy the most preferred treatment modality. Further advances in formulations that optimize drug delivery through newer routes of administration can provide improved treatment adherence and clinical outcomes for patients.

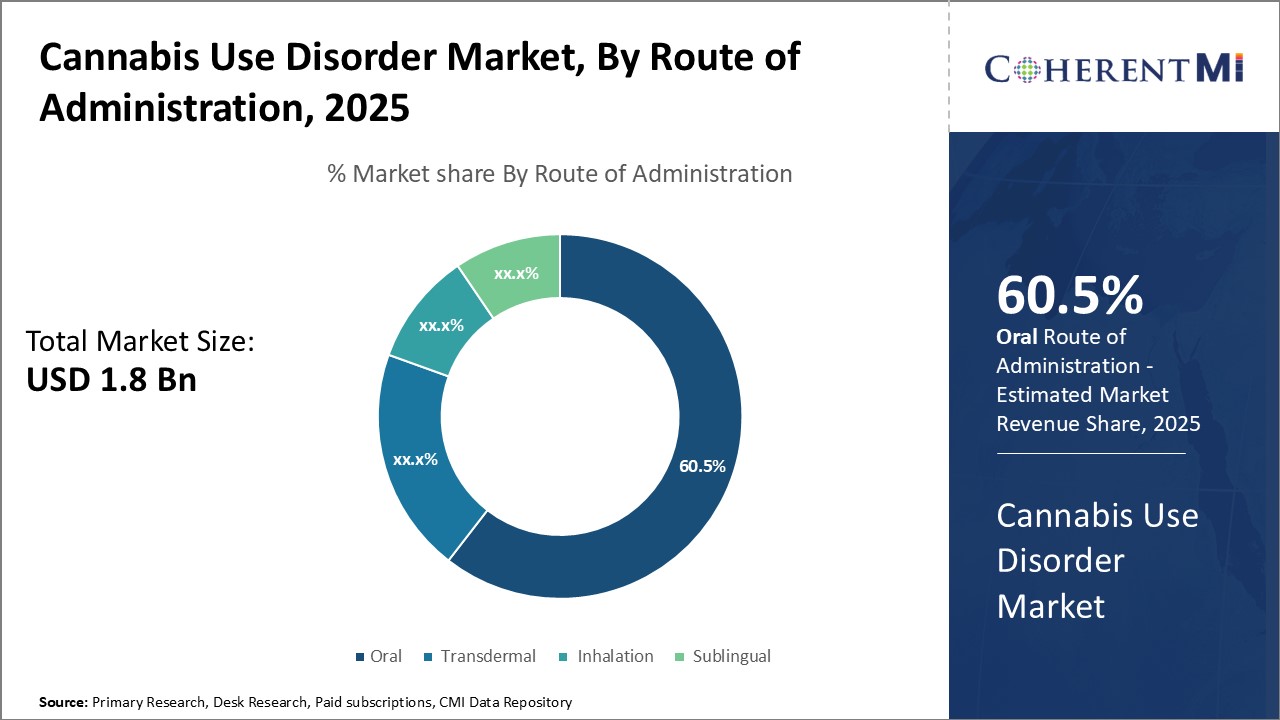

Oral route of administration is expected to contributes 60.5% share of the cannabis use disorder market in 2025, owning to the advantage of oral self-administration that eases adherence to treatment plan.

Oral drugs also permit flexible dosing schedules suited to individual patient needs. The non-invasive nature of oral administration puts users at ease, encouraging long-term adherence critical to management of a relapsing disorder like cannabis use. Novel drug delivery technologies further help overcome issues like reduced oral bioavailability and first-pass metabolism to optimize benefits of this convenient administration route.

Insights, By End User: Higher Insurance Coverage and Reimbursement

The hospital segment accounts for the major market share as most insurance plans have better coverage for inpatient/outpatient treatments in hospitals compared to other settings.

Many government-sponsored insurance plans often specify higher reimbursement limits for treatments in hospitals. This makes cannabis use disorder management more affordable for patients at hospitals. The availability of bulk funding and reimbursements have made hospitals a popular choice.

Additional Insights of Cannabis Use Disorder Market

- Approximately 9% of all cannabis users develop dependence, and this percentage increases among those who begin using in adolescence. The growing use of cannabis globally underscores the need for dedicated treatments, especially as more countries move toward legalization.

- Global Impact: An estimated 22 million people worldwide suffer from CUD, emphasizing the need for effective treatments.

- Youth Vulnerability: Studies indicate that individuals who start using cannabis before age 18 are 4 to 7 times more likely to develop CUD than adults.

- Clinical Trials Expansion: There has been a surge in clinical trials focusing on pharmacological interventions for CUD, indicating growing scientific interest and investment in this area.

- Government Initiatives: Some governments are funding programs to address cannabis misuse, reflecting recognition of CUD as a public health concern.

Competitive overview of Cannabis Use Disorder Market

The major players operating in the cannabis use disorder market include Aelis Farma, Indivior, Pfizer, Corbus Pharmaceuticals, Zynerba Pharmaceuticals, GW Pharmaceuticals, and Insys Therapeutics.

Cannabis Use Disorder Market Leaders

- Aelis Farma

- Indivior

- Pfizer

- Corbus Pharmaceuticals

- Zynerba Pharmaceuticals

Cannabis Use Disorder Market - Competitive Rivalry

Cannabis Use Disorder Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Cannabis Use Disorder Market

- In June 2024, Aelis Farma announced that its CB1 receptor modulator, AEF0117, entered Phase IIb trials for the treatment of Cannabis Use Disorder (CUD). This drug showed promise in early trials by significantly reducing the effects of cannabis without triggering withdrawal symptoms. AEF0117 specifically targets the CB1 receptor and blocks THC's behavioral effects, offering a novel approach to reducing cannabis dependence. The ongoing Phase IIb trial is expected to further evaluate the drug's efficacy in treating moderate to severe CUD.

- In February 2024, Pfizer initiated research into synthetic cannabinoids targeting addiction mechanisms. Their preclinical results could pave the way for a novel oral drug for CUD. Pfizer is known for extensive research in therapeutic areas, including investigational compounds for various conditions.

- In August 2023, Aelis Farma announced positive Phase II clinical trial results for AEF0117, a compound aimed at reducing cannabis dependence. This trial showed promising results, indicating that AEF0117 has the potential to lower cannabis use in individuals with moderate to severe Cannabis Use Disorder (CUD). This development strengthens Aelis Farma’s position in the CUD treatment space, potentially impacting market dynamics by offering an innovative solution in a largely underserved therapeutic area.

- In May 2023, GW Pharmaceuticals began a new clinical study investigating the use of a CBD-based drug for treating CUD. As a company with a strong track record in cannabinoid therapies, this move could expand their portfolio and offer new hope for patients. GW Pharmaceuticals has a strong history of researching and developing CBD-based treatments, particularly for conditions like epilepsy and glioma.

- In February 2023, Indivior PLC completed the acquisition of Opiant Pharmaceuticals, enhancing its portfolio of addiction treatments. This acquisition, valued at approximately $145 million with potential additional payments, was strategically aimed at strengthening Indivior’s focus on substance use disorder therapies, including treatments for opioid overdose and other substance use disorders. Specifically, Opiant’s pipeline includes OPNT003, a nasal spray for opioid overdose, and early-stage programs targeting conditions such as alcohol use disorder and acute cannabinoid overdose (a relevant condition for Cannabis Use Disorder therapies).

Cannabis Use Disorder Market Segmentation

- By Route of Administration

- Oral

- Transdermal

- Inhalation

- Sublingual

- By End User

- Hospitals

- Specialty Clinics

- Rehabilitation Centers

- Homecare Settings

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the cannabis use disorder market?

The cannabis use disorder market is estimated to be valued at USD 1.80 Bn in 2025 and is expected to reach USD 3.40 Bn by 2032.

What are the key factors hampering the growth of the cannabis use disorder market?

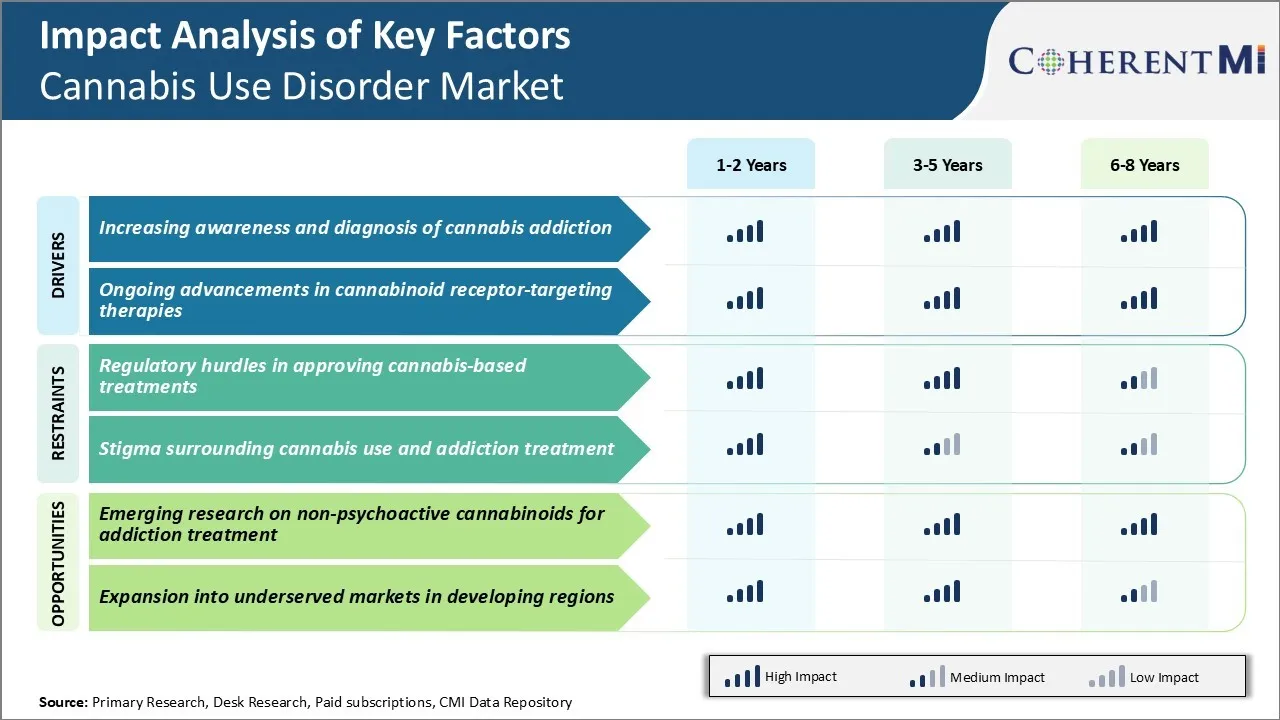

The regulatory hurdles in approving cannabis-based treatments and stigma surrounding cannabis use and addiction treatment are the major factors hampering the growth of the cannabis use disorder market.

What are the major factors driving the cannabis use disorder market growth?

The increasing awareness and diagnosis of cannabis addiction and ongoing advancements in cannabinoid receptor-targeting therapies are the major factors driving the cannabis use disorder market.

Which is the leading treatment in the cannabis use disorder market?

The leading treatment segment is pharmacotherapy.

Which are the major players operating in the cannabis use disorder market?

Aelis Farma, Indivior, Pfizer, Corbus Pharmaceuticals, Zynerba Pharmaceuticals, GW Pharmaceuticals, and Insys Therapeutics are the major players.

What will be the CAGR of the cannabis use disorder market?

The CAGR of the cannabis use disorder market is projected to be 9.5% from 2025-2032.