The chemotherapy induced neutropenia (CIN) market is estimated to be valued at USD 14.88 Bn in 2025 and is expected to reach USD 21.08 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.1% from 2025 to 2032. The growth of this market is primarily driven by the growing prevalence of cancer cases worldwide and increasing adoption of chemotherapy as an effective treatment modality.

Market Size in USD Bn

CAGR5.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.1% |

| Market Concentration | Medium |

| Major Players | Amgen Inc., Sandoz, Teva Pharmaceutical Industries Ltd., Coherus BioSciences, Mylan N.V. and Among Others |

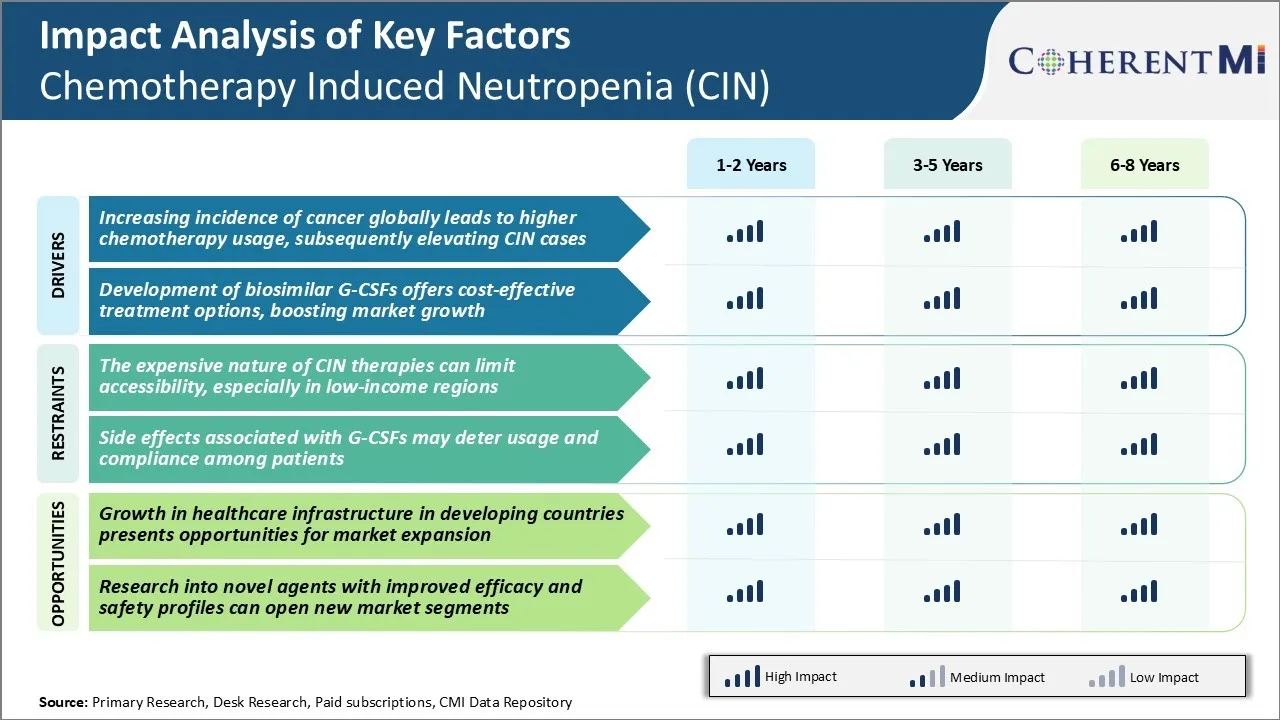

Market Driver - Increasing Incidence of Cancer Globally Leads to Higher Chemotherapy Usage, Subsequently Elevating CIN Cases

As per the latest global cancer statistics, cancer burden has been continuously increasing over the past few decades. The global cancer incidence reached 18.1 million new cases in 2018 and this number is further expected to rise to 29.5 million new cancer cases by 2040.

The rising cancer incidence has consequently led to a proportional rise in chemotherapy usage for cancer treatment worldwide. Chemotherapy still remains one of the most widespread and invaluable treatment approaches for various cancers.

Chemotherapy severely depletes the neutrophil counts in patients by damaging the bone marrow where they are produced. This leaves the patients highly susceptible to life-threatening infections. With rising global cancer incidence, the patient pool opting for chemotherapy is also constantly increasing year-on-year. This substantially enlarges the at-risk population for CIN development worldwide.

Additionally, newer chemotherapy regimens involving combination therapies are becoming common practice nowadays to enhance treatment efficacy for several cancers. However, combined chemotherapy often leads to greater myelosuppressive effects and deeper as well as prolonged neutropenia compared to single agent chemotherapies. All these factors related to widespread chemotherapy usage are majorly fueling the growing CIN caseload globally.

Market Driver - Development of Biosimilar G-CSFs Offers Cost-Effective Treatment Options

The biosimilar version of granulocyte colony stimulating factors (G-CSFs) has emerged as an affordable prophylactic treatment approach for chemotherapy-induced neutropenia (CIN) in recent years. However, the originator biological G-CSFs have remained very expensive for long due to their premium pricing by manufacturers despite facing patent expiration.

This affordability challenge restricted their wider adoption, especially in low and middle-income countries with considerable cancer patient populations. The development of biosimilar G-CSFs by many pharmaceutical players has completely transformed this treatment landscape in the past decade.

Biosimilars are highly similar copies of innovative biologic medicines that typically cost 25-50% less than the originator products while offering similar efficacy and safety profiles. The approval and successful commercialization of a large number of G-CSF biosimilars since 2015 has significantly improved accessibility and reduced the economic burden of CIN management.

This biosimilar-led pricing pressure on originator G-CSFs has also positively impacted their prices in several markets. Overall, the biosimilar era has brought G-CSF therapy within the reach of many more chemotherapy patients globally who were earlier deprived of CIN prevention due to high costs.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Expensive Nature of CIN Therapies Can Limit Accessibility

One of the key challenges for the chemotherapy induced neutropenia (CIN) market is the expensive nature of CIN therapies. Treating chemotherapy-induced neutropenia often involves administering growth factors such as G-CSF to stimulate white blood cell production.

However, these therapies come at a high financial cost, sometimes in the range of thousands of dollars for a single patient. This heavy cost burden can limit accessibility to such therapies, especially in low-income regions where many cannot afford to pay for them.

Many developing nations and underdeveloped areas have limited access to healthcare and medical insurance. The high cost of CIN treatments thus becomes a barrier, preventing patients in these low-income regions from accessing crucial therapies. This creates an untreated population who is left vulnerable to chemotherapy-related complications like severe infections.

Addressing affordability challenges through initiatives like income-based pricing can help expand access to CIN treatments in resource-constrained settings and reduce risks for those undergoing chemotherapy. However, achieving this balance remains an ongoing obstacle in the market.

Market Opportunity - Growth in Healthcare Infrastructure in Developing Countries Presents Opportunities

The chemotherapy induced neutropenia (CIN) market has potential opportunities arising from positive developments in the healthcare infrastructure of developing countries. Many emerging economies are experiencing substantial economic growth which is enabling greater investments to strengthen their healthcare systems. This includes expanding health insurance coverage, building new hospitals and clinics, and improving diagnostics and treatment capabilities.

As healthcare facilities increase in developing regions, more cancer patients will be able to access chemotherapy locally. This rises the rate of chemotherapy usage and correspondingly grows the patient pool experiencing CIN. Similarly, enhanced health insurance can help overcome the financial barriers limiting access to expensive CIN therapies.

The deepening healthcare infrastructure in developing countries thus presents lucrative prospects for CIN drug manufacturers and service providers to increase market penetration in these untapped growth markets. Entering developing country markets earlier allows companies to gain familiarity and dominate as healthcare facilities continue modernizing over the coming years.

CIN typically occurs following chemotherapy regimens given for various cancer types. First-line CIN treatment involves the use of granulocyte colony-stimulating factors (G-CSFs), which work to stimulate white blood cell production. The most commonly prescribed G-CSFs are pegfilgrastim (Neulasta) and filgrastim (Neupogen). Pegfilgrastim is preferred over filgrastim for its more convenient once-per-cycle dosing.

In cases where first-line treatment with G-CSFs is contraindicated or not well-tolerated, prescribers may opt for second-line therapies. The biosimilar pegfilgrastim Ziextenzo (pegfilgrastim-bmez) has gained acceptance as a lower-cost alternative to Neulasta for second-line use. For patients with non-Hodgkin's lymphoma or solid tumors on a chemotherapy regimen with intermediate risk of febrile neutropenia, prescribers may choose oral granulocyte-macrophage colony-stimulating factors like sodim filgrastim (Grastofil) as a more convenient option.

Key factors influencing prescribers' CIN treatment choices include drug efficacy and safety profiles, routes of administration, cost considerations, and payer restrictions. Younger patients in good general health tolerate more aggressive regimens, allowing for higher-risk protocols with greater antitumor activity. By contrast, older or immunocompromised patients tend to receive lower-risk regimens favoring outpatient management.

Chemotherapy Induced Neutropenia (CIN) can be treated differently based on its severity and the chemotherapy regimen. Treatment options range from close monitoring to drug therapy.

For mild CIN (absolute neutrophil count (ANC) ≥1000 cells/μL), treatment is not usually needed but patients are closely monitored. For moderate CIN (ANC 500-999 cells/μL), doctor may prescribe G-CSF injections like pegfilgrastim (Neulasta) or filgrastim (Neupogen). These drugs stimulate bone marrow to produce more white blood cells, reducing the risk of infection. They are administered 24 hours after chemotherapy ends, in a single dose for pegfilgrastim and daily doses for filgrastim until ANC recovery.

For severe CIN (ANC <500 cells/μL with fever or ANC <100 cells/μL), inpatient treatment with intravenous (IV) antibiotics, antifungals, and G-CSFs is needed. Doctors prefer pegfilgrastim or biosimilar Ziextenzo as a single dose is more convenient than daily filgrastim injections. Hospitalization allows close monitoring for fever which could indicate infection.

In high-risk patients receiving chemotherapy with >20% incidence of febrile neutropenia, G-CSF primary prophylaxis with pegfilgrastim or filgrastim is recommended for every chemotherapy cycle to prevent complications. This makes G-CSFs the most preferred treatment option in these cases.

Product innovation - Developing novel drugs to treat CIN has been a core strategy for market leaders. For example, Amgen's Neulasta was the first FDA approved drug to treat CIN in 2002. It significantly reduced the duration and severity of neutropenia compared to G-CSF therapies available at the time. This established Neulasta as the standard of care and helped Amgen garner over 80% market share.

Expanding indications - Gaining approval for additional indications expands the addressable patient pool. In 2012, Neulasta was approved to reduce the incidence of infection in patients receiving myelosuppressive anti-cancer drugs associated with a clinically significant incidence of febrile neutropenia.

Partnering for biosimilars - As patent cliffs approached, companies partnered with biosimilar makers. For example, in 2019, Sandoz/Novartis launched Ziextenzo, a Neulasta biosimilar approved via a partnership with Mylan.

Acquisitions - Buying competitors strengthened portfolios. In 2015, Pfizer acquired Hospira mainly for its portfolio including Neupogen, a G-CSF therapy. This gave Pfizer two genetically engineered G-CSF drugs to compete against Amgen.

Aggressive marketing - Launching direct-to-consumer advertising campaigns increased patient and physician awareness. For example, Amgen heavily marketed Neulasta's once-per-cycle dosing convenience versus Neupogen's daily injections, a strategy that helped increase Neulasta's share to over 80% of the G-CSF market.

-market-by-treatment.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy Insights, By Treatment: Recurrence of Neutropenia drives demand for Granulocyte Colony-Stimulating Factors (G-CSFs)

To learn more about this report, Download Free Sample Copy Insights, By Treatment: Recurrence of Neutropenia drives demand for Granulocyte Colony-Stimulating Factors (G-CSFs)

In terms of treatment, granulocyte colony-stimulating factors (G-CSFs) are projected to contribute 72.8% of the market share in 2025, owning to their effectiveness in managing recurrent episodes of neutropenia associated with chemotherapy. G-CSFs such as Filgrastim and Pegfilgrastim are commonly prescribed for chemotherapy regimens with high risks of causing severe neutropenia. These biologics work by stimulating the bone marrow to produce more white blood cells, helping to boost neutrophil counts and reducing the risks and impacts of infections during chemotherapy.

The recurrence of neutropenia associated with subsequent chemotherapy cycles continues to be a key challenge in cancer treatment. G-CSFs have proven track record in mitigating this issue and maintaining dose intensities of chemotherapy regimens over time. Their ability to reduce the incidence of febrile neutropenia, allow on-time administration of full chemotherapy doses with minimal disruptions, and prevent hospitalizations helps drive consistent demand for G-CSFs, especially among high-risk patients.

-market-by-distribution-channel.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By Distribution Channel: Growing Cancer Prevalence Increases Hospital Pharmacy Sales

In terms of distribution channel, hospital pharmacies are likely to contribute 68.7% share of the market in 2025, due to the acute nature of chemotherapy-induced neutropenia and its treatment. A growing prevalence of cancers treated with chemotherapy regimens such as breast cancer, lung cancer and leukemia has resulted in higher volumes of inpatient cancer care and chemotherapy administrations in hospitals.

Patients experiencing chemotherapy complications like febrile neutropenia require immediate medical intervention and IV drug administration under hospital supervision. The convenience of procuring and administering G-CSF injections, antibiotics and other neutropenia supportive drugs from hospital pharmacies for admitted patients drives their sales.

Strict cold chain requirements and shorter shelf lives of biologics like G-CSFs also encourage centralized storage and distribution through hospital supply chains versus retail settings. Furthermore, hospital pharmacovigilance policies and formulary listings favor distribution of novel and high-cost neutropenia drugs through in-hospital dispensing channels.

Insights, By Cancer Type: Targeted Therapies Increase Neutropenia Risk in Breast Cancer Patients

In terms of cancer type, breast cancer contributes the highest share of the market as it is one of the most common types of cancer treated with intensive chemotherapy. While therapeutic advances have improved treatment outcomes for breast cancer, newer chemotherapy medications and targeted therapies themselves contribute to higher risks of neutropenia due to their mechanism of action.

A growing adoption of combined anthracycline and taxane-based adjuvant regimens increases the severity and frequency of neutropenia episodes compared to older standards of care. Additionally, CDK4/6 inhibitors and PARP inhibitors used in metastatic settings add multiplicative myelosuppressive effects when given with chemotherapy backbones.

Higher needs to effectively manage neutropenia complications drive the use of G-CSF support, PJP/fungal prophylaxis and hospitalization rates among the large and growing breast cancer patient pool receiving complex multi-modality therapies.

The major players operating in the Chemotherapy Induced Neutropenia (CIN) Market include Amgen Inc., Sandoz, Teva Pharmaceutical Industries Ltd., Coherus BioSciences, and Mylan N.V.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Chemotherapy Induced Neutropenia (CIN) Market is segmented By Treatment (Granulocyte Colony-Stimulat...

Chemotherapy Induced Neutropenia (CIN) Market

How big is the chemotherapy induced neutropenia (CIN) market?

The chemotherapy induced neutropenia (CIN) market is estimated to be valued at USD 14.88 Bn in 2025 and is expected to reach USD 21.08 Bn by 2032.

What are the key factors hampering the growth of the chemotherapy induced neutropenia (CIN) market?

The expensive nature of CIN therapies can limit accessibility, especially in low-income regions. Furthermore, the side effects associated with G-CSFS may deter usage and compliance among patients. These are the major factors hampering the growth of the chemotherapy induced neutropenia (CIN) market.

What are the major factors driving the chemotherapy induced neutropenia (CIN) market growth?

The increasing incidence of cancer globally leads to higher chemotherapy usage, subsequently elevating CIN cases and development of biosimilar G-CSFS offers cost-effective treatment options are the major factors driving the chemotherapy induced neutropenia (CIN) market.

Which is the leading treatment in the chemotherapy induced neutropenia (CIN) market?

The leading treatment segment is granulocyte colony-stimulating factors (G-CSFs).

Which are the major players operating in the chemotherapy induced neutropenia (CIN) market?

Amgen Inc., Sandoz, Teva Pharmaceutical Industries Ltd., Coherus BioSciences, and Mylan N.V. are the major players.

What will be the CAGR of the chemotherapy induced neutropenia (CIN) market?

The CAGR of the chemotherapy induced neutropenia (CIN) market is projected to be 5.1% from 2025-2032.