Chronic Idiopathic Urticaria (CIU) Treatment Market Trends

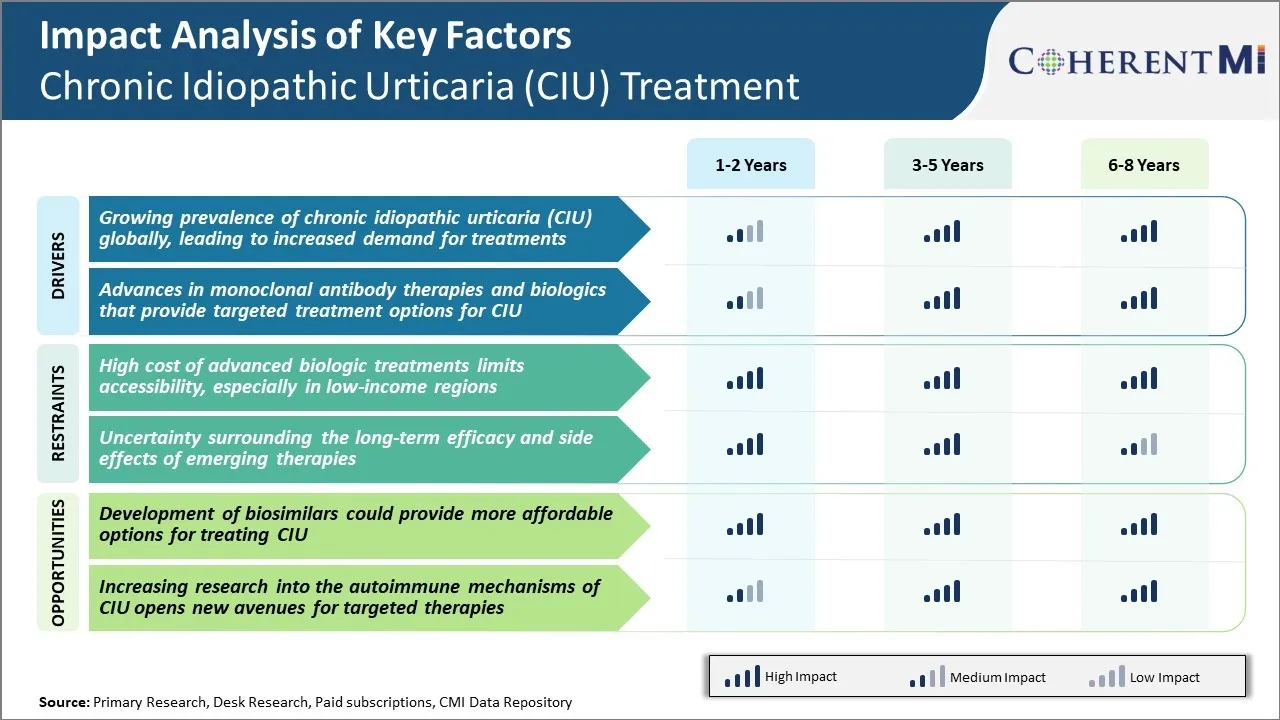

Market Driver - Growing Prevalence of Chronic Idiopathic Urticaria (CIU) Globally

Chronic idiopathic urticaria, also known as chronic spontaneous urticaria, is a common condition characterized by itchy hives or wheals on the skin that last for more than six weeks. While the exact cause remains unknown in many cases, its prevalence has been increasing over the past couple of decades around the world. Many factors such as environmental triggers, stressful lifestyle, and food allergies are considered to play a role in the development of CIU symptoms. With more people getting affected by this distressing condition, the demand for effective CIU treatment options has surged significantly.

According to available estimates, CIU is estimated to affect nearly 1% of the global population at some point in their lifetime, with higher occurrence reported in developed nations where modern risk factors are more prevalent. The condition often has a deteriorating effect on the quality of life as continuous itching and wheals can cause insomnia, irritability, lethargy and negatively impact daily activities and social interactions. With growing awareness, more people are seeking medical help for their symptoms instead of treating them as minor skin conditions. This has translated into rising numbers of prescription of CIU medications over the last few years.

Market Driver - Advances in Monoclonal Antibody Therapies and Biologics that Provide Targeted Treatment Options for CIU

Researchers have been vigorously working on developing novel treatment approaches for refractory chronic idiopathic urticaria that does not adequately respond to conventional second-generation antihistamines. This has led to significant advances in monoclonal antibody therapies and biologic agents that precisely target the underlying disease mechanisms.

For example, omalizumab, a humanized monoclonal antibody directed against immunoglobulin E, was the first biologic successfully approved by regulatory agencies for the management of CIU. In clinical trials, omalizumab has shown to provide substantially greater relief from itchiness, hives, and angioedema than placebo.

More recently, faricipimab and ligelizumab, both targeting immune system signals involved in CIU, entered late-stage clinical evaluation. Their promising efficacy and safety profile observed so far indicates these treatments could emerge as major game changers for managing difficult to control CIU cases.

The availability of such targeted biologics thatinterrupt the immunological pathways leading to wheals and itching provides fresh hope to patients not optimally responding to first line options. This has accelerated research into newer monoclonal antibodies for various subtypes of CIU. The development of precision treatments will enable improving quality of life for many CIU sufferers, driving increased adoption of these advanced therapies in clinical practice.

Market Challenge - High Cost of Advanced Biologic Treatments Limits Accessibility

The cost of advanced biologic treatments for chronic idiopathic urticaria (CIU) such as monoclonal antibodies (mAbs) pose a major challenge for widespread adoption globally. These specialty biologics which target immunoglobulin E (IgE) or its high-affinity receptor FcεRI are very effective at providing rapid symptom control but have a high list price ranging from $30,000 to $50,000 per patient annually.

While they may prove cost-effective by reducing the need for other health services in responders, their high acquisition cost puts them out of reach for many healthcare systems and individual patients in low and middle-income countries. Even in developed markets, the out-of-pocket costs after insurance reimbursement can be prohibitively high for some patients. This price barrier limits access to the most effective therapies especially for underprivileged populations in developing or resource-limited regions.

Unless more affordable biosimilar or novel oral treatment options become available, CIU will likely continue to negatively impact quality of life for many patients who fail conventional oral therapies due to financial restrictions on costly biologics.

Market Opportunity - Development of Biosimilars could Provide More Affordable Options for Treating CIU

The emergence of biosimilars referencing leading biologic therapies for CIU offers a potential opportunity to address their high treatment costs and expand access to patients worldwide. Biosimilars which have demonstrated comparable quality, safety and efficacy to their reference products but are marketed at a discounted price, could capture a sizable portion of the market once patent protection for innovator drugs begins to expire.

Global spending on CIU biologics is projected to reach $2 billion by 2025 as uptake increases, making it an attractive market segment for follow-on competition. As the first wave of biosimilar approvals are launched in major pharmaceutical markets, over time they are expected to erode prices significantly through market forces.

Wider availability of affordable near-biosimilar or biosimilar equivalents of biologics could enable physicians to optimize treatment for many more CIU patients, especially those in price-sensitive regions where cost had been a barrier to care.