Chronic Plaque Psoriasis Market Trends

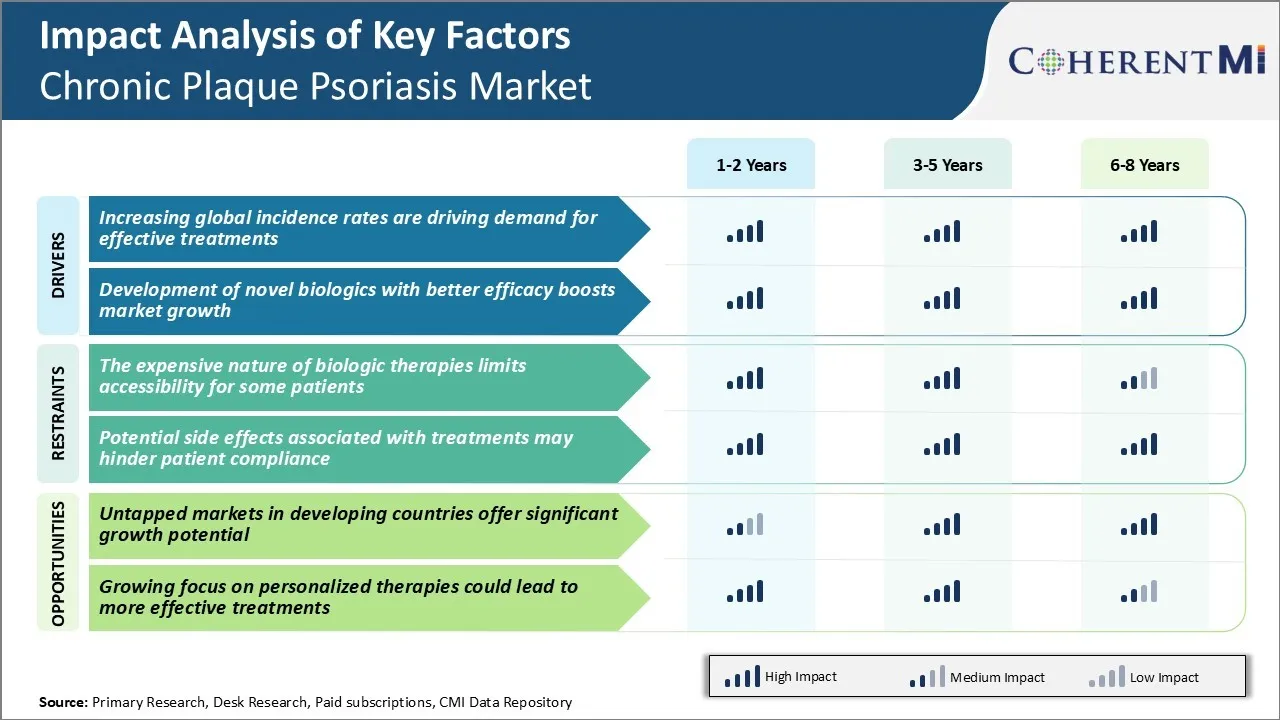

Market Driver - Increasing global incidence rates are driving demand for effective treatments

The global prevalence of chronic plaque psoriasis has been steadily rising over the past few decades. According to epidemiological studies, about 2-3% of the world's population suffers from some form of psoriasis. This poses serious medical challenges as well as financial burden on healthcare systems

Conventional topical therapies sometimes prove inadequate in controlling symptoms or undesirable due to frequent application. Phototherapy using UV light helps but access is limited. Meanwhile, people are seeking more convenient and effective treatment options to manage their condition and maintain an acceptable quality of life.

Biopharmaceutical firms are investing heavily in clinical research to offer patients more targeted solutions backed by strong clinical evidence. Injectables and oral medicines represent major improvements over traditional topical creams if they can demonstrate high skin clearance rates and minimal side effects. Successful launches satisfy unmet demand and also encourage more individuals to seek diagnosis and management of mild cases.

As awareness rises regarding available treatment alternatives, even partial reimbursement by insurance provides an incentive to actively control the disease. This steadily drives up consumption of effective chronic plaque psoriasis medications worldwide. Their long-term success depends on continuous innovation to achieve remission for more patients through safer formulations.

Market Driver - Development of Novel Biologics Drives Optimism

Having achieved remarkable progress over the last decade, development of novel biologic agents remains one of the most promising areas for chronic plaque psoriasis therapy. Biologics target specific components of the immune system known to play a key role in psoriasis pathogenesis.

This fueled intensive R&D efforts to design biologics attacking newer targets. The IL-17 inhibitors secukinumab, ixekizumab and brodalumab were breakthrough achievements, demonstrating superior efficacy to TNF inhibitors in clinical trials. They gained rapid regulatory approvals and commercial uptake based on high rates of total skin clearance after 12-16 weeks of treatment. Approvals of the IL-23 inhibitors guselkumab, tildrakizumab and risankizumab followed suit, with similarly strong efficacy data against placebo.

Effect sizes of newer biologics also surpass most historical psoriasis medications which bolsters optimism in the patient community. Significant progress continues in biosimilar development as well to improve accessibility through lower costs.

The biologics pipeline remains robust with several targets under investigation.

This promises further innovation to address unmet needs in harder-to-treat populations including pediatric patients and those with co-morbid conditions like psoriatic arthritis. Sustained high R&D productivity in the domain ensures a thriving chronic plaque psoriasis market globally driven by launch of novel safe and effective biologic treatments.

Market Challenge - The Expensive Nature of Biologic Therapies Limits Accessibility for Some Patients

One of the major challenges faced in the chronic plaque psoriasis market is the expensive nature of biologic therapies which limits their accessibility for some patients. Biologics have revolutionized the treatment of moderate to severe psoriasis however their high list prices pose affordability issues.

For instance, the top selling drug Humira has an annual list price of over $67,000 in the US. While cost sharing programs and discounts offered by pharma companies help offset the costs for insured patients, the out-of-pocket costs still remain unaffordable for many. This is a significant barrier especially in regions with less robust public healthcare systems and for patients who are uninsured or underinsured.

The costs of biologics also put pressure on public and private drug formularies to limit access in order to control prescription drug spending. This financial challenge affects treatment outcomes as some patients discontinue or ration their biologic prescriptions due to affordability reasons leading to suboptimal management of their psoriasis conditions.

Market Opportunity - Potential in Developing Markets

A major opportunity for growth in the chronic plaque psoriasis market is the untapped potential existing in developing markets. While the prevalence rates of psoriasis are high across the globe, treatment rates remain low in developing countries largely due to lack of access and awareness.

According to some estimates, over 80% of psoriasis patients in developing nations remain untreated. This presents a massive commercial opportunity for pharmaceutical companies to expand access to effective treatments.

Firstly, companies can pursue strategies such as developing low-cost biosimilar and generic versions of drugs specifically targeting these underserved populations.

Secondly, investments in building healthcare infrastructure and raising awareness can help boost diagnosis and treatment rates over time. As incomes rise across emerging economies, more patients will be able to afford standard therapies, representing considerable long term growth prospects for market players. However, ensuring drug availability at affordable price points suitable for these markets will be critical to fully capitalizing on this significant market potential.