Chronic Spontaneous Urticaria Market Trends

Market Driver - Increasing Awareness and Improved Diagnostic Capabilities

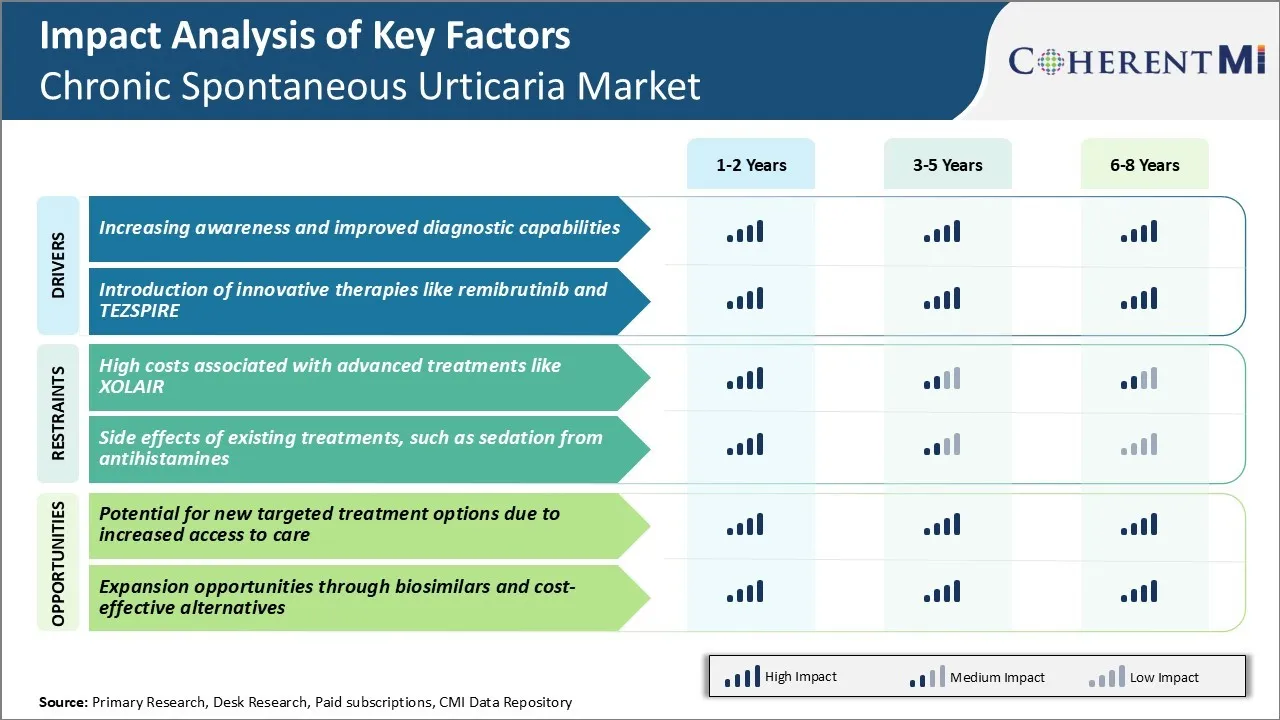

Over the past decade, patient advocacy groups and medical associations have launched numerous campaigns aimed at educating both medical professionals and the general public. Doctors are now much more vigilant in evaluating patients presenting with hives and angioedema, investigating for potential underlying triggers and making an accurate diagnosis.

Symptom diaries, skin testing, and laboratory assays have markedly enhanced clinicians' ability to distinguish chronic spontaneous urticaria from other similar conditions. This has allowed patients to receive targeted treatment instead of merely trialing various antihistamines.

The accessibility of health information on the internet has empowered individuals to learn more about their condition and advocate for proper evaluation. Online communities provide peer support that helps normalize the experience and boosts morale. Partnerships between advocacy organizations and pharmaceutical companies have sponsored educational initiatives in hospitals, clinics, and universities to spread understanding among medical professionals.

As awareness spreads and diagnostic prowess improves, more cases are brought to light, appropriately characterized, and plugged into treatment algorithms. This growing visibility and validation of chronic spontaneous urticaria as a significant disease state is strengthening the basis for the chronic spontaneous urticaria market of associated drugs and services.

Market Driver - Introduction of Innovative Therapies Like Remibrutinib and TEZSPIRE

The development of novel treatment modalities beyond traditional antihistamines represents great promise for advancing chronic spontaneous urticaria management. Early phase trials demonstrated Remibrutinib's potential to induce rapid and sustained response in patients unresponsive to antihistamines alone. Its targeted mechanism of action holds hope for improved symptom control with fewer side effects than immunosuppressants like cyclosporine.

Similarly, the recently FDA approved TEZSPIRE offers the first approved biologic option for chronic spontaneous urticaria. As a monoclonal antibody inhibiting the interleukin-31 receptor, it works to block itching signaling at its source rather than simply tamp down downstream symptoms.

Entry of these novel drugs in the chronic spontaneous urticaria market represents an inflection point, going beyond symptom palliation to target specific pathogenic mechanisms. Their varied mechanisms of action stand to significantly expand the therapeutic arsenal and benefit a broader portion of the chronic spontaneous urticaria population. By directly addressing underlying disease drivers, remibrutinib and TEZSPIRE are changing standards of care and improving quality of life for those previously uncontrolled on traditional approaches alone. Their innovative profiles will surely help invigorate the pharmaceutical segment of this therapeutic space.

Market Challenge - High Costs Associated with Advanced Treatments like XOLAIR

One of the key challenges facing the chronic spontaneous urticaria market is the high costs associated with advanced treatment options like XOLAIR. XOLAIR is a monoclonal antibody injection approved for the treatment of chronic idiopathic urticaria. However, each 300mg injection carries a wholesale acquisition cost of over $2000.

As a biologic drug, it requires injection or infusion administered by a health professional, making each treatment session more expensive compared to oral therapies. The effectiveness of XOLAIR does alleviate symptoms for many refractory patients who fail standard oral treatments. Yet the high price per injection creates barriers for broader access and reimbursement challenges.

With urticaria being primarily managed in an outpatient setting, the costs burden often falls on patients themselves via high co-payments or being uninsured. The high list prices of newer biologics threaten the sustainability of healthcare systems and patients' adherence to therapy due to cost-related concerns. This cost challenge remains a key consideration for physicians determining appropriate treatment escalation pathways as well as for market growth potential of these new urticaria therapeutics.

Market Opportunity - Potential for New Targeted Treatment Options Due to Increased Access to Care

One opportunity for the chronic spontaneous urticaria market lies in the potential for new targeted treatment options due to increased access to care. As healthcare systems evolve to improve overall primary care access via initiatives lowering barriers like telehealth and community clinics, it expands the total addressable market for new urticaria drugs.

With a better economic climate enabling greater employment and insurance coverage post-pandemic, more urticaria patients may be able to obtain an accurate diagnosis and treatment guidance from an allergist rather than remaining untreated or under-treated by primary care physicians unfamiliar with urticaria management guidelines. This creates a situation where pharmaceutical companies focused on precision or personalized urticaria treatments have a viable pathway to reach more eligible patients.

Treatments targeting specific immunologic triggers or biomarkers of disease severity have potential to deliver superior outcomes than existing one-size-fits-all therapies. If such new options demonstrate clear cost-effectiveness through shorter time to remission or decreased rescue medication use, they could overcome many reimbursement obstacles faced by high-cost drugs today.