Cold Agglutinin Disease Drugs Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Cold Agglutinin Disease Drugs Market is segmented By Treatment Approach (Rituximab monotherapy, Cort...

Cold Agglutinin Disease Drugs Market Trends

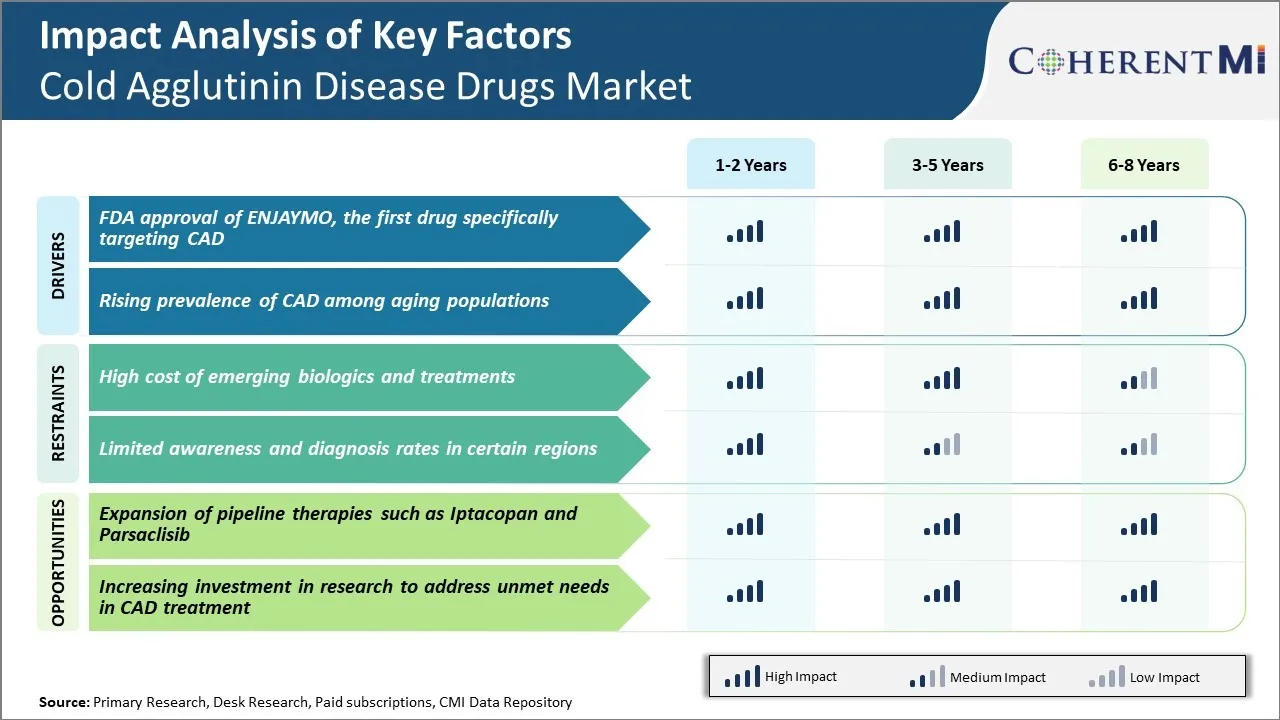

Market Driver - FDA Approval of ENJAYMO, the First Drug Specifically Targeting CAD

The approval of ENJAYMO by the US Food and Drug Administration (FDA) has provided a major boost to the cold agglutinin disease drugs market. ENJAYMO, developed by Apellis Pharmaceuticals, is the first drug approved for the treatment of autoimmune hemolytic anemia caused by cold agglutinin disease in adults. This represents a significant breakthrough as cold agglutinin disease was previously an area of high unmet medical need with very limited treatment options.

The approval was based on positive results from the Phase 3 PEGASUS trial which evaluated the safety and efficacy of subcutaneous pegcetacoplan compared to the standard of care, which is usually steroids, in both naïve and relapsed/refractory patients with CAD. Pegcetacoplan was also found to be generally well tolerated with a safety profile consistent with complement inhibition.

The approval of the first ever treatment specifically for CAD has filled an important void and means doctors now have an approved therapeutic option to help patients achieve stable hemoglobin levels and improve their quality of life. It is expected that ENJAYMO's superior efficacy demonstrated in the PEGASUS trial will drive rapid adoption among physicians.

Market Driver - Rising Prevalence of CAD among Aging Populations

CAD occurs more commonly in the elderly, with the average age of patients being around 70 years. As life expectancies increase worldwide, the population of elderly individuals is growing at an unprecedented rate. For example, the proportion of the world's population over 60 years is projected to nearly double from 12% to 22% between 2015 and 2050. The number of Americans aged 65 and older is also escalating rapidly and is estimated to reach over 98 million by 2060.

As the population ages, more people are at risk of developing CAD. The risk of most autoimmune diseases, including CAD, increases with age due to age-associated weakening of regulatory immune mechanisms. Moreover, elderly individuals are also more prone to develop infectious triggers which can induce CAD. With such strong synergies between advancing age and CAD etiology, the sharp rise in global elderly demographics is directly driving up the prevalence of the disease.

Doctors as well as patients are also now more educated on CAD since the approval of the first drug for the condition. All these factors tied to the aging trend are expected to significantly contribute to the growth of the cold agglutinin disease drugs market in the coming years.

Market Challenge - High Cost of Emerging Biologics and Treatments

One of the major challenges for the cold agglutinin disease drugs market is the high cost of emerging biologics and specialized treatments. Cold agglutinin disease is a rare condition with a limited patient pool worldwide. Developing therapies specifically for this rare condition requires extensive research and clinical trials. This development process is highly expensive and the costs are ultimately passed on to patients in the form of high drug prices.

Most patients find it difficult to afford such expensive therapies for long-term management of their condition. This poses significant barriers for market growth as patients may discontinue treatments or not seek medical help due to the prohibitive costs.

Pharmaceutical companies also recover their R&D investments through high drug prices. However, this makes the treatments inaccessible for a large section of patients. Governments and insurance companies struggle to provide coverage and reimbursement for such expensive orphan drugs.

Overall, the high prices of emerging targeted therapies, biologics and other specialized treatment modalities remain a major challenge for wider market adoption and growth of this therapeutic segment.

Market Opportunity - Expansion of Pipeline Therapies such as Iptacopan and Parsaclisib

One of the major opportunities for the cold agglutinin disease drugs market is the expansion of the product pipeline with promising new therapies such as Iptacopan and Parsaclisib. Iptacopan, under development by Apellis Pharmaceuticals, is an oral terminal complement inhibitor that has shown significant therapeutic potential in clinical trials for treating cold agglutinin disease.

In another development, Incyte is evaluating selective PI3Kδ inhibitor Parsaclisib for various hematological conditions including cold agglutinin disease. The successful development and approval of these pipeline therapies can provide patients with more treatment options beyond conventional therapies. It can also increase access by offering oral alternatives to expensive biologics and infusions.

A richer pipeline is likely to fuel future market growth by addressing the significant unmet needs in cold agglutinin disease management. It may also improve treatment outcomes and quality of life for patients suffering from this rare blood condition.