Container Fleet Market Size - Analysis

The container fleet market is estimated to be valued at USD 14.15 Billion in 2025 and is expected to reach USD 21.14 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.9% from 2025 to 2032. The demand for container shipment and transportation is increasing rapidly driven by the exponential growth in international trade. Thereby, the container fleet market has been witnessing significant growth over the past few years.

Market Size in USD Bn

CAGR5.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.9% |

| Market Concentration | High |

| Major Players | China COSCO Shipping Corporation Limited, CMA CGM S.A., MSC Mediterranean Shipping Company S.A., Maersk, Hapag-Lloyd AG and Among Others |

please let us know !

Container Fleet Market Trends

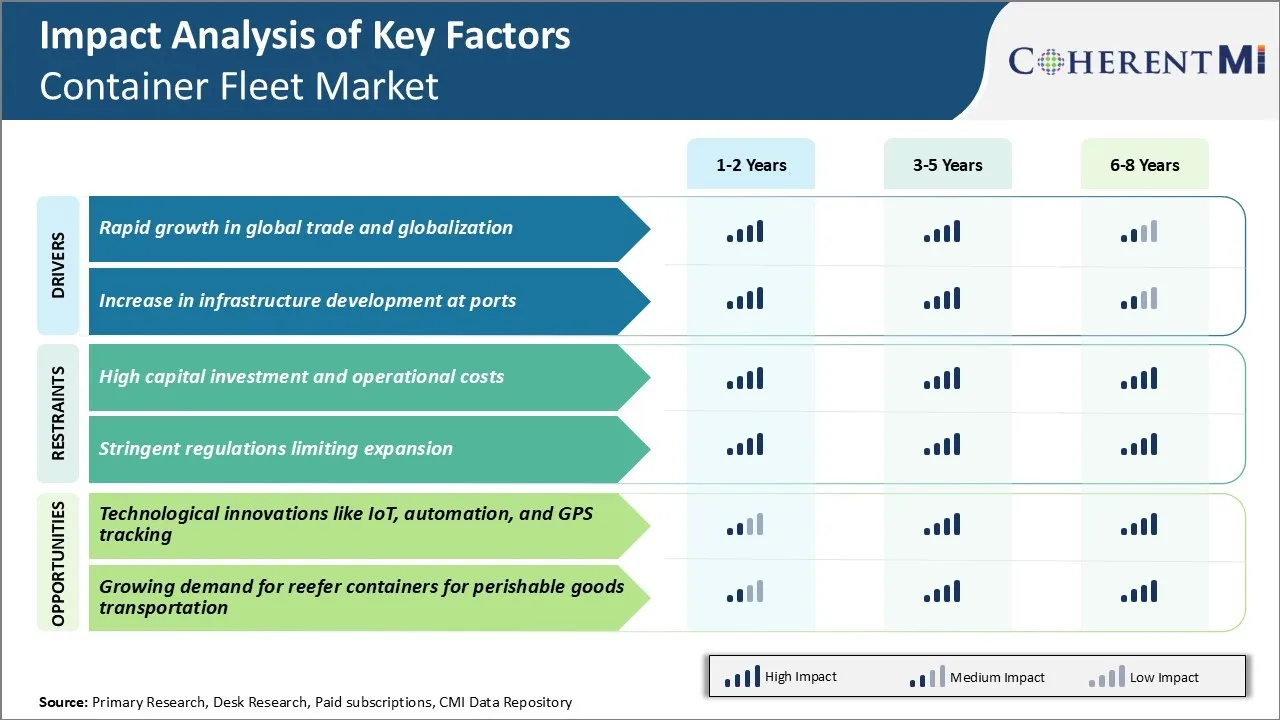

Market Driver - Rapid Growth in Global Trade and Globalization

Global trade has seen an unprecedented surge following the introduction of liberalization policies and reduction of trade barriers across countries. Containerization has emerged as the most efficient mode of transporting these goods over long distances by container fleet.

The surge in global trade volumes have considerably raised the demand for container fleet services. Manufacturing clusters have come up in different parts of the world to cater to the global supply chains of multinational corporations. Raw materials and components are shipped from resource rich regions to these manufacturing hubs for assembly and then the finished products are exported to overseas consumer markets.

Regional trade blocs like European Union and Asian powerhouses like China have also driven up intra-regional commerce. Container fleet today act as the lifeline of international trade, facilitating just-in-time deliveries. This is expected to emerge as a major driver for the container fleet market.

Market Driver - Increase in Infrastructure Development at Ports

Ports play a pivotal role in the maritime supply chain as intermediary nodal points for container handling and trans-shipment. To support the growing volumes of containerized cargo, ports across major trading nations have embarked upon massive capacity expansion and modernization programs. State-of-the-art container terminals with deep draft berths, hi-tech cargo handling equipment and expansive container yards are being developed.

Container fleet market is also witnessing development of automated terminals powered by computerized terminal operating systems. These ensure swift turnaround of container fleet. Dedicated inland clearways and rail/road linkages are also being upgraded to improve hinterland connectivity, which can immensely support growth of the container fleet market.

Several ports have also transformed into bustling logistics hubs facilitating value-added services like container repairs, stuffing/stripping, and warehousing. Manufacturers rely on these port-centric industrial clusters to optimize their supply chains. Port infrastructure development has kept pace with the larger vessels being deployed on mainline east-west trade routes. This will drive major container fleet market trends in the coming years.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Capital Investment and Operational Costs

One of the major challenges being faced by the container fleet market is the high capital investment and operational costs required. Setting up container ships and ports requires large investments in building infrastructure and purchasing ships and equipment. Container ships themselves cost tens of millions of dollars each and ports require heavy machinery for loading and unloading operations.

Furthermore, with rising fuel costs and expenses related to maintenance and repairs, the operational costs of running container fleets are also very high. This puts pressure on shipping lines and fleet owners to maximize revenue from each voyage in order to realize reasonable returns on investments and cover daily operational expenses.

With tight margins in the industry, high fixed costs pose a major barrier to profits. Fleet operators have to charge competitive rates to customers to keep their businesses viable while covering their high-cost structures, which is challenging in today's container fleet market forecast.

Market Opportunity - Technological Innovations like IoT, Automation, and GPS Tracking

The container fleet market is poised to benefit significantly from ongoing technological innovations. The integration of Internet of Things (IoT) solutions, automation technologies, and advanced tracking systems can help optimize operations and reduce costs. IoT sensors installed on containers and ships can monitor temperature, humidity and other critical parameters to ensure safety and quality of cargo.

Automating loading/unloading processes through crane automation and use of robotics can improve efficiency while minimizing human errors. Advanced GPS tracking of containers and ships provides real-time location updates which helps improve asset utilization, coordination between ports/vessels, as well as offers cargo security and theft prevention.

Adoption of these new technologies allows fleet operators to supervise operations remotely, predict maintenance needs, streamline processes and enhance customer experience. This paves the way for lower operating costs and higher revenues through improved capacity utilization and customer retention for companies in the container fleet market.

Key winning strategies adopted by key players of Container Fleet Market

Strategic Acquisitions and Consolidation: Acquiring or merging with competitors has helped players scale up and expand their fleet capacity. For example, in 2016, Maersk Line acquired Hamburg Sud, becoming the largest container shipping company. This increased its fleet size by over 50% to around 4 million TEU.

Fleet Modernization and Optimization: Leading companies have invested heavily in new, larger and more fuel-efficient ships. Additionally, optimization of routes and networks helps improve capacity utilization. For instance, Ocean Network Express (ONE) was formed in 2018 by integrating the networks of K-Line, MOL and NYK - this consolidation improved fleet utilization for the players.

Technology Adoption: Advanced technologies like IoT, telematics, analytics and automation help improve fleet performance and customer experience. For example, fleet telematics solutions from companies like MarineTraffic provide real-time location, speed and condition of vessels.

Strategic Partnerships: Collaborations help companies plug capacity gaps and network holes. For instance, THE Alliance consisting of Hapag-Lloyd, ONE, Yang Ming and HMM was formed in 2017.

Segmental Analysis of Container Fleet Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

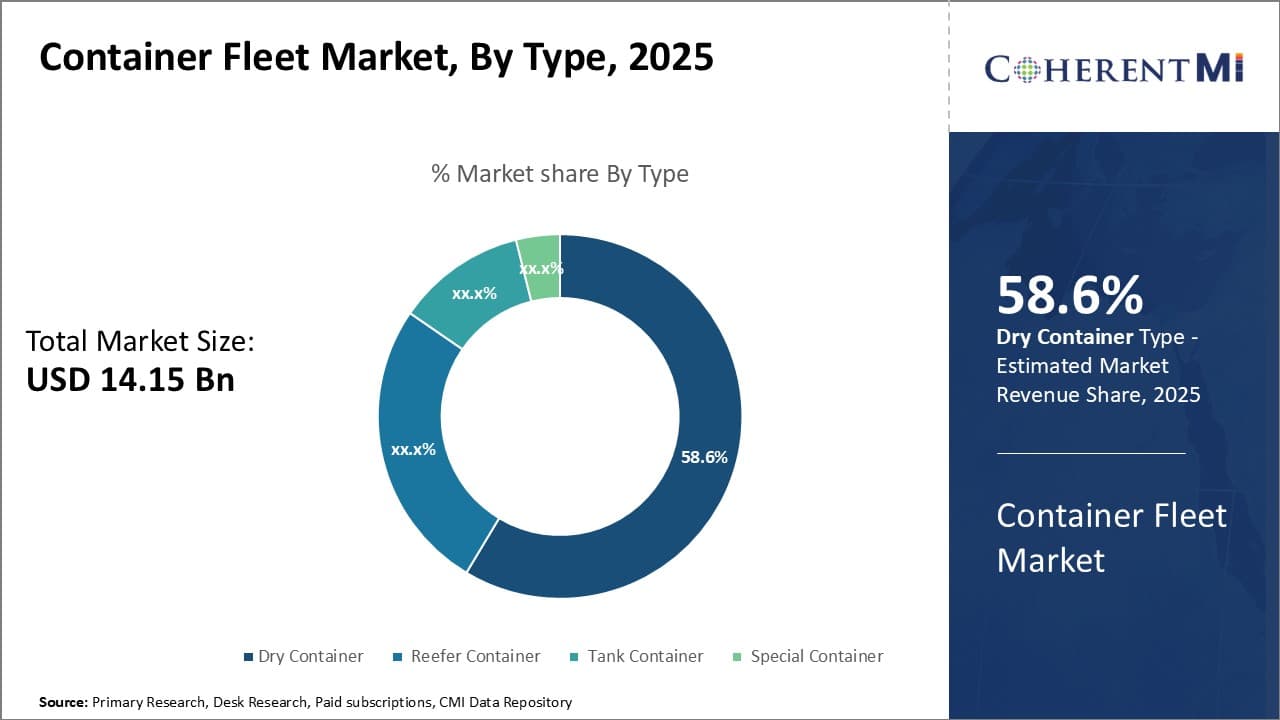

Insights, By Type: Dry Container Fleet Witness High Demand with Increasing Global Trade Volumes

In terms of type, dry container segment is expected to account for 58.6% share of the container fleet market in 2025. Dry containers represent the bulk of the total container fleet owing to their widespread usage across various industries. As global trade increases year-on-year, dry containers experience consistent demand for transportation of general cargo over long distances.

Dry containers allow for efficient loading and unloading of non-perishable packaged items while providing protection during overseas shipments. Along supply chains, dry containers are readily interchangeable with different vessel and road cargo configurations. This interoperability streamlines logistics and reduces transfer costs for shippers.

Growing e-commerce is another factor driving the volume of dry container shipments in the container fleet market. With worldwide consumption and emerging economies modernizing logistics infrastructure, dry container demand looks set to expand steadily. Their versatility and compatibility with diverse supply chain nodes cement dry containers' position as the most heavily deployed intermodal container fleet.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

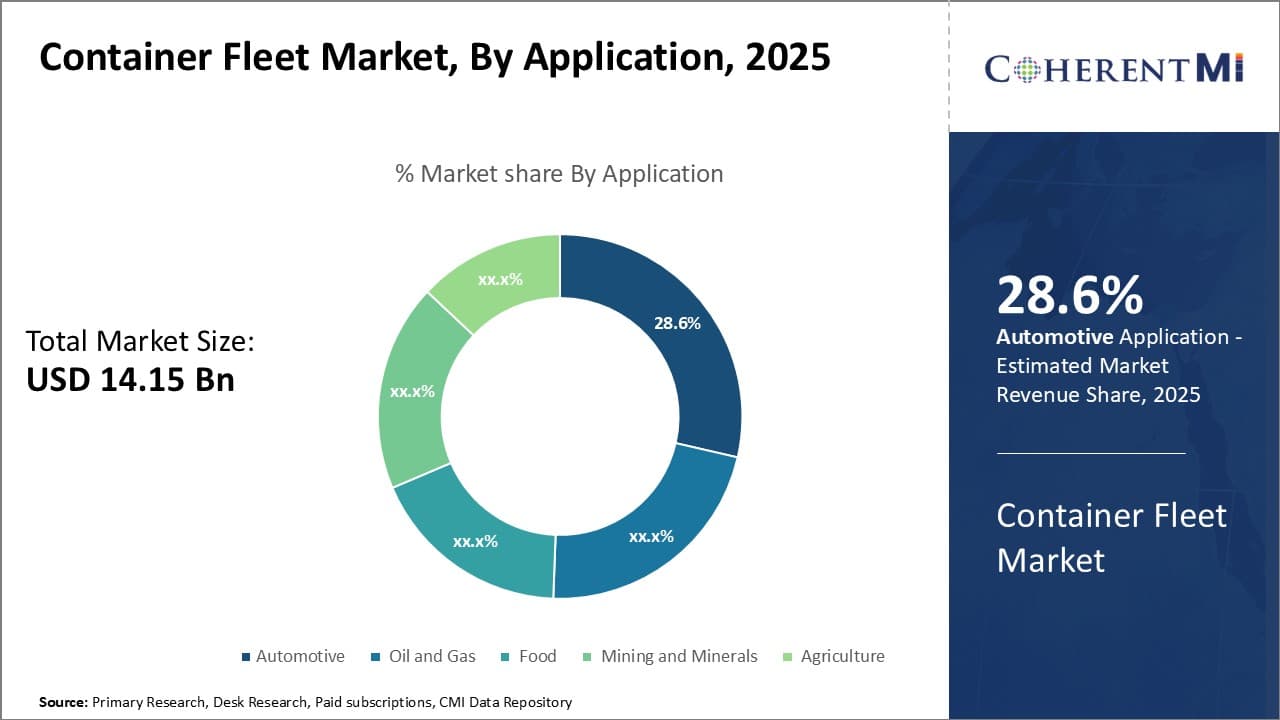

Insights, By Application: Automotive Industry Witnesses Extended International Sourcing Networks

In terms of application, the automotive industry is expected to account for 28.6% revenue share of the global container fleet market in 2025. The global automotive industry relies heavily on international sourcing of components to feed complex international supply chains.

Containerized maritime shipping affords automakers reliable transport capacity and schedule flexibility to seamlessly synchronize flows of materials between factories. Similarly, exporting completed vehicles from the plant of origin to dealerships abroad occurs predominately via container shipments.

Major automakers today source standard components globally from specialized plants, basing production at strategic international hubs near important markets or resources. Containers constitute the universal intermodal unit optimizing such choreographed flows between a carmaker's far-flung facilities and supplier tiers worldwide.

Modular container loads suit this need, ensuring a continuous yet adaptable stream of inputs keeps pace with dynamic production schedules. Overall, complex international automotive supply chains have become an important part of growth prospects of the container fleet market.

Additional Insights of Container Fleet Market

- The global tank container fleet increased by 8.65% in 2022, reaching 801,800 units worldwide.

- Shipyards delivered a record 2.2 million TEU (Twenty-foot Equivalent Units) in 2023, beating the previous record of 1.7 million TEU delivered in 2015.

- Reefer containers are becoming increasingly vital due to rising demand for temperature-controlled shipping of food and pharmaceuticals.

- Asia Pacific held the largest share in the container fleet market in 2023, primarily driven by port infrastructure development and increased demand for refrigerated cargo containers.

- North America is expected to witness rapid growth in the container fleet market due to growing global trade and adoption of advanced technologies in shipping.

Competitive overview of Container Fleet Market

The major players operating in the container fleet market include China COSCO Shipping Corporation Limited, CMA CGM S.A., MSC Mediterranean Shipping Company S.A., Maersk, Hapag-Lloyd AG Evergreen Marine Corporation, Matson Inc., Ocean Network Express Pte. Ltd., Orient Overseas Container Line Limited, Pacific International Lines Pte. Ltd., Unifeeder A/S (DP World), Wan Hai Lines Ltd., Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services Ltd., Mitsui O.S.K, Hyundai Merchant Marine Co. Ltd., and Kawasaki Kisen Kaisha Ltd.

Container Fleet Market Leaders

- China COSCO Shipping Corporation Limited

- CMA CGM S.A.

- MSC Mediterranean Shipping Company S.A.

- Maersk

- Hapag-Lloyd AG

Recent Developments in Container Fleet Market

- In May 2024, Thenamaris, a Greek shipping company, began deploying Starlink connectivity on its fleet of vessels, enhancing communication and data services for its 87 vessels, including 47 tankers and 25 bulk carriers. This deployment is expected to improve both operational efficiency and crew welfare, allowing for better communication and increased data quotas for crew members.

- In April 2024, Hapag-Lloyd launched a real-time tracking system called "Live Position," which is being implemented across its nearly 3 million container fleet. This initiative makes Hapag-Lloyd the first container shipping line to offer a fleet-wide tracking product specifically for dry containers.

- In September 2023, MSC Mediterranean Shipping Company S.A. entered into a strategic partnership with Hamburger Hafen und Logistik Aktiengesellschaft (HHLA) through a binding Memorandum of Understanding. This partnership is structured as a joint venture, where the City of Hamburg will hold a 50.1% stake, while MSC aims to acquire up to 49.9% of HHLA's shares.

- In July 2023, Maersk Line launched the world's first carbon-neutral methanol-powered container vessel, named "Laura Mærsk." This vessel completed its maiden voyage on green methanol, marking a significant milestone in the company's efforts to lead in sustainable shipping practices.

Container Fleet Market Segmentation

- By Type

- Dry Container

- Reefer Container

- Tank Container

- Special Container

- By Application

- Automotive

- Oil and Gas

- Food

- Mining and Minerals

- Agriculture

Would you like to explore the option of buying individual sections of this report?

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting. He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments. He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.