The Global Cytomegalovirus (CMV) Infection Therapeutic Market is estimated to be valued at USD 248.3 Mn in 2025 and is expected to reach USD 406.6 Mn by 2032, growing at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2032. The market has been mainly driven by the rising incidence of CMV infections among infants and AIDS patients as well as availability of late-stage pipeline drugs which are likely to enter the market in the coming years.

The market trend has shown steady and gradual growth over the past few years. Recent research and partnerships between companies have worked to improve diagnostic techniques and therapeutic development for CMV infection. Additionally, rising awareness regarding hygiene practices and prevention of infection has positively impacted the market size. Further innovations to provide broader treatment options are expected to continue driving the market during the forecast period.

Market Size in USD Mn

CAGR7.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.3% |

| Market Concentration | Medium |

| Major Players | Moderna, Trellis Bioscience, SpyBiotech, Vical, Atara Biotherapeutics and Among Others |

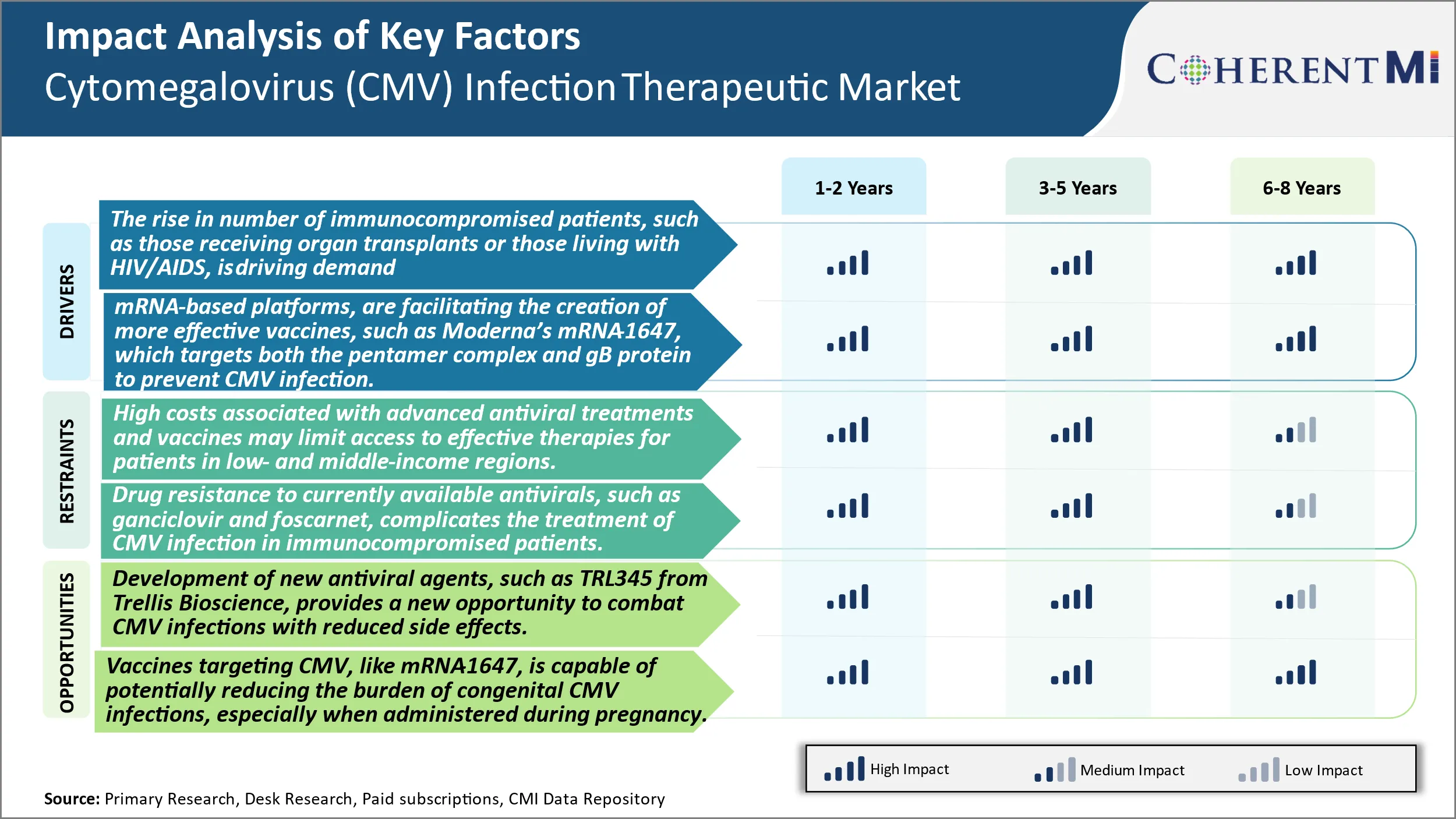

Market Driver - The Rising Number of Immunocompromised Patients, Such as Those Receiving Organ Transplants or Those Living With HIV/AIDS, is Driving Demand for More Effective Therapies and Preventive Vaccines for CMV.

The rising number of immunocompromised patients who are more susceptible to CMV infection is a key driver of demand for improved treatment options. Patients who receive organ transplants must take immunosuppressive drugs to prevent rejection of the transplanted organ by their immune system. However, this leaves them vulnerable to infections, including CMV. According to studies, CMV infection is common after kidney transplantation, with 50-80% of recipients experiencing CMV infection within the first year. For lung and heart transplant patients as well, CMV infection is a serious threat, with infection rates as high as 60%. Timely treatment of CMV in these patients is critical to prevent end-organ disease.

The growing population of HIV/AIDS patients worldwide is another risk group that is increasingly prone to CMV infection and disease. As antiretroviral treatment has improved survival rates of HIV patients, CMV has emerged as an important viral pathogen affecting this immunocompromised population. While antiretroviral treatment can control HIV and restore some immune function, patients still remain at risk for CMV disease. Reports estimate that 20-40% of HIV/AIDS patients experience CMV infection or end-organ disease involving the retina, gastrointestinal tract or lungs in their lifetimes. With over 36 million people living with HIV globally according to UNAIDS, the large prevalence of this virus group continues to fuel the need for more effective anti-CMV treatment and prophylactic options.

Market Driver - Technological Advancements Facilitating More Effective Vaccines Encourages Industry Developments.

Scientific and technological progress, especially in nucleic acid-based vaccine platforms, is opening up new possibilities for developing safe and effective anti-CMV vaccines. One example is Moderna's MRNA-1647 vaccine candidate, which utilizes a two-antigen MRNA approach to induce immunity against both the pentamer complex and envelope glycoprotein B (gB) of CMV. Pentamer complex is involved in CMV entry into host cells, while gB mediates fusion between the viral envelope and host cell membranes during infection. By targeting these two key players, mRNA-1647 aims to prevent CMV from gaining entry and establishing infection in host cells.

A key advantage of the mRNA platform is its ability to prompt in vivo production of target antigens in host cells, thereby inducing robust cellular and humoral immunity against these antigens. mRNA vaccines do not contain live attenuated or inactivated virus, making them potentially safer than traditional vaccine approaches. Moderna has also demonstrated the ability to develop MRNA vaccines for other viruses like Zika, influenza and HIV in animal models, supporting the translation of mRNA-1647 into clinical studies. If proven safe and effective in clinical trials, a single-dose mRNA-1647 could provide long-term protection against CMV and help curb its spread in high-risk groups. Technological innovations like these are expanding options for CMV prevention, a major driver of market growth.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Costs Associated with Advanced Antiviral Treatments and Vaccines May Limit Access to Effective Therapies for Patients in Low- And Middle-Income Regions.

The development of advanced antiviral treatments and vaccines for cytomegalovirus (CMV) infections comes with considerable costs that can potentially restrict patient access in low- and middle-income regions. Developing new drug candidates and bringing them through the clinical trial process into regulatory approval involves enormous research and development investments by pharmaceutical companies. The pricing of new therapies targeting a niche market indication like CMV also needs to factor in the high costs to ensure reasonable returns. However, setting costs that are unaffordable for public health programs and individual patients in developing nations means a large section of the patient population remains underserved. Given the widespread distribution of CMV globally, this disparity in access to care poses a serious public health challenge. Innovative pathways and partnerships are needed to make new treatment options financially viable and geographically accessible.

Market Opportunity: Novel Candidates Offer Improved Options for Combating CMV.

The development of new antiviral agents targeting CMV provides an opportunity to address current limitations and better manage infections. Trellis Bioscience's TRL345 represents a promising candidate that acts on the conserved glycoprotein B site of the virus. This novel mechanism of action could enhance efficacy as resistance is less likely to emerge compared to existing therapies. Furthermore, focusing on a highly conserved region minimizes the risk of drug resistance developing due to viral mutations over time and geography. TRL345 has also exhibited a favorable side effect profile in early studies, raising hopes for improved tolerability. If successful in clinical trials, TRL345 may establish a new standard of care option able to combat a broader range of CMV strains. Its distinct profile could expand the commercial potential of the drug beyond current labels. This innovation illustrates how continuous R&D drives progress and enhances options to tackle challenging pathogens like CMV.

CMV is commonly treated differently based on the patient's immune status and severity of infection. For transplant patients or those with weakened immune systems, ganciclovir (Cytovene) is the first-line treatment for mild to moderate CMV infection. Foscarnet (Foscavir) may be used instead for patients who cannot tolerate or do not respond to ganciclovir. For treatment-resistant or severe cases, prescribers may use cidofovir (Vistide) in combination with ganciclovir or foscarnet.

In immunocompetent patients with CMV retinitis, practitioners typically start with an intravenous dose of ganciclovir for 2-3 weeks, followed by switching to the oral version for maintenance therapy to prevent relapse or progression of the disease. Valganciclovir (Valcyte), an oral prodrug of ganciclovir, is also commonly prescribed and preferred by some due to its convenient oral dosing.

Other factors influencing prescriber choices include cost, potential side effects of the drugs, and limitation or failure of prior treatments. Newer alternative agents, such as brincidofovir (Tembexa) and maribavir (Livtencity), have recently entered the market and may capture more market share if proven safer or more tolerable for patients compared to existing options.

Cytomegalovirus (CMV) infection can range from asymptomatic to life-threatening depending on the patient’s immune status. Treatment involves antiviral medication and supportive care. For healthy individuals with mild or no symptoms, no treatment is needed as the immune system can often clear the virus naturally. However, for immunocompromised patients such as those with HIV/AIDS or who have received an organ transplant, CMV can become dangerous if left untreated.

For those with active CMV disease, ganciclovir is usually the first-line treatment. It is a nucleoside analog antiviral available as both intravenous and oral forms. It works to inhibit the viral DNA polymerase and stop viral replication. For mild to moderate disease, oral valganciclovir is also often used due to its improved oral bioavailability compared to ganciclovir.

For patients who do not respond adequately or cannot tolerate ganciclovir, foscarnet is commonly used as the second-line agent. It is an inorganic phosphorylated pyrophosphate analog that also prevents viral DNA synthesis. For refractory or resistant cases, the lipid-conjugated form of ganciclovir called cidofovir is administered, though it has worse renal toxicity.

CMV infection in transplant patients may require long-term suppressive therapy to prevent reactivation disease. Low dose maintenance medication with either oral ganciclovir or valganciclovir is commonly used for this until immune function is restored. Aggressive treatment is crucial for controlling CMV, particularly in immunocompromised individuals, to prevent end-organ disease and other serious complications.

Leading players such as Merck & Co., Inc. and GlaxoSmithKline plc have focused on R&D and clinical trials to develop novel drug candidates for CMV infection treatment.

Merck & Co. launched antiviral drug Valganciclovir in 2001, which is still a standard treatment option. It gained dominance in the market through extensive clinical trials showcasing its efficacy and safety. Valganciclovir became the gold standard first-line therapy, achieving global annual sales of over USD 500 million by 2010.

GlaxoSmithKline is developing maribavir, a candidate with a novel mechanism of action targeting the UL97 protein kinase. In 2018, positive Phase 3 results demonstrated maribavir successfully achieved the primary endpoint of reducing CMV disease compared to conventional antiviral therapy in transplant recipients. If approved, maribavir will be a major advance and capture significant market share given its ability to address unmet needs in resistance and safety.

Roche entered the CMV arena through acquisition of Argene Biosoft in 2015, gaining access to oral CMV drug candidate transfuranyl oxalate (TX-24), which selectively inhibits viral DNA polymerase. This acquisition allowed Roche to strengthen its anti-infectives pipeline. TX-24 is currently in Phase 2 studies and has potential to be complementary to existing therapies.

These examples highlight how constant R&D efforts, successful clinical trials proving efficacy and safety advantages, and acquisitions to gain novel candidates have enabled major players to capture and defend leadership in the CMV therapeutic market. Sustained investment in innovations addressing unmet medical needs will likely remain a key strategy for players to dominate this disease area.

-infection-therapeutic-market-by-drug-type.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

Insights, By Drug Type, Clinical Superiority Drives Valgnciclovir Market Share Dominance in the Forecast Period.

To learn more about this report, Download Free Sample Copy

Insights, By Drug Type, Clinical Superiority Drives Valgnciclovir Market Share Dominance in the Forecast Period.

By Drug Type, Valgnciclovir is expected to contribute the highest share 41.2% in 2025 owing to its established clinical efficacy and superiority over other therapeutic alternatives. Valganciclovir demonstrates significantly higher oral bioavailability compared to ganciclovir, allowing for once-daily convenient dosing. This ease of administration coupled with its ability to achieve therapeutically effective drug concentrations has made it the standard of care treatment for CMV infections arising post-organ transplant. Valganciclovir’s favorable pharmacokinetic profile also translates to improved adherence for patients compared to multiple daily doses of other drugs. Further, valganciclovir has demonstrated consistent and meaningful viral load reductions along with a well-characterized long-term safety profile spanning over a decade of clinical use. These distinct therapeutic advantages have allowed valganciclovir to dominate uptake among clinicians aiming for optimal viral suppression and patient outcomes.

-infection-therapeutic-market-by-application.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By Application, Organ Transplantation is the Leading Segment in the Forecast Period.

By Application, Organ Transplantation is expected to contribute the highest share 51.3% in 2025 as effective anti-CMV therapies are paramount in this patient population. CMV remains the most common viral infection experienced by transplant recipients in the early post-operative period due to their immunocompromised state from chronic immune suppression. Uncontrolled CMV infection poses serious risks such as graft rejection and loss, as well as increased susceptibility to opportunistic infections. Given the life-sustaining nature of organ transplantation, there exists an urgent clinical need to actively prevent and treat any CMV reactivation. The high stakes associated with organ transplantation make it an influential driver of anti-CMV agent utilization overall.

Insights, By Distribution Channel, Optimizing Access in Specialized Settings

By distribution channel, hospital pharmacies are expected to contribute the highest market share in 2024. This disparity occurs as anti-CMV therapeutic options such as valganciclovir and ganciclovir are extensively administered and monitored in hospital settings early post-transplant. Hospitals serve as central points of specialized care for high-risk patients undergoing organ or stem cell transplantation. Care is closely coordinated across medical teams to optimize dosing and delivery of anti-virals as part of multi-drug immunosuppressive regimens. Additionally, inpatient treatment allows for convenient intravenous administration of select anti-CMV drugs such as foscarnet in severe cases not responsive to oral therapies. Overall, the hospital segment is poised to benefit from being the preferred environment for initiating and managing anti-CMV therapy in life-threatening conditions.

Cytomegalovirus (CMV) represents a major public health challenge, particularly for immunocompromised individuals and infants born with congenital infections. Current treatment options include antivirals like ganciclovir and foscarnet, but these have limitations such as drug resistance and toxicity. Moderna’s MRNA-1647 vaccine, currently in Phase III trials, shows promise in preventing CMV infections by inducing immunity against two critical viral antigens. Furthermore, antibody-based therapies, such as Trellis Bioscience’s TRL345, aim to neutralize the virus with high specificity, providing alternative treatment options for drug-resistant infections. The global push for CMV vaccines and improved antiviral treatments is fueled by the high burden of congenital CMV, which is a leading cause of hearing loss and developmental delays in newborns. While the market for CMV treatments continues to grow, the high costs of advanced therapies pose challenges for widespread access, particularly in low-income regions. As research progresses, the development of cost-effective and safe vaccines or antiviral therapies will be crucial in controlling the impact of CMV.

The major players operating in the Cytomegalovirus (CMV) Infection Therapeutic Market include Moderna, Trellis Bioscience, SpyBiotech, Vical, Atara Biotherapeutics, Chimerix Inc, Pfizer Inc, Merck & Company, Johnson & Johson, Bio-Rad Laboratories Inc, and F.Hoffman La-Roche Ltd.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Cytomegalovirus (CMV) Infection Therapeutic Market is segmented By Drug Type (Valgnciclovir, Gancicl...

Cytomegalovirus (CMV) Infection Therapeutic Market

How Big is the Cytomegalovirus (CMV) Infection Therapeutic Market?

The Global Cytomegalovirus (CMV) Infection Therapeutic Market is estimated to be valued at USD 248.3 Mn in 2025 and is expected to reach USD 406.6 Mn by 2032.

What will be the CAGR of the Cytomegalovirus (CMV) Infection Therapeutic Market?

The CAGR of the Cytomegalovirus (CMV) Infection Therapeutic Market is projected to be 7.10% from 2024 to 2031.

What are the major factors driving the Cytomegalovirus (CMV) Infection Therapeutic Market growth?

The rising number of immunocompromised patients, such as those receiving organ transplants or those living with HIV/aids, is driving the demand for more effective therapies and preventive vaccines for CMV. The technological advancements in vaccine development, particularly mRNA-based platforms, are facilitating the creation of more effective vaccines, such as Moderna’s mRNA-1647, which targets both the pentamer complex and gB-protein to prevent CMV infection are the major factor driving the Cytomegalovirus (CMV) Infection Therapeutic Market.

What are the key factors hampering the growth of the Cytomegalovirus (CMV) Infection Therapeutic Market?

The high costs associated with advanced antiviral treatments and vaccines may limit access to effective therapies for patients in low- and middle-income regions and drug resistance to currently available antivirals, such as Ganciclovir and Foscarnet, complicates the treatment of CMV infection in immunocompromised patients, increasing the need for new therapeutic approaches are the major factor hampering the growth of the Cytomegalovirus (CMV) Infection Therapeutic Market.

Which is the leading Drug Type in the Cytomegalovirus (CMV) Infection Therapeutic Market?

Valgnciclovir is the leading drug type segment.

Which are the major players operating in the Cytomegalovirus (CMV) Infection Therapeutic Market?

Moderna, Trellis Bioscience, SpyBiotech, Vical, Atara Biotherapeutics, Chimerix Inc, Pfizer Inc, Merck & Company, Johnson & Johson, Bio-Rad Laboratories Inc, F.Hoffman La-Roche Ltd are the major players.