Electric Construction Equipment Market Trends

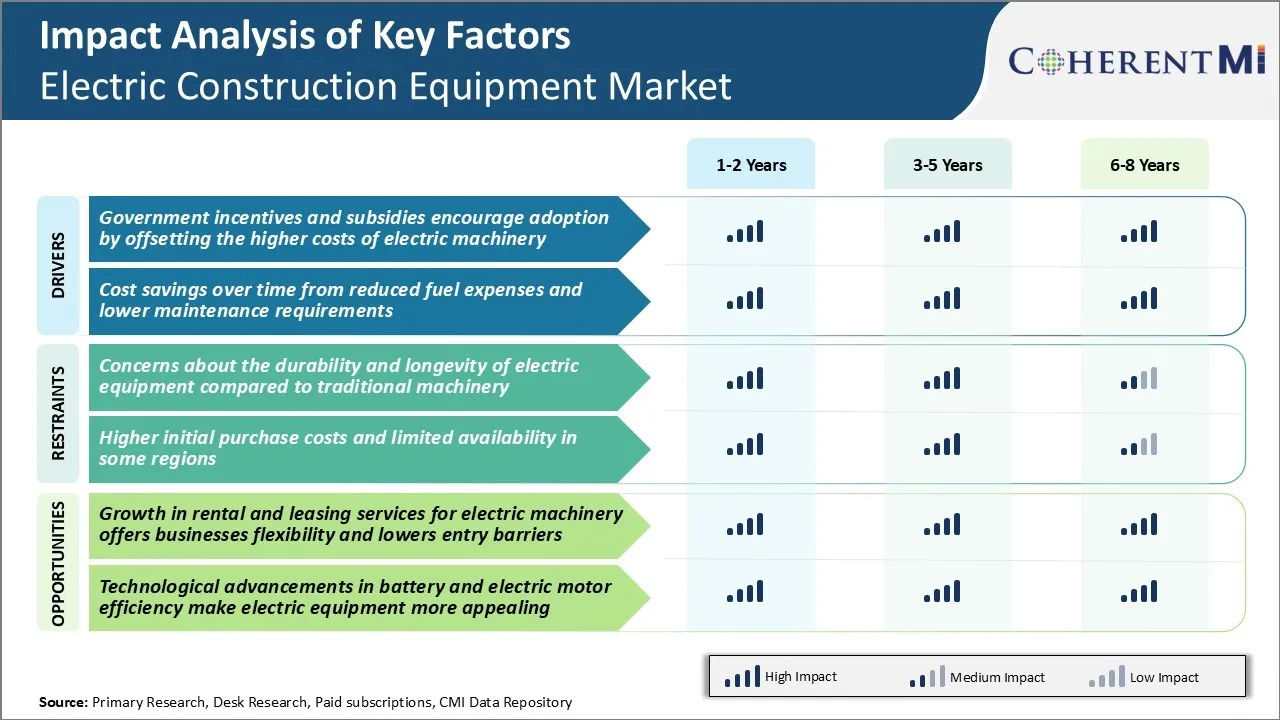

Market Driver - Government Incentives Encourage Adoption

The transition to more eco-friendly electric construction equipment has been gaining momentum in recent years. Many governments around the world have started introducing subsidies and incentive programs to promote the adoption of electric machinery in the construction industry. Authorities realize that construction activity has significant impact on the environment and climate change. Thus, supporting manufacturers and customers to shift to electric powered options can meaningfully contribute to emission reduction targets.

Several attractive subsidy schemes have made electric equipment more affordable for contractors and builders. Most of the incentives cover not just purchase price but also installation of charging infrastructure which is critical for electric construction equipment market growth.

Original equipment manufacturers now have greater confidence to extensively test new electric models and mass produce them. Subsidies help mitigate risks and reassure manufacturers about return on investments in electric technology. Over time, with more robust support schemes and increasingly competitive total cost of ownership, adoption rates are expected to pick up at a stronger pace.

Market Driver - Cost Savings Drive Adoption over Long Run

While upfront costs of electric construction equipment are higher currently, operating expenses are significantly lower compared to diesel- or gas-powered equivalents over the lifecycle of machinery. Electric motors are vastly more efficient than internal combustion engines as more than 90% of electrical energy gets converted to motive power versus only about 30% for fuel engines.

Maintenance needs are also far lesser for electric powertrains that have far fewer moving parts than engines. Electric vehicles have fewer unscheduled downtimes which enhance productivity and reduce costs associated with equipment failure or breakdowns. Fewer fluid changes further minimize workshop expenditures.

Upfront premiums are shrinking due to technology advancements and scale of production. So, total expenditures will become comparable or even lower than diesel equivalents within ownership cycles spanning 15-20 years typically. The total cost of ownership therefore strongly favors electrification gradually as electric solutions gain maturity and electric construction equipment market size allows costs to fall further.

Market Challenge - Concerns about the Durability and Longevity of Electric Equipment Compared to Traditional Machinery

One of the key challenges faced by the electric construction equipment market is addressing concerns around the durability and longevity of electric machinery. While electric construction equipment reduces fuel costs and emissions, contractors and construction firms are still wary about the lifespan of critical components like batteries in electric vehicles.

With the current battery technology, there are doubts regarding how long the batteries in electric equipment would last under such intensive usage conditions. Additionally, the high upfront costs of electric vehicles also contribute to perceptions about whether they are robust enough to deliver a long duty cycle comparable to conventional equipment.

Equipment downtime due to battery replacements or repairs could significantly impact project timelines and budgets. To overcome this challenge, OEMs will need to focus on improving battery life, reliability, and charge/discharge cycles through ongoing research and development.

Market Opportunity - Growth in Rental and Leasing Services for Electric Machinery

The electric construction equipment market is poised to benefit significantly from the rising popularity of rental and leasing models available for machinery. Given the high upfront procurement costs of electric vehicles, renting, or leasing provides businesses the flexibility to try out new electric alternatives. This lowers the entry barrier for contractors and construction companies to experiment with green technologies and incorporate electric construction equipment into their fleets.

Many companies in the electric construction equipment market are adding electric vehicles and mobile charging stations to their inventory to tap into this opportunity. The pay-per-use business model also shifts the responsibilities of maintenance and equipment upkeep to the rental firms. This attracts more small- and medium-sized enterprises to electric options by reducing their financial and operational risks.

As rental players expand electric construction equipment offerings across different vehicle categories, it will help boost overall market exposure and acceptance of these technologies.