EMI Shielding Market Size - Analysis

Over the years, the demand for effective electromagnetic interference shielding solutions to filter radio waves and noise generated from electronic equipment has grown significantly. The rising adoption of connected and autonomous devices has introduced critical interference issues that require specialized EMI shielding techniques. Additionally, stringent regulation for product electromagnetic compatibility added by government bodies worldwide has compelled manufacturers to invest in advanced EMI shielding systems. This growing emphasis on electromagnetic compatibility across industries is expected to drive the EMI shielding market during the forecast period.

Market Size in USD Bn

CAGR6.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.9% |

| Market Concentration | Medium |

| Major Players | Sealing Devices Inc., Captor Corporation, Seal Science, Inc., Schaffner Holding AG, Henkel AG & Co. KGaA and Among Others |

please let us know !

EMI Shielding Market Trends

With the advancements in technology across industries, there has been a dramatic increase in the usage of electronic devices and digitization of processes. Right from consumer electronics to automotive, healthcare to industrial manufacturing – electronic components have become an integral part of operations. This has led to a surge in electromagnetic interference (EMI) issues as multiple devices operating in close proximity can cause signal disturbance and other operational glitches.

In the automotive industry, the integration of advanced driver-assistance systems, telematics, infotainment and other electronic control modules has made modern vehicles highly dependent on their electronic architecture. However, it has also introduced EMI vulnerability points across power lines, data cables and other interfaces. With vehicles expected to become even more connected in future, adequate shielding is important to ensure reliable performance and avoid issues that can arise from interference.

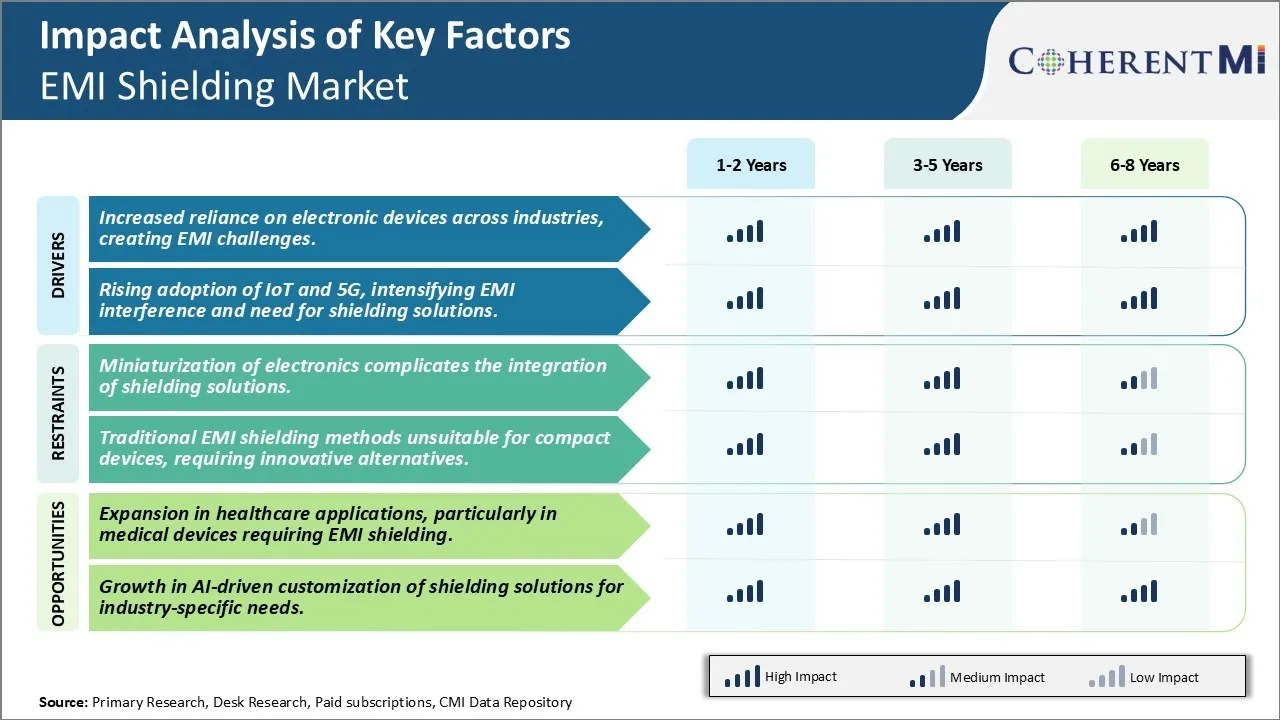

The proliferation of wireless technologies is revolutionizing connectivity but also amplifying EMI issues. The rapid growth of IoT devices, coupled with upcoming 5G networks, will generate massive electromagnetic noise levels unless properly addressed. IoT deployments involve a multitude of sensors, gateways, modules and edge systems communicating wirelessly at close proximity for monitoring physical environments as well as industrial and infrastructure assets. Similarly, 5G promises blazing speeds but will use higher frequencies that travel shorter distances and get blocked easier, necessitating more network access points or repeaters very close to each other.

A solution that many organizations are looking at is installing EMI shielding materials and equipment at strategic spots to mitigate these prospective conflicts. For example, critical infrastructure elements like electricity transmission lines, water pipelines and railway tracks deploying IoT sensors for monitoring purposes require robust shielding enclosures to avoid disruptions from external noise sources. Similarly, indoor spaces transforming into smart buildings through densely installed IoT and wireless networks will demand comprehensive EMI countermeasures. As autonomous vehicles and connected transport take off, shielding cabins effectively becomes equally important as cybersecurity for assuring reliable autonomy, telematics and infotainment functionality performance despite heavy wireless traffic around.

The constant drive towards miniaturization of electronic devices has posed significant challenges for the EMI shielding market. As electronics become smaller and more compact, integrating EMI shielding solutions has become an increasingly complex task. With components packed tightly together and form factors continuing to shrink, traditional shielding methods often no longer fit or cannot be implemented effectively. This makes it difficult for manufacturers to prevent electromagnetic interference and meet regulatory compliance standards pertaining to EMI emissions. Finding shielding products that can be incorporated seamlessly into slim and narrow device designs requires extensive research and testing of novel materials and shielding technologies. The miniaturization trend has also increased the difficulties in ensuring complete coverage and effectiveness of shielding across all surfaces of compact electronics. Shielding providers must dedicate considerable resources to innovating new shielding products tailored for integration into small spaces without compromising other design aspects or functionality of electronic devices. Unless manufacturers can overcome these challenges of fitting suitable shielding into ever smaller electronics, the demand for alternative or more advanced EMI shielding solutions is expected to rise.

Market Opportunity- Expansion in Healthcare Applications, Particularly in Medical Devices Requiring EMI Shielding

Key winning strategies adopted by key players of EMI Shielding Market

- Companies invest in research and development to innovate materials, such as conductive coatings, laminates, and metals, to improve the efficiency and cost-effectiveness of EMI shielding.

- Development of lightweight and flexible EMI shielding materials to cater to the miniaturization trend in electronics.

Expansion of Production Capacity:

- Players often expand manufacturing facilities to meet increasing demand from sectors such as automotive, telecommunications, and consumer electronics.

- Strategic establishment of production units in regions with high demand or lower operational costs, such as Asia-Pacific.

- Forming alliances with electronics manufacturers, telecom companies, and automotive firms to strengthen market position and improve the reach of their EMI shielding products.

- Collaborating with research institutions to leverage advancements in materials science and integrate cutting-edge technologies.

Acquisitions and Mergers

- Acquiring or merging with smaller companies to expand product portfolios, broaden market reach, and gain access to advanced technology.

- Consolidation strategies help companies enhance their competitive position and increase market share.

Segmental Analysis of EMI Shielding Market

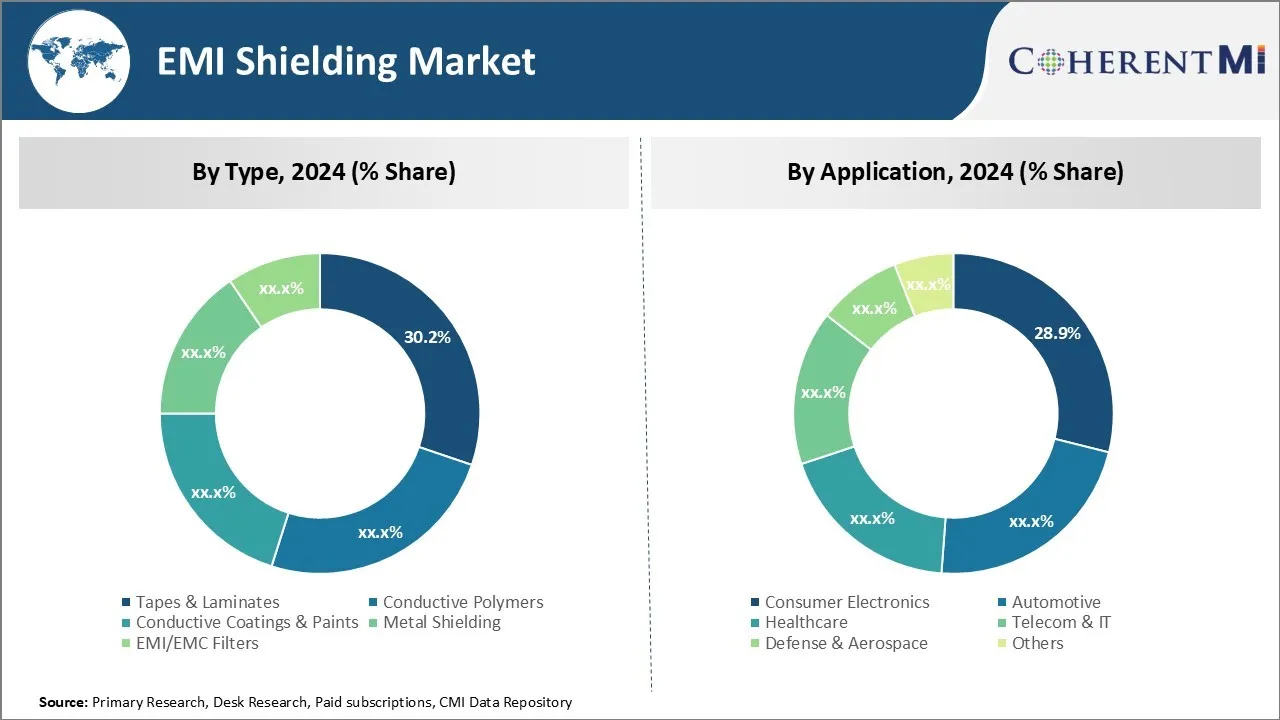

Insights, By Type, Growth of Flexible Electronics Drives the Tapes & Laminates Segment

The rising popularity of flexible hybrid electronics (FHE) has accelerated growth opportunities for tapes and laminates. Devices like wearables, curved screens, and embedded sensors require shielding materials that can seamlessly conform to non-planar surfaces without comprising on performance. Compared to other shielding types, tapes and laminates offer superior flexibility enabling integration into the tight spaces and slender profiles of advanced electronics. Their ability to self-adhere to complex contours without using adhesives or fasteners simplifies production processes for manufacturers.

Growing demand for miniaturized medical devices, wearable health monitors and implantable has boosted the uptake of tape and laminate shielding solutions within healthcare applications as well. Their thin, flexible form and precise cutting capability allows intricate, form-fitting designs demanded by emerging medical technologies.

Insights, By Application, Rising Consumer Electronics Consumption Elevates Demand for EMI Shielding

Packing more powerful components like processors, memory chips and wireless radios into ever compact device enclosures brings electromagnetic interference challenges. Without proper EMI shielding, signals from one device could disrupt others' performance. The complexity of today's consumer devices with multiple integrated circuits, antennas and protocols demands comprehensive shielding of electronics compartments, cables and I/O ports using specialized EMI solutions.

Growing emphasis on uninterrupted connectivity and entertainment experience provided by smart devices elevates customer expectations for prolonged battery life, faster response times and seamless usability even in crowded conditions. EMI shielding plays a pivotal role in ensuring conformance to such performance benchmarks. This drives formulators, brand owners and OEMs to seek out high-quality, competitively priced shielding solutions.

Additional Insights of EMI Shielding Market

The EMI shielding market is expanding rapidly due to the increasing reliance on electronic devices that demand protection from electromagnetic interference (EMI). With the advent of IoT and 5G technology, devices are exposed to more EMI sources, making shielding crucial for uninterrupted operations. Additionally, advancements in healthcare and industrial automation require more resilient EMI shielding solutions. The demand is also fueled by miniaturized electronics, where compact, innovative shielding materials are vital. Major manufacturers are continuously developing lightweight, flexible shielding to meet evolving industry standards and device aesthetics, which positions EMI shielding as a critical component across sectors.

Competitive overview of EMI Shielding Market

The major players operating in the EMI Shielding Market include Sealing Devices Inc., Captor Corporation, Seal Science, Inc., Schaffner Holding AG, Henkel AG & Co. KGaA, Tech-Etch, Inc., PPG Industries, Inc., Leader Tech, Inc., Laird PLC, Kitagawa Industries Co., Ltd., ETS-Lindgren Inc., Chomerics and 3M Company.

EMI Shielding Market Leaders

- Sealing Devices Inc.

- Captor Corporation

- Seal Science, Inc.

- Schaffner Holding AG

- Henkel AG & Co. KGaA

EMI Shielding Market - Competitive Rivalry

EMI Shielding Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in EMI Shielding Market

- In May 2023, PPG Industries Inc. announced a USD 44 million investment in powder coating manufacturing, enhancing the sustainability of its products.

- In June 2022, Laird Performance Materials launched thermally conductive adhesive tape, facilitating easier integration of EMI shielding.

- In August 2023, Schaffner Holding AG introduced the RT-Common mode choke series for EMI filtering in motor drives and robotics.

- In September 2023, Henkel launched Bergquist gap pads, providing EMI shielding at high frequencies.

- In July 2022, Henkel expanded its thread locker range with Loctite DRI 2250-W, tailored for automotive applications.

EMI Shielding Market Segmentation

- By Type

- Tapes & Laminates

- Conductive Polymers

- Conductive Coatings & Paints

- Metal Shielding

- EMI/EMC Filters

- By Application

- Consumer Electronics

- Automotive

- Healthcare

- Telecom & IT

- Defense & Aerospace

- Others

Would you like to explore the option of buying individual sections of this report?

As an accomplished Senior Consultant with 7+ years of experience, Pooja Tayade has a proven track record in devising and implementing data and strategy consulting across various industries. She specializes in market research, competitive analysis, primary insights, and market estimation. She excels in strategic advisory, delivering data-driven insights to help clients navigate market complexities, optimize entry strategies, and achieve sustainable growth.

Frequently Asked Questions :

How Big is the EMI Shielding Market?

The Global EMI Shielding Market is estimated to be valued at USD 7.5 Bn in 2024 and is expected to reach USD 12.9 Bn by 2031.

What will be the CAGR of the EMI Shielding Market?

The CAGR of the EMI Shielding Market is projected to be 6.9% from 2024 to 2031.

What are the major factors driving the EMI Shielding Market growth?

The increased reliance on electronic devices across industries, creating EMI challenges and rising adoption of IoT and 5G, intensifying EMI interference and need for shielding solutions are the major factors driving the EMI Shielding Market.

What are the key factors hampering the growth of the EMI Shielding Market?

The miniaturization of electronics complicates the integration of shielding solutions and traditional EMI shielding methods unsuitable for compact devices, requiring innovative alternatives are the major factors hampering the growth of the EMI Shielding Market.

Which is the leading Type in the EMI Shielding Market?

Tapes & Laminates are the leading Type segment.

Which are the major players operating in the EMI Shielding Market?

Sealing Devices Inc., Captor Corporation, Seal Science, Inc., Schaffner Holding AG, Henkel AG & Co. KGaA, Tech-Etch, Inc., PPG Industries, Inc., Leader Tech, Inc., Laird PLC, Kitagawa Industries Co., Ltd., ETS-Lindgren Inc., Chomerics, 3M Company are the major players.