The end-stage renal disease (ESRD) treatment market is estimated to be valued at USD 89.27 Bn in 2025 and is expected to reach USD 129.00 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.4% from 2025 to 2032. The aging population and growing prevalence of chronic kidney diseases around the world is expected to propel the demand for ESRD treatment in the forecast period.

Market Size in USD Bn

CAGR5.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.4% |

| Market Concentration | High |

| Major Players | Fresenius Medical Care, DaVita Inc., Baxter International Inc., Nipro Corporation, B. Braun Melsungen AG and Among Others |

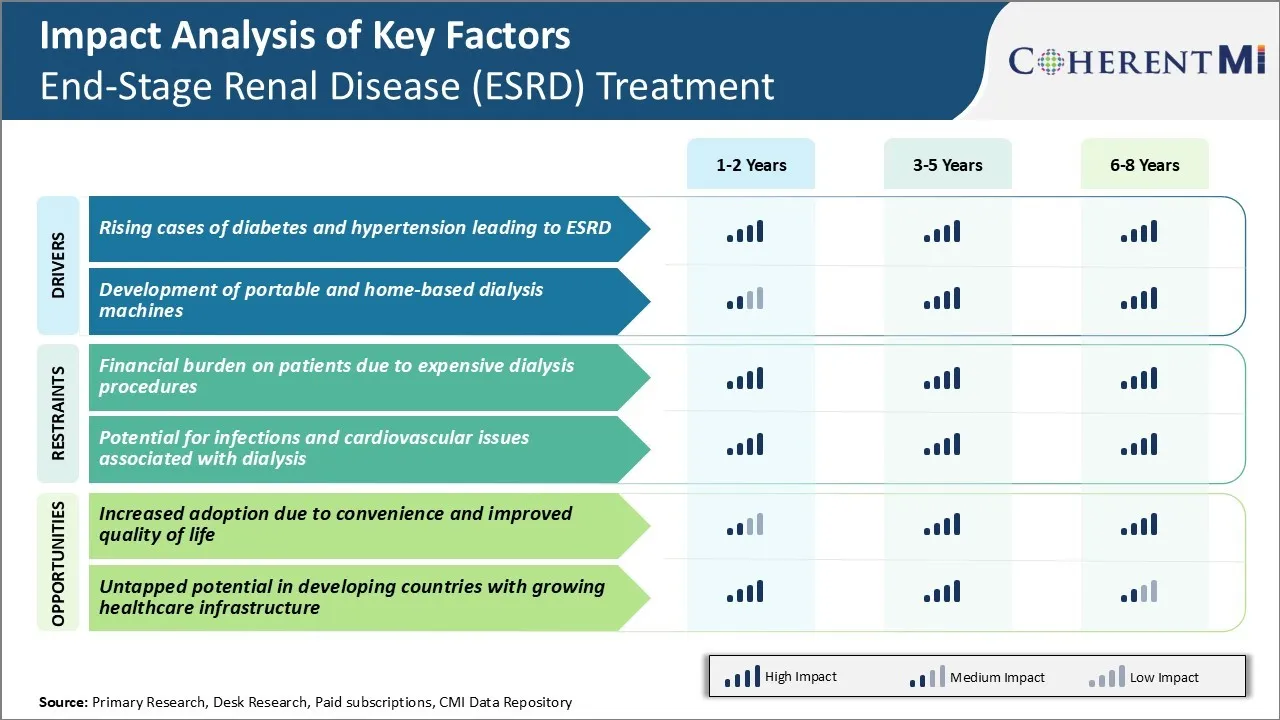

Market Driver - Rising Cases of Diabetes and Hypertension Leading to ESRD

The cases of diabetes and hypertension have been rising significantly all over the world in the past few decades. Both diabetes and hypertension are known risk factors that can eventually lead to end-stage renal disease if not managed properly. According to studies and reports from healthcare organizations, over 30% of new ESRD patients develop the condition due to complications of diabetes and another 30% due to hypertension.

If not treated on time through medications and lifestyle changes, diabetes can deteriorate into ESRD where dialysis or kidney transplant is needed for survival. Likewise, long-term uncontrolled high blood pressure strains the blood filtering units within the kidneys called nephrons. Hypertension causes the nephrons to thicken and narrow over time restricting the blood flow within the kidneys. As a result, the kidney function declines abruptly leading to end-stage renal failure.

Both diabetes and hypertension have grown into epidemics in the recent past primarily due to sedentary lifestyles and unhealthy eating habits across populations. Unless aggressive steps are taken to control these conditions, it is likely that ESRD cases attributed to them will continue rising rapidly thereby driving the end-stage renal disease (ESRD) treatment market.

Market Driver - Development of Portable and Home-based Dialysis Machines

Traditionally, dialysis treatment meant traveling to a hospital or clinic thrice a week to undergo hemodialysis procedures that lasted 3-4 hours each time. This posed major inconvenience and affected quality of life of ESRD patients significantly. However, with advances in dialysis machine technology, alternate renal replacement therapies are becoming available that offer greater portability and flexibility for patients.

Newer lightweight and compact machines allow home and portable hemodialysis to be administered more frequently but for shorter durations. Instead of visiting hospitals thrice a week for long hours, patients can hook up to a dialysis machine at home for short sessions even daily or nocturnal dialysis.

Similarly, home-based peritoneal dialysis offers periodic fluid exchanges using embedded catheters for continuous internal cleansing of fluids and wastes through the peritoneum. Low-profile machines have automated the process minimizing hands-on time and enabling independent living. Such developments have boosted patient compliance towards renal replacement therapies and quality of life. As more options emerge in home and portable care, it has driven the demands in the ESRD treatment market away from traditional hospital-centric models towards more patient-centric solutions. This shift is expected to continue shaping trends and strengthening overall growth prospects in the end-stage renal disease (ESRD) treatment market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Financial Burden on Patients Due to Expensive Dialysis Procedures

One of the major challenges faced by the end-stage renal disease (ESRD) treatment market is the high financial burden dialysis procedures place on patients. Dialysis is an expensive procedure that needs to be conducted either at dialysis centers or at home multiple times per week. The average cost of dialysis per patient annually in the US is estimated to be around $88,000.

While some of this cost is covered by public and private insurance, patients still have to bear significant out-of-pocket expenses. This poses severe financial hardship on many ESRD patients who are often retired or unable to work. The high treatment costs sometimes force patients to discontinue their care or undergo fewer sessions than required. This can negatively impact their health outcomes.

The costs of medications, transportation to dialysis centers, and incidental expenses also add to the financial strain on patients. Addressing this issue through measures like expanding insurance coverage, improving reimbursement rates, and reducing treatment costs is important to drive greater accessibility and adherence to ESRD care.

Market Opportunity - Increased Adoption Due to Convenience and Improved Quality of Life

One major opportunity for the ESRD treatment market lies in increased adoption of home dialysis solutions like peritoneal dialysis. Home dialysis therapies offer ESRD patients’ greater convenience and flexibility compared to in-center hemodialysis, as they can undergo treatment in the comfort of their own homes according to their schedules. This improves patients' quality of life by reducing hospital visits and allowing them to lead more normal lives.

Home therapies have also been associated with better clinical outcomes. With technological advancements making home machines safer and easier to use, more patients are opting for home dialysis. This reduces the burden on dialysis centers while offering lifestyle benefits. Increased education around home therapies and expansion of support programs can help boost their adoption rates further. This presents a substantial growth opportunity for suppliers of home dialysis products and services within the end-stage renal disease (ESRD) treatment market.

ESRD is typically treated via several lines of therapy depending on the stage of the disease. In early stages, lifestyle changes and medications like ACE inhibitors are prescribed to control blood pressure and slow disease progression. As the kidneys deteriorate further, stage 3 patients may be prescribed erythropoiesis-stimulating agents (ESAs) like Epogen or Procrit to treat anemia. At stage 4, the focus shifts to dialysis preparation with a phosphorus binder like Renagel to prevent bone disease.

Once the kidneys fail completely at stage 5, dialysis or transplantation are the main options. For dialysis, the preferred first-line treatment is usually hemodialysis done 3 times a week using machines like Fresenius Medical Care’s 2008K@Home HD cycler. It effectively filters waste and excess fluid. Peritoneal dialysis using a catheter for frequent at-home exchanges is a lower-cost alternative but has higher infection risks. Finally, kidney transplantation is the treatment of choice if a donor match is available since it offers best quality of life outcomes. However, organ scarcity and risk of rejection make it an option for only a fraction of ESRD patients.

Other factors influencing prescriber preferences include patient comorbidities, financial constraints, and access to specialized dialysis facilities or transplant programs.

ESRD is divided into different stages based on kidney function loss. Patients initially receive conservative management with medications as kidney function declines to Stage 3 or 4.

If kidney function falls below 15%, hemodialysis or peritoneal dialysis are the primary treatment options. Hemodialysis involves using an artificial kidney machine and filter to remove waste and excess fluids 2-3 times a week. Peritoneal dialysis uses the peritoneum membrane in the abdomen, administering dialysis fluid via a catheter for gradual waste removal. Both maintain the patient until a transplant.

For patients who are transplant candidates, a deceased donor kidney transplant is the best option for prolonging life. Immunosuppressants like tacrolimus (Prograf), mycophenolate mofetil (CellCept), and prednisone are commonly prescribed post-transplant to prevent rejection by suppressing the immune system. With proper care and medication adherence, 5-year graft survival rates are over 80%.

For those who are ineligible for transplant, long-term dialysis remains the standard treatment. Newer hemodialysis machines and frequent short daily home hemodialysis provide better clearance compared to conventional thrice-weekly treatments. Peritoneal dialysis also improves with automated systems and newer biocompatible solutions, enhancing quality of life. However, a successful transplant provides the best outcomes by restoring kidney function.

Key players in the ESRD Treatment market have focused on intensifying research and development activities to come up with more effective treatment options for patients. For instance, Fresenius Medical Care invested over $1 billion in R&D in 2017 to develop next-generation products like sensors and digital therapies for renal care.

Companies have also strengthened their product portfolio through acquisitions and partnerships. In 2019, Baxter acquired NxStage Medical, a leading provider of home hemodialysis systems. This strengthened Baxter's position in the home dialysis market, accounting for 25-30% global market share. Similarly, DaVita partnered with health tech firms in 2018 to integrate digital care management tools into their clinics. Their mobile apps and remote monitoring services saw strong growth in adoption, helping maintain over 14,000 clinics globally.

Market leaders like Fresenius and DaVita have expanded into emerging markets like Asia, Latin America and Eastern Europe in the last 5 years through Greenfield projects and acquisitions. For example, Fresenius built 100 new dialysis centers in China from 2015-2020. Their international revenues now makeup over 50% of total sales compared to just 20% in 2010. This global footprint allows them to tap high-growth opportunities outside the saturated US markets.

-treatment-market-by-treatment-modality.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

Insights, By Treatment Modality: Rise of Home-Based Treatment Modalities Drives Growth in the Hemodialysis Segment

To learn more about this report, Download Free Sample Copy

Insights, By Treatment Modality: Rise of Home-Based Treatment Modalities Drives Growth in the Hemodialysis Segment

In terms of treatment modality, hemodialysis contributes the highest share of the market owning to advancements in home-based hemodialysis technologies. Home hemodialysis offers more flexibility and independence to patients compared to in-center treatment.

The development of simple, portable machines and user-friendly supplies have made home hemodialysis a more viable option. This has led to higher preference and uptake of home hemodialysis modalities like frequent or short daily hemodialysis. Home hemodialysis is also cost-effective compared to in-center treatment for payers. Both public and private insurance providers are encouraging the shift to home-based care to manage rising healthcare costs. Kidney care organizations are educating patients about home treatment and providing necessary training and support.

-treatment-market-by-product-type.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By Product Type: Strong Demand for Ancillary Dialysis Products and Services Augments Demand for Dialysis Services

In terms of product type, dialysis services contribute the highest share of the market owing to the recurring nature of demand for these services. Patients with ESRD require lifelong dialysis treatment performed either at centers or at home. This guarantees a stable customer base and recurrent demand for services. Additionally, dialysis services provide opportunities for cross-selling ancillary products.

Considerable revenue is generated from sale of disposable products like dialyzers, bloodlines and other commodities to dialysis centers. There is also growing demand for portable peripheral products that enable home-based services. New product development by service providers helps address unmet needs and further boosts revenue.

Insights, By End User: Consolidation of Care Delivery Within Hospitals Drives Prominence of the Hospitals Segment

In terms of end user, hospitals contribute the highest share of the market owing to the gradual consolidation of ESRD treatment within hospital networks. Large hospitals are acquiring or partnering with dialysis centers to provide an integrated continuum of care for kidney patients. This ‘one-stop-shop’ approach improves care coordination and patient convenience.

It also allows hospitals to shift cost burden and better manage ESRD, a financially draining condition for healthcare systems. Government policies in various countries now promote centralized treatment in large hospital units instead of standalone centers. This favors renal departments at hospitals over independent dialysis clinics.

The major players operating in the end-stage renal disease (ESRD) treatment market include Fresenius Medical Care, DaVita Inc., Baxter International Inc., Nipro Corporation, B. Braun Melsungen AG, Nikkiso Co., Ltd., Asahi Kasei Corporation, Medtronic plc, Terumo Corporation, and Toray Medical Co., Ltd.

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

End-Stage Renal Disease (ESRD) Treatment Market is segmented By Treatment Modality (Hemodialysis, Pe...

End-Stage Renal Disease (ESRD) Treatment Market

How big is the end-stage renal disease (ESRD) treatment market?

The end-stage renal disease (ESRD) treatment market is estimated to be valued at USD 89.27 Bn in 2025 and is expected to reach USD 129.00 Bn by 2032.

What are the key factors hampering the growth of the end-stage renal disease (ESRD) treatment market?

The financial burden on patients due to expensive dialysis procedures and potential for infections and cardiovascular issues associated with dialysis are the major factors hampering the growth of the end-stage renal disease (ESRD) treatment market.

What are the major factors driving the end-stage renal disease (ESRD) treatment market growth?

The rising cases of diabetes and hypertension leading to ESRD and development of portable and home-based dialysis machines are the major factors driving the end-stage renal disease (ESRD) treatment market.

Which is the leading treatment modality in the end-stage renal disease (ESRD) treatment market?

The leading treatment modality segment is hemodialysis.

Which are the major players operating in the end-stage renal disease (ESRD) treatment market?

Fresenius Medical Care, DaVita Inc., Baxter International Inc., Nipro Corporation, B. Braun Melsungen AG, Nikkiso Co., Ltd., Asahi Kasei Corporation, Medtronic plc, Terumo Corporation, and Toray Medical Co., Ltd. are the major players.

What will be the CAGR of the end-stage renal disease (ESRD) treatment market?

The CAGR of the end-stage renal disease (ESRD) treatment market is projected to be 5.4% from 2025-2032.