The erosive hand osteoarthritis market is estimated to be valued at USD 3.77 Bn in 2025 and is expected to reach USD 6.30 Bn by 2032, growing at a compound annual growth rate (CAGR) of 7.6% from 2025 to 2032. The market is witnessing positive trends as several new treatment options are in the pipeline which can potentially change the treatment landscape. Research and development in the area of disease-modifying drugs hold promise for better management of symptoms.

Market Size in USD Bn

CAGR7.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 7.6% |

| Market Concentration | Medium |

| Major Players | Pfizer Inc., GlaxoSmithKline plc, AstraZeneca, Novartis AG, Johnson & Johnson and Among Others |

Market Driver - Increasing Awareness of Erosive Hand Osteoarthritis

Due to advancement of medical research and knowledge, awareness about lesser-known disease conditions have substantially increased over the past few decades. Erosive hand osteoarthritis is one such condition whose understanding have deepened among both healthcare professionals as well as general public.

While osteoarthritis was generally seen as wear-and-tear type joint degeneration earlier, today more types of osteoarthritis are recognized including erosive osteoarthritis which causes painful bone erosion in hands. Several awareness campaigns run by patient advocacy groups and sometimes medical institutes have played a big role in enhancing awareness. These groups educate people about symptoms like painful swelling and bone erosion in small joints of hands so patients can identify signs early and seek proper diagnosis and care.

Awareness have also grown among primary care physicians and rheumatologists who may now suspect erosive osteoarthritis in patients presenting with such complaints and confirm diagnosis with imaging tests. Overall increased medical literature and information available online has made people more knowledgeable that erosive osteoarthritis is a distinct form of hand OA with its own set of complications if left untreated for long. This growing awareness itself fuels demand for improved diagnosis and innovative treatment approaches.

Market Driver - Development of New and Emerging Therapies for Improved Treatment Outcomes

Treatment of erosive hand osteoarthritis continues to evolve as research delves deeper into disease pathomechanisms aiming to develop therapies that directly target underlying causes. While current options majorly involve symptomatic relief, researchers are evaluating new molecules and compounds that may help slow down or halt progression of bone erosion by blocking specific pathways driving the disease process.

A few biologics showing promise in early studies are now being explored further in larger clinical trials. Advancements are also being made in cell and gene therapies leveraging modern tools of regenerative medicine to repair damaged joints. Surgery too is becoming more refined with minimal invasive procedures replacing conventional joint replacement in initial stages. Another key trend is combination therapies customizing treatment based on individual patient's specific joint conditions, symptoms and risk factors.

Digital healthcare enables close remote monitoring aiding such personalized approaches. Overall, continuous efforts to widen therapeutic choices especially targeted disease modifying options hold potential to significantly improve long term outcomes for erosive hand osteoarthritis patients.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Limited Effectiveness of Current Treatment Options

One of the key challenges in the erosive hand osteoarthritis market is the limited effectiveness of current treatment options available. Currently, the treatment options for erosive hand OA include analgesic and anti-inflammatory medications like acetaminophen, COX-2 inhibitors and corticosteroid injections. While these options provide some relief from the symptoms like joint pain and stiffness, they do not slow or stop the underlying disease progression. These medications only target symptoms and do not address the root cause or structural damage in the joints.

As a result, patients continue to experience deteriorating hand function over time despite being on medications. The inability of existing pharmacological therapies to modify disease progression or prevent structural damage in the joints has been a major limitation. There is an unmet need for disease modifying therapies that can potentially protect cartilage, slow joint damage and improve long term outcomes for patients with erosive hand OA.

Market Opportunity - Emerging Pipeline Drugs with New Mechanisms of Action

One of the key opportunities in the erosive hand osteoarthritis market lies in the emerging pipeline of drugs with novel mechanisms of action. A number of biopharma companies are developing structure modifying drugs that target specific pathways involved in the disease pathogenesis. These include drugs targeting IL-1, Cathepsin K and Wnt signaling pathways which are believed to play an important role in cartilage breakdown and bone resorption in erosive hand OA.

Some of these pipeline drugs have shown promising results in modifying structural changes in hand joints in early clinical studies. If approved, they have the potential to become the first structure modifying treatment options available for patients. These new drugs will address the limitations of existing therapies by not just alleviating symptoms but also modifying disease progression.

Their ability to slow joint damage can help improve long term clinical outcomes. This emerging pipeline has the potential to significantly expand treatment landscape and presents an exciting opportunity for growth in the market.

Erosive hand osteoarthritis (EOA) progresses through three stages - mild, moderate, and severe - with treatments escalating based on severity and symptom control.

In mild EOA, lifestyle changes like hand exercises and splinting are usually prescribed first. Over-the-counter acetaminophen is also common due to its availability and affordability.

As pain and functional impairment increase in moderate EOA, prescription-strength oral NSAIDs like celecoxib (Celebrex) and meloxicam (Mobic) are frequently used. Topical NSAIDs that offer localized relief without systemic side effects, such as diclofenac gel (Voltaren Gel), are growing in popularity at this stage.

For patients with more advanced, severe EOA, duloxetine (Cymbalta) - an SNRI approved to treat osteoarthritic pain - may be added to maximize pain management. In refractory cases, prescribers may consider stronger analgesics like tramadol or topical capsaicin cream. Joint injections with corticosteroids can temporarily relieve severe flares, as can hyaluronic acid injections which lubricate inflamed joints.

When conservative options fail to control symptoms, joint replacement surgery is ultimately indicated. Prescriber factors like a patient's comorbidities, insurance coverage, and willingness to undergo surgery all influence surgical timing.

Erosive hand osteoarthritis can be classified into three stages based on severity of symptoms and structural damage seen on X-rays.

Mild Stage: In the initial stage, only symptoms like pain and swelling are present without any erosions visible on X-rays. Over-the-counter medications like acetaminophen are usually prescribed along with splints and exercises.

Moderate Stage: As the disease progresses, small erosions start appearing near the joints. The first line of treatment includes topical or oral NSAIDs like ibuprofen gel or diclofenac for their excellent pain relieving and anti-inflammatory action. Intra-articular injections of corticosteroids also provide relief from this stage onwards.

Severe Stage: In advanced osteoarthritis, multiple large erosions are seen along with secondary osteoarthritis changes. When pain is not controlled by NSAIDs and corticosteroid injections, disease-modifying drugs like methotrexate or hydroxychloroquine are used. They slow down the disease progression by modulating the immune response. For patients with severely impaired joints, surgical options like joint replacement may be considered.

In summary, a step-up approach is followed - starting with mild analgesics and progressing to stronger anti-inflammatory drugs, viscosupplementation, DMARDS and finally surgery - based on severity of symptoms, structural damages and treatment response at each stage of erosive hand osteoarthritis.

Focus on product innovation through R&D:

Anthropic launched a topical medical gel called Anthropic Relief in 2022 to treat pain from hand osteoarthritis. The gel contains scientifically studied ingredients like aloe vera, lidocaine, and camphor that penetrate deep into joints to provide hours of relief.

Partnerships to expand access and awareness:

In 2020, Perrigo partnered with pharmacy retailers like CVS to make their store brand topical analgesic cream more accessible over the counter. This helped increase sales by 35% in the first year as more customers learned about an affordable option for hand osteoarthritis pain relief near them. The success of this strategy encouraged Perrigo to partner with additional retailers and pharmacies across the US.

Education-focused marketing campaigns:

GlaxoSmithKline ran an "Own Your Hands" marketing campaign in 2021 to educate people about osteoarthritis as a progressive disease and lifestyle changes that can help. This also promoted their new oral supplement for joint support. The non-promotional campaign was well-received and increased brand awareness over 2x. It drove a 20% increase in total sales of GSK's osteoarthritis products as more patients sought formal treatment options.

To learn more about this report, Download Free Sample Copy

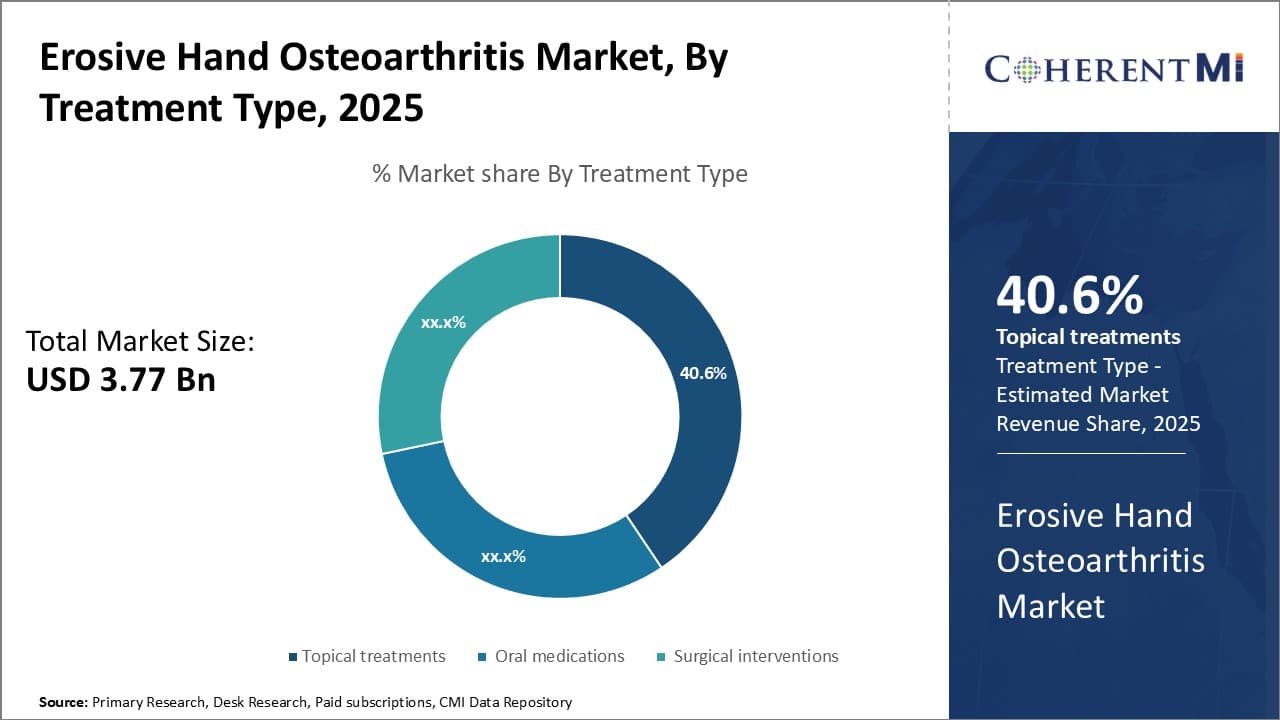

Insights, By Treatment Type: Topical Treatments: King of Non-Invasive Options

To learn more about this report, Download Free Sample Copy

Insights, By Treatment Type: Topical Treatments: King of Non-Invasive Options

In terms of treatment type, topical treatments are expected to account for 40.6% of market share in 2025, owning to its non-invasive nature. As erosive hand osteoarthritis causes pain and stiffness in hands, patients prefer minimally invasive options over surgical interventions. Topical treatments offer instant relief from pain and swelling through their active ingredients like NSAIDs and menthol, without any side effects like those from oral medications.

Being applied externally, they don't burden stomach or liver like oral drugs. Their localized action also ensures maximum benefits where it matters the most—the affected joints. This makes them highly compliant for regular usage. Various topical formulations like gels, creams and patches facilitate easy application without expert help. With convenient usage and faster results, topical treatments have emerged as the go-to first line treatment and maintain their dominance in the market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

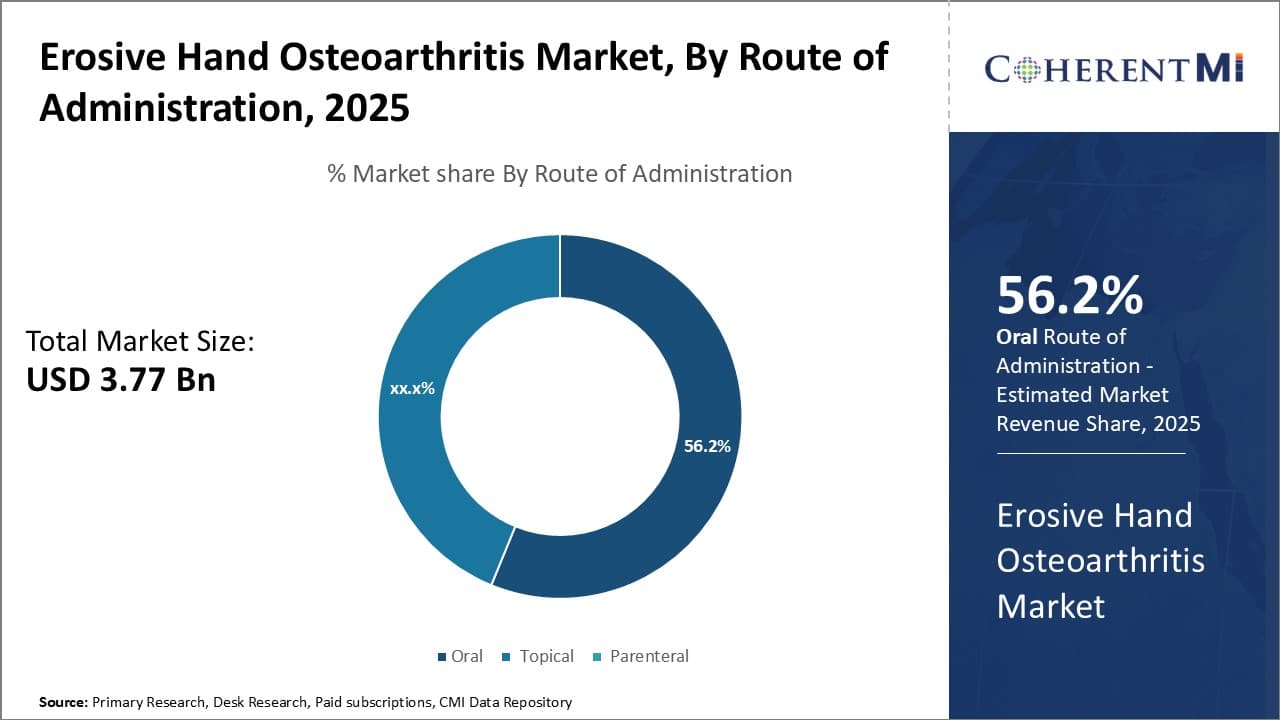

Insights, By Route of Administration: Oral Route: Reigning with Reliability

In terms of By Route of Administration, Oral contributes the highest share of the market owning to its reliability. While topical and parental routes deliver localized effects, oral medications distribute the active ingredients throughout the body through systematic absorption from the gastrointestinal tract. This ensures uniform levels of drugs in the bloodstream for effective alleviation of symptoms over a considerable duration with each scheduled dose.

Not dependent on site of application, oral drugs effectively address joint pains from erosive osteoarthritis regardless of location of affected joints in hands. Being a non-invasive option, oral medications facilitate easy self-administration and assures compliance. Its time-tested effects and consistent results have made oral route highly reliable among healthcare professionals and patients alike.

Insights, By End User: Hospitals: Hub of Comprehensive Care

In terms of end user, hospitals contribute the highest share of the market owning to their ability to provide comprehensive care. Patients with advanced cases of erosive hand osteoarthritis requiring aggressive treatment or surgical interventions rely on hospitals. Equipped with advanced medical facilities, team of specialists and 24/7 emergency support, hospitals offer highest level of joint care. They provide diagnosis, full spectrum of treatment options ranging from medications to specialized therapies under one roof.

Patients get access to advanced diagnostic technologies, customized treatment plans, specialist support and expertise of leading surgeons all together in hospitals. Joint replacement or reconstructive surgeries, which many patients eventually require, can only be performed safely in hospital setup. This makes hospitals the preferred choice especially for elderly patients who need additional medical supervision during recovery.

Overall, hospitals remain the reliability symbol as the one-stop solution provider for all joint care needs related to erosive hand osteoarthritis.

The major players operating in the erosive hand osteoarthritis market include Pfizer Inc., GlaxoSmithKline plc, AstraZeneca, Novartis AG, Johnson & Johnson, AbbVie, Celgene Corporation, Amgen, and XOMA (US) LLC.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Erosive Hand Osteoarthritis Market is segmented By Treatment Type (Topical treatments, Oral medicati...

Erosive Hand Osteoarthritis Market

How big is the erosive hand osteoarthritis market?

The erosive hand osteoarthritis market is estimated to be valued at USD 3.77 Bn in 2025 and is expected to reach USD 6.30 Bn by 2032.

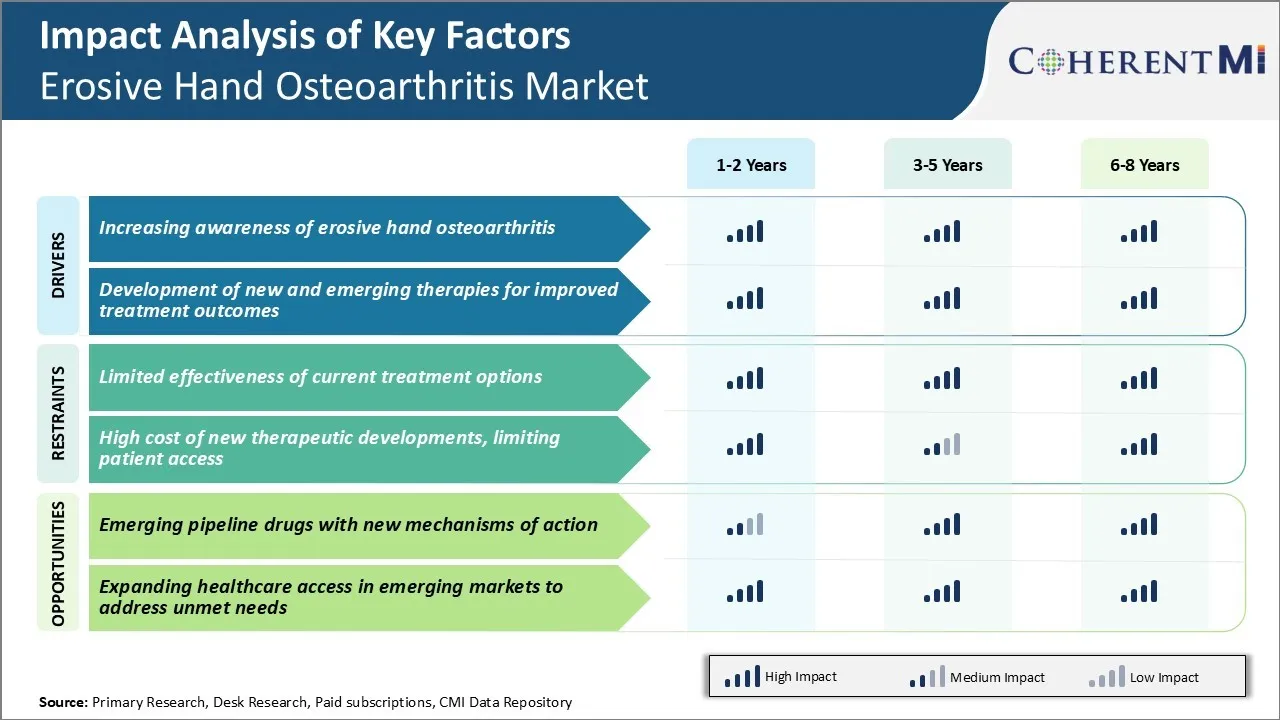

What are the key factors hampering the growth of the erosive hand osteoarthritis market?

The limited effectiveness of current treatment options and high cost of new therapeutic developments, limiting patient access are the major factors hampering the growth of the erosive hand osteoarthritis market.

What are the major factors driving the erosive hand osteoarthritis market growth?

The increasing awareness of erosive hand osteoarthritis and development of new and emerging therapies for improved treatment outcomes are the major factors driving the erosive hand osteoarthritis market.

Which is the leading treatment type in the erosive hand osteoarthritis market?

The leading treatment type segment is topical treatments.

Which are the major players operating in the erosive hand osteoarthritis market?

Pfizer Inc., GlaxoSmithKline plc, AstraZeneca, Novartis AG, Johnson & Johnson, AbbVie, Celgene Corporation, Amgen, and XOMA (US) LLC are the major players.

What will be the CAGR of the erosive hand osteoarthritis market?

The CAGR of the erosive hand osteoarthritis market is projected to be 7.6% from 2025-2032.