Foam Plastics Market Trends

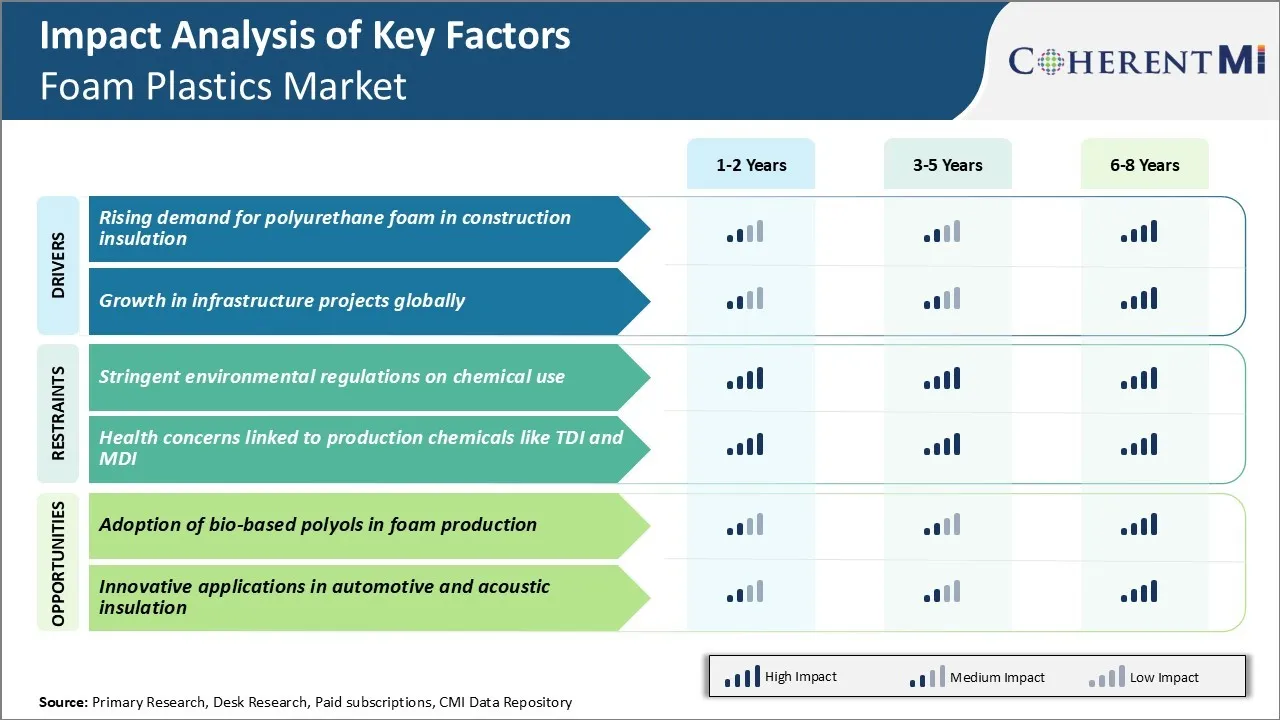

Market Driver - Rising Demand for Polyurethane Foam in Construction Insulation

The global construction industry has been experiencing steady growth over the past decade primarily due to rapid urbanization. Growth in construction activities has translated to heightened demand for various insulation materials that can help improve the energy efficiency of buildings and structures. Polyurethane foam, owing to its versatile insulating properties, has emerged as one of the preferred choices among building owners and contractors.

Moreover, polyurethane foam adheres strongly to various surfaces such as wood, metal, and masonry. It expands and fills up tiny gaps and cavities effectively, providing a continuous insulating barrier. Its airtightness characteristics prevent air leakage which is a major cause of heat loss.

Major construction markets like China, which is urbanizing at a swift pace, have rolled out stricter guidelines mandating superior insulation standards. Similarly, Europe has implemented energy efficiency directives under its Energy Performance of Buildings Directive that emphasize retrofitting existing buildings and reducing their carbon footprint. Eventually, the consumption of polyurethane foam for insulation purposes is envisioned to keep its upward momentum. This will contribute to the growth of the foam plastics market.

Market Driver - Growth in Infrastructure Projects Globally

Recently, governments and multilateral agencies across the world have focused on upgrading mobility networks and bolstering social infrastructure to lift economic growth. Major regional blocs like the European Union have earmarked large packages for seamless cross-border transportation links while developing nations are prioritizing household electrification and water supply projects.

Also, widespread urban logjams have necessitated ambitious metro, airport and freeway expansion plans especially within emerging markets in Asia Pacific and Latin America. The surge in developmental activities pertaining to roads, rails, bridges, ports and utility corridors has translated into higher opportunities for manufacturers of industrial materials. This will remain an important driver for the foam plastics market in the coming years.

Foam plastics have emerged as an instrumental product category gaining usage across diverse infrastructure applications owing to their characteristics of strength, durability and lightweight properties. For instance, rigid polyurethane foam finds extensive employment in the manufacturing of composite structural insulated panels. Similarly, ethylene propylene diene monomer foams are effectively utilized as flotation devices and fenders to protect bridges, piers, and ships from collisions.

Market Challenge - Stringent Environmental Regulations on Chemical Use

One of the key challenges for the foam plastics market is stringent environmental regulations on chemical use. Foam plastics manufacturing relies heavily on chemicals like petroleum-based polyols that can pose health and environmental risks if not handled properly.

In recent years, regulations around the use of such chemicals have become much stricter, especially in developed markets of North America and Europe. The REACH regulations in Europe have imposed tough restrictions on using certain harmful chemicals in foam production. Similarly, the US EPA has been strengthening rules regarding VOC emissions and use of ozone-depleting substances.

Complying with these evolving regulations requires foam manufacturers to invest heavily in upgrading their plants and production processes. The need to constantly develop low-VOC and more sustainable recipes also raises R&D expenses. With the focus on sustainability growing globally, regulatory pressures on the industry are expected to further intensify in the coming years. This poses both financial and technological challenges for the foam plastics market.

Market Opportunity - Adoption of Bio-based Polyols in Foam Production

One significant opportunity area for the foam plastics market is the adoption of bio-based polyols in foam production. Foam plastic manufacturers are increasingly looking at substituting traditional petroleum-based polyols with those derived from renewable biomass sources like plants, trees, and agricultural wastes. Bio-polyols offer various advantages - they have a much smaller carbon footprint, enable producers to gain eco-labels and green credentials.

While bio-polyols were once more expensive than petroleum-based options, technology advances have helped lower their costs significantly. Many large polyols suppliers now offer a wide assortment of plant-derived polyols. As awareness rises amongst brand owners about sustainability, the market for bio-based flexible foam plastics and insulation products is projected to expand rapidly.

This growing demand would drive manufacturers in the foam plastics market to adopt green polyols on a wider scale. It presents an opportunity for companies to strengthen their brands, capture a premium, and access fast-growing market segments by offering sustainable foam plastic solutions.