Gene Therapy in Ophthalmology Market Size - Analysis

Market Size in USD Bn

CAGR25.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 25.4% |

| Market Concentration | High |

| Major Players | Johnson & Johnson Innovative Medicine, MeiraGTx, Beacon Therapeutics, Nanoscope Therapeutics, GenSight Biologics and Among Others |

please let us know !

Gene Therapy in Ophthalmology Market Trends

Genetic factors contribute significantly to the development of various ophthalmic conditions including retinitis pigmentosa, age-related macular degeneration (AMD), and glaucoma. Researchers have found that mutations in as many as 250 genes can result in retinal degeneration alone. The worldwide prevalence of such inherited retinal diseases (IRDs) is estimated to range from 1 in 2,000–3,000 persons.

Gene therapies, however, offer the promise of long-term vision restoration or preservation by precisely targeting the underlying genetic roots of ocular disorders. This potential for gene therapies to provide a curative outcome through a single administration has spurred significant interest from biopharmaceutical firms. It has also encouraged greater patient enrollment in ongoing clinical trials evaluating candidate therapies for conditions like Leber congenital amaurosis and AMD.

Market Driver - Advances in Gene Editing Technologies Enhancing the Development of Novel Therapies

Building on these platforms, scientists are gaining deeper insights into disease-causing gene mutations and the complex molecular mechanisms underlying retinal degeneration. This has led to the creation of several proof-of-concept animal models that emulate human genetic eye diseases. Such models have been instrumental in demonstrating proof-of-principle for novel therapeutic strategies like knocking-out defective genes, inserting functional gene copies and gene supplementation through viral vector delivery.

Market Challenge - High Costs Associated with Gene Therapy Treatments Limiting Accessibility

Additionally, manufacturing gene therapies is a complex process that often involves customized viral vectors and careful dosing for each patient's specific needs. All of these factors contribute to the high price tags of many gene therapies currently available or in the pipeline.

As gene therapies for ophthalmic conditions continue to advance, bringing down the costs associated with development as well as administration will be crucial to maximize the utilization and benefits of this technology across broader patient populations.

Market Opportunity - Expansion into Emerging Markets with Unmet Medical Needs

Gene therapies have the potential to transform the management of genetically-driven retinal disorders that currently have limited treatment options in these markets. International drug developers and domestic pharma companies can capitalize on this unmet need by conducting clinical trials and regulatory submissions strategically tailored for emerging markets. Partnering with local healthcare providers and patient advocacy groups will help facilitate patient identification and treatment delivery.

Key winning strategies adopted by key players of Gene Therapy in Ophthalmology Market

Novartis has been a pioneer in developing gene therapy for ophthalmology indications. In 2017, it received approval for Luxturna (voretigene neparvovec), the first ever gene therapy approved in the US for an inherited retinal disease. Luxturna is designed for patients with confirmed biallelic RPE65 mutation-associated retinal dystrophy. It helped restore vision in patients who would have otherwise experienced progressive vision loss. Luxturna’s approval demonstrated the promise of gene therapy for treating inherited eye conditions. It gave Novartis first-mover advantage and established its leadership in this therapeutic area.

Both companies’ successes reinforced gene therapy as a viable treatment paradigm for ophthalmic conditions like inherited retina diseases. They established clinical proof-of-concept which de-risked the field and attracted more players. Over 15 biotechs are now developing various gene therapies for retinal degenerations, glaucoma, dry eye etc.

Segmental Analysis of Gene Therapy in Ophthalmology Market

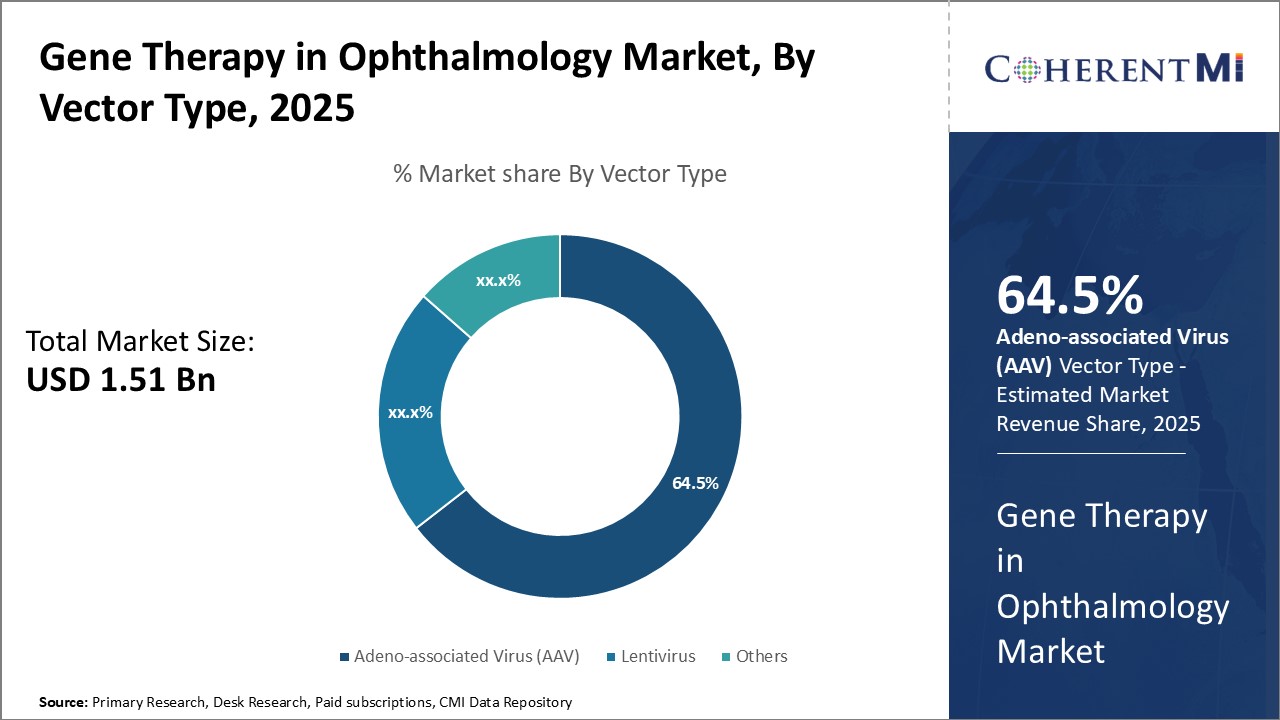

Insights, By Vector Type: Clinical Potential of AAV Drives its Dominance

Insights, By Vector Type: Clinical Potential of AAV Drives its DominanceIn terms of vector type, adeno-associated virus (AAV) segment is estimated to hold 64.5% share of the market in 2025, due to its excellent clinical potential for ocular gene therapy. AAV vectors have emerged as the leading vector of choice owing to their non-pathogenic nature and ability to efficiently transduce retinal cells without adverse effects. They also have the advantage of long-term transgene expression in post-mitotic cells like photoreceptors.

The scalability of AAV vector production and longer stability also offer economic and logistical benefits. Their proven ability to safely deliver therapeutic genes makes AAV the most widely used and commercially viable vector system currently for retinal gene therapy.

In terms of end user, hospitals contribute the highest share of the market owing to the need for advanced infrastructure and multidisciplinary care required for gene therapy procedures. Gene therapy for ocular disorders is a complex treatment modality requiring specialized equipment, trained professionals, and biosafety facilities for vector production and administration.

The in-patient hospital setting also allows for postoperative care and monitoring of patients. As gene therapy demand increases with commercialization, hospitals will play a central role in its delivery utilizing their advanced facilities and wider network to improve patient access to these novel sight-saving therapies. Ambulatory surgery centers and specialized eye clinics may also contribute to the hospital segment growth over the long term.

Additional Insights of Gene Therapy in Ophthalmology Market

- Over 200,000 individuals worldwide are affected by inherited retinal diseases, representing a significant market opportunity.

- Gene therapies have the potential to provide long-term solutions with a single administration, reducing the treatment burden.

- The market saw its highest share in the United States in 2020, with approximately USD 35 million, followed by Germany within the EU4.

- In Japan, there were around 800,000 cases of wet AMD eligible for gene therapy in 2020.

- The successful approval and commercialization of Luxturna have set a precedent, encouraging other companies to invest in gene therapies for ophthalmic diseases.

Competitive overview of Gene Therapy in Ophthalmology Market

The major players operating in the gene therapy in ophthalmology market include Johnson & Johnson Innovative Medicine, MeiraGTx, Beacon Therapeutics, Nanoscope Therapeutics, GenSight Biologics, 4D Molecular Therapeutics, Coave Therapeutics, Bionic Sight, Neuropht Therapeutics, Adverum Biotechnologies, EyeVensys, Exegenesis Bio, Atsena Therapeutics, Ocugen, AbbVie, REGENXBIO, Skyline Therapeutics, Huida Gene Therapeutics, Opus Genetics, Spark Therapeutics, Novartis AG, Adverum Biotechnologies, REGENXBIO Inc., and AGTC.

Gene Therapy in Ophthalmology Market Leaders

- Johnson & Johnson Innovative Medicine

- MeiraGTx

- Beacon Therapeutics

- Nanoscope Therapeutics

- GenSight Biologics

Gene Therapy in Ophthalmology Market - Competitive Rivalry

Gene Therapy in Ophthalmology Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Gene Therapy in Ophthalmology Market

- In December 2023, the US FDA granted Regenerative Medicine Advanced Therapy (RMAT) designation to OCU400, an investigational gene therapy by Ocugen, Inc., for the treatment of retinitis pigmentosa (RP) associated with RHO mutations. This designation is aimed at expediting the development of regenerative medicines to address unmet medical needs.

- In December 2023, 4D Molecular Therapeutics announced plans to present interim data from the Phase II dose expansion stage of their PRISM clinical trial for 4D-150 at the 2024 Angiogenesis, Exudation, and Degeneration Conference, which is scheduled to take place in February 2024. This trial focuses on patients with wet age-related macular degeneration (AMD), aiming to reduce the treatment burden by using a gene therapy approach. The presentation will cover the 24-week data analysis from this dose expansion study.

- In October 2023, the European Medicines Agency (EMA) granted Priority Medicines (PRIME) designation to 4D-150, a genetic medicine developed by 4D Molecular Therapeutics, for the intravitreal treatment of wet age-related macular degeneration (wet AMD). This designation was awarded based on promising interim clinical data from the Phase 1 PRISM trial, which demonstrated encouraging safety, tolerability, and clinical activity. The PRIME designation is intended to accelerate the development and review of medicines addressing unmet medical needs, potentially speeding up the availability of 4D-150 in international markets.

- In June 2021, REGENXBIO announced that they had dosed the first patient in a Phase II clinical trial for RGX-314, a gene therapy designed to treat diabetic retinopathy (DR). This trial, known as the ALTITUDE™ trial, evaluates the suprachoroidal delivery of RGX-314 using an in-office procedure. The goal of the therapy is to provide long-term, sustained production of anti-VEGF proteins in the eye, potentially offering a one-time treatment option for DR, which could reduce the need for repeated anti-VEGF injections.

- In March 2021, Adverum Biotechnologies reported positive interim data from its Phase 2 OPTIC trial of ADVM-022 for treating wet age-related macular degeneration (AMD). The trial demonstrated sustained efficacy after a single intravitreal injection of ADVM-022, showing a significant reduction in the need for supplemental anti-VEGF injections. Patients experienced stable and continuous therapeutic protein expression, indicating the potential of ADVM-022 as a long-term treatment option for wet AMD.

Gene Therapy in Ophthalmology Market Segmentation

- By Indication

- Inherited Retinal Diseases

- Leber Congenital Amaurosis

- Retinitis Pigmentosa

- Choroideremia

- Acquired Retinal Diseases

- Age-related Macular Degeneration

- Diabetic Retinopathy

- By Vector Type

- Adeno-associated Virus (AAV)

- Lentivirus

- Others

- Retrovirus

- Herpes Simplex Virus

- By End User

- Hospitals

- Ophthalmic Clinics

- Academic and Research Institutes

- By Route of Administration

- Subretinal Injection

- Intravitreal Injection

- Others

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the gene therapy in ophthalmology market?

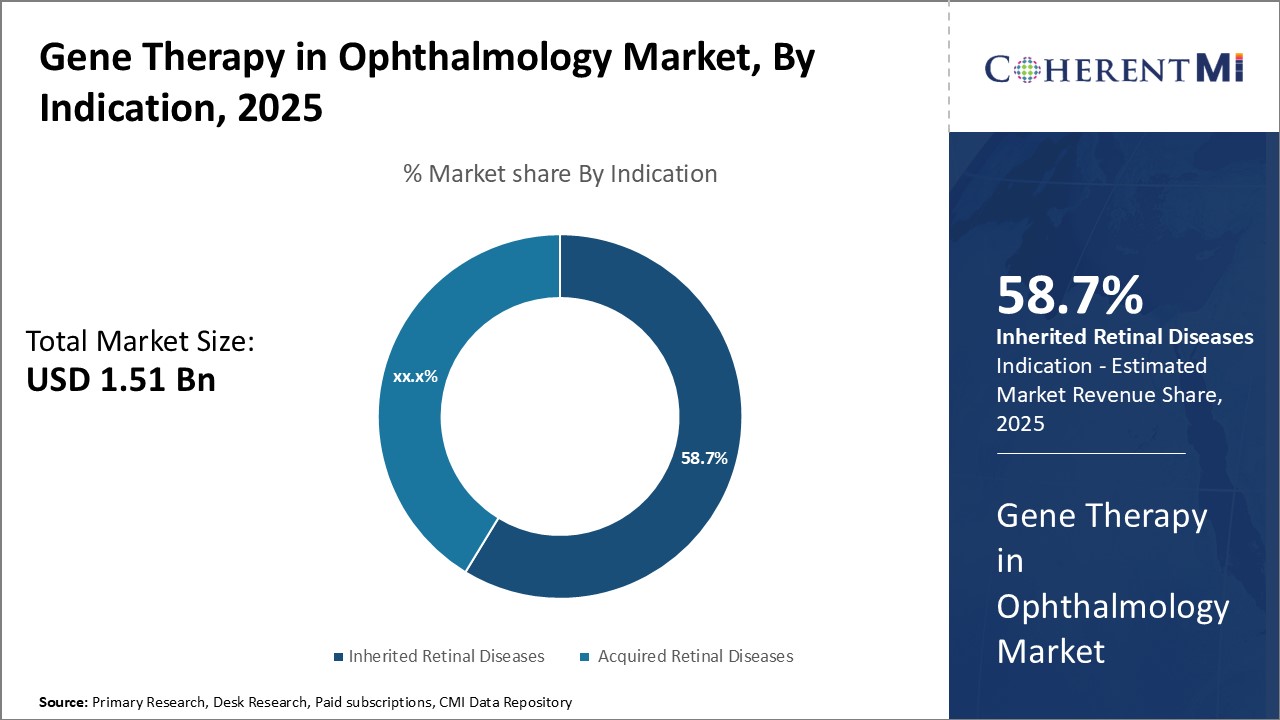

The gene therapy in ophthalmology market is estimated to be valued at USD 1.51 Bn in 2025 and is expected to reach USD 7.36 Bn by 2032.

What are the key factors hampering the growth of the gene therapy in ophthalmology market?

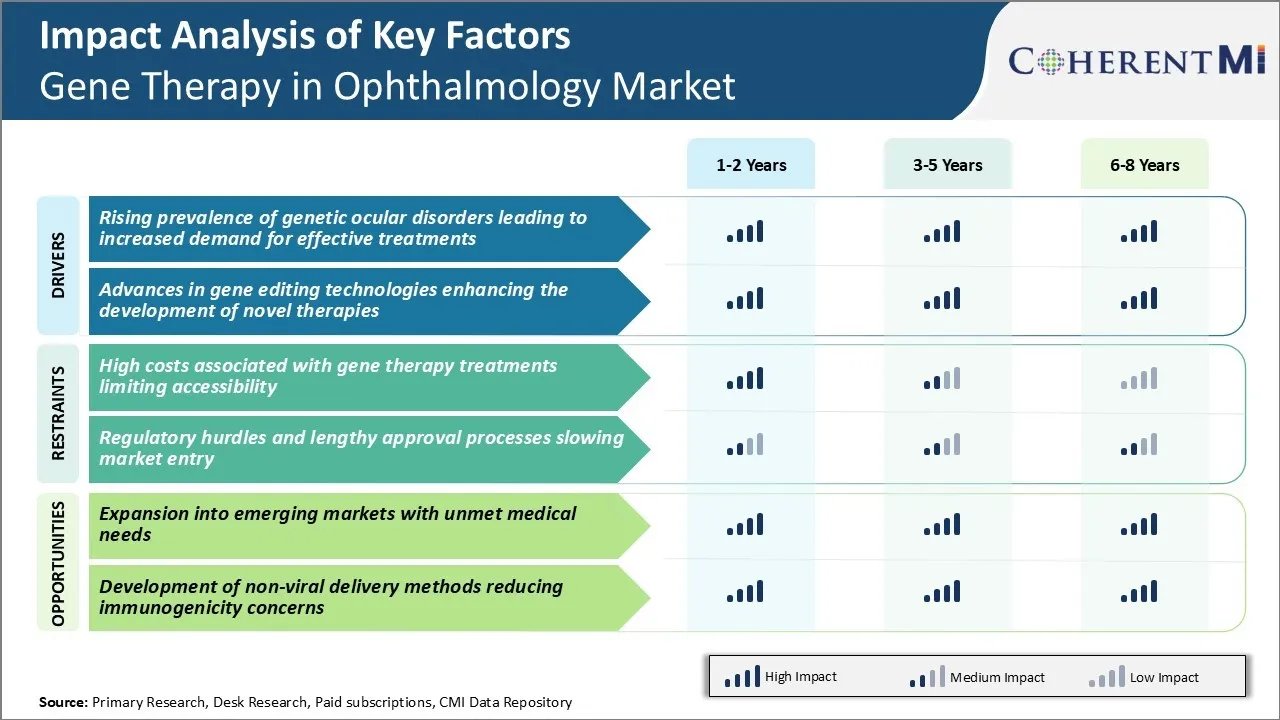

High costs associated with gene therapy treatments limiting accessibility and regulatory hurdles and lengthy approval processes slowing market entry are the major factors hampering the growth of the gene therapy in ophthalmology market.

What are the major factors driving the gene therapy in ophthalmology market growth?

The rising prevalence of genetic ocular disorders leading to increased demand for effective treatments and advances in gene editing technologies enhancing the development of novel therapies are the major factors driving the gene therapy in ophthalmology market.

Which is the leading indication in the gene therapy in ophthalmology market?

The leading indication segment is inherited retinal diseases.

Which are the major players operating in the gene therapy in ophthalmology market?

Johnson & Johnson Innovative Medicine, MeiraGTx, Beacon Therapeutics, Nanoscope Therapeutics, GenSight Biologics, 4D Molecular Therapeutics, Coave Therapeutics, Bionic Sight, Neuropht Therapeutics, Adverum Biotechnologies, EyeVensys, Exegenesis Bio, Atsena Therapeutics, Ocugen, AbbVie, REGENXBIO, Skyline Therapeutics, Huida Gene Therapeutics, Opus Genetics, Spark Therapeutics, Novartis AG, Adverum Biotechnologies, REGENXBIO Inc., and AGTC are the major players.

What will be the CAGR of the gene therapy in ophthalmology market?

The CAGR of the gene therapy in ophthalmology market is projected to be 25.4% from 2025-2032.