Global Fragment Based Drug Discovery Market Size - Analysis

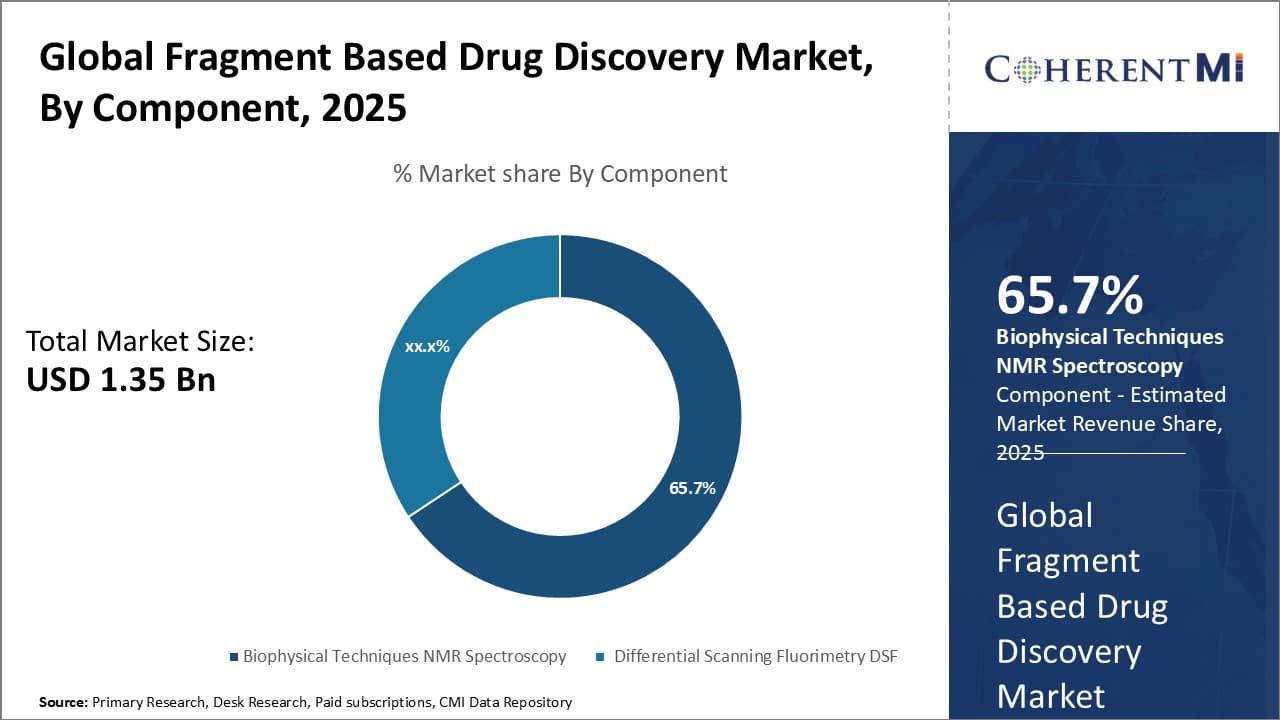

The Global Fragment Based Drug Discovery Market is estimated to be valued at USD 1.35 Bn in 2025 and is expected to reach USD 2.95 Bn by 2032, growing at a compound annual growth rate (CAGR) of 11.8% from 2025 to 2032. This significant growth can be attributed to increasing adoption of fragment-based methods over high-throughput screening.

The market is expected to witness notable growth over the forecast period. Increased R&D investments from pharmaceutical companies for drug discovery along with rapid adoption of fragment-based screening over other traditional methods are some key factors driving the market. Additionally, availability of advanced technologies for structural determination and characterization of fragments has propelled the market growth over the years.

Market Size in USD Bn

CAGR11.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 11.8% |

| Market Concentration | High |

| Major Players | Astex Pharmaceuticals, Beactica AB, Charles River Laboratories International, Inc., Evotec AG, Alveus Pharmaceuticals Pvt. Ltd. and Among Others |

please let us know !

Global Fragment Based Drug Discovery Market Trends

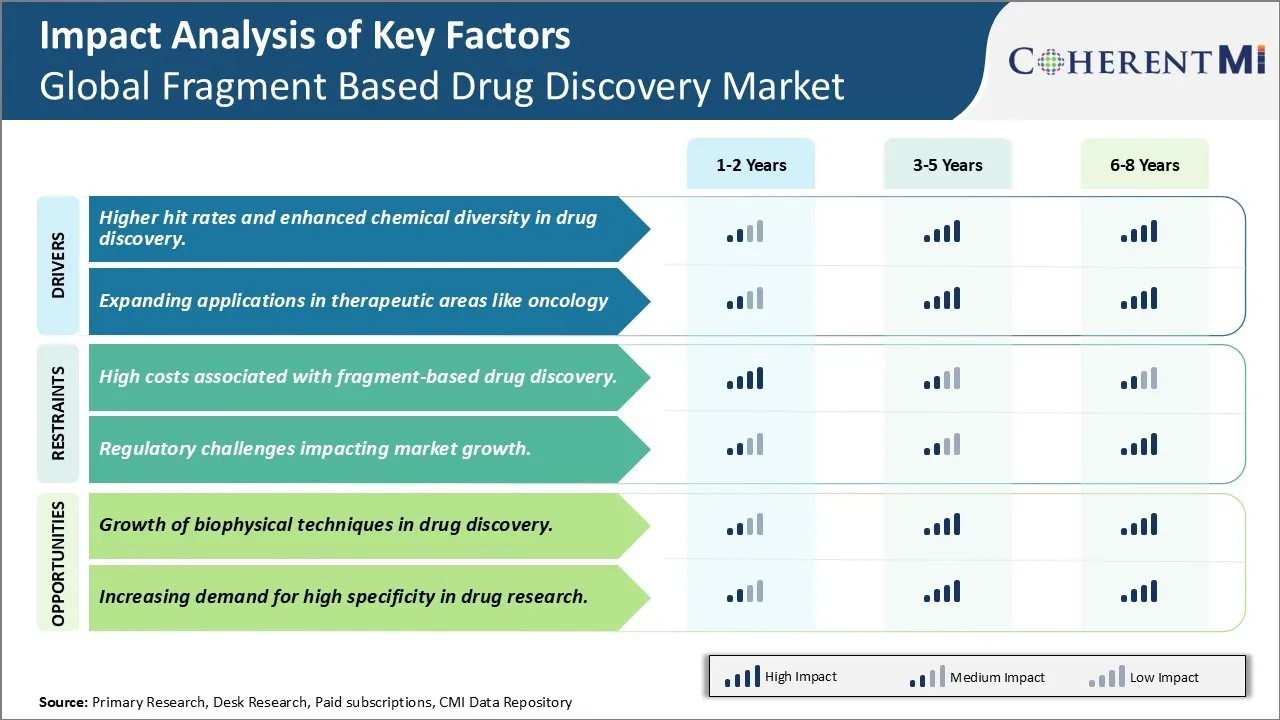

Market Driver - Higher hit rates and enhanced chemical diversity in drug discovery

When developing new drugs, pharmaceutical companies aim to maximize success rates while minimizing risks and costs during development. Fragment based drug discovery provides a potent approach to achieve this by facilitating identification of novel hits with improved chemical qualities. Compared to traditional high throughput screening which relies on whole molecules, fragment-based screening employs small molecule fragments with lower molecular weight between 100-300 Daltons. These fragments have increased potential to bind promiscuously to different regions of target proteins. During screening, any fragments demonstrating binding are then grown step-wise to develop drug-like molecules optimized for interactions with the target.

This incremental process of growing fragments translates to higher hit rates. Fragments make more productive use of chemical space during initial screening since their simple structure allows efficient exploring of potential binding locations on target proteins. Even weak binding fragments can be optimized into strong leads through growing techniques. Pharmaceutical firms have observed success rates up to 10-15% for fragment screens, significantly higher than 1% typically seen with high throughput screening of whole drug-like molecules. Additional chemicalization of screening hits also furthers diversity in generated lead matter. Starting from different fragments binding to diverse sites on a target protein yields structurally unique lead scaffolds over traditional search from one or few starting points.

Expanded chemical libraries from screening further reduce chances of duplicating work of competitors. This enhanced hit rate and diversity addresses a major challenge of drug discovery - identifying new therapeutically relevant molecular structures. It optimizes use of time and resources spent on earlier stages of research by advancing higher quality hits into later development phases. For pharmaceutical companies, fragment-based approaches provide a productive solution to mitigate compound attrition rates downstream and higher probability of clinical success.

Expanding applications in therapeutic areas like oncology

Having established its ability to efficiently explore chemical space and generate quality leads, fragment based drug discovery is increasingly applied across various disease classes. One key therapeutic area witnessing rising adoption is oncology due to growing need for novel cancer treatments. Tumors are genetically complex with multiple dysregulated pathways contributing to uncontrolled growth and metastasis. This has accelerated search for targeted therapies tackling specific cancer vulnerabilities or multipronged treatment regimens. Fragment based methods are well-suited for oncology research aiming to disrupt malignant signaling at its source.

Early binding information from fragment screening provides insight into feasibility of modulating oncology-related protein targets. Even weak binding fragments that may not directly translate to drug candidates can reveal functional pocket points of interest on target proteins like kinases. Efforts are ongoing to develop potent kinase inhibitors for blocking growth and survival signals driving numerous cancer subtypes. Fragment growing may yield selective compounds targeting treatment-resistant cancer mutations or selectively hitting multiple kinases involved in interconnected signaling webs sustaining tumor progression. This maximizes chances of achieving more durable clinical responses.

Besides kinases, applications continue expanding to other underexplored oncology targets such as protein-protein interactions modulating cell cycle, apoptosis, epigenetics. Fragment screening allows methodical interrogating these "undruggable" yet crucial nodes in cancer pathways. It generates starting points for developing substrate-competitive or allosteric inhibitors not readily found through conventional approaches. This widens options for rationally designed combination regimens adding synergistic modes of killing tumor cells. Overall, fragment based methods strategically strengthen oncology pipelines with targeted preclinical candidates worth validating in clinical biomarker-driven trials.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High costs associated with fragment-based drug discovery

One of the major challenges for the global fragment based drug discovery market is the high costs associated with the process. Fragment based drug discovery involves screening large libraries of low molecular weight fragments to identify initial hits that can be optimised into potential drug candidates. However, developing and screening these fragment libraries is an expensive endeavor. It requires sophisticated biophysical techniques such as x-ray crystallography, nuclear magnetic resonance (NMR) spectroscopy and surface plasmon resonance (SPR) to detect interactions between fragments and target proteins. Additionally, hit validation and hit-to-lead stage where fragments are elaborated also incurs substantial costs. The development of one new drug using fragment based approach is estimated to cost over USD 2 billion, making it inaccessible for many small pharmaceutical and biotechnology companies. Further, maintaining state-of-the-art infrastructure and skilled personnel for fragment screening also contributes to increased operational expenses. While the approach has potential to improve hit rates and optimize drug-like properties in early stages, the high costs pose a significant challenge for widespread adoption of this technique, especially in therapeutics areas with lower commercial potential.

Market Opportunity- Growth Of Biophysical Techniques in Drug Discovery

One of the major opportunities for the global fragment-based drug discovery market is the growth of biophysical techniques. As mentioned earlier, biophysical methods such as X-ray crystallography, NMR spectroscopy and SPR play a crucial role in detection of fragment hits by enabling characterization of molecular interactions. In recent years, there have been significant technological advancements in these techniques, allowing for improved data acquisition rates and sensitivity. For instance, new generations of NMR spectrometers and crystallography equipment have enhanced automated fragment screening capabilities. Additionally, analytical methods like isothermal titration calorimetry (ITC) and thermal shift assays (ThermoFluor) are also being increasingly used as complementary techniques. The growth of these techniques has made fragment screening for a wider range of targets and libraries feasible and more cost-effective. It has also facilitated elaboration of hits by enabling structure-based design. The continued evolution of biophysical tools is expected to further optimize the fragment-based workflow and make it an increasingly attractive drug discovery approach. This growing technical capability presents considerable opportunity for growth of the overall fragment-based drug discovery market.

Key winning strategies adopted by key players of Global Fragment Based Drug Discovery Market

Collaboration and partnership: Companies have extensively partnered and collaborated with leading research institutes, pharma/biotech companies and contract research organizations to advance their fragment based drug discovery programs. For instance, Astex Pharmaceuticals collaborated with GlaxoSmithKline in 2005 to develop novel oncology drugs using its Pyramid technology. This partnership was highly successful and led to the discovery and development of multiple clinical candidates.

Technology enhancement and acquisitions: Leading players have invested significantly in enhancing their capabilities in areas like biophysics, computational chemistry and structure based drug design to complement fragment screening platforms. In 2016, Pfizer acquired Anacor Pharmaceuticals known for its fragment-based drug discovery capabilities for US$5.2 billion. The acquisition helped boost Pfizer's R&D portfolio.

Focus on high value therapeutic areas: Companies focus their fragment screening efforts on identifying hits for complex, high value targets in oncology, neuroscience and rare genetic diseases where traditional approaches have limitations. For example, SomaLogic uses its fragment screening platform SOMAscan to discover molecules for difficult G-protein coupled receptors and ion channel targets in cancer and neurological diseases.

Build comprehensive fragment libraries: Players extensively screen large compound libraries containing hundreds of thousands of diverse fragments to maximize hits identification. In 2015, Astex reported screening of over 350,000 fragments to identify leads for multiple oncology targets. The extensive screening helped Astex discover multiple clinical candidates.

These strategic approaches have helped global leaders advance their pipeline, accelerate drug discovery timelines and achieve clinical and commercial success. Collaborations estimate the market to grow at a CAGR of over 11.6% through 2025 as companies increasingly adopt FBDD to overcome challenges in traditional drug discovery.

Segmental Analysis of Global Fragment Based Drug Discovery Market

To learn more about this report, Download Free Sample Copy

By Component - Advancements in biophysical characterization techniques drive growth in the biophysical techniques segment

To learn more about this report, Download Free Sample Copy

By Component - Advancements in biophysical characterization techniques drive growth in the biophysical techniques segment

In terms of By Component, Biophysical Techniques contributes the highest share of the market owning to continuous technological advancements in this area. Biophysical techniques provide direct information on biomolecular interactions and are crucial for fragment screening. The development of sophisticated biophysical tools that offer high-throughput capabilities at lower costs has boosted their uptake in drug discovery. For instance, surface plasmon resonance (SPR) has evolved tremendously over the years, becoming a mainstay for determining binding affinities. The availability of SPR systems paired with newer biosensor chips and automation software hasmade the method highly amenable for fragment screening. NMR spectroscopy too has reached new heights with optimization of experimental parameters and improved NMR machines equipped with enhanced field strengths and flow probes. Such enhancements have augmented NMR’s capacity to deliver high-quality data on fragment hits rapidly. Going forward, further refinement of biophysical tools and methods through automation,label-free detection, and enhanced analytic capabilities is expected to augment their utility, fueling segment expansion.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

By Application- High prevalence and economic burden of oncological diseases drive demand from oncology applications

In terms of By Application, Oncology contributes the highest share of the marketowing toincreasing incidence and socio-economic toll of cancer worldwide. According toWHO estimates, cancer cases are projected to rise by over 70% in the next two decades globally. Fragment-based approaches are widely applied in oncology projectsas they allow identification of novel chemical matter with new mechanisms of action to address cancer's complexity and tackle resistance. Additionally, key cancer drivers continue to be important molecular targets for fragment-based campaigns as they offer viability over conventional drugs. Biopharma firms are aggressively exploring fragments against complex oncology targets such as KRAS, MYC, Hedgehog pathway proteins, and epigenetic modulators. Sustained R&D focus on cancer along with rising patient numbers and healthcare burden renders oncology a major application area for fragment-based strategies, driving the segment's growth.

By End user- Fragment-based drug discovery initiatives by academic institutions and public-private partnerships spur demand from academic and research organizations

In terms of By End-user, Academic & Research Institutions contributes the highest share of the market. Several top-ranking universities and government-funded research bodies across major markets have initiated fragment-based screening centers in partnership with pharmaceutical companies and technology providers. For instance, the Structural Genomics Consortium operates fragment screening platforms with automation at the University of Toronto and Oxford. Similarly, multiple U.S. national laboratories conduct collaborative fragment screening programs. Additionally, large consortia efforts such as the Fragment Screening Consortium bring together academic laboratories from Europe and Asia to perform fragment screening on hundreds of targets. Such initiatives have boosted academic participation and expertise in the area. Availability of state-of-art infrastructure, growing emphasis on preclinical research, and rising support through grants and partnerships continue to drive demand for fragment-based solutions from the academic end of the market.

Competitive overview of Global Fragment Based Drug Discovery Market

The major players operating in the Global Fragment Based Drug Discovery Market include Emerald BioStructures, Inc., Crown Bioscience, Vernalis Research, Sygnature Discovery, Shanghai ChemPartner, SARomics Biostructures, Red Glead Discovery, Domainex, CRELUX, ComInnex, Creative Biolabs, ChemAxon, 2bind, Amgen and University of California, San Francisco.

Global Fragment Based Drug Discovery Market Leaders

- Astex Pharmaceuticals

- Beactica AB

- Charles River Laboratories International, Inc.

- Evotec AG

- Alveus Pharmaceuticals Pvt. Ltd.

Recent Developments in Global Fragment Based Drug Discovery Market

- In February 2023: Astex Pharmaceuticals partnered with Cardiff University for neurodegenerative drug discovery, leveraging their fragment-based drug discovery platform.

- In June 2023: AbbVie’s VENCLYXTO/VENCLEXTA combination therapies showed promising long-term efficacy for CLL patients, discovered through fragment-based drug discovery.

- In May 2023: Evotec AG launched an Innovation Centre for Fragment-Based Drug Discovery in Hamburg and Oxford.

Global Fragment Based Drug Discovery Market Segmentation

- By Component

- Biophysical Techniques

- NMR Spectroscopy

- Differential Scanning Fluorimetry (DSF) Assay

- Fluorescence Polarization

- Isothermal Titration Calorimetry

- X-ray Crystallography

- Surface Plasmon Resonance (SPR)

- Bilayer Interferometry

- Mass Spectrometry (MS)

- Capillary Electrophoresis

- Weak Affinity Chromatography (WAC - HPLCUV/MS)

- Other assays (biochemical)

- Non-biophysical Techniques

- Biophysical Techniques

- By Application

- Oncology

- Central Nervous System (CNS) Disorders

- Infectious Diseases

- Cardiovascular Diseases

- Metabolic Disorders

- Inflammation & Autoimmune Diseases

- By End-user

- Academic & Research Institutions

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Others

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.