Global Oil Free Air Compressor Market Trends

- Product innovations for energy efficiency: Oil free air compressor vendors are focusing on product innovations to enhance energy efficiency, lower operational costs and reduce emissions. Key trends include the incorporation of high efficiency motors such as PMAC and IE4 efficiency class motors, optimization of airend design, advanced system controllers, hybrid drives, heat recovery integration, etc. Atlas Copco’s ZR oil-free centrifugal compressors feature built-in heat recovery and PMAC IE5 or equivalent efficiency motors with PACE technology. such product innovations that improve efficiency are defining technology trends in the oil free compressors market.

- Development of compressors specifically for wastewater treatment applications: Manufacturers are developing specialized oil free compressors designed to withstand the humid, saline and corrosive environments prevalent in wastewater treatment plants. Ingersoll Rand has introduced its R-Series 90-160 kW centrifugal compressors built with coating protection and stainless steel components optimized for wastewater aeration systems with minimum downtime. Such compressors will witness increased demand as governments increase investments in water infrastructure and enhancing wastewater treatment capacities.

- Strategic collaborations and acquisitions: The oil free air compressor market is witnessing a rising number of collaborations, partnerships and acquisitions between manufacturers, distributors and technology providers. Atlas Copco recently acquired Airflow Compressors and Pneumatics to strengthen its Irish presence. Ingersoll Rand partnered with Trane Technologies to develop sustainable climate systems. Such strategic moves allow companies to expand their distribution networks, enter new markets, enhance service capabilities and access innovative technologies. This trend will continue as established vendors and new entrants aim to increase market shares.

- Launch of compressors specifically for railways: Major manufacturers are introducing oil free compressors designed for railway applications as train networks expand globally. Railways require compressors that can handle demanding environmental conditions. Atlas Copco has unveiled its GHS VSD+ range of compressors which are compact, have extremely low noise levels and are suitable for train maintenance applications. Sullair launched compressors purpose-built for train brake systems. Demand for such specialized compressors will be driven by the need for compressed air of the highest quality for railway operations.

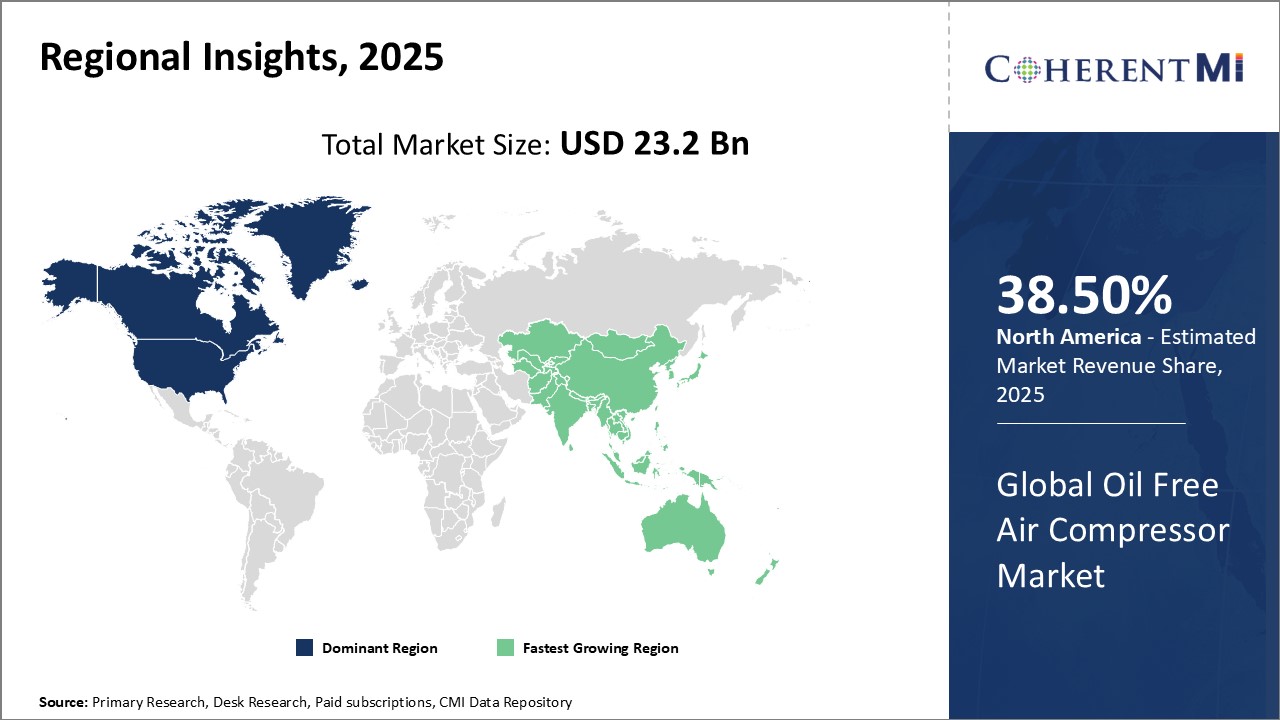

Global Oil Free Air Compressor Market Regional Insights:

- North America: North America is expected to be the largest market for Oil Free Air Compressor Market during the forecast period, accounting for over 38.5% of the market share in 2025. The growth of the market in North America is attributed to increasing manufacturing activity, stringent regulations regarding emissions and the presence of major manufacturers in the region.

- Europe: The Europe market is expected to be the second-largest market for Oil Free Air Compressor Market, accounting for over 28.7% of the market share in 2025. The growth of the market in is attributed to high demand from the food & beverage and pharmaceutical industries and the introduction of supportive government regulations in the region.

- Asia-Pacific: The Asia Pacific market is expected to be the fastest-growing market for Oil Free Air Compressor Market, with a CAGR of over 7.8% during the forecast period. The growth of the market in Asia Pacific is attributed to rapid industrialization, growing food & beverage production and increasing adoption across industries such as oil & gas, power generation, etc.